"Serious Overcapacity in the Automotive Industry": How Much is Left?

![]() 06/23 2025

06/23 2025

![]() 482

482

"Structural" Contradiction

In today's global landscape, the automotive industry grapples with a pressing issue of overcapacity. Li Shufu, Chairman of Geely Holding Group, addressed this hot topic at the 2025 China Automobile Chongqing Forum, stating, "We have decided not to build new automotive production plants and avoid redundant construction." Li emphasized that Geely will leverage global overcapacity effectively and strive for pragmatic cooperation and resource integration.

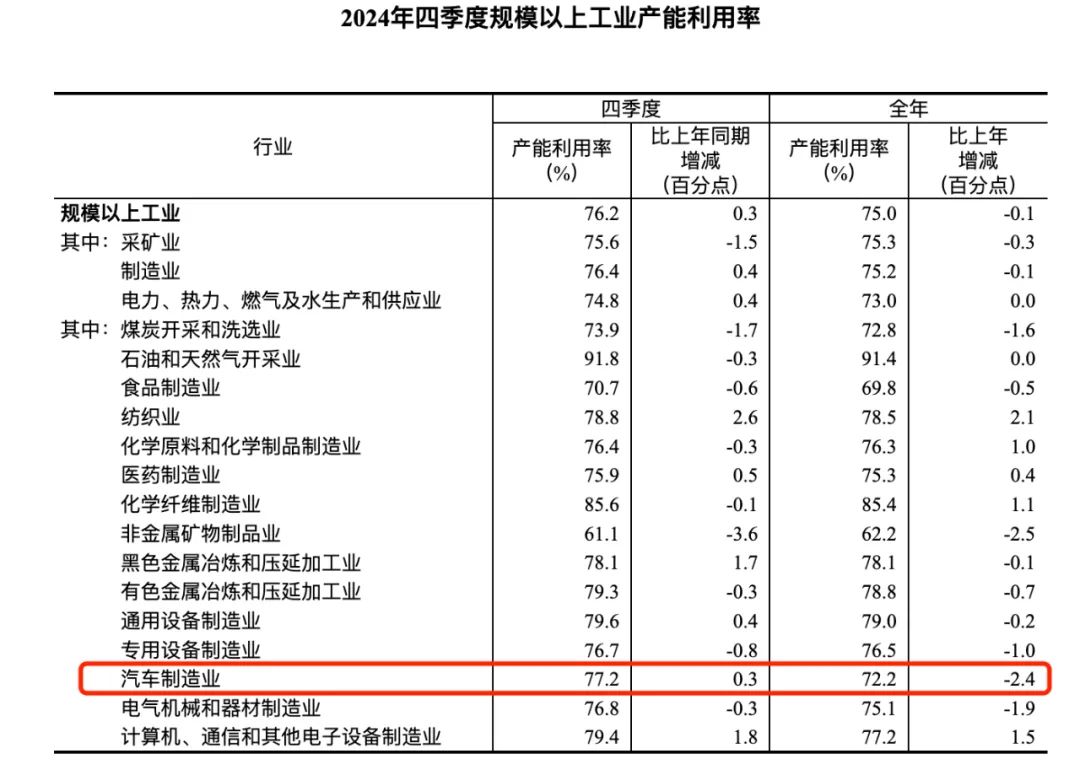

Data Source: National Bureau of Statistics

According to the National Bureau of Statistics, the automotive manufacturing industry's capacity utilization rate for 2024 stood at 72.2%, a decline of 2.4% from the previous year and slightly below the 75.0% utilization rate of industries above a certain size. Reflecting back, China's automotive manufacturing industry boasted a high capacity utilization rate of 82.2% in 2017. While the utilization rate has declined in recent years, it remains within a reasonable range overall from an industry-wide perspective.

However, the structural contradiction between traditional fuel vehicles and new energy vehicles, as well as between independent brands and joint venture brands, is increasingly prominent. At the recent China Electric Vehicle 100 Forum (2025), Su Bo, former Vice Minister of Industry and Information Technology, bluntly stated that there is currently overcapacity of at least 30 million fuel vehicles, while the over 20 million units of capacity for new energy vehicles are mostly new, with only 2-3 million units of fuel vehicle capacity absorbed through the transition to electric vehicles. "Fuel vehicle production and sales volumes, along with profitability, have plummeted, leaving a significant amount of capacity unused and facing a major survival crisis. Some enterprises have already ceased operations and gone bankrupt, signaling an imminent restructuring of the automotive industry ecosystem," Su Bo emphasized.

Moreover, as China's automotive export scale expands, some automakers have begun exploring overseas factory construction. Li Shufu's speech this time also provided insights into how to rationally utilize global automotive capacity resources during Chinese automakers' globalization process.

Imbalanced Current State of Automotive Capacity

Capacity Utilization Rate refers to the ratio of total industrial output to production equipment, essentially the ratio of actual output to production capacity.

According to the China Association of Automobile Manufacturers, China's auto sales reached 31.436 million units in 2024. Fuel vehicle sales fell by 17.4% year-on-year, with sales of 11.55 million units even lower than the 2019 level, whereas new energy vehicle sales surged by 40.2% year-on-year, with the penetration rate skyrocketing from 5.4% to 40.9%. The association predicts this ratio will exceed 50% by the end of 2025.

Wang Qing, Deputy Director of the Institute of Market Economics at the Development Research Center of the State Council, noted that from an overall growth perspective in the automotive industry, the current substitution effect of new energy vehicles for fuel vehicles is approximately 98%, meaning that nearly 98 out of every 100 new energy vehicles sold directly replace fuel vehicles in the market.

With the rising penetration rate of new energy vehicles, capacity utilization rates have diverged. Gong Min, Head of China Automotive Research at UBS, revealed that Chinese local brands' capacity utilization rate has climbed from 65% to 84% over the past few years. During the same period, foreign brands' capacity utilization rate fell from 73% to 56%, with an estimated 10 million units of redundant capacity needing reduction.

Su Bo urged, "It is recommended that competent government departments promptly study and formulate relevant policies to guide and lead, vigorously promoting the electrification transformation of fuel vehicle enterprises while supporting the expansion of new energy vehicle production capacity, primarily through mergers and acquisitions, joint-stock reforms, and asset acquisitions of fuel vehicle enterprises. Avoid large-scale land acquisition and new construction to mitigate greater resource waste caused by continued parallel development."

Currently, leading new energy vehicle enterprises generally boast high capacity utilization rates, and leading new carmakers are also expanding capacity. For instance, Xiaomi's first-phase factory in Beijing's Yizhuang Economic Development Zone has commenced production with a rated capacity of approximately 150,000 units per year. Alone, Xiaomi's SU7 model sales volume from January to May this year reached 132,467 units. According to plans, Xiaomi's automotive factory's second-phase project is expected to officially commence production in July, bringing Xiaomi's overall automotive capacity to 300,000 units per year.

Conversely, enterprises unable to keep pace with the market rhythm are being eliminated. Zhang Yong, the founder and CEO of NIO, once stated that the sales target of 1 million units would be achieved by 2026, but NIO fell in 2025. On June 13, 2025, NIO, once the sales champion among new forces, officially entered the bankruptcy reorganization process. Along with NIO's collapse, its three major factories ceased operations. In fact, after the suspension of cross-border automakers like WM Motor, Aiways, Enovate, Baoneng, and Evergrande, their idle new energy factories also face closure, merger, or transfer.

Capacity Issues of Joint Venture Automakers Become Prominent

With changes in China's automotive market structure, joint venture brands' capacity issues have become increasingly salient in recent years.

In February this year, SAIC-GM closed its Beisheng plant in Shenyang, Liaoning. As one of SAIC-GM's four major production bases in China, this plant primarily produced models such as the Buick GL8, Envision, and Enclave. Data shows that SAIC-GM's four major production bases have a combined annual capacity of approximately 2.6 million units, while its 2024 production volume was only 422,000 units, with a capacity utilization rate of just 16.2%.

Japanese and Korean automakers confront the same issue. Beijing Hyundai's sales volumes from 2021 to 2023 were 380,000, 270,000, and 250,000 units, respectively. By 2024, Beijing Hyundai's annual retail sales volume had plummeted below 160,000 units. Accompanying sales decline is the disposal of excess capacity. Beijing Hyundai originally had five factories in China, and currently, only the Beijing Third Plant remains operational with a planned annual capacity of 450,000 units. Simply put, Beijing Hyundai's current capacity utilization rate is less than 40%.

The situation for Japanese automotive brands is equally grim. In June last year, Nissan Motor closed its Changzhou passenger car plant, a joint venture with Dongfeng Motor, marking the first time Nissan shuttered a passenger car plant in China. In July, Honda China announced the closure of some production lines in China. Among them, GAC Honda closed its fourth production line with an annual capacity of 50,000 units in October, and Dongfeng Honda shut down its second production line with an annual capacity of 240,000 units in November.

Moreover, outdated fuel vehicle capacity in the market largely goes unattended. For instance, GAC FCA's Changsha plant initiated its fifth auction in January 2025, with the starting price significantly reduced by nearly 1 billion yuan compared to the first auction. Unfortunately, all five online auctions failed due to a lack of bidders.

It is reported that GAC FCA's Changsha plant primarily produces fuel vehicles, and if the acquirer intends to produce new energy vehicles, they must make a secondary investment to modify the production line. According to the asset auction announcement of the GAC FCA bankruptcy liquidation case, since GAC FCA ceased production in 2022, some assets in the subject matter have been idle for an extended period and may be lost or damaged, with the current assets' maintenance and custody status generally poor. Given these factors, acquirers will meticulously assess initial investment and later-stage output.

To attract bidders, significantly reducing prices has become a necessity for these production lines. For example, Beijing Hyundai sold its Chongqing plant to Chongqing Liangjiang New Area Yufu Industrial Park Construction Investment Co., Ltd., for 1.62 billion yuan at the end of 2023. The transfer price of the aforementioned plant underwent four reductions, with the four listing prices being approximately 3.684 billion yuan, 2.58 billion yuan, 2.248 billion yuan, and 1.917 billion yuan, respectively. Ultimately, the transaction price for Beijing Hyundai's Chongqing plant was 1.62 billion yuan, a significant decrease of over 2 billion yuan compared to the first listing price of 3.684 billion yuan.

Rationally Utilize Global Automotive Capacity

Notably, Li Shufu's proposal this time addresses "serious overcapacity in the global automotive industry," emphasizing the strategy of "utilizing global overcapacity." This perspective stems from the global automotive industry layout, emphasizing that Chinese automakers should fully leverage local overcapacity when "going out" and replace incremental expansion with stock integration.

From a global automotive industry perspective, with market demand fluctuations, capacity issues merit attention. Nissan Motor's aggressive downsizing is quite representative. On May 13, Nissan Motor announced plans to close seven factories globally by the 2027 fiscal year, reducing the number of factories from the current 17 to 10. Global capacity (excluding China) will also decrease from 3.5 million units in the 2024 fiscal year to 2.5 million units in the 2027 fiscal year, accompanied by a plan to lay off 20,000 employees.

This is not an isolated case. The Volkswagen Group announced in 2024 that it would close at least three factories in Germany and lay off tens of thousands of employees. This marks the first time in its nearly 100-year history that it has contracted its domestic capacity, with simultaneous downsizing of remaining factories. In February 2025, Audi's factory in Brussels officially closed. Due to low sales of the Audi Q8 e-tron produced at this factory, the 76-year-old facility, once crucial for Audi's electrification transformation, faded away.

Both the European and North American automotive markets face issues of declining demand for traditional fuel vehicles and slower-than-expected new energy vehicle adoption. Data shows that U.S. auto sales in 2024 were 15.9 million units, and EU auto sales were approximately 12.84 million units, both lower than the 2019 sales levels. Alongside sales decline, capacity utilization rates have also decreased. Statistics from the financial data platform YCharts reveal that the U.S. automotive industry's capacity utilization rate in the first quarter of 2025 was 65.28%, hitting its lowest point in recent years.

A report released by LMC Automotive stated that basic forecasts indicate the global automotive capacity utilization rate will be 65% in 2028. In the case of weak demand, the capacity utilization rate may drop to 60%, as the new capacity brought by electric vehicle factory construction may not be supported by demand at that time.

In recent years, China's automobiles have achieved remarkable export success. According to the General Administration of Customs, China's cumulative auto exports in 2024 reached 6.41 million units, an increase of 22.8% year-on-year. However, for China to transition from a large automotive country to a powerful one and gain more international recognition, merely selling cars is insufficient. It is also imperative to build a globalized ecosystem of "value symbiosis" to achieve win-win cooperation.

In fact, Chinese automakers have already made relevant attempts. For example, in April 2024, Chery Automobile and Spain's Ebro-EV Motors announced the signing of a cooperation agreement, making Chery Automobile the first Chinese automaker to establish a production base in Europe. Moreover, the legendary Spanish brand EBRO, once thought to be disappearing, has regained vitality due to Chery Automobile's involvement.

Amidst accelerating technological iteration, deep market differentiation, and the restructuring of the globalization landscape, the gradual clearing of outdated fuel vehicle capacity will coincide with the "explosive expansion" of new energy vehicle capacity. As the automotive industry officially transitions from the "era of incremental competition" to the "stage of stock competition," the industry reshuffle process not only harbors risks and challenges of structural adjustment but also nurtures development opportunities for technological innovation and market restructuring.