When Technology Lags, Even Foreign Giants Fear Being 'Choked': China's Smart Car Supply Chain Gains Momentum

![]() 03/18 2025

03/18 2025

![]() 795

795

Introduction

Amid technological dividends and geopolitical games, Mercedes-Benz, Volkswagen, and Renault have opted to take decisive action.

While Germany publicly warned about the need for vigilance against Chinese technology monopolies, Mercedes-Benz announced its integration of China's Hesai Technology's lidar into its global strategic models; Geely-backed Ecarx is in advanced talks with Volkswagen; and Renault has officially commenced trials of WeRide's autonomous driving Robobus.

This seemingly paradoxical industrial landscape is a true reflection of the globalization process of China's smart car supply chain. Driven by the dual waves of electrification and intelligence, the global automotive supply chain is undergoing a silent yet profound revolution.

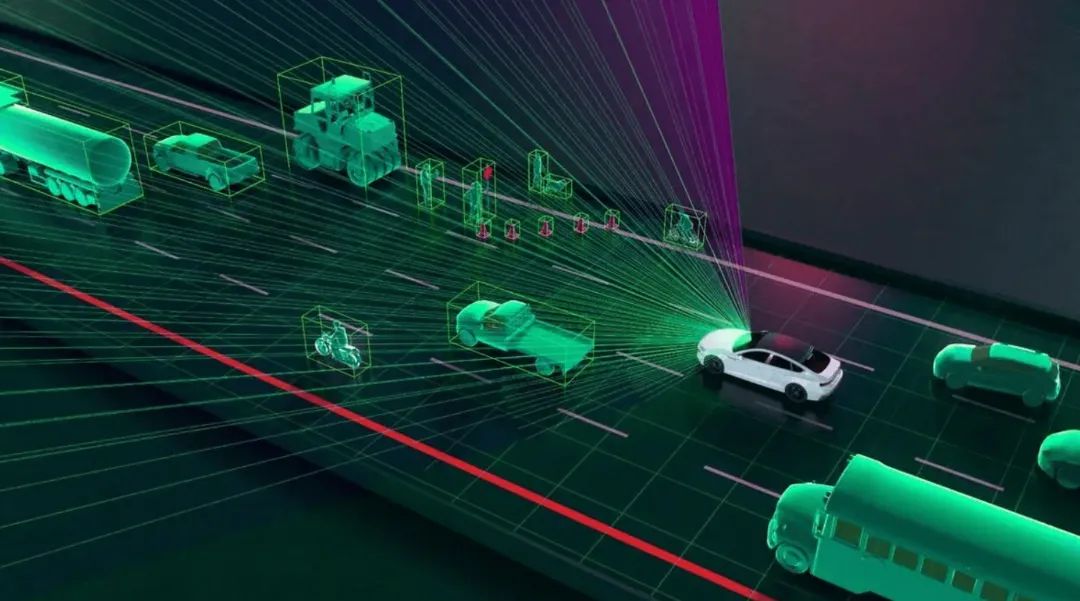

From lidar to intelligent cockpits, and from autonomous driving algorithms to automotive-grade chips, Chinese enterprises are racing ahead on the track of technological iteration, continually breaking trade barriers and establishing new technical benchmarks in the core areas traditionally dominated by Western automotive powers.

This process not only showcases the rise of China's smart car technology but also heralds profound changes in the global automotive industry landscape. In the interdependent and competitive global market, cooperation and competition between Chinese and European automotive enterprises are intricately intertwined. This revolution has not only reshaped the global automotive industry but also paved the way for the ascendancy of China's smart car supply chain in the global market.

01 China's Supply Chain Successfully Breaks Into Overseas Markets

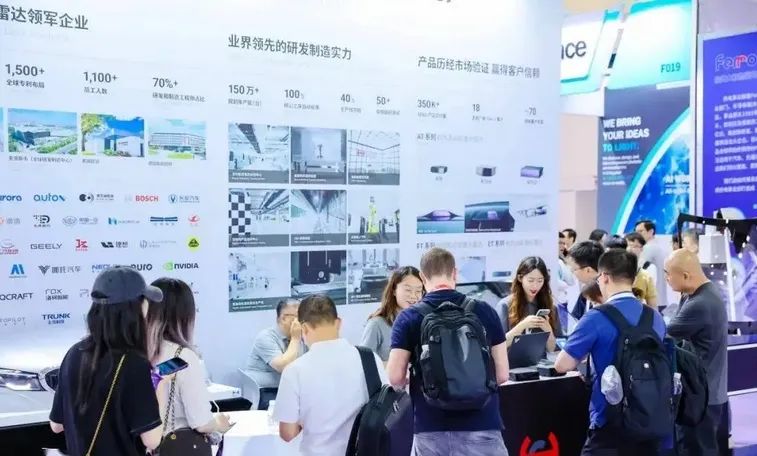

Recently, according to relevant media reports, Mercedes-Benz has selected Hesai Technology as the supplier of lidar sensors for its global models.

This decision holds landmark significance. It marks the first time a foreign automaker has attempted to apply such Chinese-made technology to models sold outside China, reflecting Hesai Technology's leading position in the lidar field and the global recognition of the technology and cost-effectiveness of Chinese supply chain enterprises.

Hesai Technology's ability to stand out from numerous competitors and become a partner of Mercedes-Benz is primarily attributed to its continuous innovation and cost control capabilities in lidar technology. Not only does Hesai Technology dominate the domestic market but it has also successfully expanded into overseas markets, establishing collaborations with numerous internationally renowned automakers.

According to Fan Peng, CFO of Hesai Technology, to meet growing demand, Hesai has expanded two production lines in China this year to achieve an annual production capacity of over 2 million units. Simultaneously, the company is setting up overseas production lines, planned to commence operation as early as next year, to serve overseas customers concerned about tariff and logistics risks.

Furthermore, Hesai Technology's 'exclusive multi-year' contract with a leading European automaker underscores its competitiveness in the international market. Although the specific details of the contract have not been disclosed, it is foreseeable that this cooperation will bring more orders and market share to Hesai Technology, driving its continuous expansion in the global lidar market.

Against the backdrop of the United States intensifying efforts to restrict global automakers from using Chinese components and software solutions, Hesai Technology's success undoubtedly has demonstrative significance. It shows that despite trade tensions and geopolitical risks, Chinese supply chain enterprises can still secure a place in the global market with their technological prowess and cost advantages.

Similar to Hesai Technology's breakthrough in the lidar field, Ecarx is also gradually achieving a global footprint in the intelligent cockpit system.

As a company supported by Geely, Ecarx has partnered with Volkswagen to apply its digital cockpit system Antora 1000 to smart cars produced by Volkswagen in Brazil and India. This system employs Ecarx's proprietary chips and software, providing services such as voice recognition and navigation maps, enhancing the intelligence level of vehicles.

Shen Ziyu, CEO of Ecarx, stated that the two companies are currently seeking to expand their partnership to include Volkswagen's Skoda brand cars sold in Europe and are also exploring the possibility of launching cars equipped with Ecarx technology in the United States. This plan reflects Volkswagen's high regard for China's intelligent technology.

In the context of the intelligent transformation of the global automotive industry, the intelligent cockpit system, as a vital means to enhance vehicle competitiveness, is receiving increasing attention from automakers. Relying on its advanced technology and rich experience, Ecarx has successfully entered the supply chain system of global automakers and become their key partner.

Notably, in the process of overseas market expansion, Ecarx also focuses on mitigating geopolitical risks.

Shen Ziyu said that Ecarx has been establishing its R&D team overseas, aiming to alleviate concerns about the use of Chinese technology through localized operations. Additionally, Ecarx plans to reduce its dependence on the Geely Group and lower the proportion of Geely-related revenue to below 50% by 2028. By 2030, half of Ecarx's revenue will come from overseas markets.

In addition to Hesai Technology and Ecarx successfully breaking into overseas markets, WeRide in the field of autonomous driving is also accelerating its entry. Recently, Renault and WeRide launched an autonomous driving Robobus trial in the center of Barcelona, Spain, providing free services to citizens from March 10 to 14. This initiative marks the successful penetration of China's smart car technology into the European public transportation sector.

The Robobus trial route in Barcelona spans 2.2 kilometers with a total of 4 stops, approved by the Barcelona City Council and the Department of Transport. This not only attests to the recognition of China's smart car technology but also affirms the expansion capabilities of China's supply chain in overseas markets.

Meanwhile, in Valence, France, Renault, WeRide, and other partners are preparing to launch commercial services for Level 4 autonomous driving shuttles, connecting the TGV railway station and business parks, serving 150 companies and 3,000 employees, further demonstrating the vast application prospects of China's smart car technology in the European market.

Beyond France and Spain, China's smart car supply chain is actively expanding in other European regions. At Zurich Airport, WeRide has been conducting autonomous transport trials since January 2025, assisting employees in traveling between terminals, showcasing the capability of autonomous technology to operate in high-security environments.

Han Xu, founder and CEO of WeRide, said that the Barcelona trial run is a pivotal moment in WeRide's international expansion strategy, demonstrating its technological leadership in the heart of Europe.

The Renault Group's efforts are not limited to its collaboration with WeRide but also extend to the field of advanced driver assistance systems (ADAS) for personal vehicles, providing functions such as adaptive cruise control and lane-keeping systems to enhance safety and comfort. This aligns with the technological advantages of China's supply chain in intelligence and electrification, jointly propelling the transformation and upgrading of the global automotive industry.

02 Geopolitical Games Cannot Stifle Technological Advancements

Some argue that when Mercedes-Benz's global models equipped with Hesai lidar roll off the production line at the Sindelfingen factory and when Barcelona citizens ride WeRide's driverless minibuses through the cobblestone streets of the Gothic Quarter, these scenes signify that the global automotive industry is undergoing a power shift unseen in a century.

The overseas expansion of China's smart car supply chain is far from a simple export of cost advantages but a paradigm shift in the industry rooted in technological generational differences. In this revolution, 'Made in China' is evolving into a global solution of 'Intelligently Made in China,' and traditional automotive powers face the challenge of striking a new balance between technological nationalism and industrial realism.

The success stories of Hesai Technology, Ecarx, and WeRide are a microcosm of the competitiveness of China's supply chain enterprises in the global market. Relying on technological innovation, cost control, and large-scale production capabilities, they have successfully penetrated the supply chain system of global automakers and become a significant driving force for the intelligent transformation of the global automotive industry.

Undoubtedly, technological innovation is the cornerstone of the success of China's supply chain enterprises. In fields such as lidar and intelligent cockpit systems, China's supply chain enterprises continue to increase R&D investment, foster technological innovation, and drive industrial upgrading. Through relentless technological innovation, China's supply chain enterprises have not only improved product performance and quality but also reduced production costs and enhanced their competitiveness in the global market.

After years of development, cost control is another significant advantage of China's supply chain enterprises. As a global manufacturing hub, China boasts a comprehensive industrial chain and abundant labor resources, enabling China's supply chain enterprises to effectively manage costs during production and offer products with price advantages.

This advantage is particularly pronounced in the global market, allowing China's supply chain enterprises to distinguish themselves from international competitors. Furthermore, the subsequent large-scale production capacity is also a crucial support for China's supply chain enterprises.

With the rapid development of the global automotive industry, the demand for components and systems is also surging. Leveraging strong production capacity and economies of scale, China's supply chain enterprises can meet the demand of global automakers for large-scale production, ensuring stable supply and timely delivery of products.

However, China's supply chain enterprises also face numerous challenges in the process of global market expansion. Trade tensions and geopolitical risks are among the most prominent issues. To tackle these challenges, China's supply chain enterprises need to strengthen communication and collaboration with international partners to jointly foster the healthy development of the global automotive industry.

Simultaneously, China's supply chain enterprises must continuously improve their technological prowess and brand influence, enhancing their voice and competitiveness in the global market.

Editor-in-Charge: Shi Jie, Editor: He Zengrong