The hidden king of industrial AI, quietly earning 2 billion yuan a year

![]() 04/11 2025

04/11 2025

![]() 589

589

Article by: Poetry and Starry Sky

ID: SingingUnderStars

Some people joke that the current AI competition is between Chinese people in the US and Chinese people in China.

In addition to the Chinese who are striving at the forefront of major AI giants, there are at least three Chinese at the "godfather (godmother)" level, namely Andrew Ng, Li Feifei, and Lu Qi. Two of them have worked for Baidu.

In 2014, Andrew Ng joined Baidu and left in 2016; in 2016, Lu Qi joined Baidu and left in 2018.

In July 2017, Lu Qi, then president and chief operating officer of Baidu, said that AI's impact on society is unprecedented in both depth and breadth. AI will usher humanity into a new era, just like the previous three industrial revolutions. AI is an opportunity for Baidu, and Baidu will All-In AI.

In fact, Baidu's All-in AI strategy was proposed in 2016.

In May 2018, Lu Qi left the company in disgrace.

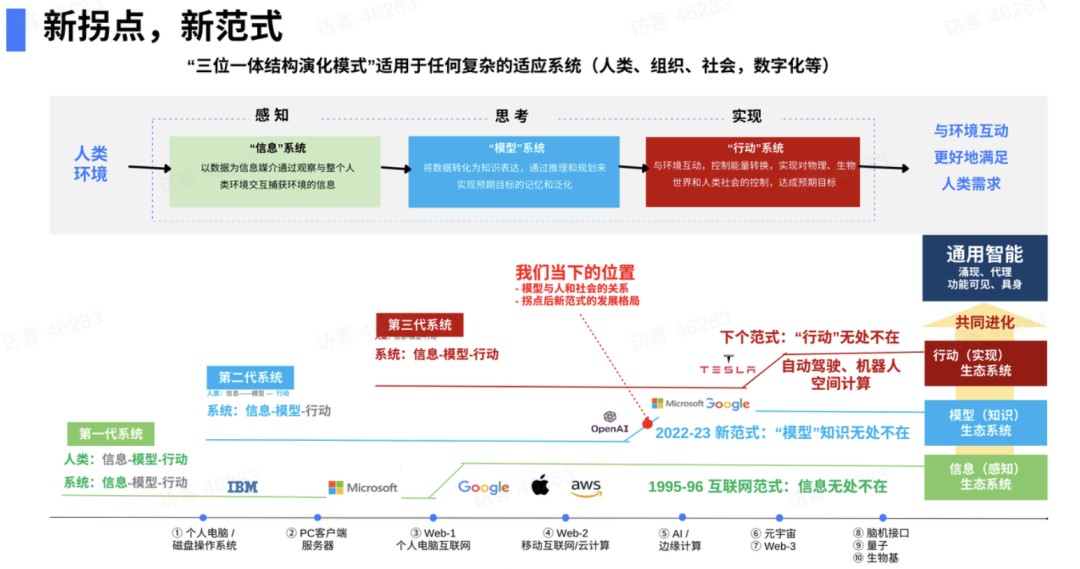

Five years later, in 2023, DeepSeek was established. That year, the author was attracted by Lu Qi's speech titled "New Inflection Point, New Paradigm," and developed a strong interest in the combination of future human development and personal hobbies.

With the release of DeepSeek v3 and r1, an irreversible wave of AI has swept across China.

What about Baidu, which is All-in AI? Nowadays, Baidu is forced to follow up and access DeepSeek, and has announced that it will open source Wenxin Yiyan in the future.

Students, what's the saying about getting up early but arriving late?

Nevertheless, many of Li Yanhong's views are still worthy of recognition. For example, he said: "In a fiercely competitive environment, commercial closed-source models are the most effective." But more important than the debate between open source and closed source is that "rolling out" applications is currently more valuable.

There was an error in the dissemination of this sentence, which was simplified to "open source is inferior to closed source." In fact, Li Yanhong emphasized rolling out applications.

Although there is intense competition among large models in China and the United States, applications are just starting.

01

AI needs to roll out applications

Since the overnight success of ChatGPT at the end of 2022, what is the largest-scale application in the field of generative AI?

Customer service, education, content creation, office work, programming...

The author does not deny the importance of these AI applications, which have indeed improved production efficiency. However, from the perspective of the foundation of a country, "manufacturing," they are all "trickery and deceit."

Before the explosion of generative AI, CV (computer vision) was the main application of AI.

What is CV doing? It checks display defects on the production line of BOE, performs automatic welding on the production line of BYD, and inspects X-rays of products on the production line of Baosteel...

This is real productivity.

The ultimate application of AI must be industry.

The future of industry will inevitably be All-in AI.

Open source is the light of industry.

OpenAI's idea is very simple and brutal: to be the brain of the world. Whether it's B-end or C-end, anyone who wants to use AI can connect, and OpenAI can collect fees effortlessly. It can even impose computing power sanctions on some countries.

However, for most industrial enterprises, on the one hand, the data of many industrial enterprises involves core secrets and cannot be leaked on the public internet; on the other hand, the gross profit of industrial enterprises is usually relatively low, and there is not enough budget to purchase AI services.

Open source perfectly solves this problem.

02

When DeepSeek enters the industrial sector

On February 25, Nanning Metro officially announced its access to DeepSeek.

The author carefully studied it and found that it mainly realizes AI knowledge base functions in several different scenarios.

The process reengineering and information system transformation of industrial enterprises are relatively complex. What can be presented in the short term is the easiest to go online, which is a normal operation.

The technical support for Nanning Metro is provided by Baosight Software.

The major shareholder of Baosight is Baosteel Co., Ltd. Relying on a powerful backer, the company is responsible for the entire group's information technology business. Nearly 60% of the company's revenue comes from related party transactions, and both revenue and net profit are relatively stable.

Relying on the Baosteel Group, the company has also extended its business to the manufacturing fields of steel, non-ferrous metals, pharmaceuticals, etc.

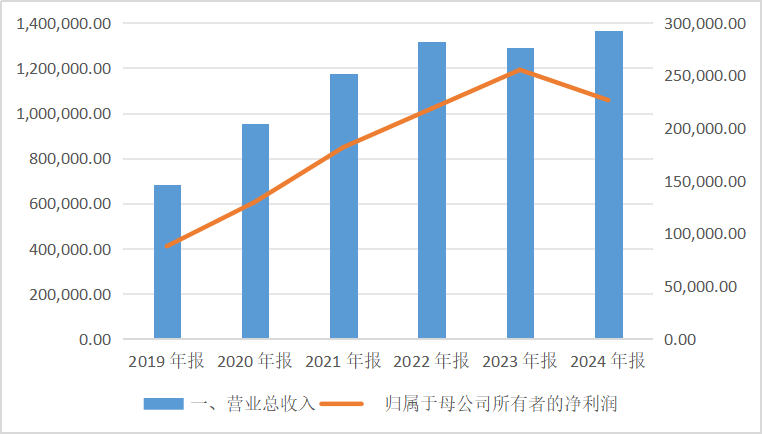

The 2024 annual report shows that Baosight Software achieved a total operating revenue of 13.6 billion yuan, an increase of 5.64% year-on-year.

Data Source: iFind

The net profit attributable to shareholders was 2.265 billion yuan, a year-on-year decrease of 11.28%; the non-deductible net profit was 2.198 billion yuan, a year-on-year decrease of 8.91%.

The main reason for the company's performance decline has a lot to do with its customer composition. Baosight Software's main customers are concentrated in the steel industry, and the decline in the prosperity of the steel industry in 2024 led to a reduction in enterprise informationization and automation investments.

Especially since nearly 60% of the company's revenue depends on related parties such as Baowu Steel Group, the operating conditions of related major customers have a relatively large impact on the company.

From the cash flow statement, the company's net operating cash flow in 2024 declined, but the quality of revenue collection was still very high. Customers are mainly related parties within the group and can make payments on time, and in most years, the company can achieve a net operating cash flow that is greater than the negative value of net investment cash flow.

Data Source: iFind

Such a cash flow structure is generally called a "cash cow" by the author.

03

The analysis logic of the software industry is changing

When studying IoT enterprises, it is essential to clarify which industry the company belongs to, what it does, and what link it is in the industrial chain.

Supply-side reforms have injected new vitality into the steel industry. As the steel industry enters a transition period, there is an urgent demand for the IoT field.

The steel enterprise with the highest technological level in China is recognized as Baosteel.

The predecessor of Baosight Software was the Baosteel Information Center.

What businesses does Baosight engage in now?

First, let's talk about its core competence: It possesses a complete solution for domestic leading steel full-process, full-level, and full-lifecycle automation integration technology and core industrial control product PLC control system software and hardware, providing large-scale project contracting and implementation such as engineering design, software development, system integration, complete set manufacturing, and on-site debugging; in factory integrated management and control, industrial internet edge computing and data creation

New applications, etc., to provide customers with a full range of smart factory solutions.

For example, in the smelting process, Baosight provides information support for the entire smelting process, covering raw materials, sintering, coke ovens, blast furnaces, pretreatment, converters, refining, and continuous casting.

This is the threshold and barrier that even BAT companies find difficult to reach.

In the internet industry, the main equipment used by everyone is exactly the same. From websites to servers to computers, from applications to databases to middleware, almost everything is globally standardized.

However, in the industrial sector, the differences are huge. It's not difficult, but most code farmers have never seen it. In such fields, BAT often doesn't even have the qualification to bid.

This is also true in the era of large models. In October 2024, Baowu released the self-developed large model product for the steel industry, the "Baolianden Steel Industry Large Model," which includes a three-tier architecture of basic large models, industry-specific large models, and application scenario domain models. The model integrates "general and specialized models" (general models and professional models), "industry and technology fusion" (industry knowledge and AI technology), and "digital and physical integration" (digital technology and physical manufacturing) to create an industry-first platform that integrates platform, data, computing power, models, and scenarios.

In other words, in an era of blooming diversity, the idea of only looking at industry leaders may be outdated. Instead, mid-tier enterprises in niche fields have more vitality.

04

The future of software enterprises is to sell services

The author has dissected the financial reports of many software companies. Even industry leader Yonyou Network has relatively poor profitability.

This is related to the lack of comprehensive informatization in various industries in China. The main source of revenue is large customers, and the revenue brought by small and medium-sized enterprises is not stable, and even bad debts often occur.

Apart from the relatively widespread use of financial software, the vast majority of small and medium-sized traditional enterprises have long lacked the internal motivation for informatization transformation.

DeepSeek will change all this, and it is even more of a challenge and opportunity for Chinese software enterprises.

Many software companies are stuck in the mindset of selling products. In the future, software companies can only sell services.

With the popularization of AI agents, standardized products no longer exist. On the one hand, software development costs have dropped significantly; on the other hand, the demand for personalized and customized software services from traditional enterprises is becoming stronger and stronger.

Software companies will become a "symbiote" of enterprises.

-END- Disclaimer: This article is based on the public company attributes of listed companies and an analytical study with the core basis of information (including but not limited to temporary announcements, periodic reports, and official interactive platforms) publicly disclosed by listed companies according to their legal obligations; Poetry and Starry Sky strives for fairness in the content and opinions carried in the article, but does not guarantee its accuracy, completeness, timeliness, etc.; the information or opinions expressed in this article do not constitute any investment advice, and Poetry and Starry Sky will not bear any responsibility for any actions taken using this article.

Copyright Notice: The content of this article is original by Poetry and Starry Sky and may not be reproduced without authorization.