Behind Weekly Sales Rankings: A Major Shakeout in the Auto Industry

![]() 03/18 2025

03/18 2025

![]() 560

560

Introduction

After scrutinizing the weekly sales rankings of new energy vehicle brands, I cannot help but feel concerned for those that consistently fail to make the list.

On June 13, 2022, Li Auto unveiled its weekly sales figures from June 5 to 11, maintaining its lead in the new force segment with 8,400 vehicles sold. Since then, this so-called "weekly sales ranking" has become a source of anxiety for all new force automakers, new energy automakers, and even traditional fuel vehicle companies.

Almost instantaneously, automakers began following suit. Whenever a product becomes a hot seller, they rush to showcase these impressive results across various metrics. Over the course of two and a half years, the weekly sales rankings have witnessed the rise and fall of numerous enterprises.

Amidst this ebb and flow, the weekly updated new energy vehicle sales rankings have evolved into more than just a numbers game.

While leading brands fiercely compete for top spots, they may not realize that those continuously absent from the rankings are being pushed to the brink of survival by the market. This data-driven "secret war" underscores a crucial turning point in China's new energy vehicle industry, transitioning from a phase of rapid growth to one of stock competition.

Every fluctuation in the sales curve on these rankings can trigger a surge of anxiety among certain players and might even become the final straw that breaks the camel's back for those languishing at the bottom.

01 Silent Crisis

Recently, new energy automakers and emerging brands have once again released their weekly sales rankings.

From the sales rankings of Chinese new energy brands from March 3 to March 9, compared to previous weeks, the rankings of automakers have largely remained unchanged, with only minor shifts observed. The top six automakers—BYD, Wuling Motors, Tesla, Geely Automobile, XPeng Motors, and Li Auto—have maintained their positions, and the sales of several automakers have even increased. Specifically, BYD leads with sales of 57,400 vehicles, followed by Wuling and Tesla with 15,400 and 13,800 vehicles, respectively. XPeng Motors surged to fifth place with sales of 8,500 vehicles, solidifying its top spot in the new force segment for several consecutive weeks.

Among the next tier of automakers, ranking seventh to tenth, are AION, Xiaomi Motors, Leap Motor, and Galaxy Auto, with weekly sales of 6,600, 6,200, 5,900, and 5,300 vehicles, respectively.

Regarding the sales rankings of emerging brands, there have also been no significant adjustments in the rankings of major automakers for the new week. Breaking it down, XPeng Motors continues to outperform Li Auto with sales of 8,500 vehicles versus Li Auto's 7,300. Among the emerging brands, the most surprising is NIO, which failed to enter the top ten, with weekly sales plummeting to only 2,800 vehicles.

Whether it's the sales rankings of emerging brands or the subsequent derivative rankings of new energy brands, these lists are chronicling the current fervor and brand ecology within the new energy vehicle sector.

Examining the emerging brand rankings reveals a consistent presence of established players like "NIO, XPeng, Li Auto," new forces such as Leap Motor, Xiaomi/Wenjie, and brands like Zeekr/Dark Blue that embody the new energy dreams of traditional automakers. Looking at the new energy brand rankings, BYD usually leads the pack, followed by Wuling/Geely, Tesla, and a host of emerging brands hot on their heels.

These automakers represent the cream of the current new energy market and are the spearhead enterprises that best embody China's new energy overtaking in corners.

However, beneath the spotlight of brands like BYD, Tesla, and Li Auto dominating the top ten sales, there lies a group of brands, particularly emerging ones, that once made a splash on these rankings but are now conspicuously absent.

Brands such as ENOVATE, AIWAYS, Byton, HiPhi, WM Motor, and JYEV have successively vanished from the mainstream rankings. Among the new energy sub-brands nurtured by traditional automakers, more than half have sales that pale in comparison to the tenth-ranked brand.

Among these fallen brands, some have already crumbled, becoming a wasteland littered with the remnants of countless dreams crushed by the rugged path of new energy development. Others, while not completely out of the market, have fallen into a "boiling frog" dilemma due to a chain reaction of insufficient product competitiveness, channel contraction, a sudden decrease in brand voice, and financing stagnation.

The strong grow stronger, and the weak fade away. As the Matthew Effect in the automotive market becomes increasingly pronounced, more sales, brand attention, and financing flow to the leading brands.

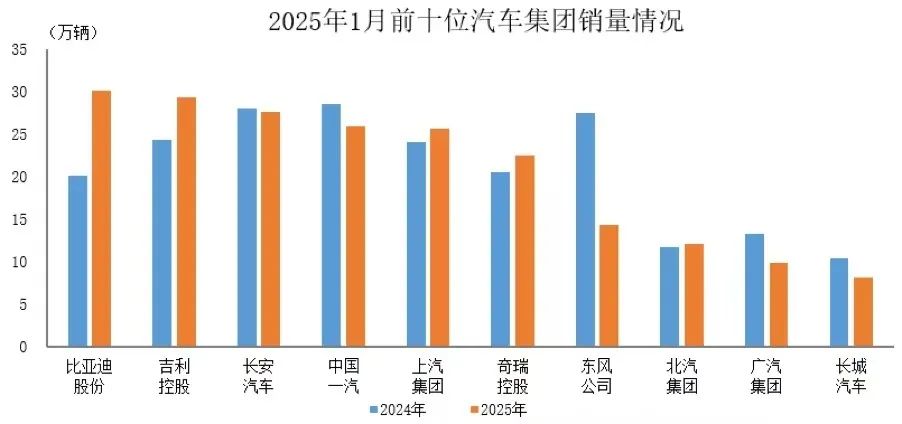

Data shows that in January of this year, the top ten enterprises (groups) in automobile sales collectively sold 2.053 million vehicles, accounting for 84.7% of total automobile sales. This means that the top 10 automakers have almost carved up the entire pie. Behind the feast enjoyed by leading automakers lies the melancholic tale of countless small and medium-sized players. The remaining hundreds of brands can only engage in a life-and-death struggle in less than 20% of the market space.

02 Survival Window in a Systemic War

"When weekly sales fall below 500 vehicles, even the supplier's payment terms begin to shorten."

An industry insider once admitted that 500 is the lifeline in the weekly sales rankings. In his view, the price war that has become normalized in recent years has forced automakers and suppliers to compete fiercely, and there's no turning back. Profits are being squeezed at every level.

Against this backdrop, leading enterprises leverage economies of scale to drive down the cost per vehicle below the industry average, while tail brands get caught in a vicious cycle of "selling more, losing more" due to insufficient capacity utilization. When weaker brands struggle with poor sales, suppliers also selectively abandon small, unprofitable orders, essentially writing off the weaker brands.

Furthermore, current competition has long surpassed a simple product showdown.

What leading enterprises are constructing is a comprehensive "iron triangle" system comprising "technology reserve pool, ecological moat, and user operation network," creating a gap that weaker brands find hard to bridge. For instance, BYD's Blade Battery, e-platform 3.0, and vertically integrated supply chain form a closed loop of technology; NIO's battery swapping network, user community, and lifestyle brand foster emotional loyalty; Tesla's FSD algorithm and supercharging network erect technological barriers... These elements collectively constitute a formidable competitive barrier that is difficult to replicate.

In contrast, most brands that fail to make the weekly sales rankings are still stuck in the initial stage of "single-point breakthrough."

Even if they once secured good orders by achieving a single-point breakthrough, such as with gull-wing doors, subsequent slow iterations of the smart cockpit and lagging charging network construction have led to low user repurchase rates. For brands that haven't even achieved a single-point breakthrough, the situation is even grimmer.

When the industry enters a "long-distance endurance race," enterprises lacking systematic capabilities are like players with weaknesses participating in the competition, easily exposed and eliminated by their opponents when they are most vulnerable.

For brands hovering on the brink of elimination, the next few years may be their final window for self-rescue.

Industry analysis points out that with the decline in lithium carbonate prices and the recovery of chip supply, the easing of cost pressure has paradoxically accelerated market reshuffling—leading enterprises have gained greater leeway for price reductions, while the price advantage of tail brands has further weakened. Some industry insiders believe that more than 30 new energy brands will exit the market within the next two years.

During this period, the key to transformation and breakthrough lies in finding a differentiated positioning.

For example, focusing on the 100,000-yuan market and stabilizing the foundation through a market penetration strategy; leveraging the positioning of technological luxury goods to carve out niche high-end segments; or seeking mergers, acquisitions, and integrations, such as Thalys embracing Huawei's influence, Tianji Automobile being taken over by state-owned assets, and Freeland transitioning to OEM. After all, now is not the time to be concerned about face; only by surviving can one wait for the next windfall.

As weekly sales rankings become the industry's book of life and death, China's new energy vehicle industry is undergoing a critical leap from quantitative change to qualitative change. This elimination game offers no middle ground; either build a deep enough moat to join the leading camp or find a unique survival niche, or else be swallowed up by the relentless tide of time.

For consumers, this brutal reshuffle will ultimately yield better products and services. For the entire industry, only by enduring this rebirth can a truly globally competitive automotive powerhouse emerge.

Editor-in-Chief: Shi Jie Editor: Wang Yue