Frequent Recalls! BMW's Sales Decline Ranks First Among BBA in China

![]() 03/18 2025

03/18 2025

![]() 679

679

Recently, BMW Group (hereinafter referred to as "BMW") recalled some imported R18 series motorcycles due to hidden product defects, marking just one of its numerous recall actions in 2025. As a benchmark for luxury brands, large-scale recalls have significantly impacted BMW's performance, leading to a more than 30% drop in net profit in the first three quarters of 2024 and a decrease in key indicators such as operating profit margin.

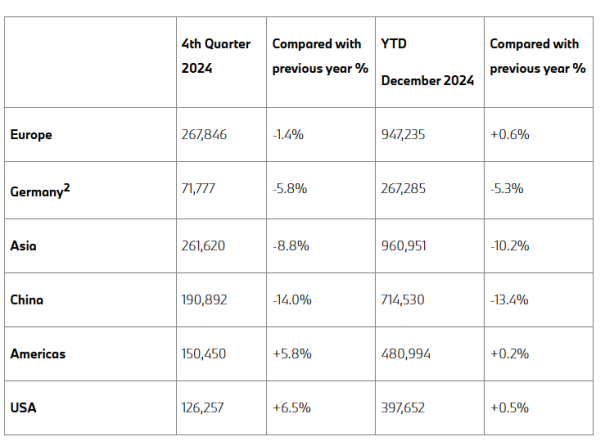

Stockstar observed that BMW's global sales declined by 4% in 2024, with sales in China, a core market, falling by 13.4%, a much larger decline compared to other regions. Under the influence of new energy vehicles, German luxury car giants BMW, Mercedes-Benz, and Audi (BBA) are facing sales pressure in China, with BMW encountering particularly severe challenges. Despite price wars last year, BMW struggled to reverse its predicament in China, with its sales decline outpacing that of Mercedes-Benz and Audi.

Looking ahead, BMW is attempting to maintain competitiveness by diversifying its product line, but whether it can retain its title as the "annual sales champion of luxury passenger cars in China" remains uncertain.

01. Major Recalls Become a 'Performance Killer'

On March 7, the website of the State Administration for Market Regulation announced that starting from that day, some imported R18 series motorcycles produced between December 1, 2020, and December 12, 2023, would be recalled, totaling 3,818 vehicles.

The announcement revealed that due to inadequate sealing of the reverse control unit in the recalled motorcycles, prolonged operation (exceeding two years) in high-temperature and high-humidity environments may lead to internal circuit corrosion, causing the reverse function to fail and posing a risk of fire in extreme cases. This recall is an amendment to the previous recall measures issued on April 3, 2024, for "BMW (China) Automobile Trading Co., Ltd. Recalls Some Imported R18 Series Motorcycles".

This is not BMW's first product recall this year. As early as January and February, due to issues such as improperly installed differential internal bevel gear shaft lock rings in the electronic drive unit, incompatibility between specific batches of oil filters and engines, and production defects in power batteries, BMW has recalled several domestically produced models and imported motorcycles.

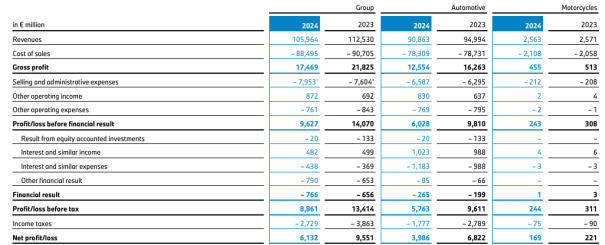

Amidst intensifying global automotive market competition, BMW, a luxury car benchmark, has repeatedly recalled its products, further threatening its profits. According to its released third-quarter financial report for 2024, BMW's revenue totaled 105.964 billion euros in the first three quarters, a year-on-year decline of 5.83%; net profit for the same period was 6.132 billion euros, a year-on-year decrease of 35.8%.

Behind the pressure on performance, in addition to the downturn in the Chinese market, recalls due to hidden dangers in the integrated braking system also contributed to the decline. In September 2024, due to a malfunction in the brake system produced by Continental AG, 1.5 million BMW and Mini cars worldwide were recalled on a large scale, with China being the most affected.

This incident led to the shutdown of BMW's largest production base in Europe and increased additional expenses related to repairs and logistics. BMW's Chief Financial Officer Walter Mertl stated that in the third-quarter financial data, BMW recognized hundreds of millions of euros in warranty provisions.

As a result, BMW lowered its full-year earnings expectations, with the operating profit margin dropping from 8%-10% to 6%-7% and the return on capital decreasing from 15%-20% to 11%-13%.

In November 2024, the impact of this failure further spread. Due to abnormalities in the welding of the hollow shaft components of the servo motor in the integrated brake booster and interference with the electrical signal of the motor position sensor, BMW recalled multiple domestically produced and imported models, with the number of recalls exceeding 5,000 vehicles. This recall was an expansion of the recall activities in September 2024.

Stockstar noted that since the second half of 2024 alone, BMW has initiated multiple product recalls globally, related to issues such as airbags and bolts in the luggage fixing guide rails of the trunk. According to recall data compiled by 58 Auto, the top five brands in terms of domestic recalls in 2024 were Tesla, BMW, Mercedes-Benz, Honda, and Dongfeng Peugeot Citroen Automobile, with Tesla, BMW, and Mercedes-Benz recalling more than one million vehicles throughout the year, at 3.3943 million, 2.4633 million, and 1.3772 million vehicles, respectively. It is evident that large-scale recalls reflect significant issues in BMW's quality control, and the frequent occurrence of recalls has raised industry concerns about its technology and product reliability.

Moreover, in October last year, BMW's Beijing Xingdebao 5S dealership closed due to poor management, exacerbating public doubts about its service system. The dealership was exposed for owing employees' salaries for two to three months, and hundreds of car owners also defended their rights out of concerns that after-sales and other rights and interests could not be met. As BMW's first global 5S dealership, the closure of Beijing Xingdebao has also raised doubts among consumers about the operational reliability and service continuity of BMW dealers.

02. Sales Falling Short of Expectations Forcing Price Wars

Stockstar observed that the rise of domestic independent brands has comprehensively squeezed overseas luxury brands.

According to BMW's global sales data, in 2024, BMW delivered a total of 2.4508 million vehicles worldwide, a year-on-year decline of 4%. Among them, new energy vehicles sold a total of 593,200 units, an increase of 4.8% year-on-year, accounting for 24.2% of total sales for the year.

In 2024, BMW delivered 714,500 BMW and MINI vehicles in the Chinese market, retaining its title as the annual sales champion of luxury passenger cars in China. However, this figure declined by 13.4% compared to 826,300 vehicles in 2023, with the largest sales decline in the Chinese market compared to other regions. The U.S. market, seen as key to balancing losses in the Chinese market, also only grew by 0.5%, with sales of 397,700 vehicles.

Stockstar noted that sales of the three German luxury brands BBA all declined significantly in China last year. Mercedes-Benz and Audi sold 683,600 and 649,400 vehicles in the Chinese market in 2024, with year-on-year declines of 7% and 10.9%, respectively. In contrast, although BMW's sales in China exceeded those of Mercedes-Benz and Audi, it faced the most severe situation, with its decline outpacing the other two automakers.

With the rise of new energy and Chinese independent brands, traditional luxury brands like BMW are in a critical period of transformation. In the Chinese market, AITO, backed by Huawei, has repeatedly set new sales records, and BYD's (002594.SZ) million-yuan luxury vehicle Yangwang U8 has also raised the ceiling for Chinese luxury vehicles. The market share of traditional luxury vehicles is gradually being eroded in price competition with independent brands.

In 2024, BMW's "two price wars" sufficiently illustrated the difficulties it faced in sales in China. In July 2024, BMW announced its withdrawal from the price war and subsequently increased prices for its entire range of models, with the i3 increasing by nearly 20,000 yuan and the X1, X3, and 5 Series increasing by 5,000 to 20,000 yuan, respectively. According to Autohome statistics, BMW's sales in the Chinese market were 48,900 and 34,800 vehicles in July and August 2024, respectively, down 12% and 29% month-on-month. In comparison, Mercedes-Benz sold 49,600 and 49,500 vehicles during the same period, while Audi sold 45,200 and 47,900 vehicles, with Audi even experiencing month-on-month growth.

In the third quarter of last year, BMW's sales in the Chinese market were only 147,700 vehicles, a year-on-year decrease of 29.8%, compared to 188,500 vehicles in the second quarter. To boost sales, BMW, which had exited the price war for only two months, had to return to it. However, even with price reductions, the brand still failed to stop the decline in sales.

In the field of new energy vehicles, BMW has delivered more than 400,000 new energy vehicles in the Chinese market. In 2024, sales of BMW and MINI pure electric vehicles in the Chinese market increased by 7.7% year-on-year, with pure electric vehicle sales accounting for 15% of the group's total sales in China.

BMW also emphasized that in the long run, the company will continue to increase its investment in new energy technologies and expand its product matrix to adapt to the global automotive market's transition to new energy. According to plans, BMW will launch more than 10 new BMW models and multiple MINI brand and BMW motorcycle products in the Chinese market in 2025. Additionally, BMW's new-generation models will be launched in the global market starting from 2025, with the first locally produced new-generation model set to be produced in Shenyang in 2026.

Under the dual pressure of domestic independent brands and other international brands, whether BMW can halt the decline in sales in China is crucial to its overall performance. (This article was originally published on Stockstar, author | Lu Wenyan)

- End -