ARM: Is It a 'Hot Pick' on the AI Chain Backed by SoftBank?

![]() 11/07 2025

11/07 2025

![]() 418

418

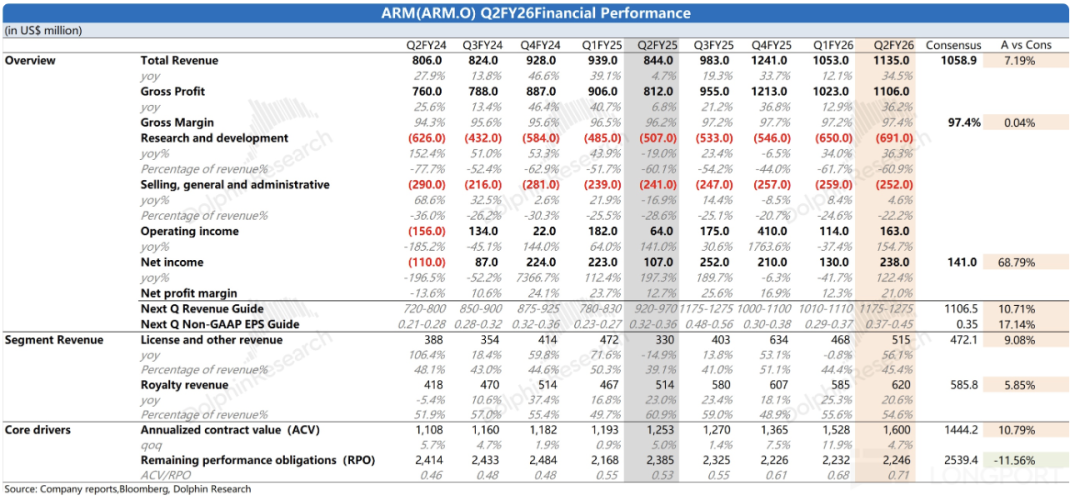

On the morning of November 6, 2025 (Beijing time), after the U.S. market closed, ARM (ARM.O) unveiled its financial results for the second quarter of fiscal year 2026 (ending September 2025). Here are the key takeaways:

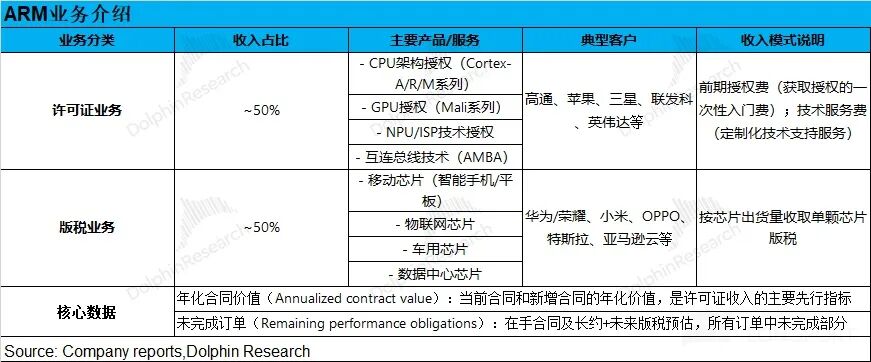

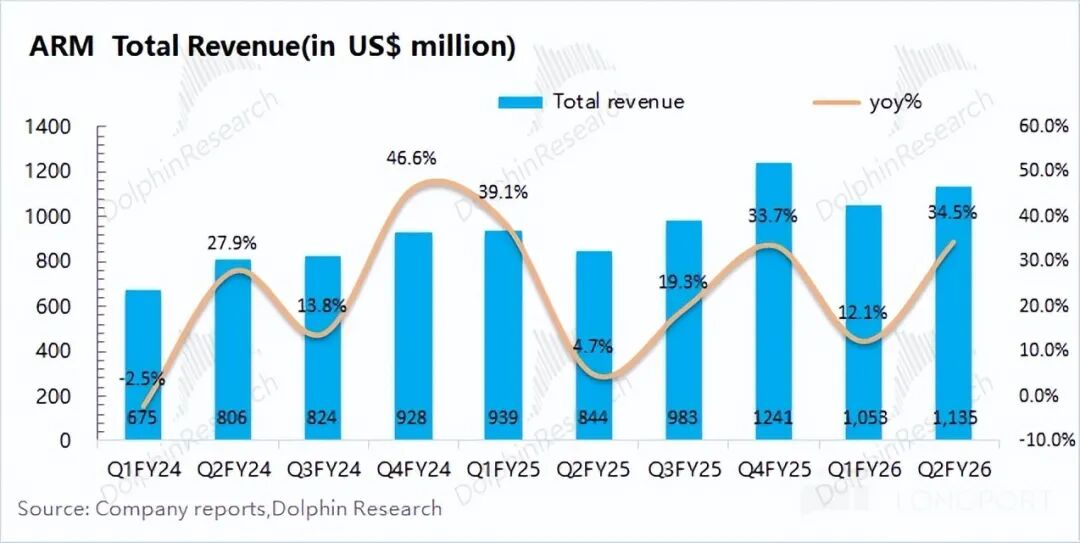

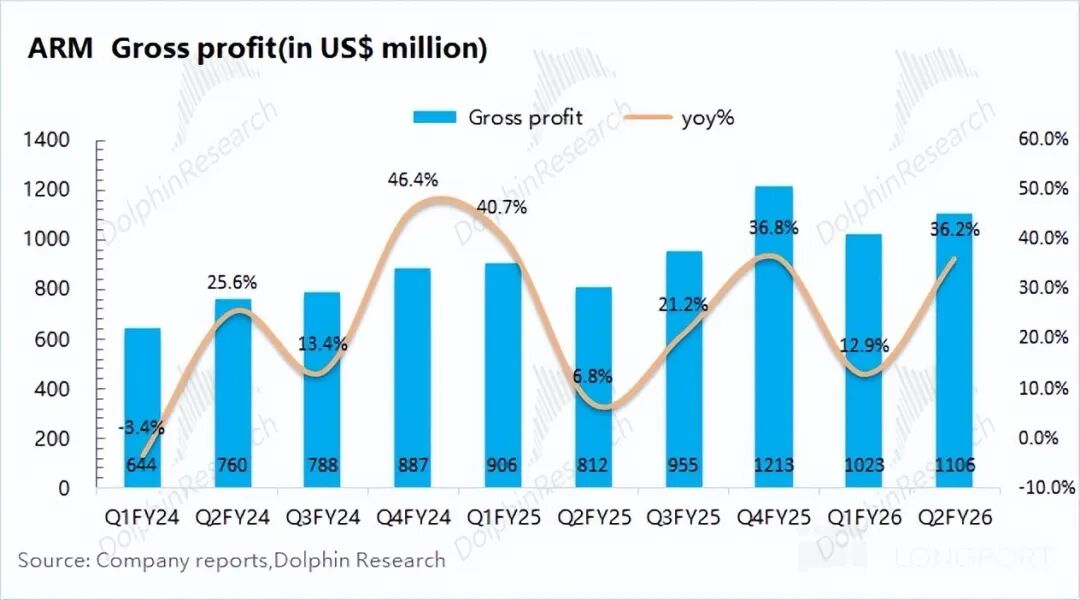

1. Key Financial Data: ARM reported a revenue of $1.135 billion for this quarter, marking a 34.5% year-on-year increase and slightly surpassing market expectations of $1.059 billion. The revenue growth of $80 million compared to the previous quarter was evenly split between the licensing and royalty businesses, both of which experienced growth. The company maintained a gross margin above 97%, at 97.4%.

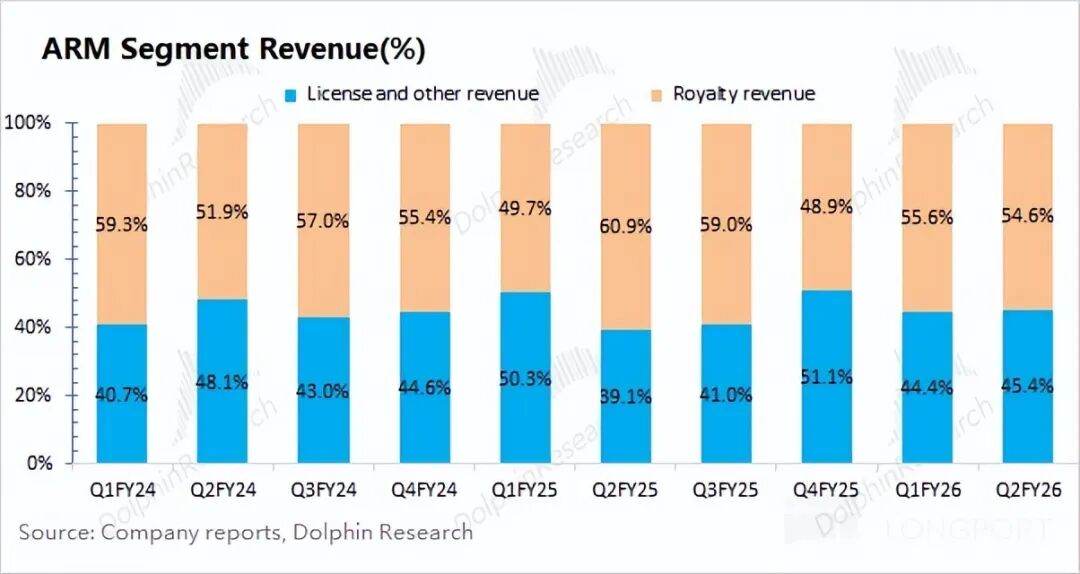

2. Business Performance Breakdown: Licensing and royalty revenues remained nearly equal.

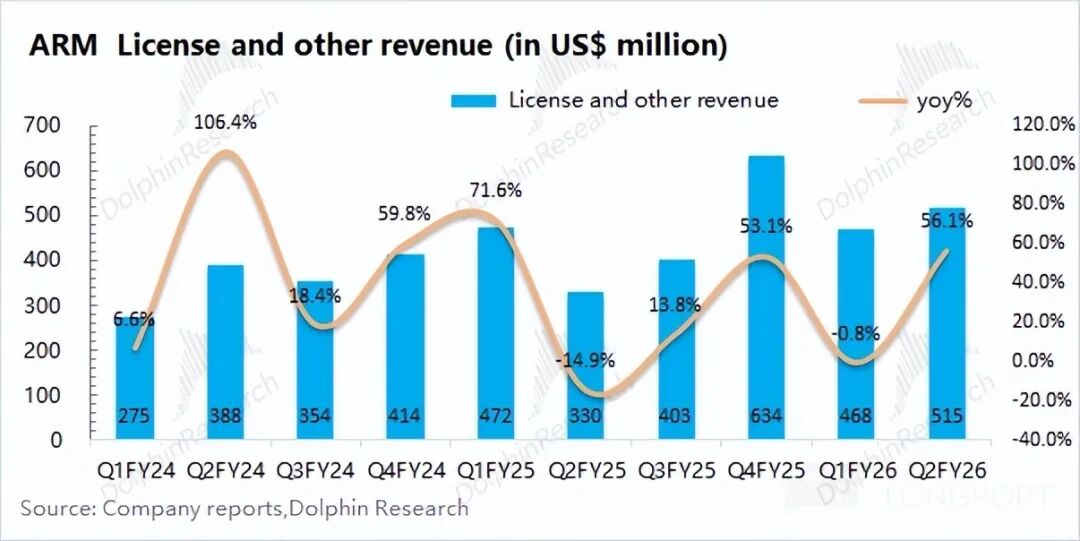

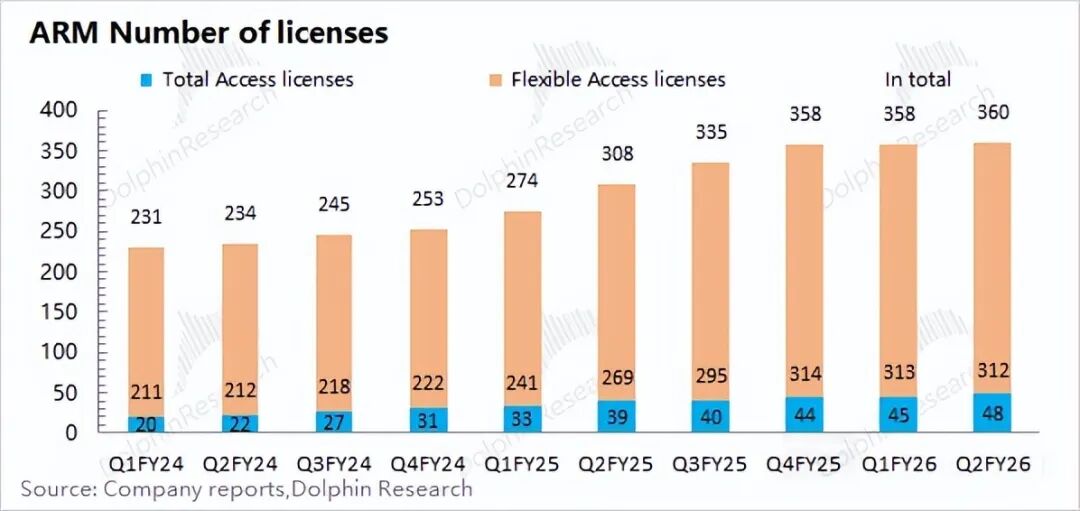

a) Licensing Business: ARM (ARM.US) reported licensing business revenue of $515 million this quarter, up $50 million from the previous quarter. Previously, the company's quarterly licensing revenue peaked at $600 million, largely due to a nearly $250 million revenue recognition from the Malaysian government. Excluding this exceptional case, the licensing business has shown an upward trajectory. This quarter, the number of full-license clients increased by three, reaching 48, with a total client base of 360.

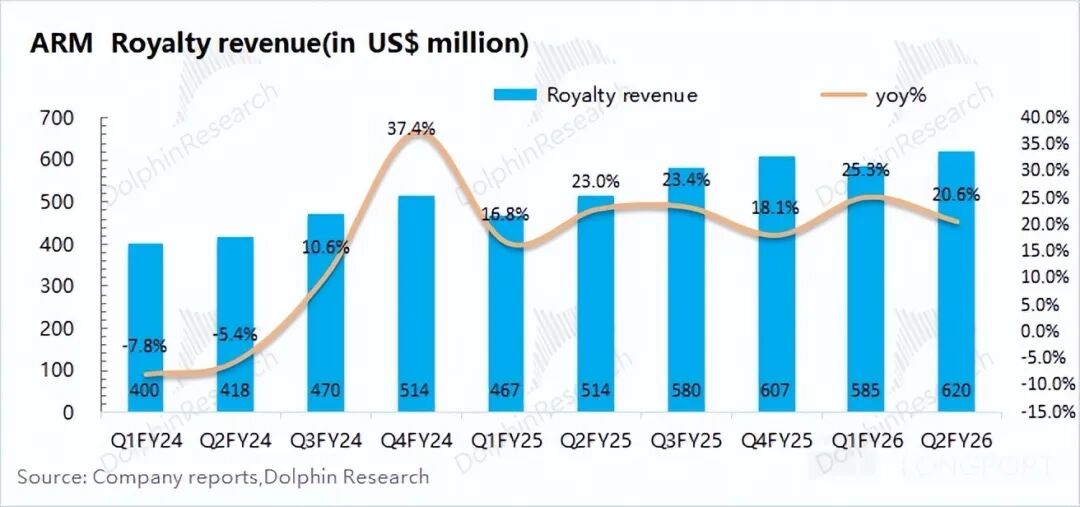

b) Royalty Business: Royalty business revenue reached $620 million this quarter, a 20.6% year-on-year increase, primarily driven by demand from data centers and smartphones. The growth was mainly attributed to increased patent fees for Neoverse (data center product line) and the rollout of CSS products.

(Note: The CSS computing subsystem is a pre-assembled IP module that includes Arm CPU cores along with other IP components, enabling companies to bypass integration and expedite product launches.)

3. Core Financial Metrics:

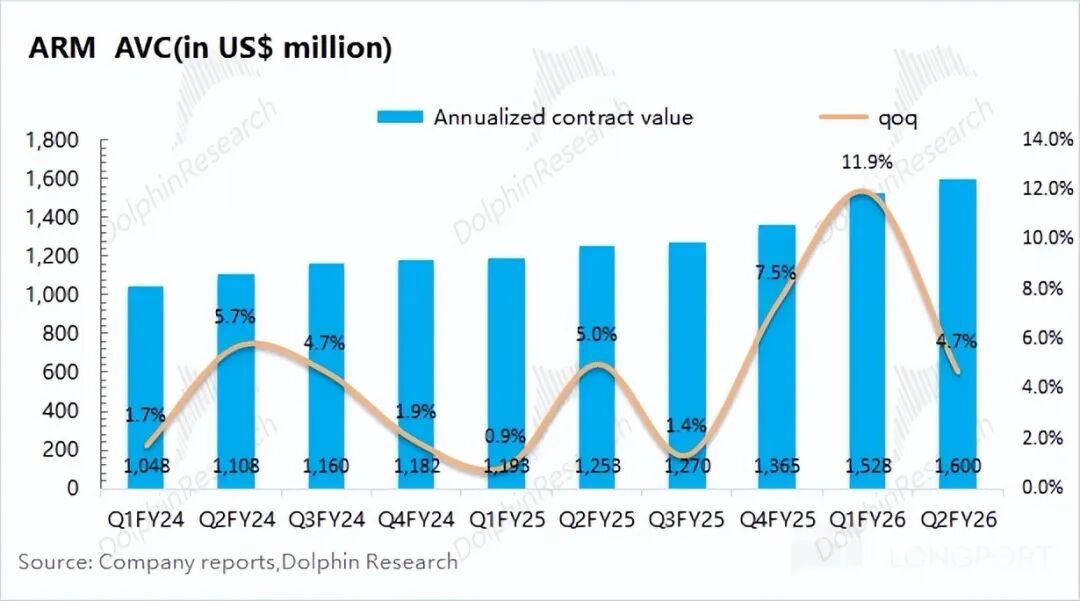

① Annual Contract Value (ACV): ARM's ACV for this quarter stood at $1.6 billion, a 4.7% increase from the previous quarter. The estimated revenue increment from new contracts this quarter is approximately $250 million, indicating steady growth.

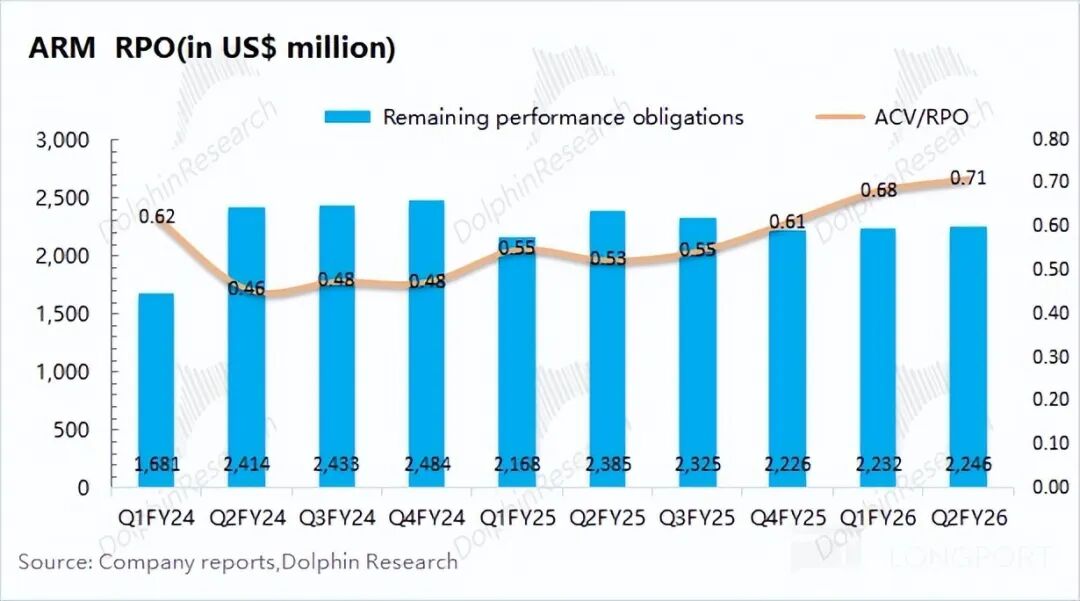

② Remaining Performance Obligations (RPO): The company's RPO for this quarter was $2.25 billion, a slight 0.6% increase from the previous quarter, falling below market expectations of $2.54 billion.

③ ACV/RPO Ratio: The ACV/RPO ratio for this quarter was 0.71, maintaining an upward trend and suggesting that the company's current order structure is more short-term oriented.

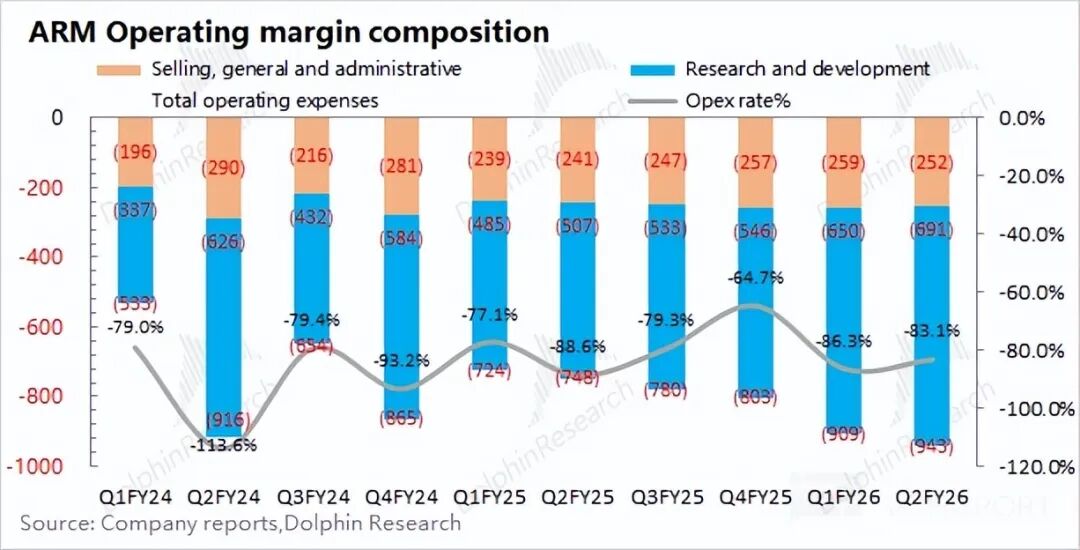

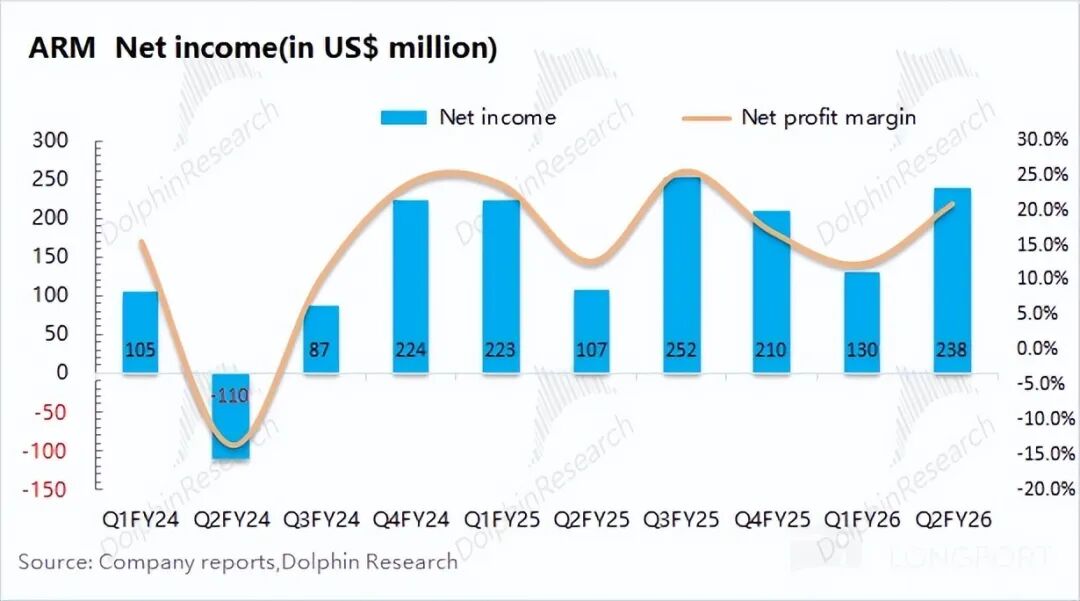

4. Operating Expenses: ARM's R&D expenses for this quarter were $690 million, a 36% year-on-year increase. The continued rise in R&D expenses is primarily due to increased exploration in chiplets and complex SoCs to cater to more complex computing scenarios. With revenue growth also at 35%, the company's R&D expense ratio remained at 61%. A consistently high proportion of R&D expenses will directly impact the company's profit margins, which currently stand at 21%.

5. Next Quarter Guidance: ARM anticipates revenue for the third quarter of fiscal year 2026 to be between $1.175 billion and $1.275 billion, with a midpoint of $1.225 billion representing an 8% increase from the previous quarter and surpassing market expectations of $1.11 billion. The company expects Non-GAAP EPS to be between $0.37 and $0.45, better than market expectations of $0.35.

Dolphin Research's Overall Assessment: Steady Performance Growth, a 'Hot Pick' on the AI Chain

ARM's overall performance this quarter was commendable, with both revenue and profit exceeding market expectations, primarily driven by the rebound in both licensing and royalty businesses. Although the company's R&D spending continues to rise, revenue growth has returned to 30%, ultimately driving a recovery in operating profit.

Compared to current performance, the market is more focused on three key aspects: company guidance, annual contract value, and remaining performance obligations:

1) Management Guidance: ARM expects revenue for the next quarter to be between $1.175 billion and $1.275 billion, surpassing market expectations of $1.11 billion, with a midpoint of $1.225 billion representing an 8% increase from the previous quarter. Dolphin Research estimates that the quarter-over-quarter revenue increment next quarter will primarily come from the royalty business, as the next quarter is a peak season for electronics sales, driving royalty revenue through downstream shipments.

2) Annual Contract Value (ACV): ACV serves as a forward-looking indicator for next quarter's revenue. ARM's ACV for this quarter was $1.6 billion, a slight 4.7% increase from the previous quarter. Combining this with the company's quarterly revenue, Dolphin Research estimates that the amount of old contracts rolled into this quarter's revenue is approximately $380 million, while the combined total of 'new contracts recognized this quarter + this quarter's royalty revenue' is approximately $750 million.

3) Remaining Performance Obligations (RPO): ARM's RPO for this quarter was $2.25 billion, falling below market expectations of $2.5 billion. The ACV/RPO ratio indicates that the company's current backlog is more short-term oriented, aligning with the relatively urgent demand in the current AI market.

Considering these three metrics, Dolphin Research believes that ARM's current operating performance is solid, maintaining a steady upward trend. While the RPO fell short of expectations, it is acceptable given the steady growth in ACV. The higher proportion of short-term orders reflects the more urgent demand from the company's clients in AI and other fields.

A more detailed value analysis has been published in the Longbridge App under the 'Dynamic-Research' section in an article with the same title.

Overall, given the sustained enthusiasm for AI capital expenditures, ARM holds a unique position and relative certainty in the entire AI supply chain. Although the company's performance this time was not overly surprising, it is steadily improving. Even with a current valuation of 100 times earnings, as long as 'AI enthusiasm remains high' and 'the company does not encounter major setbacks,' its high valuation can persist.

Additionally, it is worth noting that the company has a major financial backer—SoftBank. SoftBank has been highly active in the AI market, including joining Stargate and making additional investments in OpenAI. If SoftBank leverages ARM's platform for another round of capital operations, it could bring even greater imagination to the company.

Below are Dolphin Research's charts and data related to ARM's financial report:

- END -

// Reproduction Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, catering to users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information in this report assumes their own risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from using the data in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report may not be used or construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and data in this report are not intended for or intended to be distributed to jurisdictions where distribution, publication, provision, or use of such information, tools, and data conflicts with applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliates are required to comply with any registration or licensing requirements.

This report only reflects the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, with copyright solely owned by Dolphin Research. No institution or individual may, without the prior written consent of Dolphin Research, (i) produce, copy, duplicate, reprint, forward, or otherwise create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.