Great Wall Motors' Haval Faces "Two Consecutive Declines" in Sales: Can H6's Cooling Enthusiasm Be Revived?

![]() 03/14 2025

03/14 2025

![]() 530

530

Written by | Xingxing

Source | Beiduofinance

As the Spring Festival holiday's impact waned, most domestic automakers witnessed a sales recovery in February 2025. Among them, Great Wall Motors achieved a 9.7% increase in monthly sales, continuing its pursuit of "quality market share".

However, not all brands under Great Wall Motors shared this fortune. The market performance of the Haval brand seemed "lacking." Data indicates that the brand continued its downturn from 2024, with sales declining in both January and February 2025.

Notably, Haval H6, the "ace model," saw its January 2025 deliveries reach only one-eighth of its peak period. This decline in market appeal signifies the fading glory of the former "domestic god car."

In the new energy era, where should Haval, which relies heavily on a single model and focuses on the traditional fuel vehicle market, steer its course?

I. Multi-category Layout Fails to Boost Sales

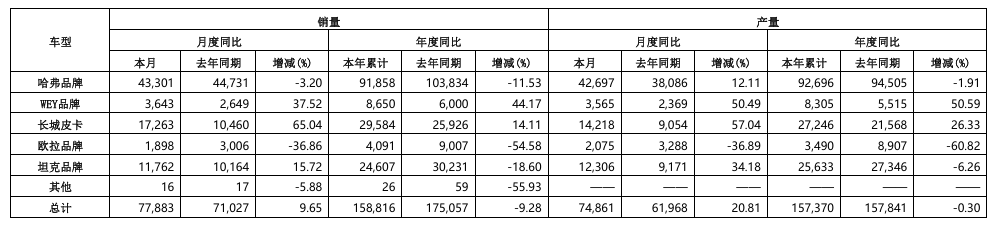

In February 2025, Great Wall Motors sold a total of 77,900 vehicles, a 9.65% increase over the same period in 2024. Overseas sales amounted to 31,100 vehicles, a 1.57% year-on-year increase, while new energy vehicle sales hit 15,100, a 23.24% year-on-year rise.

Breaking down by brands, Great Wall Pickup sold 17,300 vehicles in February 2025, a 65.04% year-on-year increase, making it the most growth-oriented brand under Great Wall Motors. The Tank brand and WEY brand sold 11,800 and 3,643 vehicles, respectively, with year-on-year increases of 15.72% and 37.5%, also showing an upward trend.

However, the sales pillar of Great Wall Motors, the Haval brand, sold 43,300 vehicles in February, a 3.20% decrease from the same period in 2024. Given the small sales base in February 2024 due to the Spring Festival holiday, this decline is certainly disheartening for Haval.

Recently, Haval announced that sales of the Haval Dagu category have exceeded 10,000 units for nine consecutive months. In February, this model sold 10,027 new vehicles and was launched in Saudi Arabia, with cumulative sales exceeding 570,000 units. Despite this, it failed to reverse the market downturn of the Haval brand.

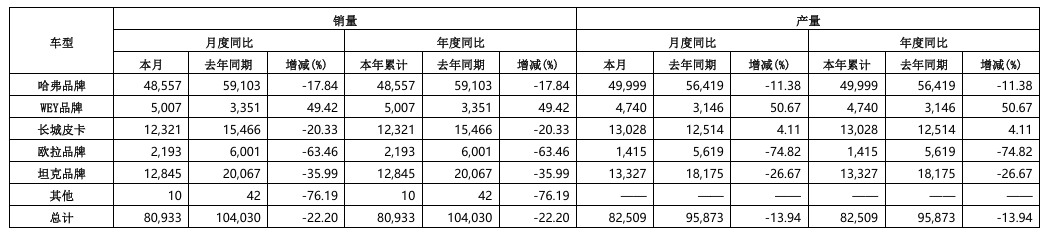

This is not the first time Haval has seen a sales decline in 2025. The brand's sales in January were 48,600 vehicles, also down 17.84% from the same period in 2024, with a month-on-month decrease of over 40%, falling below the monthly sales level of 50,000 vehicles.

Looking back at 2024 sales data, the growth rates of Haval's Menglong and Dagu categories were remarkable. The former achieved explosive growth with 10 consecutive monthly sales increases; the latter sold over 10,000 units for seven consecutive months, with December sales nearing 18,000 units.

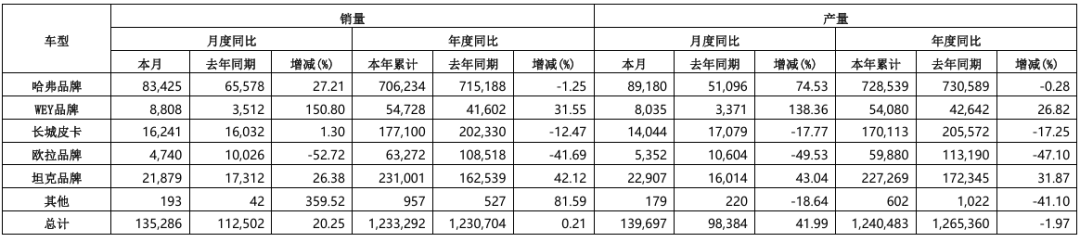

Unfortunately, the growth of these categories failed to help Haval win the "turnaround battle." Although Haval's sales increased by 27.21% to 83,400 vehicles in December, annual sales declined by 1.25 percentage points to 706,200 vehicles compared to 715,200 vehicles in 2023.

II. Ace Model H6's Glory Fades

This raises questions about why the Haval brand, once Great Wall Motors' flagship, has fallen to this point. Insights can be gained from the rise and fall of Haval's "star model," Haval H6.

Launched in 2011, Haval H6 is an urban SUV that initially won the hearts of many car owners with its cost-effective product positioning. This model once sold more than 80,000 units in a single month and ranked first in domestic SUV sales for 108 consecutive months.

Haval H6's "dominance" of the SUV market continued until 2022, when annual sales declined by 29.12% year-on-year to 250,100 units, surpassed by BYD Song and Tesla Model Y, but still ranking in the top three. In 2023, sales continued to decline to 218,200 units, a decrease of 12.74%.

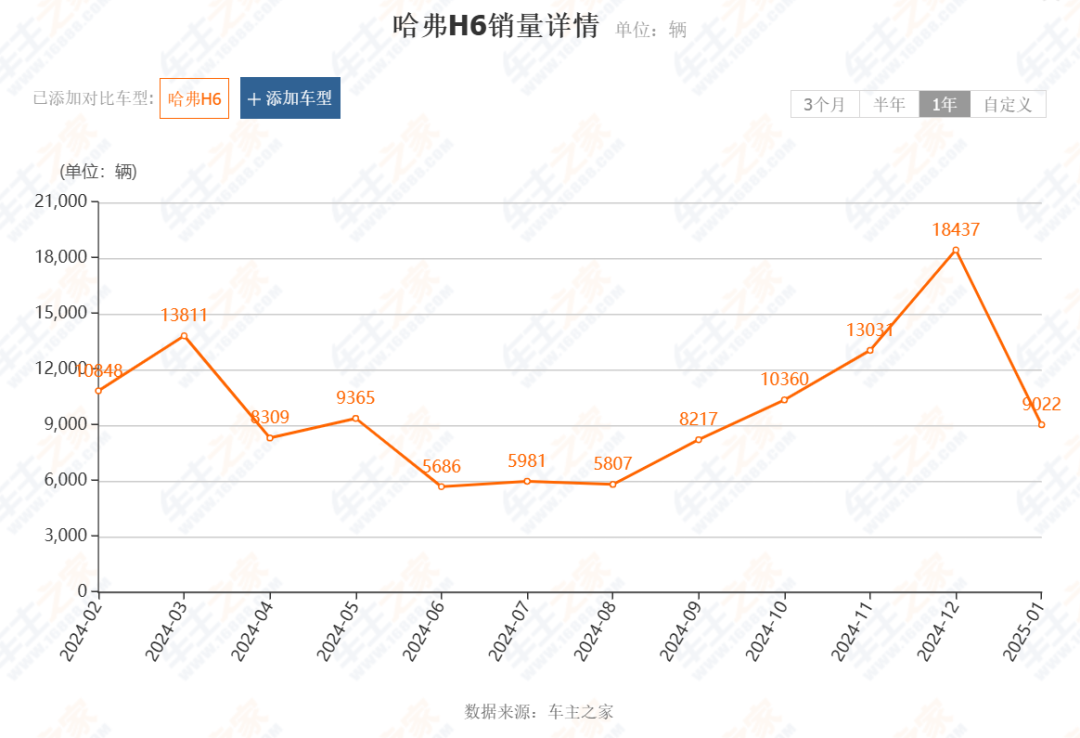

Notably, in January 2024, Haval H6's monthly sales still reached over 20,000 units but plummeted to 10,800 units the following month. Data from "Home of Car Owners" shows that sales in April 2024 were less than 10,000 units, with 8,309 units sold in a month, setting a new low in recent years.

Afterward, Haval H6 struggled to return to the "10,000-unit club." Sales from June to August 2024 were less than 6,000 units, not recovering to 10,400 units until October. In 2024, Haval H6 sold a total of 132,700 units, a significant decline of 39.2%.

In other words, Haval H6's annual sales have experienced a "three consecutive declines," with double-digit drops. Moreover, its sales ranking has dropped to eighth among domestic fuel vehicles, trailing Geely Xingyue L, which ranked first with approximately 219,900 units.

In January 2025, Haval H6's sales were 9,022 units, less than Haval Dagu's 11,767 units. The glory of the "domestic god car" that once ranked first in SUV sales is fading, pushing Haval, which relied on this model, into a comprehensive sales decline.

III. Slightly Lagging Behind in New Energy Transition

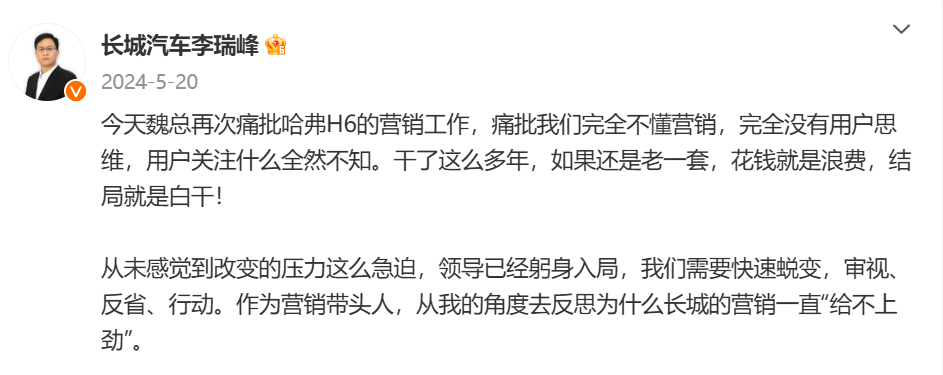

As early as May 2024, internal executives at Great Wall Motors revealed that Wei Jianjun, the founder and chairman, had severely criticized the marketing efforts of Haval H6. He believed that the marketing lacked innovation and failed to understand user thinking and needs, leading to resource waste and poor performance.

Media reports stated that Wei Jianjun also said in a live broadcast that although Haval H6 was no longer the champion, he did not regret it. The sales decline was due to industry chaos caused by disorderly and malicious competition. He emphasized, "Great Wall Motors has a bottom line and will not participate."

However, attributing all of Haval H6's sales declines to outdated marketing models and malicious market competition would be biased. The overall rise of new energy vehicles has undoubtedly eroded the market share of Haval H6, a traditional fuel vehicle.

Zhao Yongbo, general manager of the Great Wall Haval brand, also posted in September 2024 that due to the leadership's belief that the launch event lacked creativity, it was required to be quickly recreated and organized as the most creative and meaningful event.

Ultimately, the launch date for the second-generation Haval H9 was adjusted to September 25, 2024. The second-generation Haval H9 launched three versions, priced at 199,900 yuan for the Explorer version, 215,900 yuan for the Pioneer version, and 229,900 yuan for the Extreme version.

Faced with market shocks, Haval has not been very sensitive in tapping the potential of the new energy market. For instance, the plug-in hybrid version of Haval H6 was not launched until September 2023, and its starting price of 159,800 yuan lacks a competitive advantage in the fiercely competitive market, receiving a lukewarm response from consumers.

Haval Xiaolong MAX, the brand's first model equipped with a new generation of plug-in hybrid technology, made a big splash during the early promotional stage but ultimately experienced a "high start and low finish." Its monthly sales, which started in the thousands, were unsustainable, with an average monthly sales of less than 400 vehicles in 2024 and only 22 new vehicles sold in January 2025.

Haval Menglong, another new energy model highly anticipated by Haval, performed decently in the past year, with sales reaching a new high of 13,200 units in December 2024. However, sales halved to 5,043 units in January 2025, and its future development prospects remain uncertain.

Recently, market rumors suggest that Haval will upgrade multiple existing models. Among them, Haval Xiaolong Max will launch a second-generation model equipped with Great Wall Motors' second-generation Hi4 plug-in hybrid system and the latest intelligent driving system, ready to "take the exam" in the market once again.

Years ago, when Haval was still relying on H6 to "build its empire," market observers expressed concerns about the brand's over-reliance on a single model. Now, this potential risk has materialized, like a cloud hovering over Haval's head.

Haval has stated that it will officially stop selling fuel vehicles by 2030. From this perspective, laying out the new energy market is expected to become the anchor point for Haval's turnaround. For a brand deeply entrenched in traditional fuel vehicles, this new energy race presents both challenges and opportunities.