Is the Golden Age of New Energy Vehicles Ending in Just Six Months?

![]() 06/23 2025

06/23 2025

![]() 658

658

Original content by New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 2744 words, Reading time: 8 minutes

The number of green-plated cars in cities is visibly on the rise.

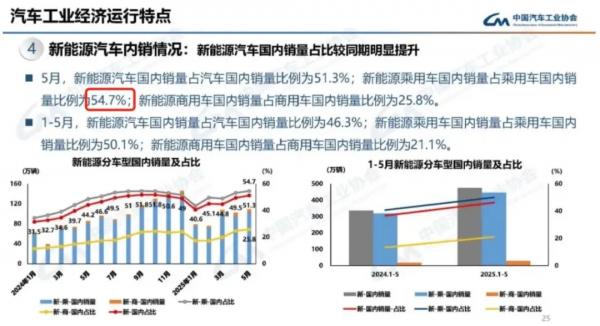

In May, domestic sales of new energy passenger vehicles reached 1.03 million, accounting for 54.7% of total passenger vehicle sales, surpassing fuel vehicles in penetration rate, marking a historic milestone.

However, variables have begun to emerge in the growth trajectory of new energy vehicles. Firstly, car replacement subsidies have been suspended in numerous regions. As we know, subsidies for new energy vehicles are generally higher than those for fuel vehicles, and the suspension of these subsidies will naturally dampen some people's enthusiasm for car purchases. Secondly, the purchase tax for new energy vehicles will be adjusted from full exemption to a 50% reduction in 2026, which may significantly increase the purchase cost of new energy vehicles.

Adding to these challenges are the long-standing pain points of new energy vehicles, such as high after-sales maintenance costs, expensive insurance premiums, and safety hazards. This naturally begs the question: Is the 'golden age' of new energy vehicles coming to an end in just six months?

1. Subsidies 'Braking', Electric Cars 'Cooling Off'

Recently, news of the 'suspension of national subsidies for new energy vehicles' in multiple regions has sparked intense discussions among netizens.

As of June 18, several regions, including Chongqing, Zhengzhou, Luoyang, Shenyang, Gansu, and Huizhou, have announced the suspension or adjustment of car replacement subsidy standards. Huizhou has suspended the issuance of vouchers for car replacement subsidies; Chongqing's first round of car replacement subsidies has ended, with the second round expected to be issued in June, possibly with adjustments to subsidy standards; Zhengzhou has suspended the acceptance of car replacement subsidy applications; and Shenyang plans to suspend five subsidy activities, including car replacement and upgrades...

Image/Various regions successively stopping subsidy policies

Source/Screenshot from the internet and New Energy Outlook

Upon hearing the news, ripples were created in the automobile consumer market. Many consumers rushed to place orders in the days leading up to the end of the subsidies, aiming to catch the 'last train'.

Similarly, in addition to the gradual 'braking' of trade-in subsidies, the relevant policies on the purchase tax for new energy vehicles will also usher in a new 'starting point' in 2026.

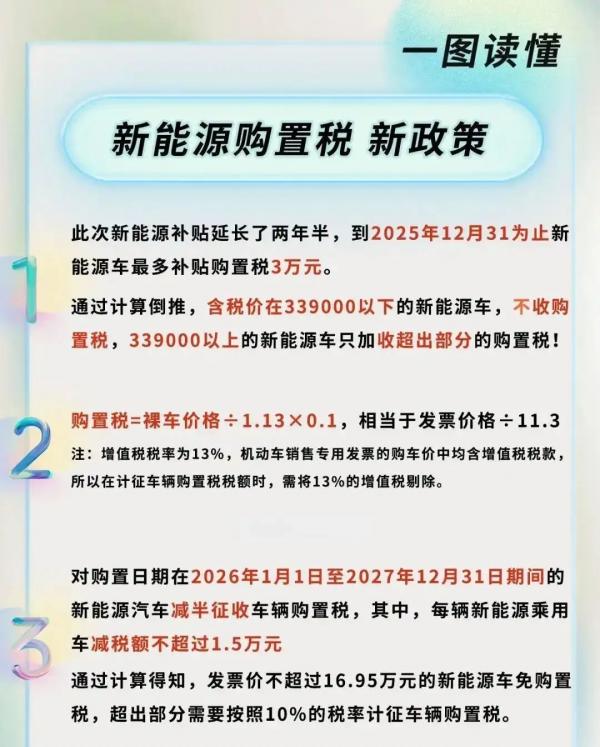

According to relevant policies of the State Council, the exemption policy for the vehicle purchase tax on new energy vehicles has been implemented since September 2014 and will continue until the end of 2027 after three extensions. From 2024 to 2025, the full exemption policy will be in effect, followed by a 50% reduction in the purchase tax from 2026 to 2027, with a single-vehicle tax exemption limit of no more than 30,000 yuan and a tax reduction limit of no more than 15,000 yuan.

Image/New policy interpretation for the vehicle purchase tax on new energy vehicles

Source/Screenshot from the internet and New Energy Outlook

This undoubtedly increases the car purchase cost for consumers to a certain extent.

A consumer who recently obtained a new energy vehicle indicator in May this year said that they originally planned to buy a car by the end of the year, but with the increasing number of notices about the suspension of subsidy policies in different places, they have changed their mind and placed an order as soon as possible. 'After all, with the suspension of subsidies and the halving of the purchase tax, the real cost has increased significantly,' the consumer bluntly stated.

The survey questionnaire of '2025 New Energy Vehicle Consumption Trend Insights' shows that among the consumers surveyed, low usage costs (72.36%) and policy incentives (59.36%) are the core reasons for choosing new energy vehicles. This sufficiently illustrates that policy subsidies occupy an important position in consumers' decision-making process when purchasing new energy vehicles.

From this perspective, if the subsidy policies are adjusted or even suspended, the impact on the new energy vehicle market is self-evident.

2. Did Electric Cars Rise to Prominence Based on Their Hard Power?

Data from the China Association of Automobile Manufacturers shows that in May, the domestic sales share of new energy passenger vehicles reached 54.7%, surpassing fuel vehicles for the first time and entering a new stage dominated by electricity.

Image/Domestic sales of new energy vehicles in May 2025

Source/Screenshot from the internet and New Energy Outlook

Over the past few years, the penetration rate of new energy vehicles has grown exponentially. In 2021, sales of new energy vehicles in China were 3.52 million, with a market penetration rate of only 13.4%. However, in 2022, this figure doubled to 25.6%, and surpassed the 35% threshold in 2023. In July 2024, the penetration rate of new energy vehicles in China reached 50% for the first time, and the annual penetration rate also climbed to 41.6%. Nowadays, when the penetration rate of new energy vehicles exceeds that of fuel vehicles, new energy vehicles have grown from being a niche market initially to becoming an important force in the automotive industry today.

Looking back, behind the explosive growth in penetration rate lies, on the one hand, the relevant policy support mentioned in the article, which provides tangible purchase subsidies to consumers.

On the other hand, it lies in the vigorous promotion by vehicle manufacturers, the improvement of infrastructure, and the increasingly mature cultivation of users. Among them, revolutionary improvements in range and refueling efficiency have directly addressed the core concerns of users and become a key driver of consumption decisions. For example, a range of 700KM is gradually becoming the 'standard configuration' for new energy vehicles, and ultra-fast charging technology has directly brought the refueling speed of new energy vehicles close to that of fuel vehicles. At the same time, NIO-led battery swap stations have shortened the battery swap time to 2 minutes and 24 seconds and have joined forces with CATL to promote battery standardization, solving the problem of cross-brand compatibility.

Image/NIO's fourth-generation battery swap station

Source/Screenshot from the internet and New Energy Outlook

Of course, in addition to the progress in the above-mentioned hard indicators, the increasingly mature intelligent assisted driving technology has also become an important factor in attracting fans.

Data shows that in 2025, the penetration rate of L2 and above intelligent driving approaches 65%, and the NOA (Navigated On-Autopilot) equipment rate reaches 18.9%, with a year-on-year growth rate exceeding 67%. The maturity of technology has also changed consumers' purchasing habits. The survey shows that 53.18% of users believe that technological experience is an important factor in purchasing new energy vehicles, and 48.6% of consumers are influenced by intelligence factors when buying cars.

A 2025 survey by the Shaanxi Provincial Consumer Protection Committee pointed out that the in-car voice control function involved in the smart cabin ranks third among intelligent functions with a usage rate of 74.3%.

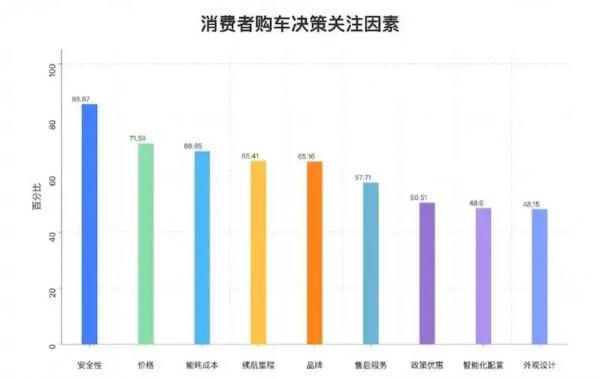

Image/Factors influencing consumers' car purchase decisions

Source/Screenshot from the internet and New Energy Outlook

Various factors have changed consumers' attitudes towards electric cars, shifting from initial skepticism to active purchases.

3. Not Many Good Days Left?

However, a practical problem lies ahead: When subsidies fade and user cultivation is basically complete, can electric cars continue to 'gallop'? Will fuel vehicles, which have originally 'fallen out of favor', once again become the first choice for consumers?

The survey questionnaire shows that policy changes will affect the next car purchase decision of 74.33% of consumers. Among them, 55.73% are waiting and seeing the policies, 19.3% are turning to other energy types, and 15.03% are firmly choosing the original model.

The shift in consumer attitudes is understandable. After all, although the advantages of new energy vehicles in terms of usage costs are indeed much higher than those of fuel vehicles, in terms of purchase costs, fuel vehicles of the same level have greater advantages.

For example, the terminal price of a Haval H6 Guochao version is only 90,000 yuan, and the starting price of the 2025 Chery Xingyue L is also less than 100,000 yuan. However, new energy vehicles of the same level are still 20,000 to 30,000 yuan, or even more, higher, even under national subsidy policies.

Image/Haval H6 Guochao version - Chery Xingyue L

Source/Screenshot from the internet and New Energy Outlook

A Beijing consumer who has been participating in the lottery since 2022 bluntly said that they would definitely not buy an electric car. 'Electric cars are only suitable for daily commuting. For people like me who do not use the car frequently, it is definitely more cost-effective to buy a fuel vehicle with a lower purchase cost. After all, in addition to the purchase cost, the maintenance cost of fuel vehicles is also lower.'

As the above consumer said, in addition to the purchase cost, the after-sales maintenance, insurance, and even residual value of new energy vehicles are also issues that consumers have always criticized. Due to their relatively new technology and high integration, new energy vehicles have higher prices for parts and more specialized maintenance technical requirements, leading to high maintenance costs. In contrast, the mature after-sales maintenance and low insurance costs of fuel vehicles are more popular among consumers.

Image/Battery replacement costs of some brands

Source/Screenshot from the internet and New Energy Outlook

Recently, Cui Dongshu, secretary-general of the China Passenger Car Association, also mentioned in a live broadcast his view that 'individuals buy fuel vehicles instead of new energy vehicles'. Cui Dongshu mentioned that the purchase of fuel vehicles is based on practical situations such as individuals having fewer annual mileage and inconvenient charging facilities in their residences. However, at the same time, Cui Dongshu also stated that the development of new energy vehicles is China's established strategic direction, and he will firmly support and strive to promote it.

So, facing the withdrawal of subsidies and the dual pressure of purchase and usage costs, how can new energy vehicles maintain their opportunities and not disappear?

Firstly, enterprises should increase investment in technological research and development, truly reducing vehicle prices through innovative processes, rather than relying on government subsidies and squeezing the supply chain.

In addition, in terms of safety, especially battery safety, automakers must truly eliminate spontaneous combustion, as safety is the primary factor influencing consumers' car purchase decisions.

Wenwu (pseudonym), who plans to replace his car before the halving of the new energy vehicle purchase tax, bluntly said that for ordinary consumers, industry terminology related to batteries is too professional and difficult to understand, but when buying a car, they will look at whether it is equipped with CATL batteries. 'First, big brands are trustworthy, with more people choosing them, and their installed capacity ranks first globally; second, they are superior in both safety and range.'

At the same time, vehicle manufacturers also need to improve the after-sales service system as soon as possible, establish standardized maintenance procedures, reduce the price of accessories, and enhance consumer confidence.

Image/Ranking of after-sales service capabilities of new energy vehicle brands

Source/Screenshot from the internet and New Energy Outlook

The survey questionnaire also shows that 71.53% of respondents believe that the transparency of after-sales prices for new energy vehicles needs to be improved. This high percentage clearly indicates that consumers have reached a considerable level of concern about after-sales prices, and vehicle manufacturers must attach importance to and actively address this issue to truly eliminate consumers' worries.

Furthermore, even if replacement subsidies disappear, the government can further enhance the convenience and economy of new energy vehicles by optimizing the layout of charging facilities and providing subsidies for the construction of charging piles.

Only by making consumers truly feel that it is 'cost-effective to buy and worry-free to use' can new energy vehicles maintain strong development momentum after subsidies fade away.

[Header image generated by AI]