L4 Autonomous Driving: A Global Market Overview

![]() 03/20 2025

03/20 2025

![]() 701

701

Produced by Cheenergy

P3 has recently updated its annual report, titled "P3 AD Market Insights," which we will dissect from two distinct angles: mobility services and intelligent driving.

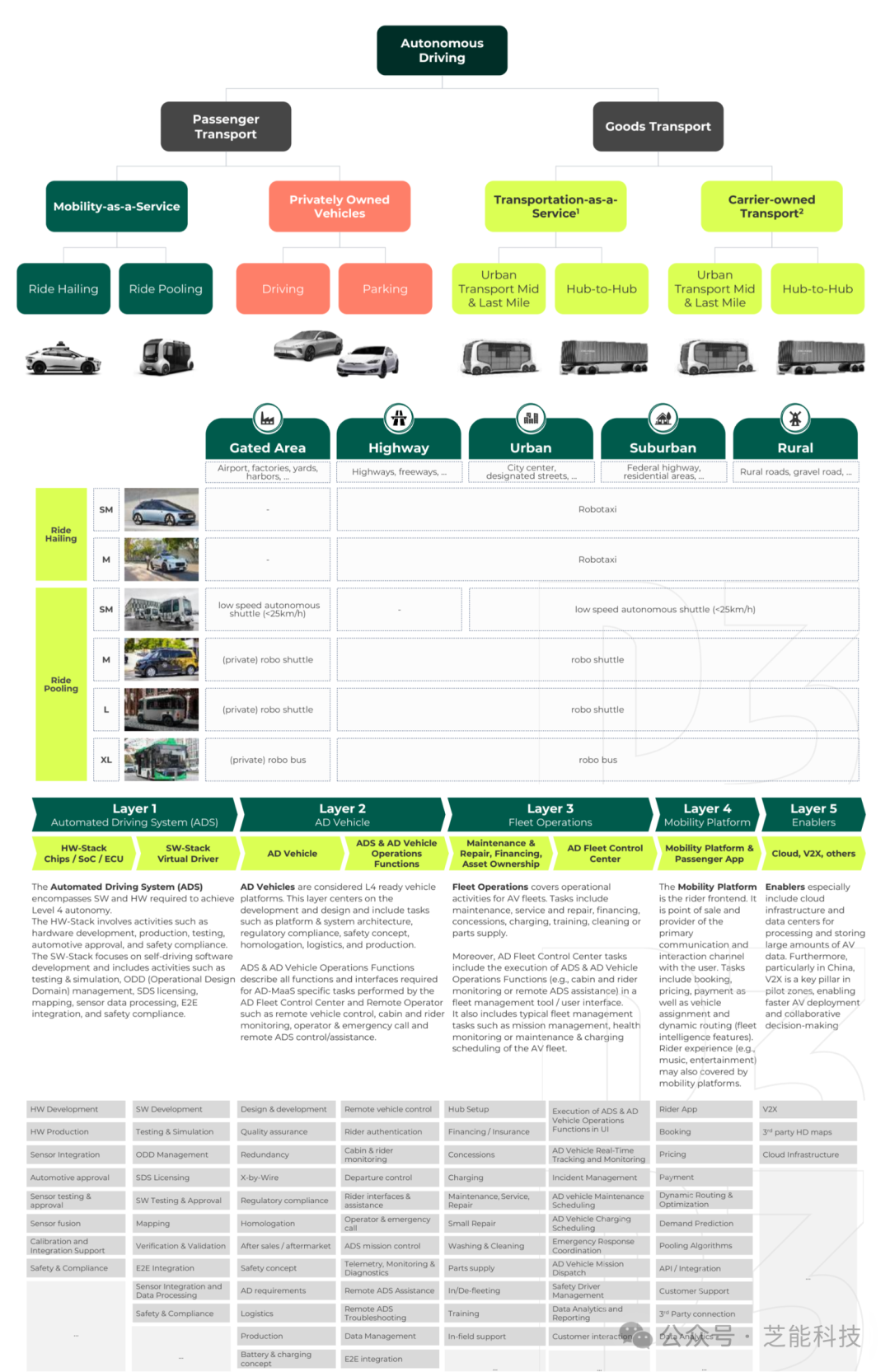

Mobility-as-a-Service (MaaS) is emerging as a pivotal solution for urban centers worldwide, addressing traffic congestion, carbon emissions, and efficiency issues by integrating various modes of transportation such as public transit, ride-sharing, and autonomous driving.

With significant advancements in autonomous driving technology, MaaS is evolving beyond traditional carpooling and car rental services into a highly automated and intelligent mobility ecosystem.

This article delves into the technological landscape, market dynamics, and policy frameworks of the USA, Asia, and Europe in the MaaS sector, exploring their strategic pathways and associated challenges.

The USA is characterized by its dominance of tech companies and rapid commercialization, Asia relies on strong policy incentives and vast market size, while Europe prioritizes regulatory guidance and sustainable development. Each region presents a unique profile in the global competitive arena, offering both opportunities and challenges.

01

USA: Aggressive Commercialization and Technological Dominance

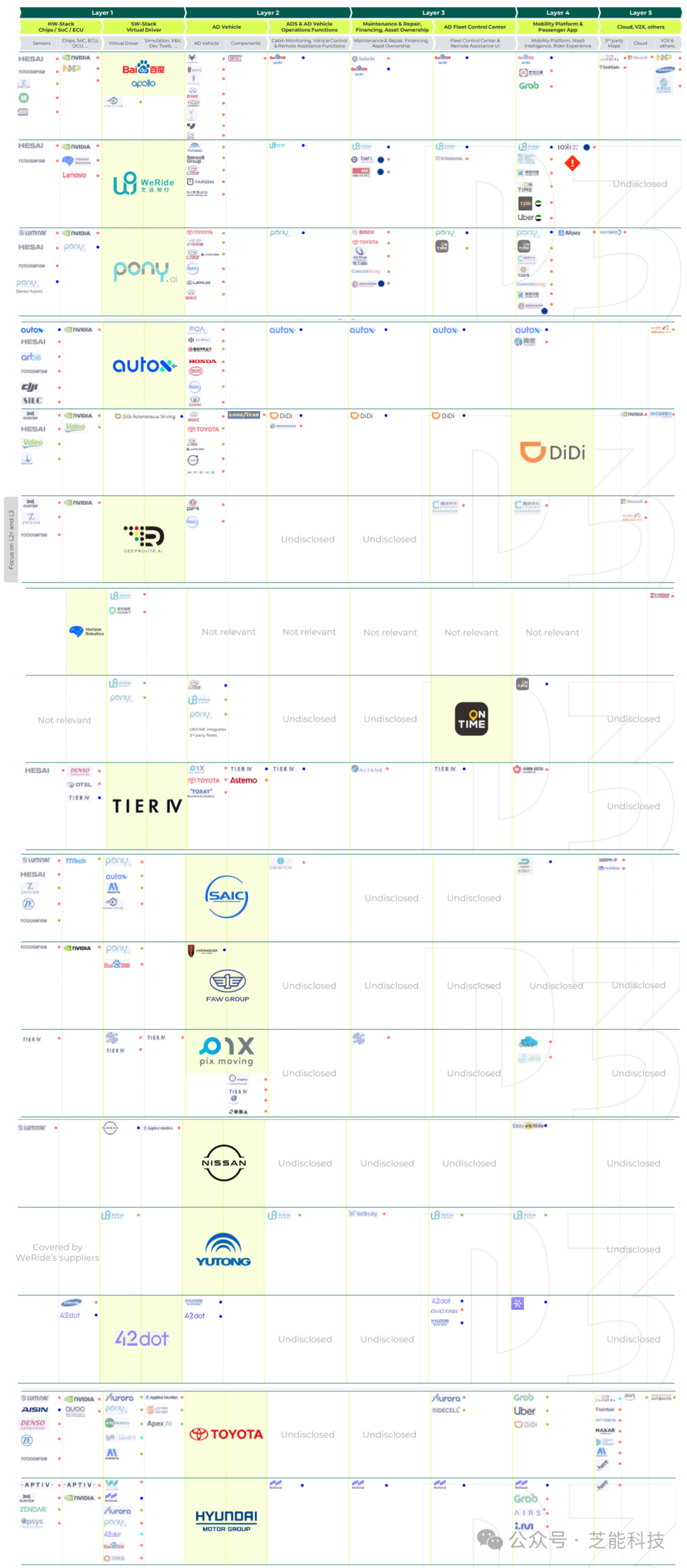

The USA's defining feature in the MaaS sector is its "technological dominance and rapid commercialization." Silicon Valley tech giants lead the industry with their algorithmic and data prowess, while traditional automakers strive to catch up through collaborations and mergers and acquisitions. This model fosters rapid technological iteration and market penetration but also spawns technical disputes and ethical dilemmas.

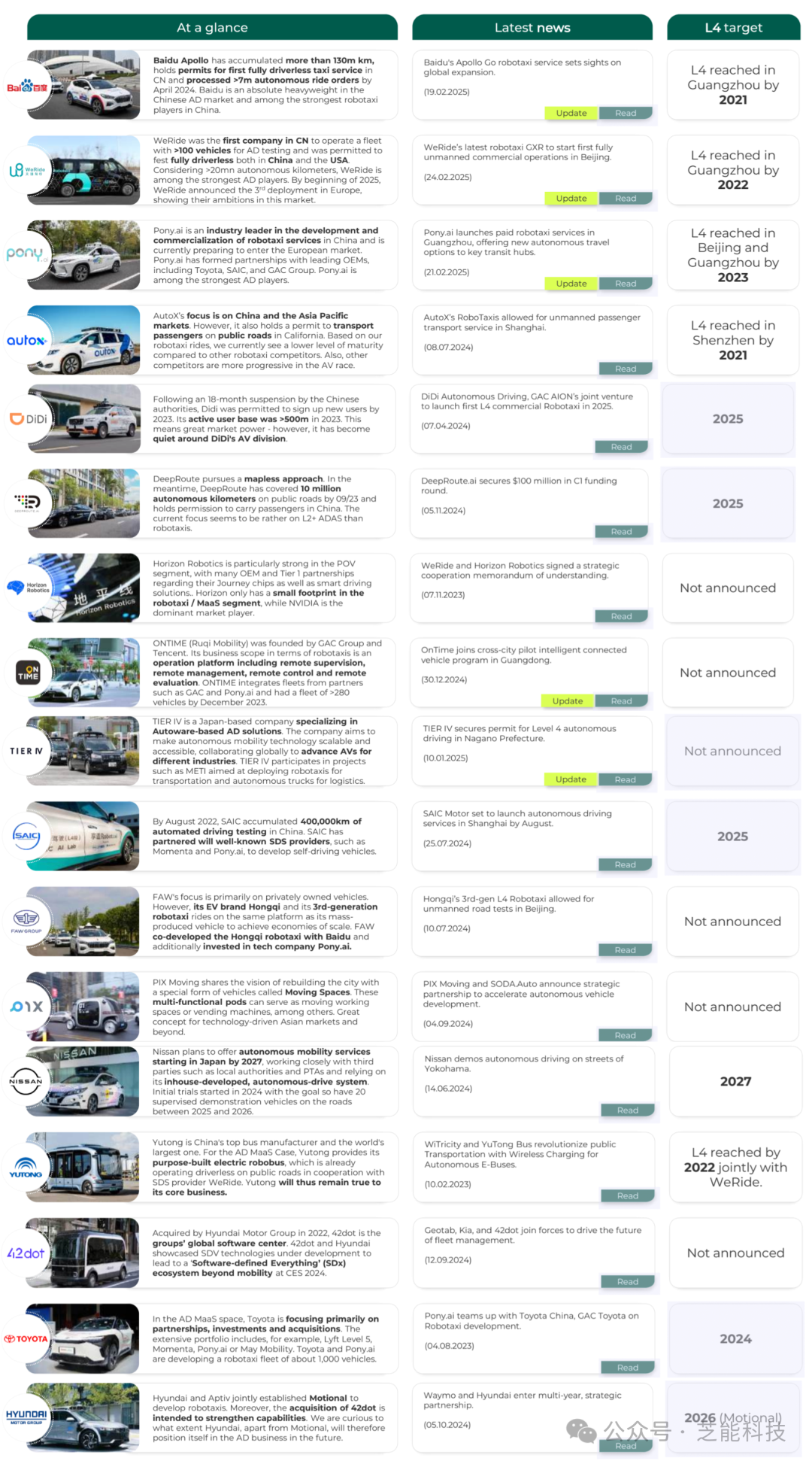

●Waymo, a subsidiary of Google's parent company Alphabet, stands as a technological pioneer in the USA's MaaS market. It has deployed over 100,000 autonomous taxis in Phoenix and San Francisco, with cumulative test mileage exceeding 30 million kilometers.

Its fifth-generation system, "Waymo Driver," utilizes a multi-sensor fusion approach including lidar, millimeter-wave radar, and cameras, achieving a 90% cost reduction compared to the first generation, showcasing technological maturity and commercial viability.

●Cruise, owned by General Motors, has commenced commercial operations of L4 autonomous driving in San Francisco, but frequent accidents in 2024 led to a financial crisis, prompting a 50% workforce reduction and a shift towards developing L3 Advanced Driver Assistance Systems (ADAS) in partnership with Honda.

●Ride-sharing platforms Uber and Lyft are partnering with companies like Mobileye and Aurora, aiming to launch autonomous ride-hailing services in Dallas and Austin by 2026, leveraging their existing user base to accelerate market expansion.

The US federal government has enacted the "SELF DRIVE Act," permitting automakers to deploy 25,000 autonomous vehicles nationwide annually. States like California and Arizona have further relaxed road test restrictions to facilitate technology implementation.

However, state regulations vary significantly; for instance, New York mandates that every autonomous vehicle be equipped with a safety officer, limiting the efficiency of cross-regional operations.

The USA's advantages in the MaaS sector include vast data accumulation (Waymo processes 200PB of data daily), robust venture capital investment (over $20 billion in funding for autonomous driving in 2024), and high consumer acceptance of new technologies.

However, challenges are equally prominent: disagreements on technological pathways (e.g., Tesla's insistence on a vision-only approach versus the multi-sensor fusion adopted by most companies), ethical controversies (e.g., liability in autonomous driving accidents), and conflicts of interest between traditional automakers and tech companies, all hinder industry progress.

Cheenergy Commentary: In the MaaS sector, the USA's true pillars are Waymo and Tesla.

02

Asia: Policy-Driven Innovation and Scalability

Asia showcases unique advantages in the MaaS sector, characterized by "strong policy intervention, large market size, and rapid technological iteration." China, Japan, and South Korea propel rapid technology implementation through government-led R&D initiatives and pilot cities. With a vast user base and policy support, the Asian market has become a key hub for MaaS development.

●China: The World's Premier Testbed

China's strides in the MaaS sector are particularly noteworthy.

◎Baidu Apollo has achieved L4 autonomous driving commercialization in 10 cities, including Beijing and Guangzhou, with over 7 million cumulative orders. Its "ANP City Navigation Assistance" system, integrating high-precision maps and V2X technology, can navigate complex road conditions such as unprotected left turns.

◎SAIC Motor and Alibaba's joint venture "IM Motors" combines shared charging, autonomous driving, and vehicle networking services, aiming to cover the Yangtze River Delta urban agglomeration by 2025.

◎At the policy level, the Ministry of Industry and Information Technology's "Technical Roadmap for Intelligent and Connected Vehicles 2.0" envisions that L3 vehicle penetration will exceed 50% by 2025, with Beijing and Shanghai launching 5G vehicle networking pilot programs to establish a collaborative "smart vehicles + intelligent roads" system.

China's advantages lie in its immense market demand (over 400 million ride-sharing users), substantial government subsidies (e.g., Shenzhen offers subsidies of up to 1 billion yuan for autonomous driving enterprises), and a comprehensive supply chain (70% of global LiDAR sensors are produced in Asia).

●Japan and South Korea: Gradual Automaker-Led Development

The evolution of MaaS in Japan and South Korea is spearheaded by automakers, adopting a gradual strategy.

◎Toyota of Japan has invested $20 billion through its subsidiary "Woven Planet" to develop an L4 system, planning to deploy autonomous buses around the venues of the 2027 Tokyo Olympics.

◎Hyundai Motor of South Korea and Aptiv's joint venture, Motional, are testing fully autonomous taxis in Las Vegas, while Samsung Electronics has invested $2 billion in automotive-grade chip development, aiming to challenge NVIDIA's monopoly.

Asia's challenges include inconsistent technical standards (with patent barriers in China, Japan, and South Korea), restrictions on cross-border data flows, and localization difficulties in emerging markets such as Southeast Asia, which may delay regional collaborative development.

03

Europe: Regulation-Driven with a Focus on Sustainability

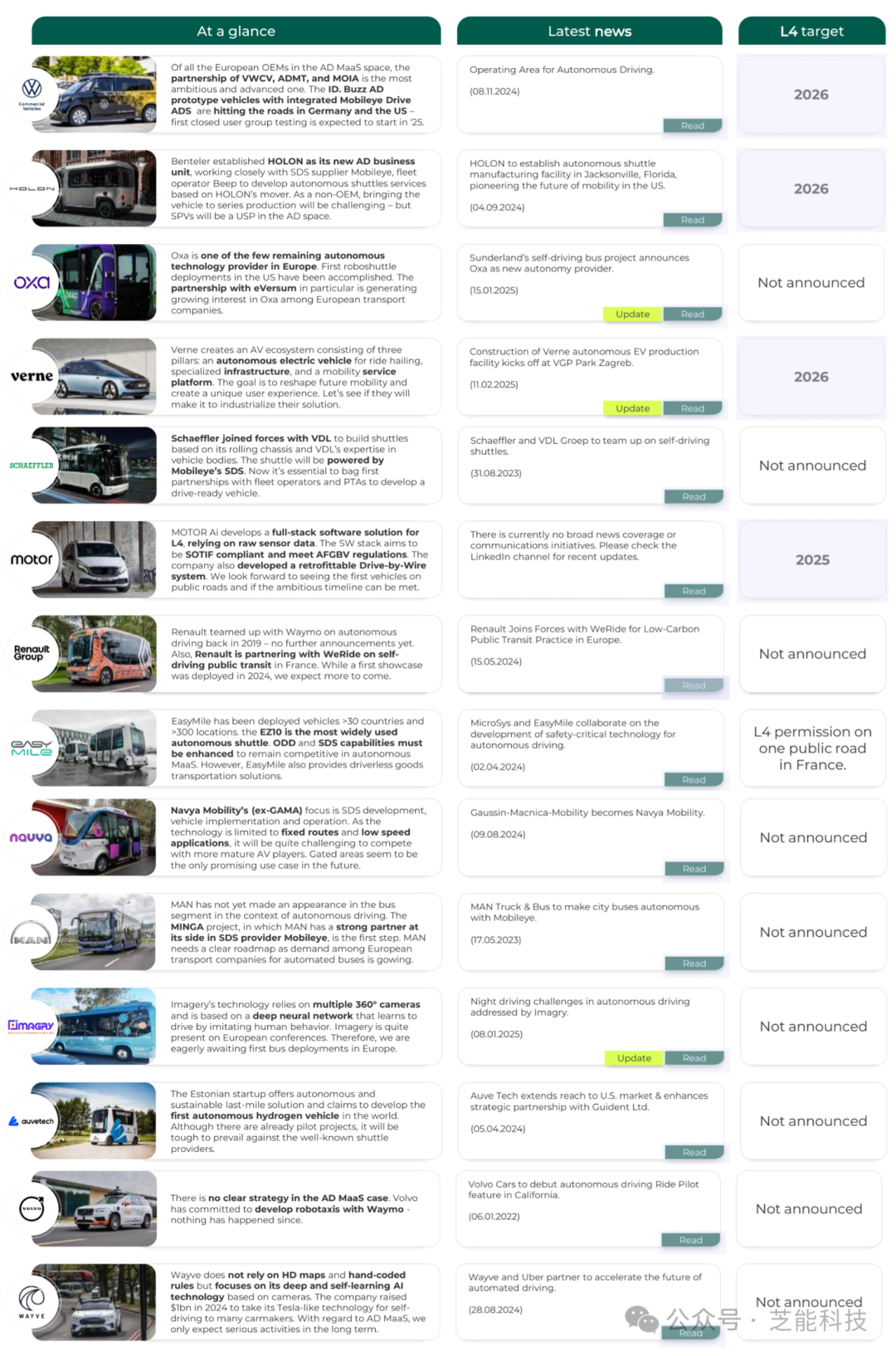

As one of the birthplaces of autonomous driving technology, Europe promotes MaaS development with a focus on "safety, environmental protection, and inclusiveness." The EU's "2030 Climate Target" necessitates a 25% reduction in transportation sector emissions, viewing MaaS as a crucial path to achieving this goal. Europe's strategy emphasizes regulatory guidance and technological cooperation but is also constrained by fragmented policies and high costs.

●Europe's technological layout is marked by deep collaborations between automakers and tech companies.

◎Volkswagen Commercial Vehicles (VWCV) and Mobileye's collaborative ID. Buzz AD autonomous taxi has entered closed testing, with plans for commercialization in 2026.

◎Bosch and Daimler's jointly developed L4 autonomous driving system is being piloted in Stuttgart, encompassing urban arterials and highway scenarios.

◎Renault of France and Waymo's jointly developed autonomous fleet plan to operate in Paris by 2026, while the French government is investing 2 billion euros in V2X communication infrastructure to foster vehicle-road coordination.

◎The sensor research and development alliance led by Netherlands-based ASML has reduced the cost of LiDAR, and logistics giant TNT is collaborating with Nuro to test the application of unmanned delivery vehicles in ports, exemplifying diversified technological exploration.

The EU's "Regulation on Automated and Connected Driving" clarifies that automakers are responsible for L4 vehicles, mandating the standardization of national road digital maps by 2025.

Germany's "Ethical Guidelines for Automated Driving" emphasizes "ultimate control by human drivers," while France allows fully autonomous driving in specific areas (such as Paris' La Defense district).

Europe's advantages include a well-established public transportation network, stringent privacy protection regulations (GDPR), and close collaborations between automakers and tech companies (e.g., BMW and Mobileye).

However, fragmented member state regulations, high technology R&D costs (VWCV invests 1.5 billion euros annually), and public concerns about data security pose significant obstacles to its development.

Summary

MaaS is transitioning from technology validation to large-scale application, with the USA, Asia, and Europe exhibiting notable differences in technological pathways, business models, and policy frameworks.

The USA leads with its commercialization speed and technological dominance, Asia is swiftly rising with policy support and market size, and Europe focuses on safety and sustainability. China's comprehensive advantages in data, policy, and industrial chain position it as a potential global leader in the MaaS sector.

In the next decade, MaaS will profoundly reshape urban mobility ecosystems, and countries' ability to balance efficiency, fairness, and safety will determine their ultimate standing in this global competition and cooperation landscape.