Spotlight on Light Guide Plates! This Optical Firm's IPO Bid Gets the Green Light

![]() 01/04 2026

01/04 2026

![]() 466

466

On December 31, 2025, Dongguan Yuanli Optoelectronics Co., Ltd. (hereinafter "Yuanli Optoelectronics") saw its IPO application accepted, with Dongguan Securities Co., Ltd. acting as the lead sponsor.

Established in 2010, Yuanli Optoelectronics has earned its stripes as a national-level specialized and innovative "Little Giant" enterprise. It stands tall among domestic producers of medium-to-large-sized light guide plates, boasting a leading position in terms of production scale. The company is deeply involved in the research, development, production, and sales of light guide plates and Mini-LED optical products, commanding a significant market share in the global sectors of flat-panel displays, laptop screens, and automotive displays. As of now, Yuanli Optoelectronics holds 55 utility model patents and 13 invention patents, and has played a role in shaping 2 national standards.

Its client roster reads like a who's who of the industry, featuring renowned manufacturers such as BOE, GVO, and Boxun Technology. The end-users of its products span a wide range of consumer electronics giants, including Samsung, HP, Dell, Google, Huawei, Honor, Lenovo, Xiaomi, OPPO, and Vivo, as well as automotive heavyweights like Toyota, BMW, BYD, Li Auto, Seres, and Volkswagen.

In a bid to refine its business strategy and broaden its market reach, Yuanli Optoelectronics unveiled plans in June 2025 to invest in the establishment of two wholly-owned subsidiaries: Ningbo Xinyangxin Technology Co., Ltd. and Ningbo Yuanli Optoelectronics Co., Ltd., with investments of 20 million yuan and 10 million yuan, respectively.

Financially, the company is projecting a robust performance for 2025, with anticipated annual operating revenue ranging from 400 million yuan to 420 million yuan, marking a year-on-year surge of 39.02% to 45.97% compared to 2024. Net profit attributable to the parent company is expected to soar to between 62.5 million yuan and 66.5 million yuan, representing a year-on-year spike of 100.56% to 113.39%. Non-recurring profit and loss net profit is forecasted to range from 61.5 million yuan to 65.5 million yuan, a year-on-year leap of 111.89% to 125.67%. This growth spurt is largely attributed to a spike in demand from downstream markets.

Over the reporting period, sales to the top five clients collectively accounted for 62.99%, 57.51%, 55.39%, and 55.14% of the current sales revenue, respectively, signaling a high yet declining level of client concentration.

The reins of the company are firmly held by its actual controllers: Zhang Yuanli, Ruan Xuhong, and Zhang Jiayi. Zhang Yuanli and Ruan Xuhong share an uncle-niece relationship, while Zhang Yuanli and Zhang Jiayi are father and daughter. The trio has inked a "Concerted Action Agreement." By the end of the reporting period, they directly and indirectly held a combined stake of 24.7349 million shares in the company, representing 84.30% of the total share capital and collectively wielding 80.15% of the voting rights.

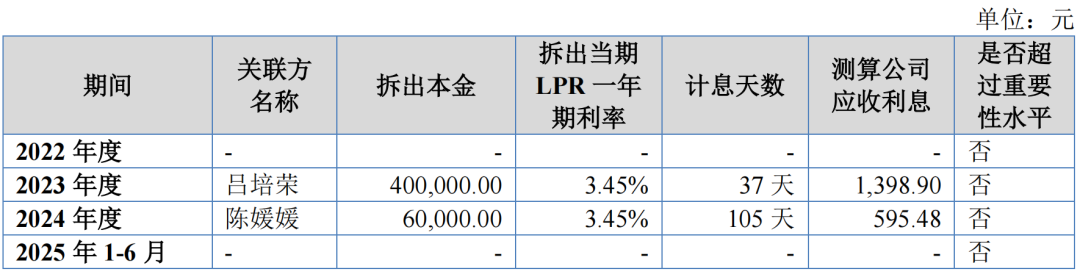

It's worth noting that during the reporting period, the company grappled with instances of related-party fund occupations.

Specifically, from October to December 2023, the company extended an interest-free loan of 400,000 yuan to its board secretary and chief financial officer, Lv Peirong. From May to August 2024, it provided another interest-free loan, this time of 60,000 yuan, to a related natural person, Chen Yuanyuan.

Although these funds underwent internal approval procedures and were fully repaid sans interest charges, they still constituted non-operating fund occupations by related parties, as their utilization was not tied to the company's production and operations.

Regarding the interest-free loans, the company clarified that the calculated interest amounts fell short of the materiality threshold at the financial statement level. Following mutual agreement with the related parties involved in the fund transactions, it was decided that no interest would be accrued for these transactions, minimizing their impact on the company's operating performance.