Plug-in Hybrid's Future: Navigating the Evolving Automotive Landscape

![]() 06/24 2025

06/24 2025

![]() 562

562

Introduction

"No single technology route can dominate China's auto market."

"Pure electric, plug-in hybrid, extended range—they are poised to share the market in the future."

In an article last year, I made this opening assertion. My rationale was twofold: the quicker-than-anticipated decline of traditional fuel vehicles and the rapid rise in sales and market share of plug-in hybrids and extended range vehicles, coupled with the gradual slowdown in the expansion of pure electric vehicles.

However, since the start of this year, the narrative has deviated from expectations.

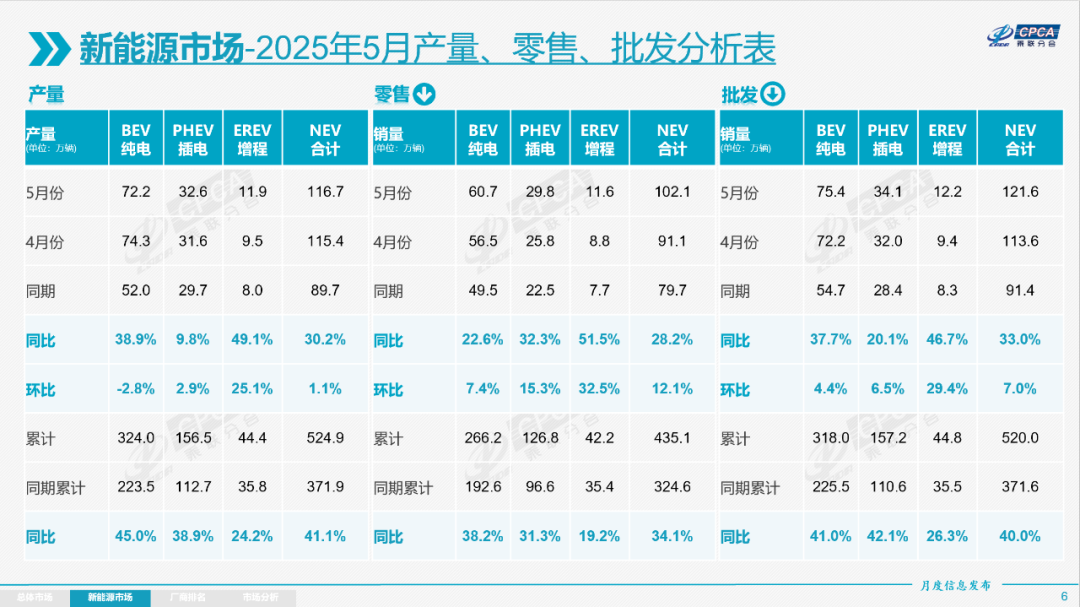

Taking May as an example, wholesale sales of pure electric vehicles reached 754,000 units, up 37.7% year-on-year and 4.4% month-on-month, according to the Passenger Car Association.

In contrast, plug-in hybrids sold 341,000 units, with a 20.1% year-on-year increase and a 6.5% month-on-month increase. Meanwhile, extended range vehicles sold 122,000 units, marking a 46.7% year-on-year and 29.4% month-on-month surge.

In terms of market share, pure electric vehicles accounted for 62.5%, plug-in hybrids for 27.7%, and extended range vehicles for 9.8%.

The goal of "sharing the market" remains distant. Notably, the year-on-year growth of plug-in hybrids, which gained popularity last year, has shown a gradual slowdown.

At last week's topic selection meeting, questions arose: "Is plug-in hybrid losing its appeal?" Or even, "Did we overestimate end-user demand for plug-in hybrids? Is the future of this technology as bright as we thought?"

In the following sections, I will share my insights.

01 "The Next Car for Plug-in Hybrid Owners is Pure Electric"

Why has the year-on-year growth rate of plug-in hybrid sales significantly slowed this year?

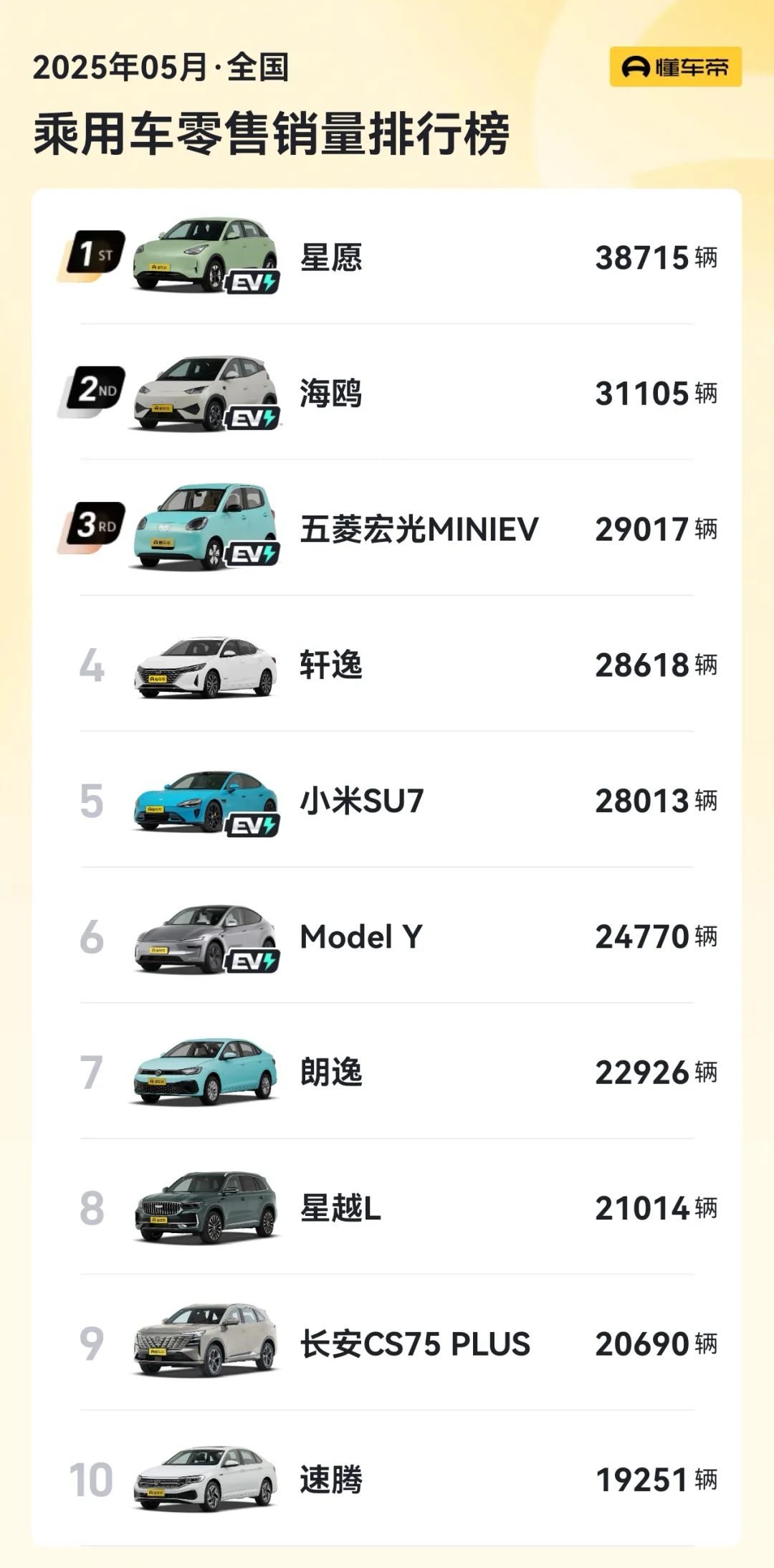

The fundamental reason lies in the mass market, where "hit" pure electric models are flooding the market. Small cars like the Geely Xingyuan and BYD Haiou are achieving remarkable sales. In the high-end market, extended range products are more favored. Additionally, traditional fuel vehicles are engaging in intense "price wars."

Plug-in hybrids find themselves sandwiched between these forces, "bullied from both sides."

At last week's meeting, I interviewed two colleagues who own Lynk & Co 08. In their nearly 20,000 kilometers of driving over the past year, they used the pure electric mode over 80% of the time and hybrid mode only 20%. Even one of them couldn't install a private charging pile at home.

Taking advantage of the situation, I inquired, "Why didn't you choose a pure electric model then?"

Their responses were, "There's still some range anxiety, and having a fuel tank for long-distance travel gives us more peace of mind." When I further asked, "If you change cars, will you still choose a plug-in hybrid?" They all paused in thought.

In fact, as the national charging network improves and pure electric models mature, more and more plug-in hybrid owners are beginning to "defect," making this paragraph's subtitle a common phenomenon.

Similarly, in the high-end market, thanks to large batteries and ultra-fast charging, the high energy consumption disadvantage of extended range models has been greatly mitigated.

Compared to plug-in hybrids, their cost advantage is further highlighted. Coupled with the leadership of pioneers like Li Auto and AITO, this technology route is poised to become the "mainstream."

Moreover, this year's product planning indicates that new pure electric vehicles in this segment will also experience an "explosive" growth. Players like Xiaomi YU7, Li Auto i8, Letao L90, and XPeng G7 are all set to enter the market and capture sales.

Given this environment, it's not hard to understand the slowdown in the year-on-year growth rate of plug-in hybrids.

It's worth noting that last year's same period coincided with the peak popularity of BYD's relevant models. However, since the start of this year, due to various obstacles, the growth rate of the group's plug-in hybrid products has not been as optimistic as expected.

Continuing with May as an example, sales of pure electric passenger vehicles were 204,000 units, while sales of plug-in hybrid passenger vehicles were 173,000 units, widening the gap to over 30,000 units.

BYD's situation mirrors the overall market trend.

Many readers will surely wonder, "Based on the current trend, where will plug-in hybrids go in the future? Will they rebound after a short-term downturn? Or will they slow down completely?"

Personally, I believe it will be a midpoint. Indeed, in the electrification era, plug-in hybrids have their place, but it's challenging for them to achieve a "three-way split" with pure electric and extended range models.

02 Pure Electric Dominates, Extended Range Leads in High-End, Plug-in Hybrid Supplements

Recently, I've been pondering, "If China's new energy market cannot achieve a three-way split, what will be the final pattern?"

The answer that convinces me most directly points to: "Over time and with technological advancements, the mass market may see pure electric vehicles dominate, with plug-in hybrids serving as supplements. In the high-end market, extended range will be a significant force for a long time. Meanwhile, with a mature energy replenishment system, the pure electric market will gradually expand, and plug-in hybrids will continue to play a supplementary role."

After years of evolution, a bold guess about the sales share relationship between pure electric, plug-in hybrid, and extended range models may approach "60%, 20%, 20%" or even "70%, 15%, 15%."

Of course, for all the above analysis to hold true, the stronghold held by traditional fuel vehicles must be fully captured by new energy vehicles.

However, we're still far from that point.

In May, although the retail penetration rate of new energy vehicles hit a record high, it was only 52.9%. In other words, the "battle between oil and electricity" in China's auto market remains intense and at a stalemate.

However, rationally and objectively, this year's data should easily surpass the 60% threshold in a single month.

With BYD, Geely, Chery, and other traditional giants launching new rounds of "profit-sharing and volume-boosting" initiatives; new forces like Xiaomi, Hongmeng Zhixing, and "NIO, XPeng, Li Auto" introducing major new products; and many joint venture brands turning around and entering the harvest period, new energy vehicles are poised for explosive growth, from products to sales volume. The "Battle of Crossing the Yangtze River" has already been won.

It's only a matter of time before sales feedback brings about a greater qualitative change.

In this process, besides the benign competition among pure electric, plug-in hybrid, and extended range models, their primary task is to focus on traditional fuel vehicles and fully dismantle those true "diehards."

Regarding today's article's protagonist, it must be acknowledged that whether liked or not, plug-in hybrids still play a crucial role as "popularizers" of electrification in China's auto market.

So, returning to the opening question, if we must explore whether plug-in hybrids have a future, we should avoid hastily labeling them as "negative."

The truth remains, "No single technology route can dominate China's auto market."

Diverse driving scenarios, vast driving environments, domestic and overseas driving differences, and end-users' driving attitudes all contribute to the "product richness" of the entire market. While some may feel plug-in hybrids are no longer attractive, their existence remains reasonable, and they continue to iterate and progress.

As witnesses, we should focus on when new energy vehicles will launch the "final offensive battle" against traditional fuel vehicles after winning the "Battle of Crossing the Yangtze River"—next year, the year after, or the year after that?

In reality, everything is changing beneath the surface. To stay competitive, one must accurately sniff out trends and quickly adjust and follow up.

Blindly rushing ahead will only lead to failure...

Editor-in-charge: Li Sijia, Editor: He Zengrong