Global Electric Two-wheelers (European Perspective): Navigating Rising Tariffs, Strategies for Breaking the Impasse

![]() 03/17 2025

03/17 2025

![]() 643

643

Preface

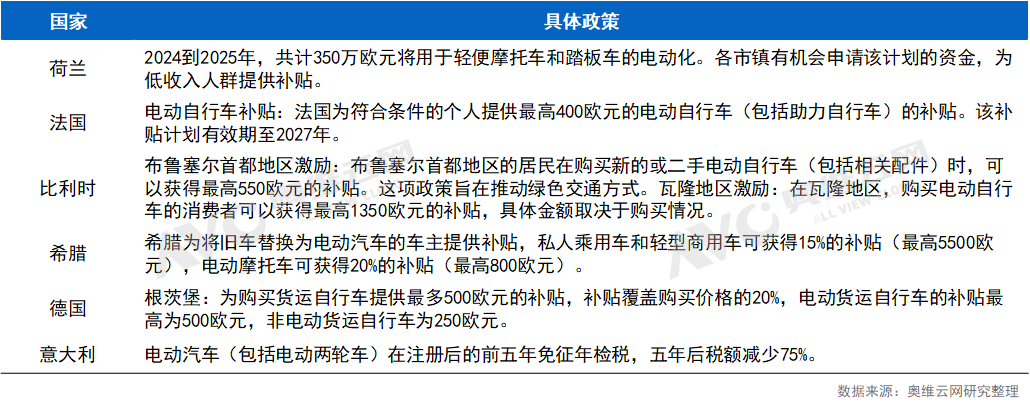

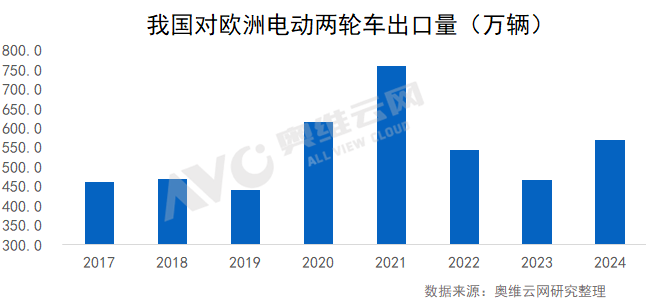

Amidst profound adjustments in the global economic landscape and the surge towards green transformation, the European electric two-wheelers market is undergoing significant changes. European economic growth remains sluggish, compounded by reduced energy independence and manufacturing competitiveness. Furthermore, the EU's tariff policy on Chinese electric bicycles, extending until 2028, poses both technological and trade barriers for export enterprises. Yet, amidst these challenges lie opportunities. European consumers' appetite for eco-friendly, high-performance models is on the rise, with governments offering subsidies and tax incentives to accelerate electrification. The Eastern European market has witnessed a surge in exports, making technological upgrades and strategic market adjustments crucial for Chinese enterprises to overcome the current impasse.

Market Background

Opportunities Amid Dual Pressures

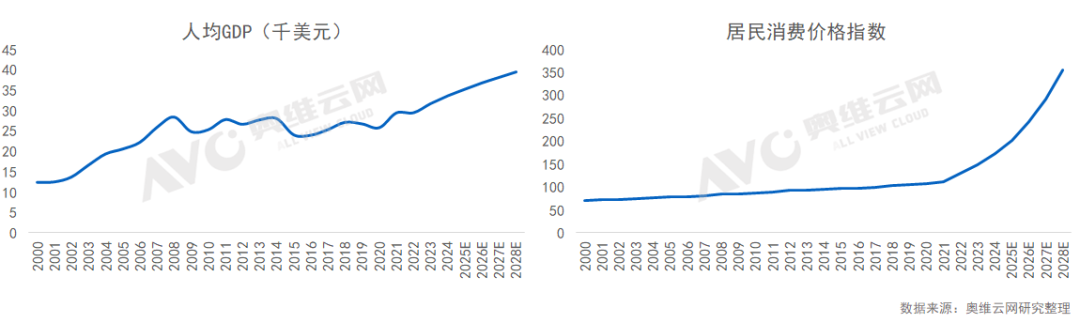

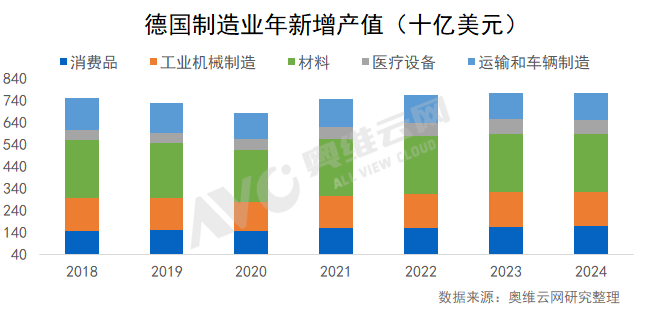

The European economy exhibits a pattern of "weak growth and high differentiation." Core economies like Germany and France are contracting (with German industry hampered by high energy costs, experiencing negative growth for two consecutive years), while Southern European countries like Spain and Portugal maintain growth rates supported by EU funding and service sector recovery. Despite inflation easing to 2.4%, service sector price stickiness and energy dependence still hinder consumption and industrial recovery. While the European Central Bank considers rate cuts, policy space remains limited.

The European economy faces "dual pressures": externally from global industrial chain restructuring and tech competition between China and the US; internally from lagging energy transformation and declining manufacturing competitiveness (Germany's automotive market share fell from 22% to 9%).

Tariffs Continue to Rise, Strategies for Breaking the Impasse: As the EU tightens trade remedy measures against China, Chinese electric two-wheelers enterprises must explore new paths to overcome the impasse. On January 24, 2024, the European Commission announced an extension of anti-dumping and countervailing duties on Chinese electric bicycles for another five years, with export enterprises facing tax rates ranging from 18.8% to 79.3%. On February 6, the UK clarified it would revoke "double anti-dumping" measures on non-folding electric bicycles but retain additional tariffs on folding models for five years.

Against this backdrop, trade barriers for Chinese electric two-wheelers in the EU and UK markets are tightening. Breaking through market access restrictions through technology upgrades, localized supply chain strategies, and market diversification has become a strategic imperative for China's industrial chain. The new EN 15194:2023 standard for electric power-assisted bicycles (EPACs), effective from August 23, 2025, significantly raises manufacturing standards, emphasizing risk control, vibration management, and battery system compliance.

Manufacturers must assess extreme temperature scenarios, fire risks, and establish lifecycle safety mechanisms. They must also perform dynamic modeling of vehicle vibrations, comply with ISO 5349-1:2021, and provide third-party verification reports. The new standard strengthens the compliance framework for power battery systems, covering electrical performance, mechanical strength, environmental adaptability, and functional safety (ISO 26262:2018 ASIL-B level), reducing battery safety risks to industry-leading levels.

For the industrial chain, implementing these regulations will reconstruct market access barriers. Battery manufacturers must upgrade BMS and thermal management technology and obtain certifications, while complete vehicle enterprises face supply chain compliance audits and cost increases.

Industry Characteristics

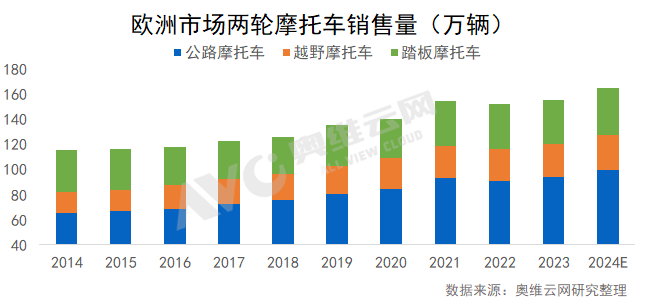

Policies Driving Electrification Transformation The European motorcycle market has grown structurally, with an annual compound growth rate of 4.3% in 2023. Electric two-wheelers, growing at 15.6%, have become the primary driver, increasing their market share from 9.2% in 2020 to 18.4% in 2023. Consumers prioritize "zero emissions" (67%), demanding balance between range and energy efficiency (mid-range models ≥120km/4h), intelligent configurations (e.g., Bosch eBike ABS adoption rate of 32%), and ergonomic optimization (vibration value ≤2.5m/s²). The market is transitioning towards "electrification-intelligentization-servitization," with future competition focusing on technical compliance, local adaptation, and user experience reconstruction.

In the European two-wheeler market, off-road motorcycles are a structural growth point, driven by personalized travel demand post-pandemic, improved off-road infrastructure, and adventure tourism industrialization (market size of €27.4 billion in 2023, with motorcycle-themed travel accounting for over 30%). Despite technical challenges, manufacturers must overcome range and charging limitations to capture this policy-driven incremental market.

Market Conditions in Major Countries

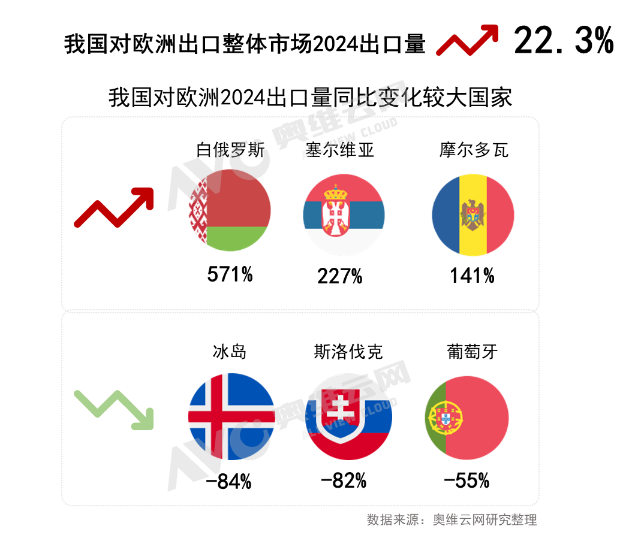

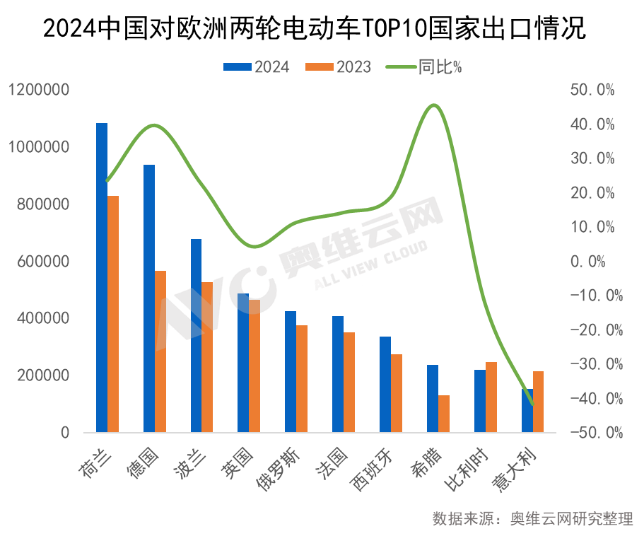

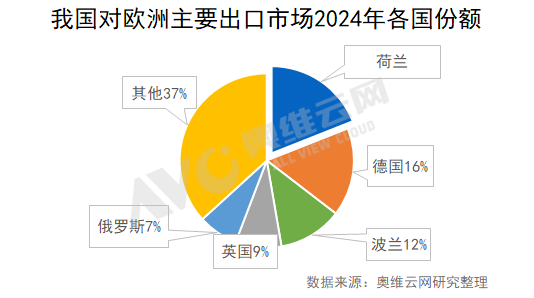

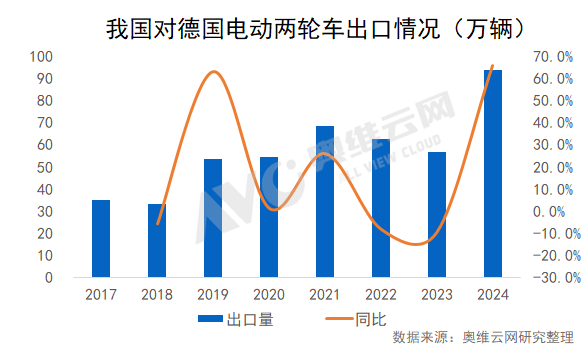

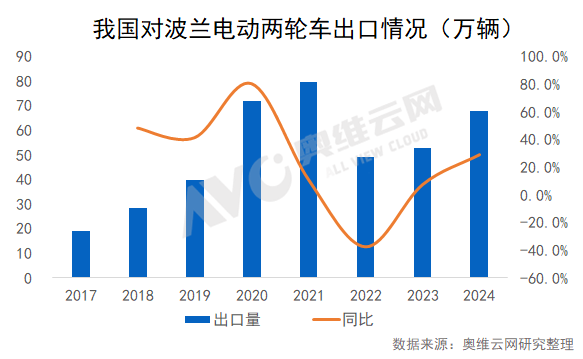

Eastern Europe is recovering, but Central and Western European countries remain the main force. While China's electric two-wheeler exports to Eastern Europe have seen the largest year-on-year increase, the largest market share is still in Western and Central Europe.

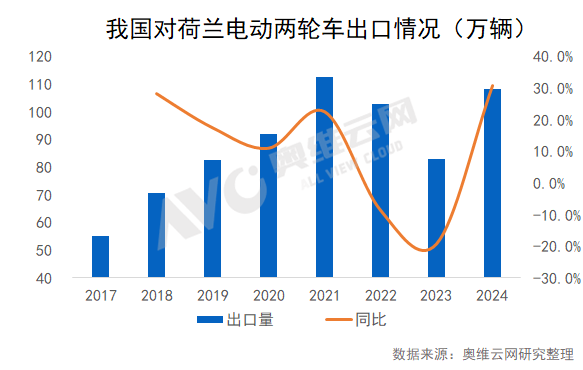

Netherlands

The Dutch government plans to impose a 19.4% private vehicle tax on electric motorcycles from 2025, abolishing previous tax exemptions. Commercial electric vehicles face lower taxes, ignoring the two-wheeler market's needs. Subsidies for new electric motorcycles have also been canceled, affecting sales through road tax relief and purchase tax incentives. Infrastructure improvements and incentive measures have made the Netherlands a pioneer in electric mobility, but ongoing adjustments highlight the complexity of promoting sustainable and safe electric two-wheelers, with market uncertainty in 2025.

Germany

The German two-wheeler market is valued at approximately $1.97 billion in 2024, expected to grow to $2.49 billion by 2030. The electric segment is particularly active, with market size forecast to jump from $9.13 billion in 2025 to $12.46 billion in 2029, averaging 8.06% annual growth. Government incentives, including subsidies and tax benefits, reduce electric vehicle purchase costs. Germany's industrial machinery manufacturing industry presents opportunities for local electric two-wheeler manufacturing in the future.

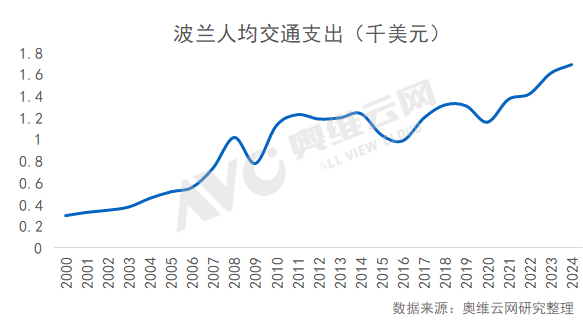

Poland

The Polish two-wheeler market was valued at $217.1 million in 2023, with electric motorcycles leading the segment at 19.3% annual growth. This growth stems from increased demand for high-power density motors (≥6kW) and modular designs (e.g., removable battery systems). By 2040, the Polish government aims for 80% of new registrations to be electric models, pushing the electric two-wheeler penetration rate from 7.1% in 2020 to 14.6% in 2023. Rising fuel costs have steered consumers towards more cost-effective modes of transportation. With charging costs just 1/5 to 1/4 of fuel vehicles, electric two-wheelers may become the preferred choice in a high-inflation environment.

Conclusion

The future of the European electric two-wheelers market is a complex interplay of policies, technological innovation, and consumer demand. Despite tariff barriers and new standards raising entry thresholds, differentiated subsidy policies, high consumer recognition of green travel, and rapid growth in emerging markets like Eastern Europe offer ample opportunities for global enterprises. For Chinese enterprises, leveraging technology as a spear and compliance as a shield is crucial. By enhancing battery safety, optimizing product performance to meet EU standards, and flexibly adjusting market strategies, they can maintain a proactive position in competition. As Europe's energy transformation deepens and electric mobility infrastructure improves, the electrification wave in the two-wheeler market will likely spread globally, with agile enterprises seizing the initiative in this transformation.