Nissan CEO Strengthens Control as Renault Exits Board

![]() 06/26 2025

06/26 2025

![]() 597

597

Introduction

Despite a rigorous examination by investors, Nissan's CEO Ivan Espinosa's restructuring plan still faces significant scrutiny.

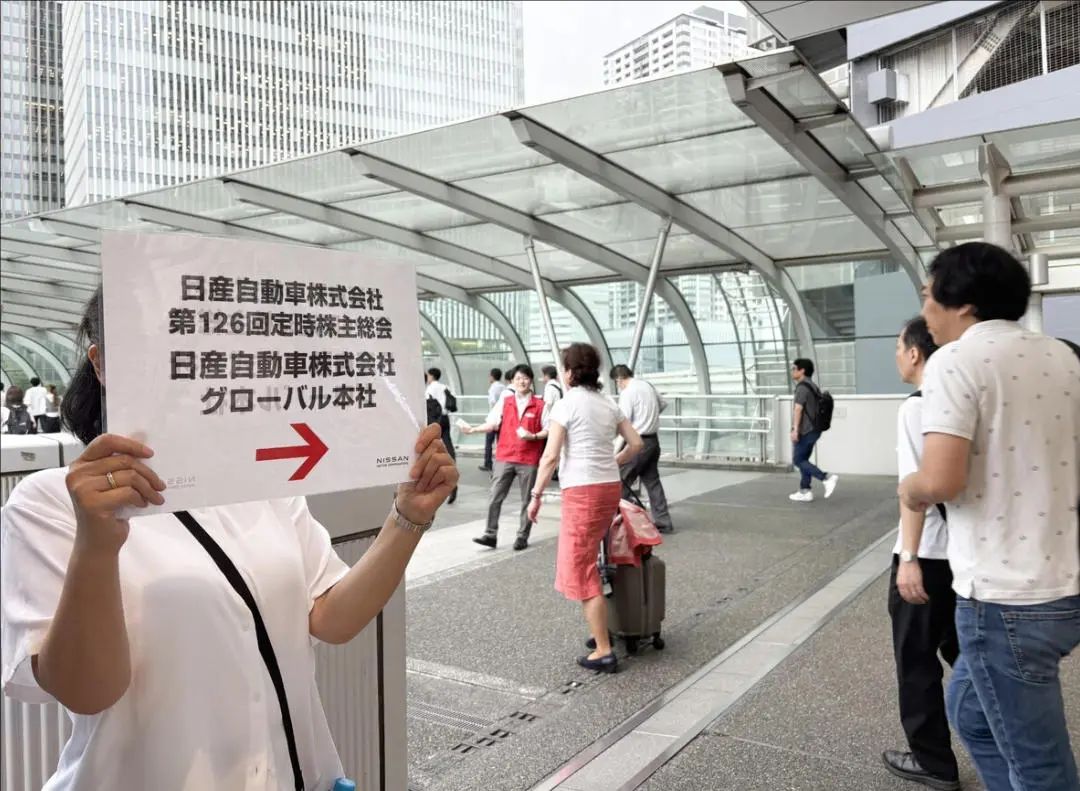

On June 24, local time, at the annual shareholders' meeting held at Nissan Motor's headquarters in Yokohama, Kanagawa Prefecture, south of Tokyo, Espinosa unveiled plans to turn around the struggling Japanese automaker by closing seven factories worldwide and laying off 20,000 employees.

The meeting drew 1,071 attendees, a notable increase from previous years. During the over three-hour session, shareholders grilled Nissan's management, particularly focusing on the reasons behind the company's net loss of 670.8 billion yen for the fiscal year ending in March 2025.

Other key topics included the specifics of the restructuring measures and the payment of 600 million yen in retirement benefits to former President and CEO Makoto Uchida and three other former senior executives. Despite the controversy, shareholders ultimately approved all company proposals, including the appointment of Espinosa and 11 other board members.

Nissan is currently grappling with multiple challenges: sluggish sales in the US and Chinese markets, delayed new model development, and the collapse of two-month business integration negotiations with Honda in February, which led to Uchida's resignation as President and CEO.

While some shareholders demanded a personal response from Uchida, they were not accommodated. Espinosa assured shareholders that Nissan's strategic collaboration with Honda in areas like electric vehicles would continue. Independent director Yasushi Kimura noted that although the initial aim of the merger was to leverage the brand strengths of both automakers in global competition, Nissan's strategic vision has always lacked clarity.

To address operational challenges, Nissan plans to introduce a voluntary severance compensation plan in Japan for the first time in 18 years, starting next month. When queried about the closure of two factories in Kanagawa Prefecture, Espinosa stated that relevant decisions were still pending. After the meeting, a shareholder in his 60s admitted, "I haven't seen any substantial measures to turn the company around." He even added, "Perhaps it would be better if Nissan became a subsidiary of Honda."

01 New CEO Apologizes for Poor Financial Performance

This was Espinosa's first shareholders' meeting since assuming office, during which he firmly established his initial control over the loss-making automaker. The meeting marked significant personnel changes on the board: Renault Chairman Jean-Dominique Senard and ousted former Nissan CEO Makoto Uchida officially stepped down from their board seats.

Since joining the Nissan board in 2019, Senard has been tasked with repairing the alliance fractured after former Chairman Carlos Ghosn was arrested on financial misconduct charges in 2018 (Ghosn has consistently denied these charges). In March 2025, he publicly stated that Renault was ready to assist Nissan in overcoming its difficulties.

With Senard's resignation as Vice Chairman of the Nissan board, the Japanese automaker now faces a complete leadership overhaul at a critical juncture when its performance remains under pressure. Additionally, Renault representative Pierre Fleuriot also exited the board simultaneously.

As the youngest CEO to helm Japan's third-largest automaker, the Mexican engineer faced sharp questioning from retail investors at the annual meeting in Yokohama on June 24. Participants focused on Espinosa's radical restructuring plan, which aims to reduce costs by 500 billion yen (about $3.5 billion) by the fiscal year ending March 2028 through 20,000 job cuts and the closure of seven factories. They also questioned the company's governance optimization, executive retirement plans, and product sales strategies in core markets like the US and Japan.

In his opening remarks, Espinosa apologized for Nissan's sluggish financial performance and the aborted Honda merger plan announced in February. When the meeting was disrupted by some participants' aggressive behavior, he had to suspend the agenda to restore order and emphasized that the specific details of layoffs and factory closures had not yet been finalized: "The reorganization plan for manufacturing bases is still under discussion, and employees and stakeholders will be notified as soon as it is determined."

Nissan's restructuring plan is currently under double pressure: its already fragile financial situation has been further exacerbated by US tariff policies. The company expects an operating loss of 200 billion yen (about $1.4 billion) for the April-June quarter, primarily due to a negative free cash flow of 550 billion yen (about $3.8 billion) generated by its automotive business, compared to an operating profit of only 100 million yen (about $690,000) in the first quarter of the same period last year.

Looking ahead to the fiscal year ending March 2026, tariffs are expected to cause a loss of 450 billion yen (about $3 billion). Although the company plans to offset 30% of cost pressures in the first quarter, it is still struggling to reverse the decline. Meanwhile, a wave of $5.1 billion in debt maturing in 2026 is also intensifying the automaker's capital chain issues.

Data shows that Nissan's global sales declined by 2.8% year-on-year to 3.4 million vehicles for the fiscal year ending March 2025; sales for the fiscal year 2026 are expected to further shrink by 2.9% to 3.3 million vehicles, and no profit guidance has been announced. An anonymous shareholder who participated in the three-hour meeting commented that the new CEO was "fluent" in explaining the recovery plan but "avoided important issues and lacked substance" during the Q&A session, and the entire meeting was "more confrontational than expected".

02 A "Turbulent" Meeting

Espinosa acknowledged the dissatisfaction with Nissan's current situation and emphasized that the company has devised a credible revitalization plan, promising that the transformation process has officially commenced. "We must press ahead with the restructuring, even though the process is incredibly painful," he said. "This is not the choice we hoped for, nor is it the ideal goal, but the company has started moving in the right direction."

Regarding the integration negotiations between Nissan and Honda, Espinosa defended that although the merger plan was shelved, strategic cooperation between the two parties on projects is continuing, and Nissan is currently focused on resolving its financial difficulties.

Corporate governance and compensation systems emerged as another focal point of the meeting. Previously, shareholders had questioned why external directors on the board had largely remained in place despite significant changes in the senior management team due to the sharp decline in performance over the past few years. However, at the June 24 meeting, the list of external directors nominated by management was still approved by investors.

With the previously announced resignation of Senard and another Renault board representative, Pierre Fleuriot, being replaced by new external directors, the direct influence of the French long-term partner on the Nissan board has been completely eliminated. Currently, the representatives of Nissan's executive management on the board are Espinosa and Chief Technology Officer Eiichi Akashi, both of whom are newly appointed directors.

Uchida's retirement benefits have garnered attention from Nissan observers. Espinosa revealed that a shareholder motion requiring Uchida to take responsibility for Nissan's poor performance during his tenure was rejected in advance voting, which immediately sparked angry protests at the scene.

Uchida and four other senior executives dismissed in the March management reshuffle (during which Espinosa took over as CEO) received a total of 646 million yen (about $4.3 million) in severance payments. Notably, these retirement benefits were paid out at a time when Nissan had repeatedly failed to meet its performance targets.

According to reports, Uchida's compensation for the previous fiscal year was 390 million yen (about $2.6 million), a 41% decrease from the previous year, including about 175 million yen (about $1.2 million) in retirement benefits.

At the meeting, Uchida's presence triggered continuous questioning from shareholders about his responsibility, and some shareholders expressed outrage that the company did not pay dividends. However, the four former executives, including Uchida, received high severance payments. Facing the questions, Uchida consistently refused to respond.

Tsuyoshi Maruki, CEO of activist investor Strategic Capital Inc., pointed out, "Many people demanded explanations from Uchida and even questioned the meaning of his attendance at the meeting if he refused to answer questions." However, he also expressed expectations for Espinosa, believing that despite the chaotic order of the shareholders' meeting, the new CEO remained calm and said, "Now we can only hope for a positive outcome."

It is reported that in addition to layoffs and factory closures, Nissan also plans to sell its Yokohama headquarters building to ease cost pressures. A 76-year-old shareholder with a 50-year history of owning Nissan vehicles bluntly stated, "Their explanations are not convincing, and management is avoiding responsibility by shifting the burden onto employees and firing them."

However, Espinosa remains confident in public. He told investors that Nissan has an unused credit line and liquid reserves of 2.1 trillion yen, and the company has begun to reallocate its limited resources.

Editor-in-Charge: Li Sijia, Editor: He Zengrong