Volkswagen and BMW Embrace Range-Extended Technology; Benz Officially Denies Entry

![]() 06/23 2025

06/23 2025

![]() 691

691

By Wang Han / Five-Star Car Reviews

Recent media reports have suggested that Benz is preparing a plug-in hybrid product with 'combined oil and electric drive and ultra-long range' for the Chinese market. Despite Benz China's prompt denial, stating that 'the information is not true,' many believe there's merit to the rumor.

Recently, foreign media reported that BMW will resume development of range-extended systems, initially applying them to the sixth-generation X5. BMW and ZF are jointly developing a system based on the 800V high-voltage platform, drawing heavily from the hydrogen fuel cell iX5 architecture for its chassis and electrical layout. This will later be extended to SUVs such as the X3 and X7.

At this year's Shanghai Auto Show, Volkswagen unveiled its first full-size range-extended SUV concept car, the ID.ERA, with a pure electric range of 350 kilometers. The EA211 1.5T EVO II range extender can be installed on the larger ID.ERA, showcasing its adaptability to various models. Given this, Audi's range-extended plans are likely imminent.

Volkswagen and BMW's shift is intriguing and hints at Benz potentially being 'drawn into' range-extended technology. A few years ago, these brands, which 'dominated' fuel engine technology, questioned range extension, even going as far as calling it 'the worst solution.' Today, none have escaped its allure.

The BMW X5's ability to maintain a monthly sales volume of around 8,000 units is remarkable. Previously, BBA's high-end models hadn't demonstrated such competitiveness. However, it's undeniable that these luxury brands' high-end model market is being encroached upon by new players' flagship SUVs.

In the 500,000 yuan market segment, new players' intelligence, configuration levels, and power performance rival BBA's brand value. It's difficult to pinpoint which aspect is most crucial, but power performance is undoubtedly the easiest for BBA and even Japanese automakers to catch up on.

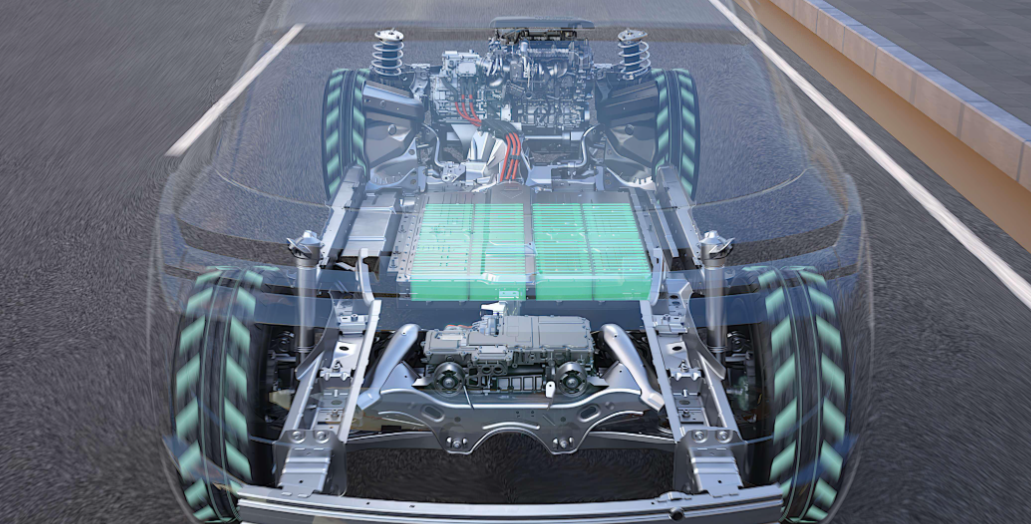

Domestic brands once struggled to break into the mid-to-high-end market, with the lack of large-displacement engine technology being a significant barrier. Range extension has transformed this landscape. Century-old automakers' fuel engines, despite generations of research and development, are now outpaced by range-extended vehicles boasting four to five hundred horsepower and single-digit fuel consumption. When competition revolves around V8 power performance combined with 1.5L fuel consumption, extensive engine development can't keep up.

Claiming that range-extended technology is outdated is meaningless. Even if we consider these consumers technology advocates, they likely advocate new players' intelligent technology. As for the power form, do they value the technology itself, or are they opting for a 'hassle-free lifestyle'?

Range extension serves as a transitional solution beneficial to multiple parties, balancing policy orientation, user experience, and industrial chain interests. For domestic brands, the technical threshold for range extension is relatively low, making it easier to offset decades of joint venture brands' technological accumulation. For joint venture brands, switching to range extension allows them to continue their fuel vehicle era technological advantages, maintaining a degree of leadership before fully embracing the electric era.

As early as BMW Group's Innovation Day in 2010, BMW publicly stated it was evaluating range-extended power technology. By 2013, BMW officially launched its first mass-produced range-extended electric vehicle, the BMW i3 REx. This model featured a battery pack ranging from 60Ah to 120Ah and a 647cc inline twin-cylinder range extender derived from the BMW 650GT motorcycle engine, offering a maximum pure electric range of 203 kilometers and a combined range of 320 kilometers.

However, the BMW i3 REx emerged in an era when battery technology wasn't mature, and electric vehicles generally struggled with short driving ranges and slow charging speeds. Moreover, the cost of electric components (battery, motor, and electronic control unit) was significantly higher than today. The i3 REx's limited battery capacity and poor fuel vehicle experience led BMW to abandon further range-extended exploration.

Benz's attempt came in 2023 when it installed a range extender on the EQS pure electric platform for prototype testing, using a 1.0T two-cylinder engine to push the combined driving range beyond 700 kilometers. However, this plan didn't materialize, and after evaluation, Benz deemed range extension a 'transitional technology' with high production costs and limited benefits.

Considering the market's perception of a 1.2T range-extended engine, Benz was right not to implement the 1.0T two-cylinder engine, which would've struggled to gain positive market feedback. Yet, by 2025, with Benz facing a decline in global turnover and a 10% drop in Chinese sales, its immediate denial of range-extended plans was somewhat surprising.

On June 18, Audi issued a 'Responsive Statement on Audi's Electrification Strategy,' revoking its decision to cease internal combustion engine production by 2033. The company officially stated it might continue producing fuel vehicles until around 2035 or beyond. Previously, Audi had stated it would stop selling fuel vehicles by 2026 and cease production by 2033.

In the coming years, Audi will provide a differentiated product mix as flexibly and stably as possible, encompassing battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and internal combustion engine (ICE) vehicles.

Switching to range-extended power isn't the end of the story. As power forms become homogeneous, more in-depth comparisons will occur on other technological levels, sparking new rounds of competition in intelligent cockpits, assisted driving, or new market demands.

For brands or models known for sports handling, maintaining driving control advantages post-battery system addition will be a common challenge for German luxury brands. Currently, neither the new C-Class AMG nor BMW M5 excel in sales performance or reputation. (The former's displacement has been reduced from 6.2L and 4.0T to 2.0T, while the latter, with a plug-in system, weighs more than the Ford F-150 Raptor.)

Nowadays, it's not just BMW and Volkswagen eyeing the 'range-extended brawl'; Toyota, Nissan, and Hyundai are catching up too. The future medium and large SUV market will fully embrace range-extended technology. In China, newcomers and established players like Xpeng, Xiaomi, and Zeekr are lining up to enter, with dozens of new range-extended products expected in the next two years.

This signifies that range extension is no longer a choice for a few automakers but a collective industry response to market demand. Judging by the scale and investment, the range-extended boom isn't a flash in the pan but a long-term layout.