Baidu's Stock Soars 20%: AI Chip Valuation Takes Center Stage, When Will Robotaxi Services Follow Suit?

![]() 09/18 2025

09/18 2025

![]() 691

691

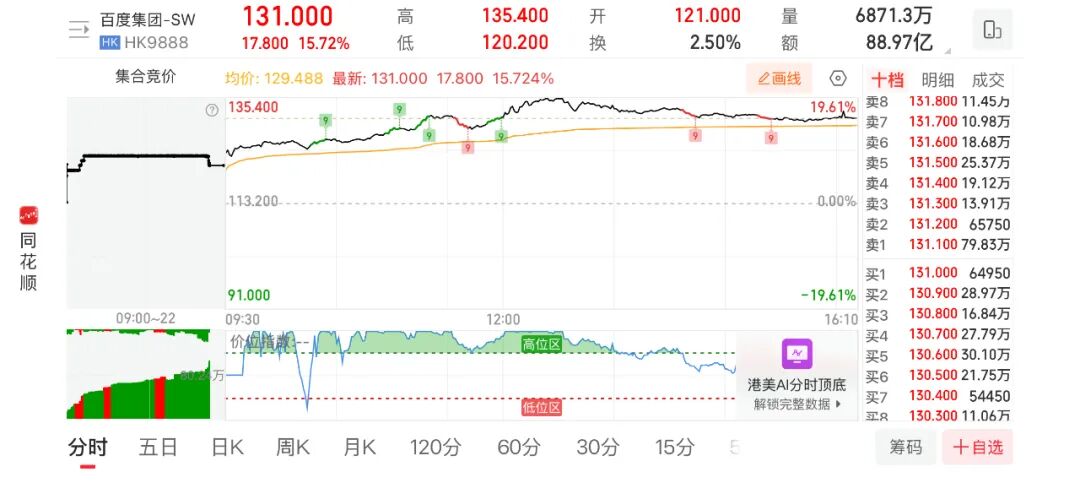

On September 17, Beijing time, Baidu (09888.HK), a company listed on the Hong Kong Stock Exchange, experienced a remarkable 19.61% surge during intraday trading, hitting a new peak since October 2023. Although the closing gain was somewhat tempered, the stock still finished the day up 15.71%, culminating in a cumulative September increase of over 46%.

Baidu's dramatic intraday spike is closely tied to its AI chip division, Kunlunxin.

Following in the footsteps of Alibaba, the secondary market has started to assign a valuation to Baidu within the AI chip sector.

Online discussions have proliferated, with some of the most optimistic voices drawing parallels between Baidu's Kunlunxin and Cambricon.

As of today, Cambricon's market capitalization closed at 603.2 billion RMB, while Baidu's latest market valuation in Hong Kong stands at 360.2 billion HKD.

According to Qichacha data, Baidu holds a 59.45% stake in Kunlunxin. The most recent revenue forecast for Kunlunxin this year has been revised upwards from 4 billion to 5 billion RMB. In contrast, Cambricon's full-year revenue projection, released on August 28, falls between 5-7 billion RMB.

So, what is the true value of Kunlunxin? And how much is Baidu's stake in it worth?

Following this wave of NVIDIA's attempted dumping of H20 chips, which led to an investigation and subsequent antitrust scrutiny on September 15,

the impetus for NVIDIA's investigation stems from China's conviction that it does not need to rely on NVIDIA's outdated chips for AI development. This confidence is bolstered by investments in the AI chip sector by companies such as Huawei, Cambricon, Baidu, and Alibaba.

Indeed, Baidu has been a pioneer in AI-related investments for an extended period (over a decade) and with substantial financial commitment (exceeding 100 billion RMB), a feat relatively uncommon among Chinese tech firms for such sustained and intensive AI investment.

Certainly, Alibaba and Tencent are now also making significant AI-related capital outlays, akin to those of foreign tech giants. However, their primary AI expenditures are still centered around chip procurement. This is why NVIDIA's chips have seen a surge in demand, propelling it to become the world's highest-valued company.

Yet, Baidu's AI chips have been in development for numerous years.

According to publicly available information, Kunlunxin (Beijing) Technology Co., Ltd., formerly Baidu's Intelligent Chip and Architecture Department, secured independent financing in April 2021 with an initial valuation of 13 billion RMB. Despite becoming independent in 2021, Kunlunxin has been laying the groundwork for AI acceleration for over a decade.

As per Baidu's own accounts, as early as 2012 (a notable year, apart from the Mayan prophecy, Huawei also established its 2012 Labs), Baidu embarked on its AI journey by founding the Institute of Deep Learning, widely regarded as the breeding ground for talent in China's AI sector. By Baidu's reckoning, cumulative R&D investment had surpassed 100 billion RMB by 2022.

Kunlunxin achieved independence in 2021 but had already commenced mass production of its first-generation AI chip in 2020, deploying tens of thousands of chips across Baidu's search engine and Xiaodu services. The second-generation AI chip, boasting the new XPU-R architecture, returned from fabrication in June 2021, was activated on the same day, and began mass production in August, catering to internet and industry clients.

The aforementioned details are sourced from Baidu Baike, with the latest updates dating back to 2021. Subsequent information has not been extensively disclosed, not due to a lack of progress, but rather for specific strategic reasons.

Nevertheless, given China's resolute stance against NVIDIA today, it is evident that domestic AI chips can shoulder substantial responsibilities. What is required now is greater commercial adoption to foster a self-sustaining cycle of research, development, and iterative growth within the domestic chip sector.

Beyond Kunlunxin, Baidu's AI investments also encompass a significant focus on advancing intelligent vehicle businesses, such as Robotaxi, through its Baidu Apollo platform.

Baidu's foray into autonomous driving commenced early and has been substantial. As early as 2015, Wang Jin, then at Baidu, boldly proclaimed on stage the objective of "commercialization in three years, mass production in five," a milestone echoed by Li Yanhong receiving China's first autonomous driving ticket while seated in a vehicle—both defining moments in the industry.

When comparing the progress of Kunlunxin and Baidu Apollo, aside from the differences in commercialization within their respective industries—AI chips are currently in high demand, whereas Robotaxi has yet to commence large-scale commercialization—there is evident potential for continued growth.

Kunlunxin achieved independence with its commercially viable first-generation product. Baidu Apollo also had an opportunity for independent financing, with rumors suggesting that SoftBank's Masayoshi Son was prepared to invest, although the deal ultimately did not materialize. Son has invested in mobility giants like Uber and Didi, as well as in Robotaxi through Cruise (whose Robotaxi business was discontinued by GM but is now rumored to be restarting, particularly given Tesla's ambitious goals under Elon Musk, which the secondary market has begun to factor in).

Baidu Apollo has been functioning as an independent entity with self-accounting and self-financing capabilities for two years, albeit with Baidu continuing to provide robust support. Especially now, with the dawn of Robotaxi commercialization, Alphabet (Google's parent company), a major shareholder in Waymo, invested $5 billion in Waymo alongside other shareholders when GM discontinued Cruise.

At this critical juncture, Baidu is unlikely to retreat. Will Baidu Apollo seek independent financing? It seems probable, although the valuation is expected to be high given Baidu's substantial investments. With Kunlunxin, Xiaodu, and other AI businesses already having secured independent financing, Baidu is unlikely to monopolize the larger Robotaxi market. Financing extends beyond merely raising capital; it also encompasses acquiring resources vital for company development.

In 2024, there was a period when the secondary market attempted to assign a valuation to Baidu Apollo's Robotaxi service, Luobo Kuaipao. At that time, Luobo Kuaipao commenced scaling deployments (mass deployments) in Wuhan and planned to expand to additional cities. However, the pace eventually slowed down for reasons not elaborated upon here.

Nevertheless, it is crucial to remember that just as Kunlunxin's valuation is now reflected in Baidu's stock, Apollo and Luobo Kuaipao should not be overlooked. After all, Tesla has begun to be priced in, but Luobo Kuaipao's Robotaxi vehicles differ from Tesla's approach. Tesla aims to utilize existing mass-produced consumer vehicles for Robotaxi operations, whereas Luobo Kuaipao's latest model, the Yichi 06, has struggled to gain traction in the consumer market, weakening the narrative of personal vehicles participating in Robotaxi services.

Can Baidu firmly seize this final opportunity in AI?