Robot Industry Shines Amidst Tech Sector Pullback: Is Unitree, Backed by Tencent, Alibaba, and Geely, Geared Up for an IPO?

![]() 09/05 2025

09/05 2025

![]() 730

730

After experiencing a period of substantial growth, the technology sector recently underwent a pullback. Nevertheless, the robotics sector has bucked this downward trend, emerging as a beacon of optimism within the broader tech landscape.

On September 2, Unitree Technology announced on the social platform X that it "anticipates submitting an IPO application to the China Securities Exchange between October and December," further igniting enthusiasm for the sector.

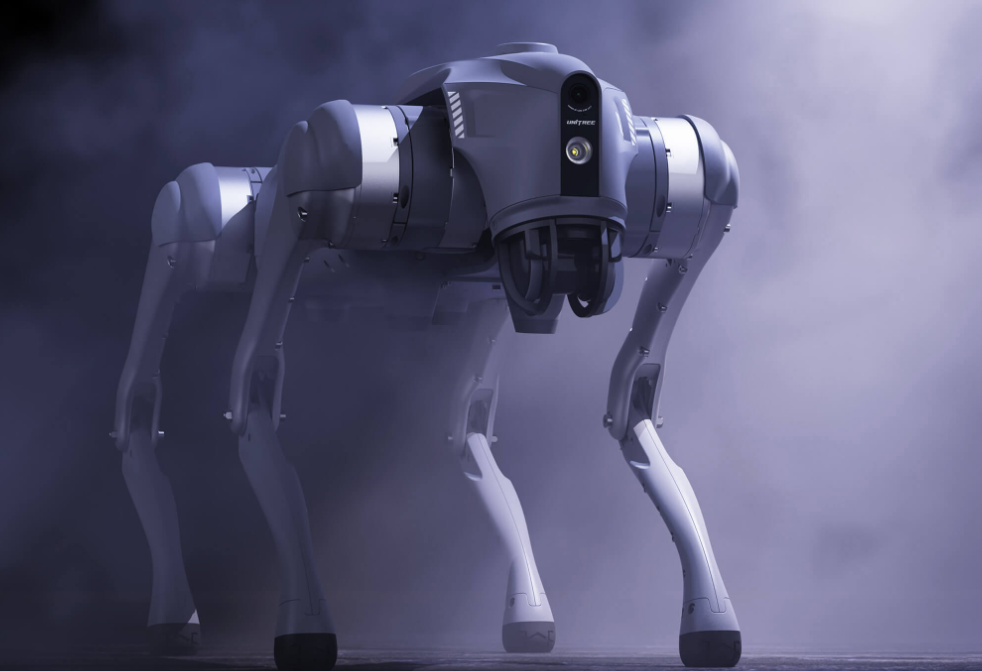

From capturing widespread attention with robotic Yangko dance performances at the Spring Festival Gala to securing additional investments from industry giants like Tencent and Alibaba ahead of its listing, Unitree Technology, which commands a 60-70% share of the global market for quadruped robot shipments, is seen as a bellwether for the transition of the humanoid robotics sector from "technical demonstrations" to "commercial viability."

Focusing on "Civilian Use": Industrial Orders Skyrocket by 220% in 2025

In 2016, a group of passionate and dedicated "post-90s tech enthusiasts" embarked on a robotics startup journey in a rented apartment in Hangzhou's Binjiang District. After nine years of relentless effort, the team has expanded from a handful of individuals to a company with hundreds of employees. Today, Unitree Technology stands as the "hidden champion" in the global quadruped robotics sector and is on the verge of entering the secondary market.

Unitree Technology's ascent began with its unwavering commitment to core technologies. Since its inception, the company has achieved full self-sufficiency in developing key robotic components, including motors, reducers, controllers, and LiDAR. It also boasts high-performance perception and motion control algorithms, forming a complete industrial chain that spans from components to complete machines and algorithms.

According to official data, Unitree Technology has amassed over 180 patent applications and over 150 authorized patents both domestically and internationally. It is the first and, to date, the only quadruped robot company in China to receive the national-level "Little Giant" award for specialized and sophisticated enterprises.

Its robust technological closed-loop capability endows its products with global competitiveness in terms of performance and market reach. For instance, its industrial-grade quadruped robot, the B2-W, can effortlessly traverse complex terrains such as mountains, rivers, and high jumps while carrying loads. Meanwhile, its consumer-grade Go2 series, equipped with 4D ultra-wide-angle LiDAR and AI large models, has become a "smart favorite" in household and educational settings.

According to official business data, Unitree Technology primarily focuses on civilian robots, with revenue reaching the billion-yuan mark in 2024. In terms of revenue composition, quadruped robots, humanoid robots, and related components account for 65%, 30%, and 5% of total sales, respectively.

Nearly 80% of quadruped robots are utilized in research, education, and consumer markets, with the remaining 20% applied in specific scenarios such as inspection and firefighting, significantly differing from UBTECH's emphasis on industrial applications. Humanoid robots entirely avoid industrial scenarios, focusing solely on research, education, and consumer sectors. This indicates a rapid commercialization path extending from "B2B research" to "multi-scenario penetration," distinguishing it from peers like UBTECH.

The viral success of the "robotic Yangko dance" at the 2025 Spring Festival Gala significantly accelerated Unitree Technology's commercialization. Founder Wang Xingxing revealed in May that industrial robot orders surged by 220% year-on-year in 2025, with contract values exceeding 1.2 billion yuan. The star product, the G1 quadruped robot, contributed 60% of the revenue.

Unitree Technology, in collaboration with Zhiyuan Robotics, secured the bid for China Mobile's subsidiary's "Humanoid Biped Robot OEM Service Procurement Project." Unitree won a 46.05 million yuan contract for a package including small-sized humanoid robots, computing backpacks, and five-finger dexterous hands. This order marks a substantial step in its commercialization and demonstrates Unitree's ability to transition "from lab to market."

Simultaneously, while continuously optimizing product capabilities, Unitree has accelerated its product launch pace. In late July, Unitree officially unveiled its third humanoid robot, the "Unitree R1 Smart Companion," priced from 39,900 yuan. It features 26 joints, weighs approximately 25kg, and integrates a multimodal large model for voice and image processing, supporting development and customization.

Less than a month later, the company released a teaser poster for its new humanoid robot. According to disclosures, this "ballet dancer"-inspired humanoid robot will be equipped with 31 joints, enabling more precise motion control.

Tencent, Alibaba, Geely Compete to Invest Before IPO

Unitree Technology's IPO journey is not a solitary endeavor but is supported by intense backing from top-tier capital.

From its Series A funding in 2017 to its Series C funding in June 2025, the company has completed 10 funding rounds, attracting early investments from renowned institutions such as Sequoia China, Meituan Dragonball, and Shunwei Capital. The latest Series C funding round raised nearly 700 million yuan, again drawing investments from first-tier industrial capital players like Tencent, Alibaba, Ant Group, and Geely Holding. The post-investment valuation soared to between 12 billion and 15 billion yuan.

Amidst the dual pressures of "difficult fundraising" and "cautious investing" in the current primary market, why has Unitree Technology become a target for capital "competition"?

The capital enthusiasm for Unitree Technology essentially reflects the spillover effect of the booming humanoid robotics sector. KPMG data shows that from 2020 to 2024, financing in China's humanoid robotics sector skyrocketed from 1.58 billion yuan to 7.23 billion yuan, with a compound annual growth rate (CAGR) of 35.6%. The CAGR is expected to further accelerate to approximately 45.5% by 2029.

With highly optimistic long-term expectations and increasingly mature technologies across the entire industrial chain, 2025 is emerging as a pivotal year for robotics companies to go public. Companies like Geek+, Bulldozer, and others have successfully listed, while Zhiyuan Robotics' backdoor listing and the Hong Kong IPO plans of Woan Robotics, Standex Robotics, and others are in full swing. Even established robotics component players like Sanhua Intelligent Control and Aston are accelerating their "A+H" dual-listing strategies.

As this high-potential emerging tech sector accelerates its public listing drive, Unitree Technology's IPO represents not just a corporate milestone but could potentially reshape the competitive landscape of the sector. At least, with viral events like the Spring Festival robot performance and humanoid robot combat competitions, Unitree Technology has achieved significant market recognition in terms of brand awareness.

Moreover, Unitree Technology's top-tier shipment performance in the humanoid robotics sector makes it an irresistible hot choice for capital deployment.

Especially when compared to Zhiyuan Robotics' indirect approach of acquiring a listed company for a backdoor listing, Unitree Technology's orthodox IPO path is viewed by the industry as a more direct indicator to test the true level of its technological commercialization.

Threefold Logic Behind the Robotics Sub-Sector's Strength

The robotics sub-sector's strength, defying the broader tech sector's pullback, is essentially a result of the resonance of three factors: "policy incentives, initial growth validation, and relatively undervalued estimates."

At the policy level, national and local support continues to intensify. The "14th Five-Year Plan for Robotics Industry Development" explicitly aims for an average annual revenue growth of over 20% in China's robotics industry by 2025, with a doubling of robot density in manufacturing. At the local level, Shanghai, Zhejiang, and other regions are increasing investments in the robotics industry, building industrial parks, nurturing leading enterprises, and improving industrial chains.

In terms of valuation, the current overall price-to-earnings ratio of the robotics sector is below the average level of the tech sector, yet the industry's growth potential is becoming evident. According to Guojin Securities data, in the first half of 2025, the revenue of 120 companies in the robotics sector increased by 13.8% year-on-year. Among them, 106 companies were profitable, with a total net profit attributable to shareholders of 21.618 billion yuan, up 13.72% year-on-year.

Notably, companies involved in core components such as heat sinks, "brains" (control systems), joint assemblies, motors, lead screws, and reducers reported highly profitable results. This strong performance and growth trend are likely to provide robust support for the valuation repair of the robotics sector.

Although Unitree Technology is not yet listed, its quadruped robots have performed exceptionally well in the market due to their "high cost-effectiveness + AI large model empowerment." In 2024, sales of these products reached 23,700 units, capturing a 69.75% market share globally, far surpassing established competitors like Boston Dynamics. The Go2 quadruped robot is priced at just 9,997 yuan, showcasing a significant price advantage and highlighting its high commercialization potential in civilian scenarios.

Upon listing, Unitree Technology is likely to provide the sector with more "performance validation" through its "fully self-developed industrial chain + high order growth rate" performance. Investors are naturally unwilling to miss this opportunity.