Just out of ICU and onto the race track! It's revealed that Baoneng has acquired WM Motor, hoping for a "negative plus negative equals positive"?

![]() 06/24 2025

06/24 2025

![]() 534

534

"Trust bankruptcy" is harder to rescue than "financial bankruptcy".

Will WM Motor officially make a comeback?

In recent days, two WM Motor exhibition vehicles, one black and one white, models WM E.5 and WM EX5 respectively, have appeared in a Baoneng Auto showroom in Luohu District, Shenzhen. Baoneng Auto insiders revealed through media channels that Baoneng Auto has completed the "acquisition" of WM Motor, and both parties are in the process of asset transfer, including production qualifications.

Image source: WM Motor

Two struggling automakers have come together in the depths of debt.

WM Motor, once one of the "Four Little Dragons of Car Manufacturing", was on par with NIO, Li Auto, and XPeng. Today, it is over RMB 20.3 billion in debt; Baoneng, which spent huge sums acquiring Qoros, has over RMB 12 billion in executed judgments against it, and incidents of employees demanding unpaid wages occur frequently.

Is this partnership, dubbed by the industry as "negative plus negative equals positive", a desperate last stand for survival, or just another bubble in the capital game?

Baoneng + WM Motor: One dares to save, the other dares to reborn

Let's go back to 2019, WM Motor's highlight moment. As a leading player among new forces in car manufacturing, WM Motor's annual sales volume surged to second place among new forces, with cumulative financing exceeding RMB 41 billion, backed by capital giants such as Tencent, Baidu, and Sequoia.

At that time, founder Shen Hui was full of energy. This automotive industry veteran, who had helped Geely acquire Volvo, insisted on building factories on his own and not adopting the OEM model. The product quality earned the reputation of being the "Santana among electric cars" among car owners. One car owner's WM EX5 purchased in 2018 had traveled 300,000 kilometers without major repairs, becoming a vivid footnote to the brand's reliability.

However, the highlight was fleeting. Due to a series of issues such as broken capital chains, insufficient product competitiveness, and the collapse of the after-sales system, WM Motor completely stalled in 2023. As of March 2023, WM Motor's total liabilities amounted to RMB 20.367 billion, while its total assets were only RMB 3.988 billion, revealing a shocking insolvency situation.

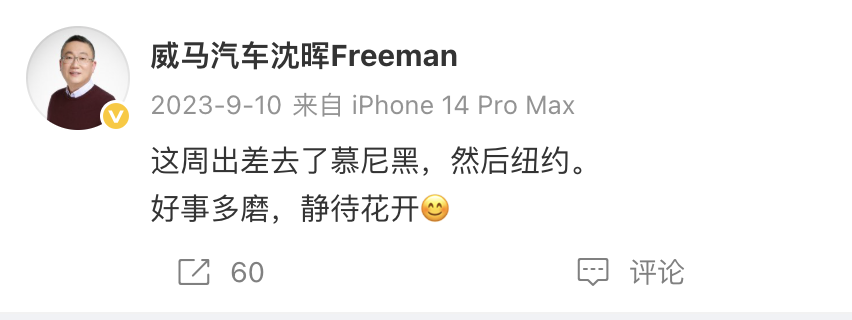

On September 10, 2023, Shen Hui posted on Weibo, "This week, I traveled to Munich and then New York. Good things come to those who wait." What seemed to be an ordinary business trip post initially, turned out to be a hidden reflection of the collapse of an empire that was gradually fading away.

Image source: Weibo

A total of 1,412 creditors are pursuing debts totaling RMB 44.2 billion, with RMB 40 million in unpaid employee wages and RMB 1.7 billion in unpaid supplier payments. The once beloved market darling has fallen into a situation where the APP cannot connect, the car system lags, and after-sales services are paralyzed, triggering collective rights protection actions by car owners and a complete collapse of brand reputation.

Just when we thought WM Motor's story had reached its end, in early 2025, there was a turnaround in WM Motor's bankruptcy reorganization. The creditors' meeting in January approved the draft reorganization plan, with Shenzhen Xiangfei Auto Sales Co., Ltd. becoming the main strategic investor, promising to invest over RMB 10 billion.

On the surface, WM Motor has welcomed a white knight, but Qichacha data reveals a deeper connection: Shenzhen Xiangfei was established in September 2023, and its legal representative, Huang Jing, is also the actual controller of Kunshan Baoneng Auto. Meanwhile, Zhang Xiao, the legal representative of Shenzhen Xiangfei's shareholder, Shenzhen Fengyu Enterprise, not only serves as a director of Baoneng New Energy Automobile Group but also holds real power in multiple Baoneng-affiliated auto sales companies.

The answer is obvious: the "white knight" saving WM Motor is Baoneng.

Image source: WM Motor

However, Baoneng is also struggling to stay afloat. After acquiring a 51% stake in Qoros for RMB 6.63 billion in 2017, Qoros sales plummeted from 62,000 units annually to almost zero. The self-created brand Youbaoli has yet to see mass-produced vehicles, and many new energy base projects are unfinished or have been recovered by the government. At the end of 2023, Baoneng Auto was listed as an executed person. Public information shows that in May of this year, Baoneng Auto added a new piece of executed person information. As of now, the total executed amount of Baoneng Auto has exceeded RMB 12 billion.

Coincidentally, in recent days, the long-silent Baoneng Auto has also made a splash. On June 17, Baoneng Auto officially issued a statement claiming that some media had distorted the facts and maliciously reported that Baoneng Auto and its affiliated companies had issued dissolution and liquidation announcements, disrupting network order and seriously infringing on the legitimate reputation of Baoneng Auto.

Baoneng Auto also stated that the company's operations are normal and that new cars will soon be launched. It seems that there will indeed be new moves in the future.

However, netizens are not buying the partnership between these two companies. Some netizens have made sharp comments such as "two cripples supporting each other, shouting that they want to run a marathon together" and "Baoneng's car manufacturing is like a jerk in a relationship, shouting slogans loudly but taking no actual action."

The strong come and go alone, while the weak seek mutual support

On January 21 of this year, the creditors' meeting of the reorganization case of WM Motor Technology Group Co., Ltd. was held via online video. The reorganization plan (draft) provided by WM Motor painted a stunning blueprint:

From 2026 to 2027, the new WM Motor will increase R&D investment to build a full product spectrum, with 1 to 2 models launched each year; it plans to exceed 600,000 annual sales in 2027, initially forming a trend of large-scale development. From 2028 to 2029, the new WM Motor will launch 10 all-new models into the global market, covering high-end, mid-range, and economy markets. In 2029, the new WM Motor plans to exceed 1 million annual sales and over RMB 110 billion in annual revenue in the global market.

These figures do seem a bit "magical" in the context of the industry. Shouting about million sales right after coming out of the ICU is like asking a patient who has just been discharged from the hospital to run a marathon next year.

If WM Motor can truly return to the market, the primary challenge will be the technology gap.

WM Motor's technological advantage dates back to 2021, when the intelligent driving technology equipped in its models was still considered advanced, but it has now been far surpassed by city NOA systems from companies such as Huawei and XPeng. More critically, the core technical team has been greatly lost due to bankruptcy reorganization, making it difficult to catch up with peers and even more difficult to rebuild the team.

In today's fiercely competitive new energy vehicle market, consumers have extremely low tolerance for "revived brands". Traditional automakers such as BYD and Geely sell over a million vehicles annually, and Xiaomi's SU7 has exceeded 150,000 sales in just one year. If WM Motor fails to achieve significant improvements in product strength, it will be difficult to secure a share in the existing market.

China's new energy vehicle market has entered the "pressure race" stage in 2025. BYD firmly occupies the mid-range market with its technological strength, while Huawei and Xiaomi quickly penetrate the high-end market with their ecological advantages. New forces such as Li Auto, XPeng, and Zero Run have also found their own rhythms. In this battleground, the living space for small and medium-sized players has been drastically compressed.

Now, Baoneng and WM Motor plan to utilize WM Motor's existing EU certification and export channels to obtain cash flow in overseas markets such as Israel and Turkey. However, the reality is that Chinese brands such as BYD and XPeng have already established well-established sales networks overseas, making the overseas market equally competitive.

Putting aside the capital puzzle, WM Motor still has a few trump cards in its hand. The Wenzhou factory has a production capacity of 100,000 units, and restarting production is not a fantasy as long as funds are in place. WM Motor's accumulated industry experience, production qualifications, and channel resources provide a certain foundation for its revival.

Even so, in today's electric vehicle market, what makes consumers bet real money on a new WM Motor vehicle, a brand that has just climbed out of the bankruptcy quagmire, without a "killer app"? The plot of the second season of the automotive market is even more brutal than the first. The essence of this reorganization is not a desperate last stand for survival, but rather an attempt by two "struggling households" to extend their survival through piecemeal resource assembly.

"Trust bankruptcy" is harder to rescue than "financial bankruptcy"

The "weak-weak alliance" between WM Motor and Baoneng is not an isolated case. Amid the tide of industry consolidation, China's automotive circle is forming a trend of "the strong coming and going alone, while the weak seek mutual support."

Especially after entering 2025, well-known new forces in car manufacturing such as WM Motor, Zhidou Auto, Leiding Auto, and HiPhi Auto have all released signals of their return through alliances.

On May 22, an automotive manufacturing enterprise named Jiangsu HiPhi Auto Co., Ltd. was established with a registered capital of USD 143.2665 million. The investors were EV Electra Ltd. and Human Horizons (HiPhi's parent company), holding 69.8% and 30.2% of the shares respectively. Public information shows that EV Electra, founded in 2017, is the first electric vehicle company in the Middle East and the Arab world, with operations in Canada, Italy, Germany, Turkey, and China.

Various indications show that HiPhi Auto's resumption of production is rapidly progressing.

Image source: HiPhi Auto

It's not just HiPhi. With the support of capital from Geely Automobile, Aima Technology, and GSR Ventures, Zhidou Auto has also completed its reorganization. In March 2025, it announced that the new Zhidou Rainbow Long-Range Edition will soon be launched, aiming to compete with models like the Wuling MINI EV, Changan Lumin, Geely Panda, and BYD Seagull in the A00-class automotive market.

Leiding Auto has also begun its rebirth. On March 21, Leiding Auto officially unveiled its new model, indicating that it is expected to be launched in the second half of this year, while also disclosing subsequent new car plans. Obviously, Leiding Auto's reorganization work has made breakthrough progress. According to market reports, Leiding Auto has entered a normal inventory turnover stage and is firmly confident in returning to the market.

However, this does not mean that these revived new forces have a glimmer of hope for "survival". The biggest obstacle to revival is not money or production capacity, but consumer trust. The brutality of this "trust rebuilding" battle far exceeds the challenges of technological research and development and production capacity restoration.

Take WM Motor as an example. The collapse of trust in WM Motor began with a systemic disaster of user rights. After stalling in 2023, its service system completely collapsed, with hardware falling into a "vegetative state". Battery failures could not be replaced, vehicle body parts were out of stock, and some car owners reported that "steering gear abnormal sound repair queue was 9 months with no results." The in-car system was also out of service, causing navigation failures and remote vehicle control function paralysis, with some vehicles completely becoming "scrap metal."

(Image source: social network)

Even if Baoneng resolves all historical issues, consumers will still have a conditioned reflex repel towards "bankrupt brands."

Firstly, as mentioned above, technological backwardness is an undeniable fact. Secondly, there are concerns about a second collapse: Baoneng itself has been plagued by negative news such as unpaid wages and land recovery, leading users to suspect that "if you buy a car today, the company may go bankrupt tomorrow."

And most critically, there is a lack of value identification. New energy consumption has evolved from "functional purchase" to "identity identification." Driving a BYD is supporting domestic products, driving a Tesla is a technological belief, but driving a WM Motor yields no emotional value.

For consumers, the words "WM Motor" no longer represent just a brand, but rather a nightmare-like collapse of trust. Unsustainable vehicles, vanished after-sales services, and thoroughly betrayed expectations. Baoneng has cast a heavy shadow of a potential second collapse over this "rebirth." Technology gaps, brand stigma, and trust deficits are all gaps harder to overcome than tens of billions of funds.

When "bankruptcy reorganization" becomes part of a brand's DNA, and when "whether it can survive tomorrow" becomes consumers' primary concern when purchasing a car, no matter how grand the sales blueprint or how tempting the overseas story, they all appear pale and powerless.

WM Motor, Baoneng, HiPhi unfinished cars, Evergrande Auto

Source: LeiTech