"Xiaopeng" Returns from "ICU": How to Compete with Xiaomi YU7?

![]() 06/26 2025

06/26 2025

![]() 552

552

The elimination round in the automotive industry is intensifying.

According to industry leaders, the number of surviving automakers in China will only be in the single digits in the future. Whether it's Huawei's Yu Chengdong's "one hand", Xiaomi's Lei Jun's "5-8", or He Xiaopeng's "less than 7", there is no doubt that they all hope to survive.

Among them, Xiaopeng Motors may be in an even worse situation. In March this year, He Xiaopeng said, "Some friends told us we were already in 'KTV' (a metaphor for being out of business), but we're still at the door of 'ICU' (intensive care unit)."

Relying on the MONA M03 and the enhanced version of the classic model P7+, Xiaopeng Motors struggled to escape from "ICU", but while cost-effectiveness can "save lives", it also hampers brand power. Whether the newly released Xiaopeng G7, with a presale price starting at 230,000 yuan, can carve out a path to survival between Model Y and Xiaomi YU7 may determine the development direction of Xiaopeng Motors.

Like NIO and Xiaomi Motors, Xiaopeng has also set a goal of achieving profitability in the fourth quarter of this year. Xiaopeng Motors is indeed improving, but can it confidently enter "KTV"? Perhaps, the challenge has only just begun.

The real deal of cost-effectiveness

Cost-effectiveness has never been Xiaopeng's first choice, but rather a reluctant move.

In 2023, sales of Xiaopeng's high-end model G9 fell short of expectations, and the G6 encountered production capacity issues, coupled with supply chain corruption incidents, Xiaopeng once "lay in ICU".

Xiaopeng's ability to stage a comeback benefited from the management system getting back on track under radical changes. The launch of the ultra-cost-effective model Xiaopeng MONA M03 accurately hit market demand, and the technological route adhered to since its inception, along with the market strategy of "intelligent driving equality", ensured key market competitiveness.

From then on, after the "intelligent driving technology" gene, "cost-effectiveness" also became one of Xiaopeng's labels, and the road to comeback officially began.

In 2024, Xiaopeng Motors delivered a total of 190,000 new vehicles, a year-on-year increase of 34.2%; total revenue reached 40.87 billion yuan, a year-on-year increase of 33.2%; however, it still failed to change its loss-making situation, realizing a net loss of 5.79 billion yuan, with a loss of about 30,000 yuan per vehicle sold; fortunately, its profitability has been greatly improved, ushering in a turning point signal, with gross margin increasing from 1.5% in 2023 to 14.3%, but there is still a gap compared to the industry's top enterprises at around 20%.

By 2025, Xiaopeng Motors was even more high-spirited. Relying on the hot sales of MONA M03 and P7+, a total of 94,008 new vehicles were delivered in the first quarter, a year-on-year increase of 331%, topping the sales chart of new forces, and the loss per vehicle was also reduced to 7,021 yuan. Obviously, Xiaopeng has initially tasted the sweetness of scale effects, which is closely related to organizational transformation, product marketing, technology upgrades, etc.

The Xiaopeng MONA M03, a model starting at just over 100,000 yuan, accounted for more than 50% of sales in multiple months. In 2024, the average price per Xiaopeng vehicle was still above 200,000 yuan, but it fell to 150,000 yuan in the first quarter of this year, widening the gap with Lixiang's vehicles priced above 250,000 yuan.

Obviously, Xiaopeng relies heavily on cost-effectiveness, so the question arises, after the comeback, how to go to the next level, continue with the cost-effectiveness route? The reality may not be optimistic.

If it can always trade price for volume, at least it can sacrifice "face" to win "substance", but the sales of MONA M03 have shown some subsequent weakness, starting to show a downward trend. From January to April, the average monthly sales of MONA M03 were 15,335 vehicles, and sales in May were 10,900 vehicles, a significant decline of 28.92%. In today's "price war" of open and covert competition, whether Xiaopeng can still hold onto its cost-effectiveness fortress is questionable.

△Sales trend of Xiaopeng MONA M03 Source: Dongchedi

△Sales trend of Xiaopeng MONA M03 Source: Dongchedi

Currently, Xiaopeng's higher-priced models such as G9 and X9 have average monthly sales of only one or two thousand vehicles in the first five months of this year, hardly qualifying as best-sellers. This is an unfavorable trend for Xiaopeng to shape its high-end image, and the cost-effectiveness route that can save lives is also a drag on brand power.

"In the past, we did well with MONA, P7+, and X9, but I actually didn't have that many internal demands because Xiaopeng hopes to form a system capability. Occasional appearances at single points, I think, are meaningless." Obviously, the cost-effectiveness route is not He Xiaopeng's intention or goal planning.

For Xiaopeng, taking over MONA M03 from Didi was a self-rescue under the crisis of survival, and the "system capability" it aims to build in the future is the key to stable and long-term development and the victory in the high-end market.

How to compete with formidable rivals like Model Y and Xiaomi YU7?

Xiaopeng has returned from "ICU", and Xiaopeng needs to fight the "average price defense war" with best-selling products priced above 200,000 yuan to endorse brand power. The recently released Xiaopeng G7, as the first all-new model after the reform of the process system, has sounded the horn to re-enter the mid-to-high-end SUV market.

This is destined to be a more difficult journey, as this price segment is the most competitive market. Li Bin of NIO once described it as "the most brutal, and it will become even more brutal".

Here, there is Tesla Model Y across the front, this global benchmark for pure electric SUVs, which has always been the target of Chinese new energy brands, with domestic models such as Zhijie R7, NIO ES6, Zeekr 7X, and Avita 07 all challenging it. From October to December last year, Model Y's domestic retail sales reached 36,204, 44,576, and 61,881 vehicles respectively, and obviously, no model has been able to threaten its sales champion status.

Model Y has leading advantages in terms of performance, range, intelligent driving, charging network, and brand power, and domestic brands find it difficult to suppress Model Y's comprehensive strength by emphasizing handling performance or family use characteristics.

However, now is also a good time. According to data from the China Passenger Car Association, Tesla China's sales in May this year fell 15% year-on-year to 61,700 vehicles, marking the eighth consecutive month of year-on-year sales decline. After the Model Y was renewed this year, the sales curve did not rise but fell. From January to May, Model Y's retail sales in China were 25,694, 8,006, 48,189, 19,984, and 24,770 vehicles respectively, all showing significant year-on-year declines.

△Sales trend of Tesla Model Y Source: Dongchedi

△Sales trend of Tesla Model Y Source: Dongchedi

Tesla is not invincible. For example, in the mid-size pure electric sedan market, Xiaomi SU7 left the renewed Model 3 far behind after its production capacity ramped up. In May this year, the former's retail sales reached 28,013 vehicles, while the latter was only 13,818 vehicles.

The launch of Xiaopeng G7 can fill the product line between Xiaopeng G6 and G9. The presale price of 235,800 yuan has created a considerable market response, with over 10,000 small orders placed within an hour.

With high intelligence and cost-effectiveness, Xiaopeng G7 does have the potential to carve out a path, but the difficulty is not small. As a global benchmark for electric vehicles, Tesla's brand power far surpasses that of Xiaopeng. In the case of similar prices, Xiaopeng G7 can only compete with Tesla if its product strength is far ahead.

Moreover, the most terrifying competitor may not be Model Y, but Xiaomi YU7, which will be released on June 26. Even after experiencing a public opinion storm, Xiaomi YU7 is still one of the most talked-about models on the internet. Some bloggers who have test-driven it said that Xiaomi YU7 will definitely be a big hit. And before the new car is released, online there have already been links for renting, taking pictures on behalf of others, and transferring orders, supporting long-term or short-term rentals, with short-term rental prices generally ranging from 1,000 to 6,000 yuan, reflecting its high popularity.

The final pricing of Xiaopeng G7 will most likely be lower than that of Xiaomi YU7. The head-on confrontation between the two is an important opportunity for Xiaopeng to regain market share, but from the perspectives of the discontinuously leading attention, gender-neutral design, and super performance, Xiaopeng faces considerable pressure.

In the second half of the intelligent era, is AI a lifesaver?

"We hope to become the leader in AI cars." On May 28, at the exchange meeting after the release of Xiaopeng MONA M03 MAX, He Xiaopeng said that AI will become the core capability of automobiles in the next decade.

The attribute of AI technology is a label that He Xiaopeng has always emphasized.

In November last year, the promotional positioning of Xiaopeng P7+ was "the world's first AI car", with AI high-level intelligent driving as standard equipment across the board, claiming to shoulder the two missions of allowing more people to enjoy the space and comfort of a "luxury executive sedan" and allowing more fuel vehicle users to enjoy the fun of "high-level intelligence".

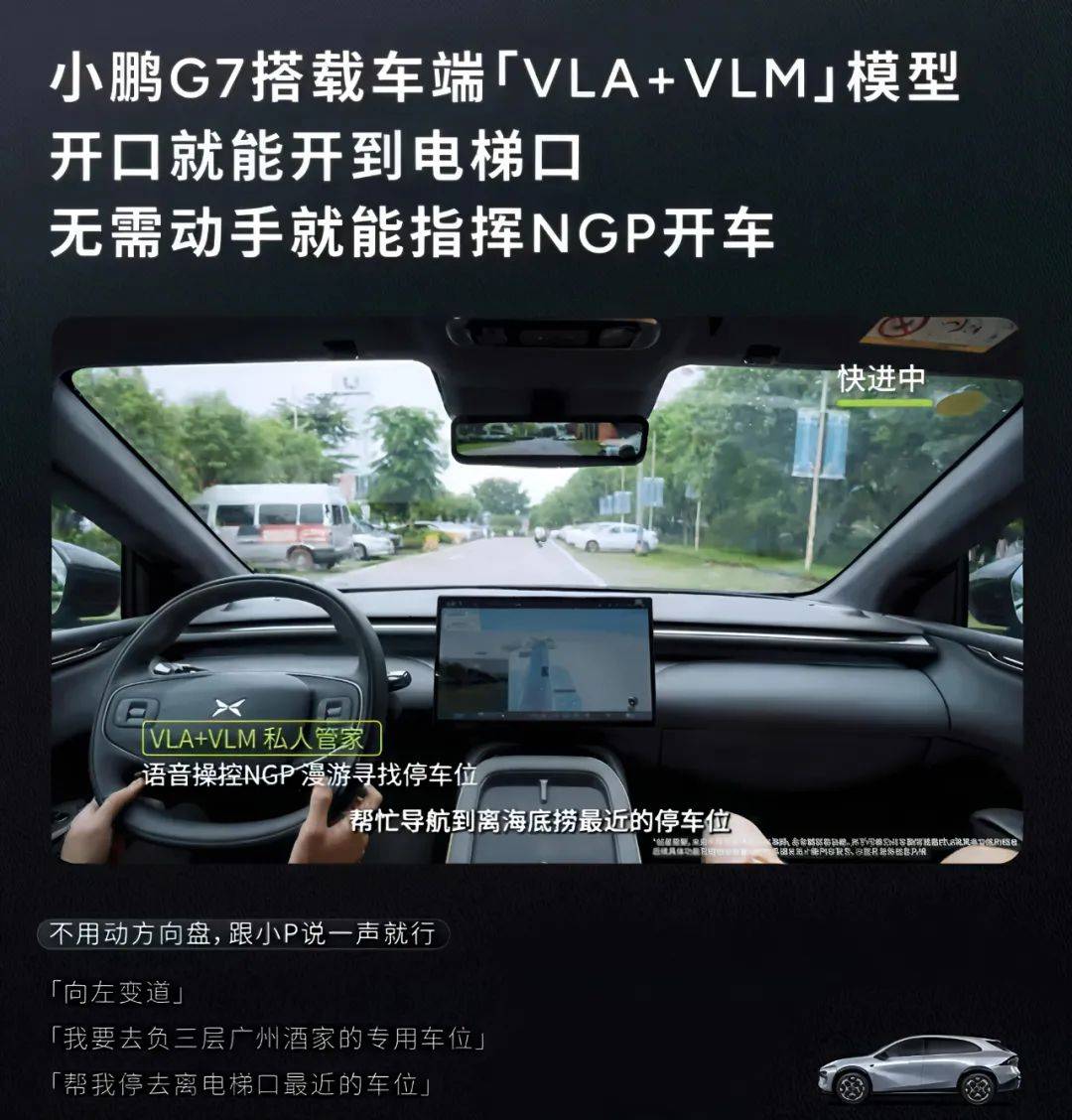

By the time the G7 was released this year, the promotional positioning was "the world's first L3-level computing power", meaning an AI computing power level exceeding 2,000 TOPS, and supporting the local deployment of Xiaopeng's self-developed VLA (Vision-Language-Action) model and VLM (Vision Language Model).

Against the background of prohibiting exaggerated promotion of intelligent driving, Xiaopeng uses "L3-level" to describe computing power, using wording to circumvent regulations, essentially to strengthen the impression of technological leadership to the outside world.

Moreover, Xiaopeng's reliance on high computing power may also be to make up for hardware deficiencies.

There have always been two routes for intelligent driving: the mainstream solution for domestic automakers is to complement each other with vision and lidar, but the cost is relatively high. Xiaopeng followed Tesla's lead, shifting from the high-cost lidar route to a pure vision intelligent driving solution, significantly reducing costs while needing higher computing power chips to compensate for insufficient accuracy.

However, high computing power does not necessarily mean a better experience. At present, there is no perfect basic large model framework in the industry. Xiaopeng's pursuit of computing power redundancy today cannot directly translate into a leading experience, and its envisioned AI-assisted driving experience is a "big pie" for ordinary customers.

According to He Xiaopeng, Xiaopeng's base model can gradually evolve to a level that "surpasses human veteran drivers", laying the foundation for Xiaopeng's autonomous driving to truly move towards L3 and L4, and some AI capabilities will achieve a generational lead by 2026.

△Illustration of Xiaopeng G7's "VLA+VLM" model on the vehicle end Source: Xiaopeng Motors official Weibo account, zoom in

△Illustration of Xiaopeng G7's "VLA+VLM" model on the vehicle end Source: Xiaopeng Motors official Weibo account, zoom in

In He Xiaopeng's view, the turning point for automotive AI may come as early as the second half of 2025, when the market share of new energy vehicles will usher in a new round of explosion.

Although "ALL in AI" is as visionary as the stars and the sea, for now, the commercialization path is not obvious, with high costs for technology implementation and long commercial return cycles. Before that, Xiaopeng must first solve the problem of balancing sales and profitability: on the one hand, continue to use MONA M03 to stabilize the basic market in the sinking market, and on the other hand, use technology to seize market share in the high-end market and shape brand power.

At the end of last year, Xiaopeng released its new range extension technology, the "Kunpeng Super Electric System". Recently, it was reported that the G01, Xiaopeng's first model equipped with this range-extended hybrid power system, has a comprehensive range of 1,400 kilometers, and is expected to become a best-seller comparable to Lixiang.

With old model redesigns, new powertrain models, and breakthroughs in AI technology, Xiaopeng has many cards in its hand and the confidence to aim for profitability in the fourth quarter of this year. Whether it can strengthen its label of intelligent driving leadership to the outside world will determine Xiaopeng's positioning and long-term development in the industry.

Conclusion

After bringing in Wang Fengying to address traditional automotive industry links such as procurement, cost control, and marketing sales, Xiaopeng Motors has provided a better soil for the company's technological innovation.

In the second half of the intelligent era, the scope of competition is no longer limited to dimensions such as power, comfort, and space. Intelligence will become a key factor determining survival and is also the focus battlefield for many brands to compete for.

Technology is inherently Xiaopeng's natural gene, and now is the time for He Xiaopeng to make a big splash. Under the premise of advancing the AI strategy, whether it can maintain the rapid growth of delivery volumes and steadily increase the gross margin of automobiles will not only determine whether Xiaopeng can achieve profitability by the end of 2025 but also whether it can break through in the elimination round.