"World-class Automotive Group" Vision Remains Elusive

![]() 06/24 2025

06/24 2025

![]() 573

573

Reform Imperatives

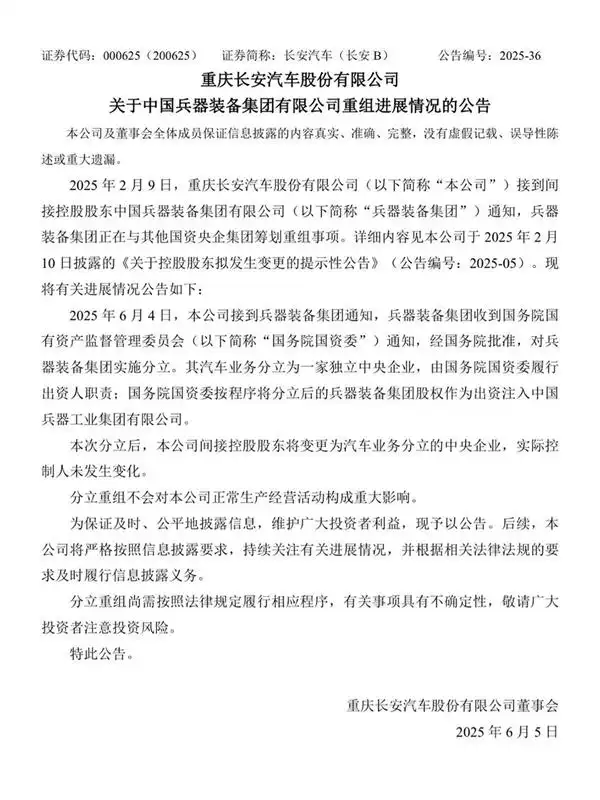

The reorganization efforts initiated by Changan Auto and Dongfeng Motor on February 9 have unveiled new developments within a span of less than four months.

In early June, Changan Auto issued an announcement confirming receipt of a notification from CSGC, which in turn had received approval from the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) to proceed with the splitting of CSGC. As a result, CSGC's automotive business will be spun off into an independent central enterprise, with SASAC taking on the role of a contributor. SASAC will then inject the equity of the newly formed entity into China North Industries Group Corporation Limited (CNIGC) as a contribution, adhering to established procedures. Post-split, Changan Auto's indirect controlling shareholder will shift to the central enterprise spun off from the automotive business, though the actual controller remains unchanged.

Image source: Changan Auto

Concurrently, Dongfeng Automobile Co., Ltd. issued an announcement the following morning. On February 9, 2025, the company received notification from its indirect controlling shareholder Dongfeng Motor Corporation (DFMC) regarding plans for DFMC's reorganization with other state-owned central enterprises. However, on June 4, 2025, the company was informed by DFMC that it was not currently involved in the reorganization of related assets and businesses. The company's regular production and operational activities will remain unaffected.

Industry insiders interpret this as a temporary halt to the previously anticipated merger between Dongfeng and Changan. Changan Auto's indirect controlling shareholder, China Changan Automobile Group, will no longer be part of CSGC but will instead be spun off into an independent central enterprise directly managed by SASAC.

Changan Auto emphasized that following this split, its actual controller remains unchanged, and the reorganization will not significantly impact the company's regular production and operational activities.

The long-anticipated trend of "separation leading to unity and unity leading to separation" in the automotive industry has yet to materialize this time, with the "century merger" between Nissan and Honda also concluding in a stalemate. For Changan and Dongfeng, evolving market dynamics, the rapid rise of private enterprises, declining performance of joint venture brands that contribute the majority of profits, and new national assessment regulations are all compelling them to accelerate their transformation. Other large state-owned automotive groups face similar challenges.

Separate Paths

The proposed reorganization between Changan Auto and Dongfeng Group emerges against the backdrop of the ongoing strategic reorganization of central enterprises. On January 17, 2025, Lin Qingmiao, Director of the Enterprise Reform Bureau of SASAC, stated at a press conference held by the State Council Information Office that SASAC aims to leverage the reorganization and integration of central enterprises to further optimize the layout and structural adjustment of the state-owned economy.

On February 9, Changan Auto announced receipt of a notification from its indirect controlling shareholder CSGC regarding plans for CSGC's reorganization with other state-owned central enterprises. This reorganization could lead to a change in the company's controlling shareholder. On the same day, several listed companies within the Dongfeng Group, including Dongfeng Motor Corporation, also announced DFMC's plans for reorganization with other state-owned central enterprises.

Following the confirmation of the reorganization, rumors persisted. Some sources claimed that due to Changan Auto's lower administrative level, Dongfeng Group would dominate the reorganization, with Changan Auto becoming the entity subject to reorganization.

On March 29, a relevant SASAC official stated that the next step would involve strategic reorganizations of central enterprises in the automotive industry to enhance industrial concentration. SASAC emphasized that the goal of strategic reorganization is to integrate the research and development, manufacturing, and market advantages of central enterprises to create a globally competitive, world-class automotive group with independent core technologies and a leading role in the intelligent connected vehicle revolution.

At Changan Auto's 2024 annual performance briefing held on April 11, Chairman Zhu Huarong responded to the matter of reorganization with Dongfeng Auto, stating that Changan Auto had already participated as an "important role" and was working with related groups to advance the process, with "the relevant reorganization plan having been basically completed."

On May 27, Zhu Huarong further stated at Changan Auto's annual shareholders' meeting that the reorganization was a SASAC mandate, aimed at global competition and leveraging new energy and intelligent technology to create a world-class intelligent new energy technology group and brand.

To the surprise of the industry, however, the announcement did not bring the latest progress on the reorganization but rather news of Changan's "independent promotion."

According to the announcement, CSGC's automotive business will be spun off into an independent central enterprise directly managed by SASAC. Industry insiders view this as a crucial step for SASAC to optimize the layout of the central enterprise automotive industry and enhance professional integration capabilities. This approach aligns better with the highly market-oriented and rapidly iterative nature of the automotive industry, facilitating improved decision-making efficiency and market competitiveness.

Simultaneously, Changan Auto will become the core entity of the newly formed first-level central enterprise, effectively dispelling previous rumors of its "lower administrative level compared to Dongfeng Group." With Changan Auto's "upgrade," it appears that the reorganization and reform of central enterprises in the automotive industry have taken a new direction.

Accelerated Transformation

Several major domestic automotive groups, including Changan Auto and Dongfeng Group, are currently undergoing significant reforms.

In sales, SAIC Group sold 1.687 million vehicles from January to May, representing a year-on-year increase of 10.54%; of these, 526,000 were new energy vehicles, up 42.99% year-on-year. From January to May, Changan Auto's cumulative sales reached 1.12 million vehicles, roughly on par with the previous year; in May, retail sales were 239,000 vehicles, up 14.5% year-on-year, with new energy vehicle sales at 95,000, up 70% year-on-year.

Dongfeng Group sold a cumulative total of 672,800 vehicles from January to May, down 17.1% year-on-year; of these, new energy vehicle sales were 161,000, up 34.4% year-on-year. GAC Group sold a cumulative total of 605,200 vehicles from January to May, down 13.48% year-on-year; of these, new energy vehicle sales were 124,000, down 5.82% year-on-year.

Apart from GAC Group, which is still experiencing a decline, the other three companies have identified new growth avenues thanks to the deepening reforms of the past few years.

Taking SAIC Group as an example, since the leadership adjustment in July last year, "integration" has been the main theme of the group's reform. Building on the momentum of 2024, SAIC Group proposed to continue deepening comprehensive reforms in 2025, focusing on products and marketing, promoting industrial chain coordination, and strengthening cadre team construction.

In the autonomous segment, SAIC Group has organized the Passenger Vehicle Company (Roewe, MG, Flying Avatar), SAIC International, the R&D Institute, Zero-Bound Technology, and Overseas Mobility into a "large passenger vehicle segment." Through strategic integration and optimized resource allocation, limited resources are concentrated in key areas to improve resource utilization and break down barriers between business segments.

Changan Auto has established a brand matrix comprising Gravitation, Qiyuan, Dark Blue, and Avita. The most mature Gravitation brand has surpassed the million-unit mark, Qiyuan has gained a foothold in the market, and Dark Blue and Avita are also showing an upward trend.

Dongfeng Motor Group's new energy brand Voyah is also gradually gaining scale, achieving profitability in 2024.

Currently, among domestic large automotive groups, only GAC Group is still under significant pressure. Although it announced the launch of the three-year "Panyu Plan" in November 2024, both sales and profits require further improvement.

The domestic automotive industry currently faces fierce homogeneous competition and serious resource dispersion. As such, strategic contraction and mergers and acquisitions are seen as a new direction for breakthrough integration. Gou Ping, Deputy Director of SASAC, has clearly stated the need for strategic reorganizations of central enterprises in the automotive industry to comprehensively enhance industrial concentration. It is imperative to combine the research and development and market advantages of central enterprises and strive to become world-class automotive enterprises through competition.

This was also the original intention behind the proposed reorganization of Changan and Dongfeng. However, with Changan's "independent" upgrade, this highly anticipated central enterprise reorganization plan has encountered new variables. Nevertheless, industry insiders maintain that the overall direction of central enterprise reorganization remains unchanged, but large automotive groups' involvement in mergers presents numerous challenges. The difficulties and obstacles faced by both parties are exceedingly complex, encompassing management culture, regional interests, technology integration, and other aspects. Given the wide range of areas covered by automotive enterprises, the challenges associated with reorganization will be even greater. This shift towards reorganization and separation marks a crucial step in the transformation of China's automotive central enterprise reform from "scale integration" to "professional focus."

This article is original content from China News Auto. Welcome to share it with your friends. If media outlets wish to reprint this article, please indicate the author and source at the beginning of the text. Any media or self-media outlet that produces video or audio scripts based on any content of this article will be held legally responsible.