The "Midfield Battle" of National Auto Subsidies: A Necessary Respite for the Industry

![]() 06/24 2025

06/24 2025

![]() 551

551

During this year's 618 shopping festival, many consumers encountered a peculiar scenario: home appliances and digital products they had pre-added to their shopping carts were eligible for national subsidies, but upon checkout, some products displayed a message stating that the "subsidy quota had been exhausted," while others simply lacked any national subsidy.

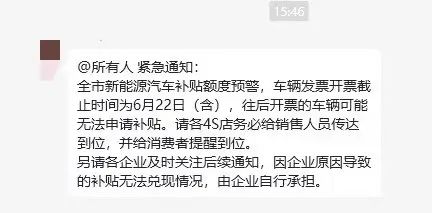

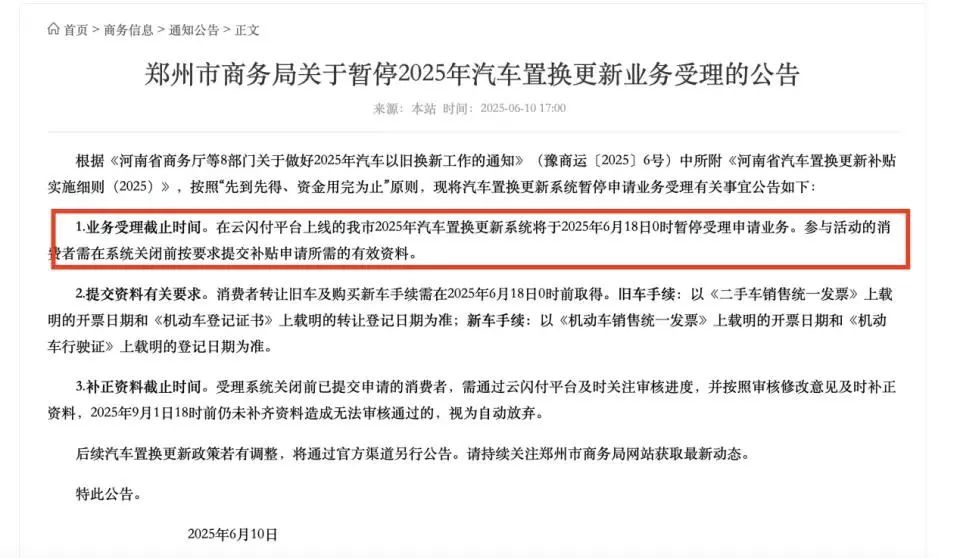

A similar phenomenon is occurring in the automotive market, with car salespeople recently posting on social media, "National Auto Subsidy Countdown! Deadline at the end of the month!" and "Catch the last train! Save up to 20,000 yuan immediately!" By perusing news reports, we find that since June, the commerce bureaus of regions such as Chongqing, Jiangsu, Guangdong, and Henan have issued urgent notices to "suspend acceptance" of subsidy applications. Xinjiang suspended on June 15, Luoyang on June 12, and Xuchang closed its system at noon on June 13. The national subsidies, which have significantly spurred auto consumption over the past two years, have suddenly been put on hold.

Auto Market Frenzy Driven by National Subsidies: Sales Boom and Structural Qualitative Change

The national subsidy policy for automobiles has unleashed unprecedented stimulus energy in 2025. In the first quarter, nationwide sales of passenger cars for "trade-ins" reached 2.793 million, a year-on-year increase of 1.002 million units, representing a growth rate of 56%. From March 24 to April 24 alone, there were 1.2 million new trade-in applications nationwide, and the total exceeded 2.7 million by the end of April. The national auto subsidies have also led to a significant shift in consumption structure, with the proportion of trade-in users soaring to nearly 70%, while first-time buyers have shrunk to around 30%. The China Automobile Dealers Association predicts that the trade-in ratio will exceed 65% in 2025.

It has to be said that the national subsidy policy has indeed provided a huge "benefit" to the market. Taking the 2025 national auto subsidy as an example, the subsidy for scrapping and replacing vehicles is approximately 90 billion yuan (covering 5 million vehicles), and the trade-in policy investment is 130 billion yuan (driving 10 million vehicles). Coupled with the 200 billion yuan dividend released by the exemption of new energy vehicles from purchase tax, the overall support scale exceeds 400 billion yuan, accounting for 8% of the 5 trillion yuan auto sales. At the same time, vehicles meeting the National IV emission standard have been included in the scrapping scope for the first time, with subsidies of 20,000 yuan for scrapping old vehicles and buying new energy vehicles, and 15,000 yuan for scrapping old vehicles and buying fuel vehicles; for trading in old vehicles and buying new ones, the subsidies are 15,000 yuan for new energy vehicles and 13,000 yuan for fuel vehicles. The superposition of triple benefits allows national, local, and automaker subsidies to be enjoyed simultaneously, making the maximum combined discount for a single vehicle reach over 40,000 yuan. Those who have bought cars using the trade-in national subsidy over the past two years should have a deep understanding of this, as cars have indeed become much cheaper.

The market's reaction also proves consumers' support for national subsidies. As of May 31, the number of nationwide auto trade-in subsidy applications has reached 4.12 million, with 1.23 million new applications in May alone, a month-on-month increase of 13%. However, simultaneously, the 300 billion yuan of national subsidy funds are being consumed at an alarming rate, exceeding 150 billion yuan by the end of May, accounting for more than 50% of the annual budget; driven by the "618" sales promotion, an additional 50 billion yuan is expected to be consumed in June alone, bringing the cumulative proportion in the first half of the year to 70%. This intensity of consumption has completely disrupted the policy rhythm, and the "suspension announcements" in many places were issued against this backdrop.

Double Pressures Behind the Sudden Brake: Fund Depletion and Chaos

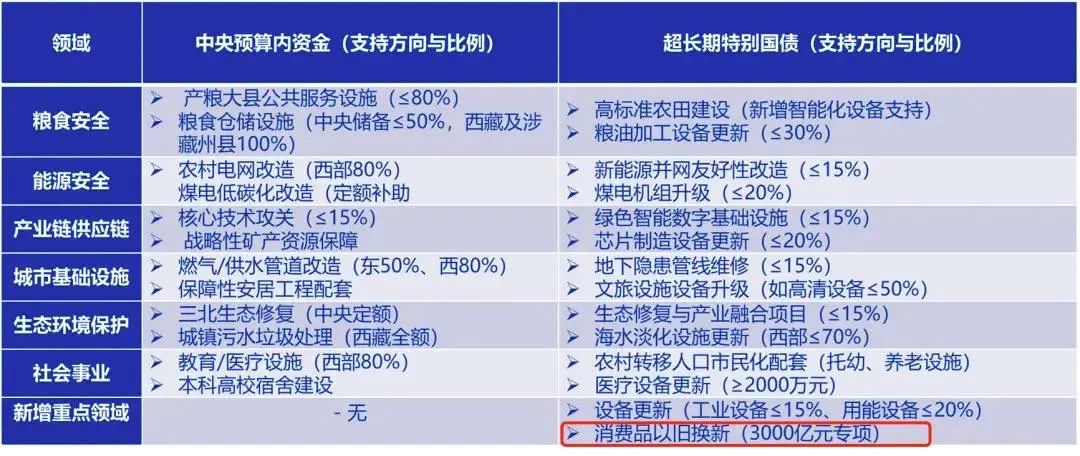

People's Daily previously published an article stating that the total scale of funds arranged by the central government this year to support the trade-in of consumer goods, including auto consumption, is 300 billion yuan. This quota is fixed. To enable local governments to use central funds reasonably, orderly, and sustainably, this year's 300 billion yuan of central funds will be allocated in batches.

These 300 billion yuan are "allocated in slices" to local governments. When allocating funds, factors such as the resident population, regional GDP, car and home appliance ownership, and the implementation of the consumer goods trade-in policy and funds in 2024 in various regions will be considered. Fund allocation will be moderately tilted towards regions with better performance in the consumer goods trade-in work in 2024.

It is reported that two batches of central funds totaling 162 billion yuan have been allocated in January and April this year to support local governments in conducting consumer goods trade-in work in the first and second quarters. However, under the national subsidy policy, consumption is also proceeding rapidly. Chongqing's initial 1.2 billion yuan subsidy was quickly exhausted, forcing the online channel to be closed; due to its large population base and strong consumption power, Henan's application volume quickly approached the budget limit. Although the Ministry of Finance allocates funds in batches – with the first batch of 81 billion yuan allocated to connect policies – faced with the monthly consumption rate of tens of billions of yuan, local finances are still stretched thin. Jiangsu has reduced the daily offline quota to 6.7 million yuan since June 1, and many places in Guangdong have closed online entry points and switched to offline "Yue Huanxin" platforms for verification, which are all helpless measures to cope with the lack of funds.

Of course, besides the rapid consumption of funds, another issue is that during the implementation phase of the national subsidy policy, many irregularities have also emerged in the market. For example, there was recently a high level of discussion about "zero-mileage used cars." Some automakers colluded with used car dealers to falsely complete the trade-in process using scrap vehicles or cheap old cars, and then sold the new cars at low prices in the used car market as "zero-mileage used cars" after obtaining subsidies. Industry insiders revealed that some people have earned over a million yuan in a single month through this method. At the same time, many 4S stores advertise with "the lowest one-price" to attract customers, but consumers only find out after arriving at the store that they need to meet the old car trade-in conditions; in some regions, there have even been price frauds such as "raising prices before subsidies." These irregularities not only distort market prices but also expose the 150 billion yuan of financial funds to the risk of inefficiency. These irregularities have forced many local governments to urgently upgrade their systems. Jiangsu's closure of online entry points and switch to the "Yue Huanxin" platform for verification is essentially an emergency repair of market order.

However, the policy suspension is only a midfield break. It is reported that the remaining 138 billion yuan of central funds will be allocated in batches and in an orderly manner in the third and fourth quarters. At the same time, local governments will also provide corresponding supporting funds and arrange sufficient local funds accordingly. The "national subsidy" will continue to benefit consumers. Jiangsu has stated that it will reopen after system repairs, and Chongqing has also announced that a second-phase plan will be introduced. This policy vacuum period is a valuable opportunity for the industry to self-purify.

Industry Reconstruction During the Painful Transition Period: Short-term Pressure and Long-term Transformation

The suspension of national auto subsidies should have the greatest impact on sales data in July and August. It is already the off-season for the market, and coupled with the subsidy reduction, the auto market will face a severe test.

Some forward-looking brands have already started preparing in advance, trying to mitigate the impact through their own strategies. For example, some automakers have recently announced the expansion of their "trade-in" program, introducing official subsidy schemes where "two-wheelers (electric vehicles, motorcycles) can also be used to trade in for cars." The goal is to maintain market activity during the period when national subsidies are absent.

In fact, when viewed from a longer industrial cycle, this necessary "midfield break" benefits the industry more than it harms it. After the national subsidies are paused, the auto industry can temporarily break away from excessive dependence on subsidies and push the focus of competition back to its origins. When the direct "price war" eases due to the subsidy retreat, automakers will have to invest more resources in their true core competitiveness, including safer, smarter, longer-lasting, and better-experienced products, as well as more efficient and transparent sales and service systems. This will help squeeze out some of the market bubbles generated by excessive subsidy heating in the early stage and guide the industry to shift from "policy-driven" to a healthier "market-driven + innovation-driven" model.

However, during the suspension of national subsidies, the more important thing is the refinement of policy supervision. The author predicts that to eliminate irregularities such as "zero-mileage used cars," subsequent regulations may strengthen closed-loop fund management, such as requiring the use of personal real-name accounts for payments and ensuring that the invoice title matches the consumer's name and specifies the model. Additionally, many local commerce bureaus have begun to clearly stipulate that subsidies should be disbursed to applicants' UnionPay debit card type I accounts to prevent enterprises from collecting them on behalf of individuals. Furthermore, through data interconnection and blockchain technology, the Ministry of Industry and Information Technology is establishing a cross-departmental vehicle lifecycle verification system to ensure "one subsidy per vehicle" and traceable funds.

Conclusion

With 70% of the 300 billion yuan fund pool consumed in the first half of the year, policy calibration is imperative. However, phased adjustments do not equal a change in direction. For consumers, the period before December 31, 2025, is still the golden window for car purchases. With follow-up funds in place and policies improved, it won't be long before national subsidies are restarted. The suspension is not the end but a step towards more sustainable acceleration. For the industry, this "midfield break" test is precisely the coming-of-age ritual towards market-driven development. When subsidies completely withdraw, only enterprises that build their core competitiveness through technology cost reduction and product innovation can win in the final stage of the global automotive industry transformation.