Exporting Excellence: BYD Triumphs Over Tesla in Europe, Becoming a Medal Winner!

![]() 06/24 2025

06/24 2025

![]() 555

555

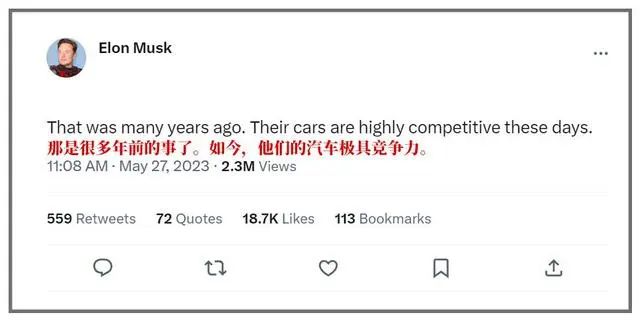

Everything has its omens, evolving in the direction you hope for or not. This adage can be traced back to Musk, whose contrasting comments about BYD in 2011 and 2023 highlight this.

It seems that even foreigners believe in 12-year cycles. Musk's 180-degree turn in attitude indicates that even the Iron Man of Silicon Valley is susceptible to cognitive bias, fortunately corrected in time.

Musk's attitude has drastically changed.

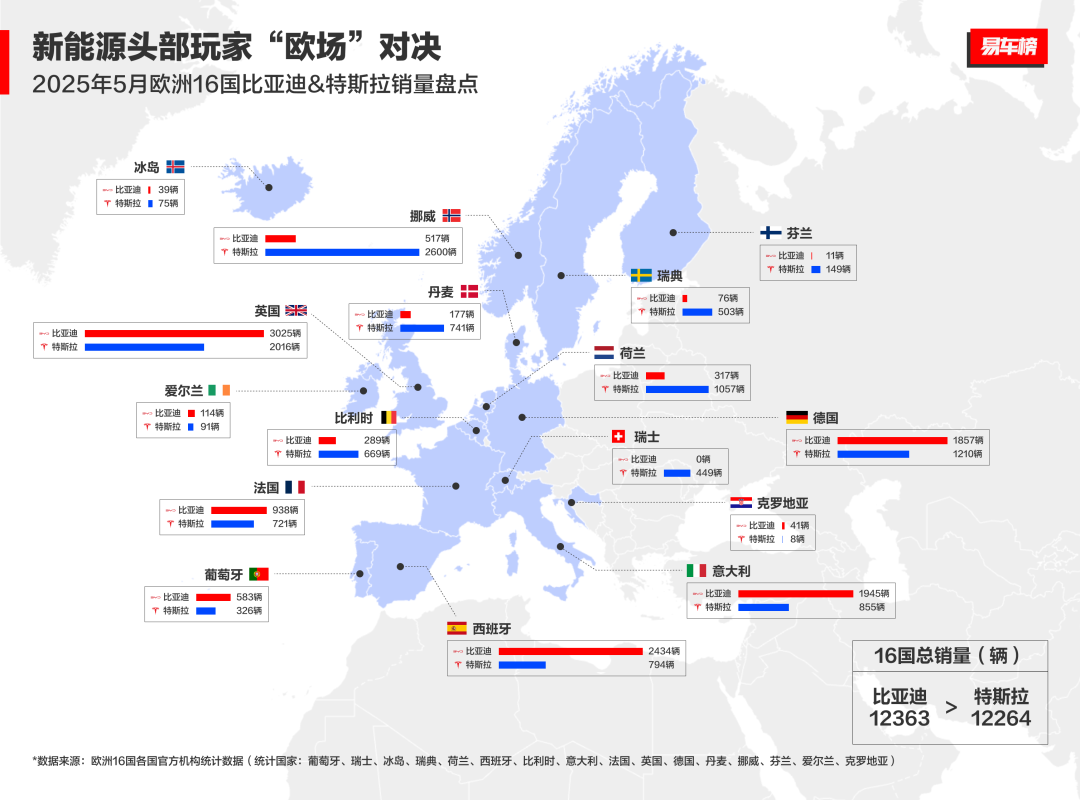

Just as Tesla can no longer dominate the European electric vehicle market, BYD has stepped in to take its place.

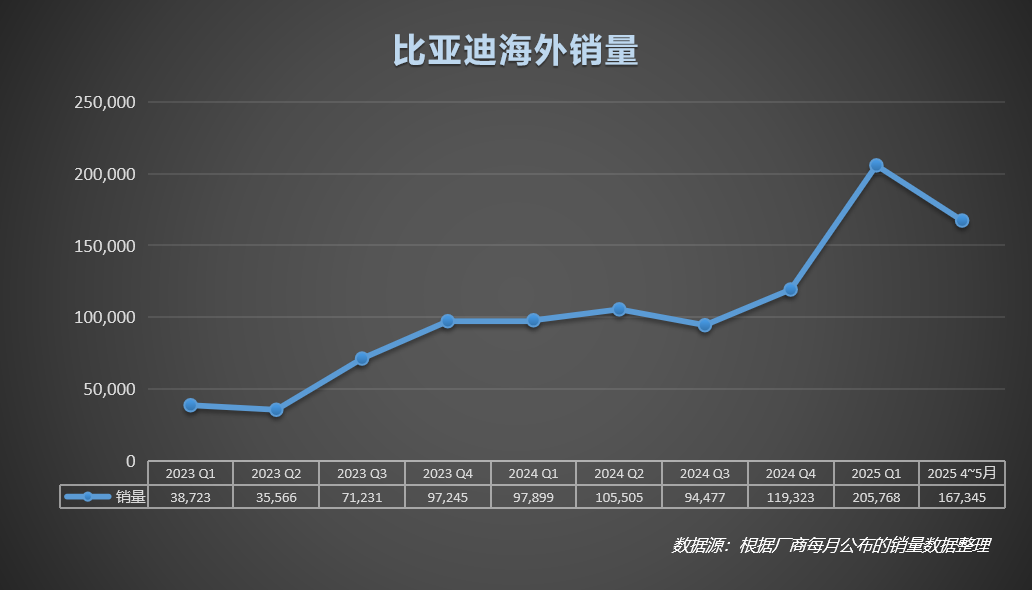

BYD, firmly entrenched as the market leader in China, is now penning a new chapter on the international stage.

In May, BYD secured the top spot in the European market with over 10,000 sales, outpacing Tesla by 6,619 vehicles. One wonders what Musk might be thinking: politically and commercially frustrated, but emotionally satisfied – rumors suggest that Musk's Xth child has acknowledged him as their father, a testament to Musk's numerous potential offspring and his favorite code name 'X'.

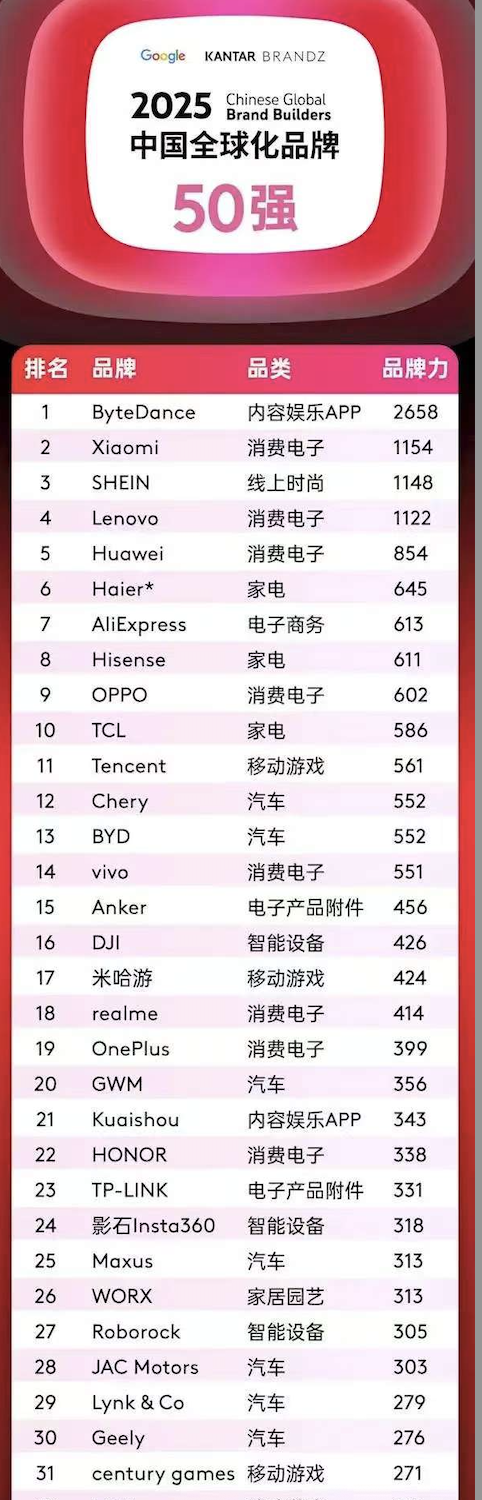

BYD's success doesn't end there. On June 19, Google and Kantar released the 2025 "Top 50 Chinese Globalized Brands" list, with BYD ranking among the top 50 for the 8th consecutive year, scoring 552 points, tied with Chery at the top of the automotive industry.

This list holds significant value for brand globalization. While it may not be familiar to ordinary consumers, it is highly regarded by capital and industry circles.

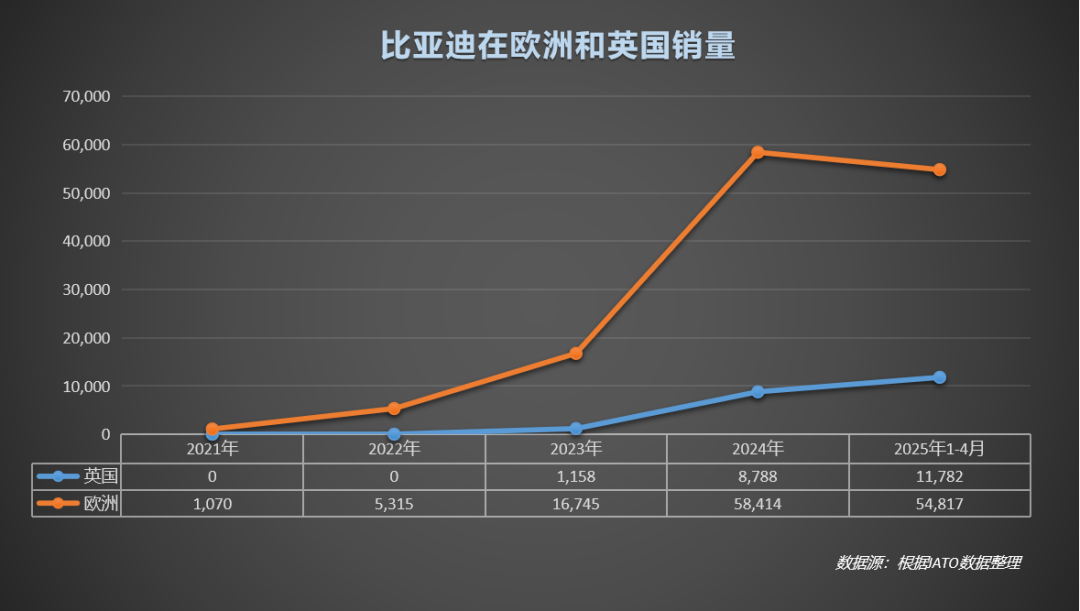

A 60-Fold Increase in 3 Years: Demonstrating True Skills in Europe

Amidst the fierce domestic competition, BYD has achieved remarkable results overseas, particularly in Europe. In May 2025, BYD sold 10,199 vehicles in the UK, Germany, France, Italy, and Spain, outpacing Tesla by 6,619 vehicles.

In Germany, the birthplace of automobiles, BYD's sales surged 824% year-on-year; in the UK, sales soared 408%, exceeding 3,000 vehicles in a single month; in Spain, sales tripled that of Tesla! In 2025, BYD's market share of new energy vehicles in Europe exceeded 6%, with sales reaching 55,000 vehicles from January to April, nearly matching the total for 2024. UK sales surpassed 10,000 in the first four months, and BYD has outperformed Tesla in Germany for two consecutive months.

Four years ago, BYD's annual sales in Europe were only 1,000 vehicles. Sales in the first four months of this year are already 60 times that initial figure.

For a long time, China's auto export market has been dominated by underdeveloped regions like Asia, Africa, and Latin America. The path for Chinese brands to enter Europe is fraught with difficulties. In 2021, BYD launched its DM super hybrid technology in China, drawing a rising sales curve. Subsequently, it announced its overseas expansion, entering Europe, the market with the highest difficulty coefficient. Despite challenges in policy barriers, manufacturing thresholds, market recognition, products, and brands, BYD steadfastly pursues its goal of becoming a world-class brand.

One may face setbacks, but national integrity must be upheld. Europe, as the industry's weathervane and the bridgehead of global automobiles, is a crucial fortress for a world-class globalized brand. As the saying goes, one can be broken but must never wither.

The first challenge was the tax issue. The European Union imposes a 27% tariff on Chinese brands – a relatively gentle blow compared to the United States. To break through these tariff shackles, BYD invested in a factory in Szeged, Hungary, at the end of 2023. This factory is China's first passenger vehicle base in the EU with long-term plans. Simultaneously, BYD established its European headquarters in Budapest, Hungary, to smoothly navigate localization strategies.

BYD's European headquarters in Budapest

However, entering Europe's challenges extend beyond policy barriers. Renowned as the cradle of automobiles, Europe is home to numerous century-old brands, inevitably carrying a filter of "predecessors." Younger brands like BYD are often overlooked. Even BYD's German dealers acknowledge, "Europeans only recognize local brands." The 2025 European electric vehicle sales rankings reveal that the local champion is still Volkswagen with a 9.6% market share, followed by BMW with 7.8%.

Undeterred by difficulties, BYD chose to impress consumers with its products. Quickly introducing its lineup to Europe, BYD targeted Europeans' preference for small cars. Models like the Seagull ignited the local small car market upon introduction. In just three years, BYD has launched 10 models, fully meeting local market needs.

European name for Seagull: Dolphin Surf

As of the first quarter of this year, BYD's market share in Europe has significantly increased to 15.4%, nearing the top 3 in the European electric vehicle market.

Ranked Among the Top 50 for 8 Consecutive Years, Tied for First with Chery This Year

The industry has witnessed BYD's globalization progress, evident from a recent authoritative list.

On June 19, Kantar and Google released the "2025 Kantar BrandZ Chinese Globalized Brands," revealing the top 50 Chinese globalized brands for 2025. Nine automotive brands made the list, mostly enterprises with excellent export performance.

As the export champion for over 20 consecutive years, Chery made the list again, ranking first in the automotive industry; BYD closely followed, ranking second. Notably, BYD's score is the same as Chery's at 552, meaning these two brands are essentially tied for first place.

Chery ranked 12th, BYD ranked 13th

This list comprehensively utilizes Kantar BrandZ's brand asset valuation framework and Google's consumer behavior data collection capabilities to measure overseas consumers' perception of Chinese globalized brands. Data is sourced from 11 developed and emerging markets globally, including the United States, the United Kingdom, France, Germany, Australia, Brazil, Spain, India, Mexico, and Indonesia. This list serves as a comprehensive exam for Chinese brands' overseas expansion capabilities, showcasing their precision manufacturing prowess and commanding influence.

A Technology-Driven Enterprise, Sweeping the Globe

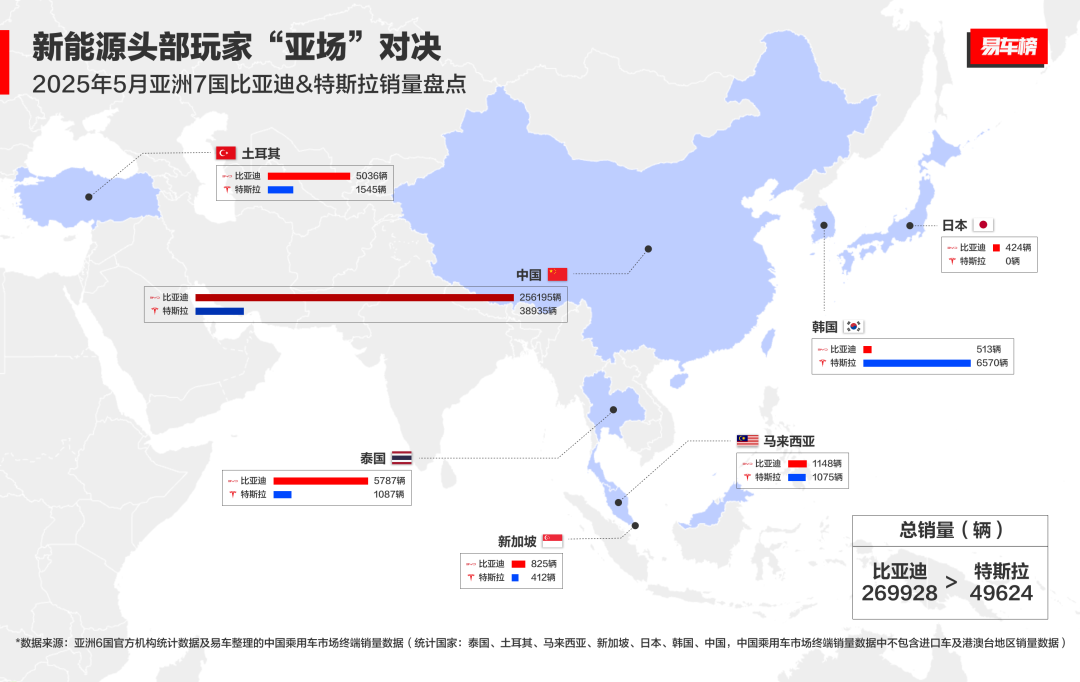

Beyond European market breakthroughs, BYD has also achieved frequent victories in Asia. In Singapore, BYD ranked first in total brand sales from January to May 2025; in Malaysia, BYD's sales surpassed Tesla; in Thailand, BYD continues to deliver phenomenal results; and even in the Japanese market resistant to electric vehicles, the Sea Lion 07EV helped BYD enter the top 10 imported car sales for the first time.

From having no presence to sweeping the globe, BYD's approach remains consistent: technology is king. When 800V charging was not yet widespread in Europe and the charge rate was only 5C, BYD's megawatt flash charging amazed foreign media, earning praise for the "Chinese speed" – one minute of charging adds 100 kilometers of range, with a charge rate of 10C.

CNBC, a renowned American financial news outlet, stated that "BYD is comprehensively surpassing Tesla." It commented, "BYD is reshaping the logic of the global industry with technology and ecology!" Beyond megawatt flash charging, addressing the last bit of electric vehicle range anxiety, BYD's fifth-generation super hybrid technology, e-platform 3.0 Evo, CloudRider, intelligence, and drone ecology have all impressed foreigners.

Foreign media: BYD has left Tesla behind

BYD has not only exported technology but also actively laid the groundwork for European brains, such as setting up a research and development center at its European headquarters in Hungary, transitioning from away games to home games. Once, foreign brands entered China, claiming to exchange technology for the market. Now, companies like BYD are reversing this trend. Abroad, Chinese automobiles are practicing the exchange of technology for the market.

The bridgehead of global automobiles is stacked with technology. As a technology-driven enterprise that spares no expense in research and development, BYD will inevitably reshape the global automotive industry landscape sooner or later.