BMW's Struggle with Price Wars: Unable to Let Go of Brand Obsession, Losing Ground in China

![]() 06/20 2025

06/20 2025

![]() 756

756

BMW is mired in the quagmire of price wars largely because its products are increasingly failing to keep pace with the wave of new energy transformation.

Author/Wu Zi

Produced by/New Pick Finance

Amidst the rapid changes in the automotive industry, BMW is increasingly struggling to maintain its prestigious heritage.

At the end of May 2025, The Beijing News reported that the lowest bare-car price for the new BMW 5 Series at a BMW 4S store in Beijing was only 263,000 yuan, a decrease of approximately 20,000 yuan from the price of around 290,000 yuan in early April.

Image source: BMW China

The 2025 BMW 5 Series was launched at the end of 2024 with an official guide price ranging from 439,900 yuan to 525,900 yuan. In just half a year, the price of the new BMW 5 Series has nearly been "halved," which is quite distressing.

Once upon a time, BMW was synonymous with luxury cars, with popular models often hard to come by and consumers even needing to pay a premium to purchase them. Nowadays, BMW frequently initiates price cuts to attract consumer attention, largely indicating that its competitive edge is gradually eroding in the era of new energy vehicles.

Faced with the siege of domestic new energy vehicle brands, BMW's driving advantages are no longer obvious, and there are still significant shortcomings in comfort and intelligence, making it increasingly difficult to convince consumers to pay higher costs to choose its products.

I. BMW Doesn't Want to Fight a Price War, but Dealers Have "Opinions"

Unlike most new energy vehicle brands that rely on direct sales models to expand market influence, traditional automotive brands represented by BMW mainly rely on distribution models to reach consumers.

Since dealers are independent enterprises, BMW only needs to "wholesale" its models to dealers at a certain discount price to avoid inventory pressure. After obtaining the vehicles, dealers can sell them to consumers at a higher terminal price and earn the price difference.

It should be noted that the premise for the healthy operation of the above business model is that BMW's products are highly sought after by consumers. Once BMW's products lose popularity, leading to inventory accumulation, dealers will seek price reductions.

In mid-2020, Li Xiang, CEO of Li Auto, stated in his speech "A Professional CEO" that the cash flow of auto dealers is most prone to problems. Once one or two dealers in a city experience cash flow issues due to inventory accumulation, they can only "desperately reduce prices to sell the cars." Because information is too transparent, if one dealer is willing to sell at a loss, other dealers can only follow suit.

Image source: BMW China

Unfortunately, in recent years, BMW has precisely faced the challenge of sluggish sales. Official data shows that in 2024, BMW's sales in China were 714,500 units, a year-on-year decrease of 13.4%, making it the brand with the largest sales decline among "BBA" (BMW, Benz, Audi).

Against this backdrop, most BMW dealers are facing tremendous pressure to survive and have to reduce prices to stay afloat. According to reports from ecarx.com.cn, in June 2024, the starting price of the BMW i3 model was only around 190,000 yuan, about 160,000 yuan lower than the official guide price; the starting price of the BMW 5 Series was only around 310,000 yuan, about 120,000 yuan lower than the official guide price.

However, due to the fact that "halved" price cuts greatly damage the high-end brand image, in July 2024, BMW officially announced its withdrawal from the price war and required 4S stores to increase model prices. In response, Gao Xiang, President and CEO of BMW Group Greater China, said, "Regardless of how unpredictable the market environment may be, BMW will unwaveringly walk on the difficult but correct path and refuse to participate in meaningless 'internal competition.'"

Image source: BMW

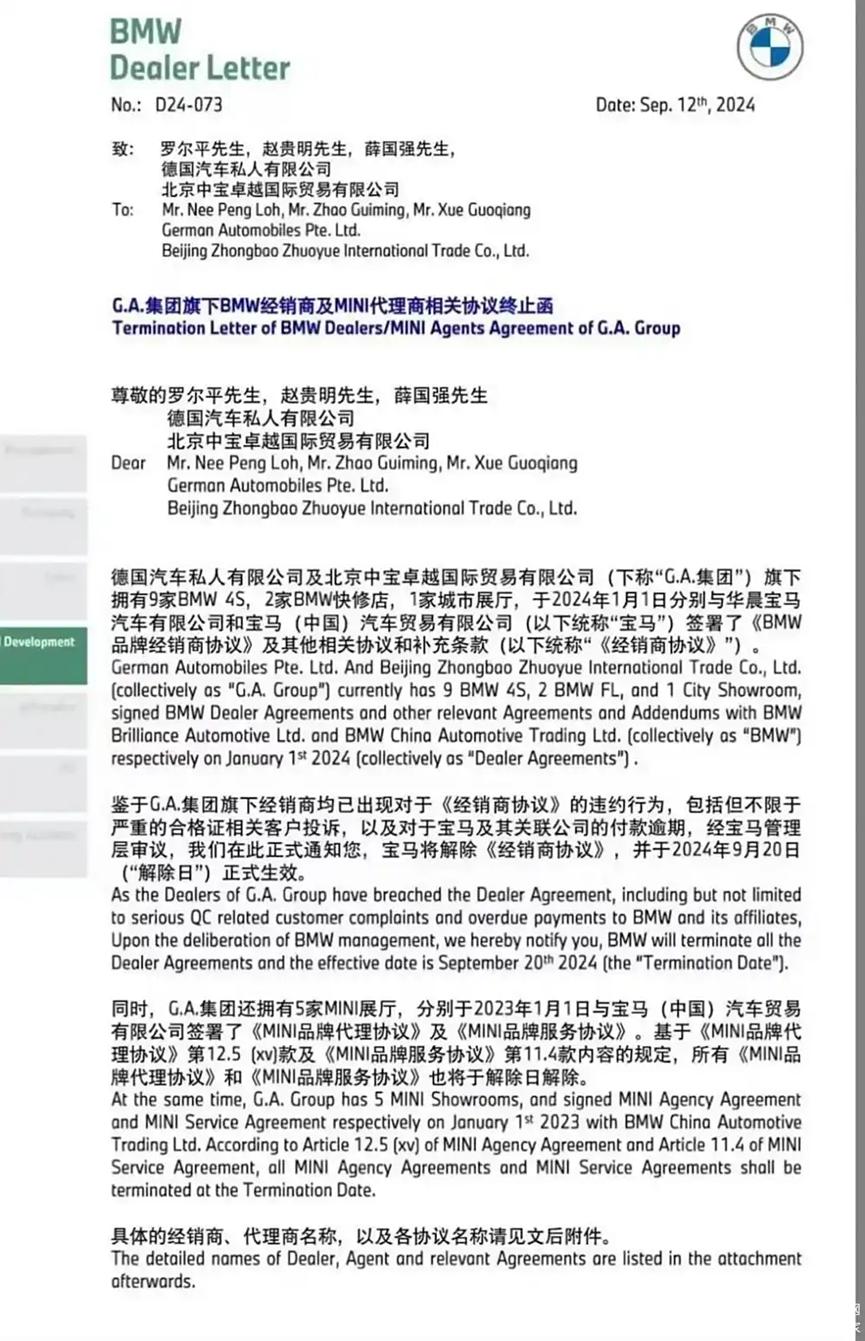

However, after the price increase, BMW was immediately abandoned by consumers. According to data from Tianyancha, in August 2024, BMW's sales in the Chinese market were only 34,800 units, a year-on-year plunge of 41.93%. This also became the last straw that overwhelmed many dealers. In September of that year, BMW Singapore G.A. dealers announced their withdrawal from the network. The following month, BMW's first global 5S store in Beijing, Beijing Xingdebao, was deserted.

Due to the large downward pressure on the market, despite repeatedly shouting slogans of refusing "internal competition," BMW is increasingly struggling to control dealers' "price chaos." In September 2024, many BMW models again saw significant price reductions. In response, BMW officials could only helplessly state that there had been no adjustments to the suggested retail price, and authorized dealers would independently decide the retail price based on market conditions.

It can be said that in recent years, BMW's price policy has swung repeatedly. On the surface, it is due to the decline in the popularity of its models, but the root cause is actually its over-reliance on the traditional distribution model. As sales decline, dealers are forced to actively reduce prices to relieve inventory and cash flow pressures, while BMW has to repeatedly negotiate with dealers to maintain its brand image.

Although BMW has provided dealers with more subsidies and discounts, these concessions appear to be inadequate against the backdrop of continuously sluggish sales, making it difficult to effectively curb dealers' price-cutting behavior.

II. In the Era of Electrification, BMW is Besieged by AITO and Li Auto

In recent years, BMW is mired in the quagmire of price wars to a large extent because its products are increasingly unable to keep up with the times in the wave of new energy transformation.

In the era of fuel vehicles, after a century of refinement, BMW has accumulated a deep business moat in dimensions such as engines, chassis tuning, and handling performance, enabling it to establish extremely high brand value and status. Due to the difficulty in compensating for the shortcomings of internal combustion engines in a short period of time, few local Chinese automakers have been able to challenge BMW in the luxury car market over the past few decades.

However, in recent years, China's automotive industry is accelerating into the era of electrification. Due to their simple structure, good power output characteristics, and high energy conversion efficiency, the power performance of new energy vehicles can easily surpass that of traditional fuel vehicles, and the market competitiveness of BMW's internal combustion engines has begun to decline.

At the same time, as the degree of electrification deepens, cars are no longer simply a means of transportation but are moving towards becoming intelligent spaces integrating "home, entertainment, work, and socializing."

Riding on the wave of electrification and intelligence, in recent years, a number of local Chinese automakers have leveraged their keen insight into consumer demand and strong innovation capabilities to create many popular products.

Image source: Li Auto

For example, in June 2022, Li Auto launched the extended-range SUV Li One L9 Max, with a length of 5218mm, a wheelbase of 3105mm, equipped with a front and rear dual-motor intelligent four-wheel drive system with a total power of 330kW, featuring a five-screen interaction system, a built-in 8.8L refrigerator, and support for AD Max assisted driving, priced at 459,800 yuan. Li Xiang proudly declared, "Li One L9 is the best home flagship SUV under 5 million yuan."

Facts have proven that due to its outstanding configuration, Li One L9 has indeed become a popular product. As of April 2025, the cumulative delivery volume of Li One L9 has exceeded 250,000 units, ranking first in full-size SUV sales.

Image source: HarmonyOS Intelligence

Similarly, at the end of 2023, HarmonyOS Intelligence also launched the panoramic smart flagship SUV Wenjie M9, with a length of 5230mm, a wheelbase of 3110mm, available in both extended-range and pure electric versions, with a total power of 365kW for the extended-range version, featuring an integrated three-screen system, support for ADS 2.0 assisted driving, priced in the range of 469,800 yuan to 569,800 yuan.

Similar to Li One L9, the highly competitive Wenjie M9 has also become a favorite in the market. As of May 2025, the cumulative sales of Wenjie M9 have exceeded 200,000 units, ranking first in monthly sales of luxury cars priced above 500,000 yuan in the Chinese market for ten consecutive months.

Image source: BMW China

In comparison, the product strength of the 2025 BMW 5 Series launched by BMW at the end of 2024 is clearly lagging behind. The new BMW 5 Series not only does not support end-to-end assisted driving but is also only equipped with a 2.0T inline four-cylinder engine and a 48V mild hybrid system. The maximum output power of the 525 Li model's engine is only 140kW, with a price range of up to 439,900 yuan to 525,900 yuan.

Given that models such as Li One L9 and Wenjie M9 not only offer larger space and more powerful engines but also provide superior experiences in intelligence, comfort, and ecological interconnection, BMW naturally struggles to convince consumers to choose its products.

III. By Setting Aside Arrogance, BMW Can Adapt to the New Era

In fact, the BMW 5 Series' inability to compete with domestic luxury cars is largely due to the arrogance of the German development team. As we all know, as a German automotive brand, BMW's core models are developed by the German headquarters team and then distributed to the global market. For example, most of the 5 Series models currently sold by BMW in the global market are the standard-axle versions developed by the German headquarters team.

Image source: BMW China

However, Chinese consumers favor models with long wheelbases, large spaces, and "soft" chassis. This requires the BMW 5 Series to undergo localization for the special needs of Chinese consumers.

In fact, the BMW China team is aware of the above-mentioned needs of the consumer market. At the end of May 2025, 36Kr quoted a BMW China R&D source as saying that for the new 5 Series, the Chinese team proposed, "We hope the wheelbase will continue to be lengthened, the space will be larger, and the chassis will become softer."

However, according to 36Kr, when some colleagues from the Chinese team put forward new ideas or questions, the BMW German R&D department arrogantly responded, "From a technical perspective, there are no issues with our development."

Thus, the biggest problem facing BMW China at present is not a lack of insight into market demand but rather the extreme arrogance of the German headquarters and its unwillingness to delegate power, leaving it to watch helplessly as consumers turn to competitors.

In fact, BMW China's predicament is almost a common challenge faced by all foreign brands in the wave of electrification and intelligence. However, after years of arduous exploration, brands such as Mercedes-Benz and Audi have firmly embarked on the path of localization in the Chinese market.

For example, in November 2024, Audi jointly launched a new brand "AUDI" with SAIC, targeting the Chinese market. The models under this brand will be developed and launched based on the intelligent digital platform jointly built by both parties.

Image source: Audi

Having completely shed the heavy "burden" of internal combustion engines, the new energy models under the AUDI brand are highly competitive. The AUDI E concept car has a length of 4870mm, a wheelbase of 2950mm, and a very sporty appearance. The model is equipped with a 100kWh battery, with a CLTC range exceeding 700 kilometers, supporting an 800V architecture, adding 370 kilometers of range in just 10 minutes of fast charging, with a total power output of 570kW and a 0-100km/h acceleration time of 3.6 seconds.

In stark contrast to Audi's full embrace of the Chinese market, BMW China's current planned models still adhere to German centrism, flaunting the brand's driving culture, which is somewhat out of sync with the current value orientation of electric smart cars in the Chinese market.

And this also seems to indicate that for some time to come, BMW China will continue to be mired in the quagmire of price wars, unable to extricate itself.