A Year of Extreme Challenges: CATL's Triumphant Rise

![]() 03/20 2025

03/20 2025

![]() 572

572

CATL Remains Unbowed Amidst Crises.

Written by | Lin Yuan

Produced by | Zero Carbon Knowledge Bureau

Over the past year, CATL has undergone a remarkable transformation.

Since the launch of the Tianheng energy storage system in April, marking the dawn of the 6MWh era, CATL has consistently dominated industry headlines throughout 2024.

On one hand, CEO Zeng Yuqun has been visibly active in public appearances and interviews.

From discussing collaborations with Tesla and unveiling plans for a secondary listing;

To favoring the LRS (technology licensing) model and expressing a willingness to export technology for global lithium battery access;

To the ironically candid statement, "There is no 'king of competition,' and I don't know what the word 'competition' means";

There were also industry-wide advocacy efforts, such as emphasizing the high thresholds and the need for order in the energy storage industry.

Subsequently, CATL launched a large-scale promotional campaign targeting consumer-end customers.

In August, CATL's New Energy Lifestyle Plaza, spanning over 10,000 square meters, was inaugurated in Chengdu, Sichuan, showcasing 41 brands and over 70 popular new energy vehicle models, creating a "global hub for new energy vehicle brands";

During the Olympics, consumers were incessantly reminded of the slogan "Choose electric vehicles with CATL batteries" alongside the games;

Coupled with frequent social media updates and large-screen advertisements on high-speed rail/subways, CATL was determined to etch "CATL Inside" into the public consciousness.

※CATL's Unwavering Push Towards Consumer Markets

If one word were to encapsulate CATL's 2024, it would likely be "turbulent." However, not all of CATL's "turbulence" was voluntary.

First, there was the widely circulated "No. 1 Document" from CATL's President's Office, accompanied by uproar over the "896 work system" and stringent "100-day strive" requirements, bringing CATL's overseas expansion anxieties to the forefront;

Then, in September, a fire broke out in CATL's prized "Lighthouse Factory," the world's first in the lithium battery industry;

Coupled with the US repeatedly advocating sanctions against Chinese enterprises, CATL, as the leading lithium battery company, was almost always included.

It is no exaggeration to say that last September, when CATL successfully reclaimed a market value of one trillion yuan, we rarely saw such "ups and downs" that didn't align with its global dominance.

By the end of December, CATL issued 18 announcements in succession, finally confirming its secondary listing in Hong Kong, drawing a relatively satisfying conclusion to this year's "turbulence."

However, from the results, despite frequently topping hot searches, either voluntarily or involuntarily, throughout the year, CATL remains the industry's top winner.

※"Go Out, Go Overseas" Once a Company Slogan

According to the company's latest financial report, in 2024, CATL achieved operating revenue of 362.013 billion yuan, marking the first annual revenue decline in a decade, with a decrease of 9.7%.

Its net profit for the year reached 50.745 billion yuan, a positive growth of 15.01% compared to 44.1 billion yuan in the same period last year. This equates to earning 139 million yuan every day last year, making it the number one "money printer" in the lithium battery industry.

"Increased profits but stagnant revenue," CATL, with its unparalleled position in the global lithium battery industry, also faces an almost uniquely awkward situation within the industry.

Fairly speaking, the overall decline in revenue cannot be entirely attributed to CATL itself.

In terms of sales volume alone, the company shipped 475GWh of lithium batteries throughout the year, an increase of 21.79% year-on-year. Among them, power battery shipments were 381GWh, an increase of 18.85% year-on-year; and energy storage battery shipments were 93GWh, an increase of 34.32% year-on-year.

From the perspective of gross profit margin, CATL's two major business segments, power battery systems and energy storage battery systems, had gross profit margins of 23.94% and 26.84%, respectively, in the current year, representing increases of 5.81% and 8.19%, respectively, compared to the same period last year.

Sales performance and business gross profit margins have not decreased but increased, especially with significant growth in the energy storage battery business. Against the backdrop of the lithium battery industry repeatedly proclaiming that "winter has arrived," this is quite in line with CATL's brand status and market dominance.

This also means that the reason for CATL's revenue decline is indeed as stated in its announcement, continuously affected by the industry's macroenvironment of declining prices:

"Due to the decline in raw material prices such as lithium carbonate, the company's product prices have been adjusted accordingly, resulting in a year-on-year decrease in operating revenue."

※The Theory that "Guangzhou Automobile is Working for CATL" is Still Fresh in Mind

It is worth mentioning that despite CATL's efforts to strengthen its direct influence on consumer-end customers, it is also continuously leveraging its advantage in discourse power with downstream customers. After several previous waves of "de-CATL-ization" by major new energy vehicle and energy storage customers, CATL still faces collective encirclement from second- and third-tier battery cell manufacturers.

Haibo Sichuang, which once procured 98.56% of its battery cells from CATL two years ago, saw its procurement amount drop to only about 39.2% in the first half of last year, significantly lagging behind EVE Energy, which accounted for more than 60%, with the gradual "decoupling" from the former being quite successful.

On February 7, the company and EVE Energy finalized their strategic procurement relationship for battery cells for the years 2025-2027, with an expected total procurement volume of 50GWh.

Sungrow Power Supply, currently in the limelight and a traditional major customer of CATL, has also begun to support second-tier battery cell manufacturers such as EVE Energy and GP Batteries.

The company's 7.8GWh global largest energy storage project signed with Saudi Arabia's ALGIHAZ last year and the 4.4GWh energy storage system order with the UK's Fidra Energy both used battery cells supplied by CALB, which ranks second only to CATL and BYD in the industry.

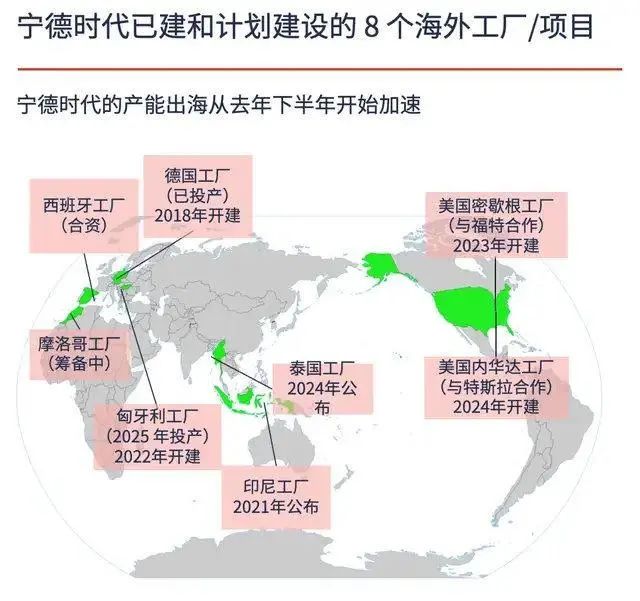

※LaterPost's "CATL's Capacity Expansion Overseas Map"

The ability to "increase profits despite stagnant revenue" sufficiently demonstrates that CATL's foundation, despite seemingly frequent blunders, remains unshakable, and its next moves should not be underestimated.

On one hand, CATL's determination to accelerate its overseas expansion is evident. Considering that its plan to list in Hong Kong faces few obstacles, and under the general direction of "further expanding international business, promoting overseas project construction, and supplementing overseas operating funds," it is bound to succeed in overseas markets.

At the same time, CATL, with its already formidable production capacity, continues its global expansion.

As of the end of the year, the company's production capacity reached 676GWh, with 219GWh under construction. In China, some production lines of ongoing projects, including the Zhongzhou Base, Guiyang Base, Xiamen Base, and Jining Base, have been put into operation and are ramping up capacity; overseas, the capacity of the German factory is gradually increasing, and the Hungarian factory, the Spanish factory jointly invested with Stellantis, and the Indonesian battery industry chain project are under construction or in preparation.

Since the second half of 2024, CATL's capacity utilization rate has increased quarter by quarter. The company's annual capacity utilization rate was 76.33%, and it has been basically operating at full capacity since the fourth quarter.

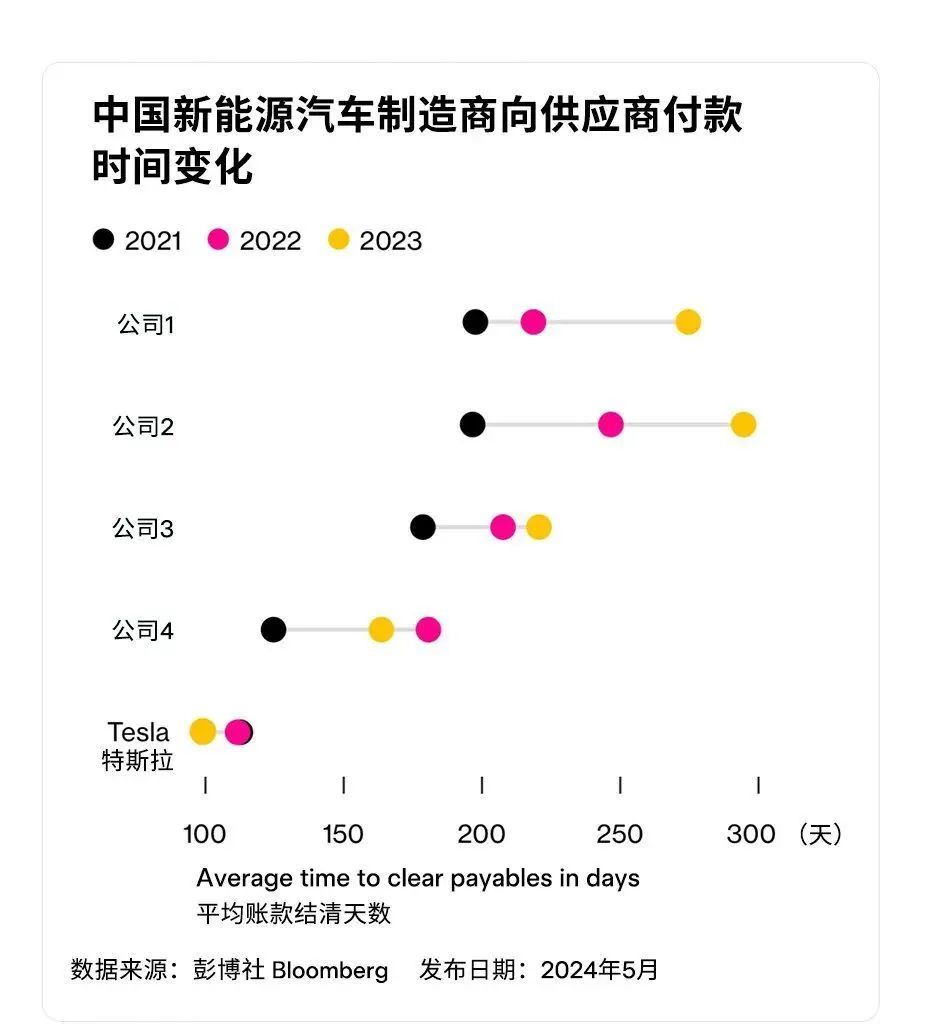

※"Automakers' Ultra-Long Payment Terms: The Deeper You Dig, the Scarier It Gets"

On the other hand, the crisis transfer capability brought about by industry discourse power has always kept CATL standing tall.

Last year, new energy automakers experienced a round of comprehensive scrutiny over "ultra-long payment terms."

According to previous estimates by Caijing based on the financial reports of 16 listed Chinese automakers, the current average number of days for accounts payable and notes payable of automakers is 182 days, nearly twice the payment terms of international automakers. This number is still increasing, with the first nine months of 2024 generally being one month longer than those of 2023.

The tight funds throughout the industry chain have also transmitted pressure on CATL's collections. The company's accounts receivable turnover days increased from 49.98 days in 2022 to 57.9 days in 2023, peaking at 68.13 days in the third quarter of 2024.

CATL's performance in transferring the pressure of delayed payments upward is also evident. The company's accounts payable turnover days soared from 110 days in the first three quarters of 2022 to 174 days in the same period of 2024, far exceeding the industry median (approximately 92 days).

Regardless, the company's cash flow situation remains quite good. In 2024, the company's net operating cash flow was 96.99 billion yuan, a year-on-year increase of 4.49%; as of the end of 2024, monetary funds amounted to 303.512 billion yuan, a year-on-year increase of 14.83%, with ample cash reserves.

According to CATL's profit distribution plan for 2024 released during the same period, CATL plans to distribute cash dividends of 45.53 yuan (tax included) for every 10 shares to all shareholders. The total amount of this cash dividend accounts for 50% of the company's net profit attributable to shareholders for 2024, with a total planned distribution amount of 25.372 billion yuan.

In short, as the industry's number one "money printer," half of CATL's high profits of 139 million yuan earned daily will ultimately be distributed to all shareholders.

Whether it is CATL or its "resolutely tenacious" investors, they have both emerged as big winners.

So, is CATL still the familiar CATL?