Figma's IPO: Navigating Over 150 Mentions of 'AI' and Decoding Three Key Issues

![]() 07/08 2025

07/08 2025

![]() 560

560

Introduction: The capital markets are rife with tales, but Figma's saga stands out for its dramatic twists. When regulators abruptly ended its $20 billion merger, many believed it marked a setback. Instead, Figma bounced back with an impressive S-1 filing, signaling its return as a formidable player. Amidst the Nasdaq frenzy, where do the genuine opportunities and risks lie? This is the essence we must decipher amidst the clamor.

Beyond the noise: Key signals for decision-makers

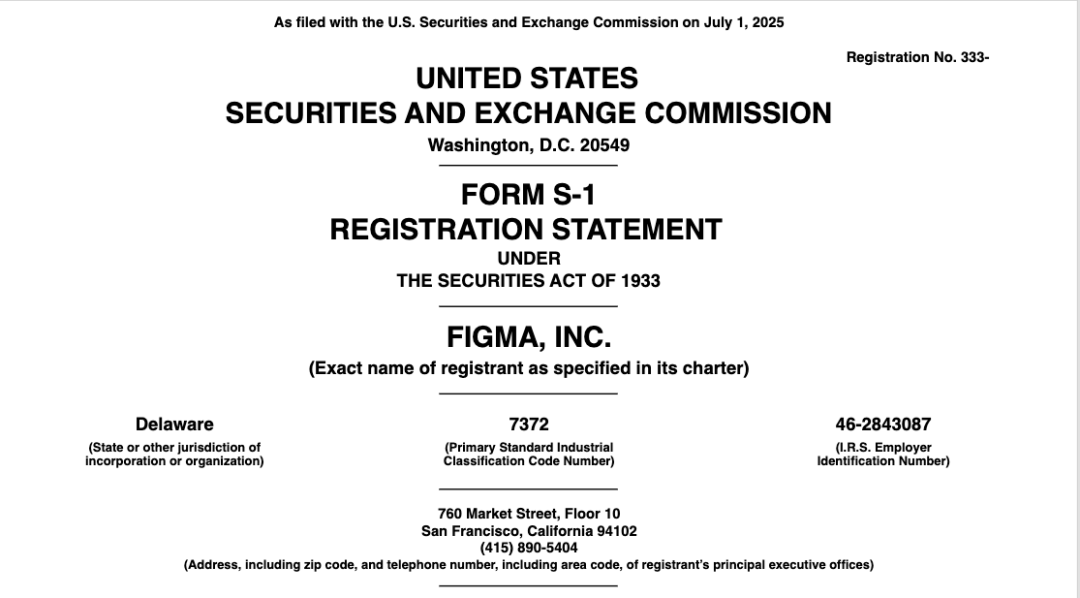

In early July, Figma filed its S-1 with Nasdaq, officially opening the door to the capital markets. This IPO is undoubtedly the year's most anticipated tech listing.

Media and analysts initially focused on its stellar financials – a remarkable 48% annual growth rate, strong quarterly profits, and the aborted $20 billion merger with Adobe. These are compelling narratives, crafted for public consumption.

However, when a company that pioneered the "Product-Led Growth (PLG)" model and revolutionized design collaboration goes public, the signals it sends are intricate and multi-faceted. The S-1 filing, akin to a detailed "medical report," is retrospective, outlining Figma's journey but not fully revealing its future trajectory.

The real crux lies not in achieved growth but in unrealized potential, unspoken risks, and the profound transformation of its business model amidst the AI revolution. It's time to shift our focus from financial numbers to deeper strategic discussions.

Three pivotal questions beyond financial reports

Question 1: Over 150 mentions of AI – what's the next step?

Figma's S-1 filing mentions 'AI' over 150 times, positioning it as a core driver for attracting new users, lowering creation barriers, and fueling growth. But questions loom:

Is this mere 'AI-washing' to appeal to the capital markets, or a genuine technological moat?

How will Figma's AI features disrupt designer and developer workflows? In the AI arms race with Adobe Firefly and Microsoft Co-pilot, what are its genuine strengths and challenges?

Will implementing its AI strategy enhance user retention or open new markets?

Question 2: What's the ceiling for 'Collaborative SaaS'?

Figma has disrupted the design software market with its cloud-based real-time collaboration technology. Post-IPO, it faces steeper growth challenges:

With high market penetration, how can it sustain a nearly 50% growth rate?

As it evolves from a "design tool" to a broader "enterprise collaboration platform," it will clash with players like Atlassian, Microsoft, and even Google. How will it navigate these waters?

What bottlenecks will its vaunted PLG model encounter when serving large enterprises with complex processes and long decision-making chains?

Question 3: What else does Figma aspire to beyond design?

Understanding Figma's post-IPO ambitions is crucial for investors and partners:

What drives North America's top investors to value Figma? Is it its SaaS attributes, platform potential, or AI narrative?

Beyond horizontal expansion into areas like FigJam whiteboards, where lies Figma's next strategic growth? Will it dive into code generation, project management, or content ecosystems?

For Chinese enterprises seeking innovation and collaboration, what unknown entry points and opportunities exist within the Figma ecosystem?

Connecting the 'people' who drive change

The answers to these questions transcend any analysis report. They reside in the minds of the key figures driving this transformation – this is Silicon Rabbit's value proposition.

With over a decade in Silicon Valley, we understand that authentic, firsthand insights come from those at the forefront of industry change. We don't offer secondhand opinions; we connect Asian enterprises and institutions with the world's top intellectual resources.

Regarding Figma, we can connect you with Adobe's head of product strategy to interpret the competitive landscape, invite the founder of a top SaaS company to share insights on collaborative software's evolution, or connect you with a Silicon Valley VC partner to reveal Figma's real investment logic.

Conclusion

Figma's IPO heralds a new era of competition and innovation. Information asymmetry equals value asymmetry. Stay informed to seize the opportunities.