Market Value Peaks as Tencent Reaps AI Rewards

![]() 08/18 2025

08/18 2025

![]() 479

479

From Transfusion to Hematopoiesis

Written by Chen Dengxin

Edited by Li Ji

Typeset by Annalee

True to form, it had to be Tencent.

Recently, Tencent released its second-quarter financial report for 2025, boasting operating revenue of 184.5 billion yuan, a 15% year-on-year increase, and operating profit (Non-IFRS) of 69.25 billion yuan, up 18% year-on-year.

Both operating revenue and operating profit exceeded expectations.

This signifies that as AI becomes a cornerstone of its strategy, Tencent has returned to an expansion cycle, with heavy investments not hindering performance but rather fueling robust double-digit growth.

In the capital markets, Tencent's market value nears HK$5.5 trillion, marking a four-year high. It is almost certain that the next milestone will be challenging the 2021 historical peak.

Undoubtedly, AI has evolved into Tencent's atomic capability, continuously infusing new energy into its business endeavors.

Tencent AI is making waves.

At the dawn of the generative AI revolution, the mindset of "the early bird catches the worm" prevailed, with numerous internet companies jumping in, fearing being left behind in the AI arms race.

Initially, the market failed to grasp Tencent's patient AI strategy, which believed that "good things come to those who wait".

As we entered 2024, with generative AI transitioning from its introductory phase to practical applications, Tencent clarified the relationship between large models and applications: the ultimate goal of large models is application, but application iteration is not about feeding back into large models to make them more powerful; rather, it's about serving users and solving their practical problems.

In simpler terms, AI is nurturing Tencent's next super traffic portal and driving innovation and growth in its evergreen games and emerging businesses.

Consequently, Tencent AI has embarked on a period of significant investment.

Tencent's capital expenditure for 2024 amounted to 76.76 billion yuan, accounting for 11.6% of total revenue; R&D expenses stood at 70.69 billion yuan, surpassing the 70 billion yuan mark for the first time.

Tang Daosheng, Senior Executive Vice President of Tencent Group, once stated, "We propose four accelerations for AI implementation: accelerating large model innovation, accelerating agent application, accelerating knowledge base construction, and accelerating infrastructure upgrades, to propel AI technology into thousands of industries and into everyone's daily life."

Against this backdrop, the market has voiced concerns about Tencent's long-term heavy investments.

This is not unprecedented. Meta invested a staggering $45 billion in the metaverse, yet the returns were minimal, dragging its market value down by 64.22% in 2022.

Facts have proven that the market's anxiety was once again misplaced.

In the second quarter of 2025, Tencent's R&D expenses reached 20.25 billion yuan, a 17% year-on-year increase; capital expenditure was 19.11 billion yuan, up 119% year-on-year.

Correspondingly, the gross margin rose from 53% in the same period of 2024 to 57%, setting a new record high. The gross margin is a crucial indicator of a company's competitiveness, indicating that Tencent's increased investment in AI has bolstered its business quality and competitiveness.

This is intrinsically linked to the AI feedback loop.

Benefiting from AI-driven growth, Tencent's three primary businesses—value-added services, marketing services, and financial technology and enterprise services—have achieved sustainable growth, all surpassing market expectations.

Among them, the AI-empowered advertising business is particularly noteworthy.

AI has become a catalyst for ad creation and effectiveness enhancement, thereby increasing ad click-through and conversion rates, amplifying advertisers' return on investment, and achieving double-digit growth in advertising revenue for 11 consecutive quarters, setting a new record high.

This underscores that AI has become Tencent's new business calling card.

This can be seen in DeepSeek's acknowledgment of Tencent's AI capabilities.

In February 2025, DeepSeek open-sourced five code libraries, among which DeepEP could improve communication efficiency by 300%, performing impressively on IB networks but less so on more cost-effective, widely applicable RoCE networks.

This issue wasn't resolved until Tencent intervened, doubling the effectiveness of DeepEP on RoCE networks and further enhancing performance on IB networks by 30%.

The above acknowledgment is merely the tip of the iceberg showcasing Tencent's AI prowess.

Ma Huateng said, "We are committed to empowering more application scenarios within WeChat, promoting the usage of AI-native app Yuanbao, and upgrading the capabilities of our Hunyuan foundational model to bring further AI benefits to users and enterprises."

Through data augmentation and synthesis technology, Tencent has improved the quality and diversity of data and enhanced the capabilities of the Hunyuan foundational model through more effective pre-training and post-training extensions.

As a result, Tencent's Hunyuan large model continues to iterate, and its family continues to grow.

Hunyuan Turbo S is the industry's first large-scale hybrid Mamba-MoE model, reducing first-character latency by 44% based on architectural innovations. Through monthly iterations, it has climbed to the top eight on the Chatbot Arena rankings, alongside cutting-edge large models such as OpenAI GPT, Google Gemini, and Grok.

Hunyuan Deep Reasoning Model T1 continuously improves agent capabilities and general reasoning performance, performing well in project-level code generation, high-difficulty mathematical reasoning, text writing, and other areas.

Additionally, there are the multimodal understanding model Hunyuan TurboS-Vision, the visual deep reasoning model Hunyuan T1-Vision, the first millisecond-level real-time image generation model Hunyuan Image 2.0, and the first art-level 3D generation large model...

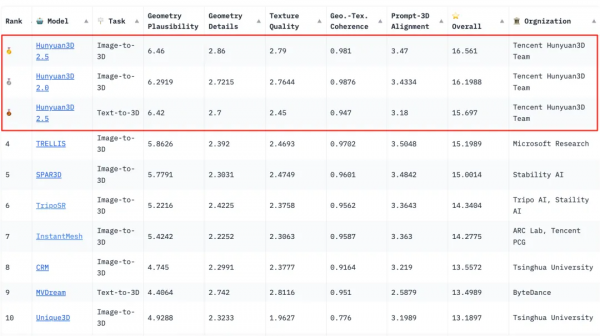

Among them, the performance of the Hunyuan 3D v2.5 model is particularly noteworthy.

With the industry's first sparse 3D native architecture, its model geometric resolution reaches 1024³, and the texture material mapping resolution reaches 4k. Consequently, the 3D model surface is smoother, edges are sharper, details are richer, and the model texture quality leads the industry.

The global 3D generation model evaluation rankings released by the Shanghai Artificial Intelligence Laboratory show that Hunyuan 3D v2.5 topped the list, while the open-source model Hunyuan 3D v2.0 ranked second.

Currently, the cumulative downloads of the Hunyuan 3D series models in the community exceed 2.3 million, with an increasing number of game developers, 3D printing enterprises, and professional designers adopting Hunyuan 3D models to generate digital assets.

Building on this, Tencent's Hunyuan large model infuses intelligent genes into its business.

It has launched AI podcasts, rolled them out on QQ Music and Tencent News, supports Tencent Meeting AI Assistant for in-depth analysis of meeting content, and aids in AI interaction with WeChat input method...

What garners the most attention from the outside world is Tencent Yuanbao.

With more versatile understanding, more diverse expression, and richer search experiences, Tencent Yuanbao has emerged as the most eye-catching "dark horse" among AI-native mobile applications in 2025.

According to QuestMobile data, in the first half of 2025, the monthly active user count of Tencent Yuanbao increased by 55.2% year-on-year, ranking second on the soaring list of AI-native applications, second only to DeepSeek.

In this way, it continuously interacts with Tencent's ecosystem.

Tencent Yuanbao has become a core carrier bridging different content scenarios within Tencent, enabling one-click access to reading (WeChat Reading, Qidian Reading), listening to music (QQ Music), navigation (Tencent Maps), and even interpreting video numbers, deeply integrating into the WeChat scenario to create an omni-scenario content platform.

In summary, AI resonates deeply with Tencent's entire business landscape.

As AI accelerates its implementation in search, input methods, content generation, and other scenarios, users, creators, and merchants benefit collectively, propelling the growth of emerging businesses such as Video Numbers, WeChat Stores, and WeChat Search, allowing WeChat to further enhance its penetration rate.

The financial report reveals that the combined monthly active user count of WeChat and WeChat reached 1.411 billion, a year-on-year increase of 3%, setting a new record high for monthly active users.

Apart from Tencent Yuanbao, games are another arena where AI can showcase its capabilities.

Games represent a natural scenario for AI implementation and are key to tapping into the value potential of games and enhancing the gaming experience. Therefore, Tencent AI collaborates with evergreen games to jointly revitalize their product capabilities, thereby attracting more users and occupying a larger market share.

For instance, "Honor of Kings" is Tencent's flagship evergreen game and a testament to long-term AI empowerment. It early introduced the AI trusteeship function, successfully addressing the pain point of teammates having to AFK due to various accidents, thus sacrificing the gaming experience.

Subsequently, the AI voice assistant "Lingbao" arrived, capable of real-time dialogue with players and can autonomously choose the dialogue style, becoming a genuine gaming companion.

Currently, the "Commander Mode" has been updated, allowing players to act as commanders leading four AI teammates in "black play", competing to see whose tactical collaboration is superior, playing to outwit the opponent.

Another example is the "Game for Peace" Jue Di Zhi Hui 2.0 version, which launched the reliable AI teammate "Hua Aotian", who will not disconnect, complain, or betray, and high communication costs and poor teaming experiences are no longer obstacles for players.

More importantly, "Hua Aotian" possesses long-term memory capabilities and can remember players' personality traits, combat habits, game preferences, and other information, adding to the joy of nurturing.

In brief, with the deep integration of games and AI, the gameplay of evergreen games becomes more diverse, satisfying the diverse needs of players and thereby continuously increasing freshness and user stickiness.

James Mitchell, Tencent's Chief Strategy Officer, said at the financial report meeting, "AI enables us to provide more human-like virtual teammates in competitive PvP games and create more realistic non-player characters in storyline-driven PvE games. Additionally, we also apply AI to game marketing activities to more efficiently target marketing expenditures on users most likely to activate and retain long-term."

In this manner, evergreen games unleash enduring vitality.

In the second quarter of 2025, Tencent's game revenue in the domestic market was 40.4 billion yuan, a year-on-year increase of 17%; game revenue in the international market was 18.8 billion yuan, with a year-on-year increase of 35%.

It should be noted that the evergreen game matrix continues to expand, and the evergreen potential of "Delta Force" is evident.

Official data shows that in July 2025, the daily active user count of "Delta Force" exceeded 20 million, ranking among the top five in terms of daily active users and top three in game revenue in China, becoming a phenomenal product that once again validates Tencent's ability to continuously create evergreen games.

Furthermore, the mobile game "Valorant: Nexus Blitz" is scheduled for August 19, 2025, with over 60 million pre-registrations, expected to become the next evergreen game.

It is evident that whether it's mobile or PC games, Tencent has a rich reserve of evergreen games. In the future, as the matrix continues to expand, operating revenue will increase while customer acquisition costs will decrease, giving Tencent's performance more momentum under this dual dynamic of growth and cost savings.

In light of this, Morgan Stanley raised its target price for Tencent by 8%, stating that "Tencent's second-quarter results comprehensively exceeded expectations, reflecting the successful deployment of AI across all business lines."

In conclusion, Tencent has transitioned AI from usable to easy-to-use, gaining "hematopoietic" capabilities while "transfusing", becoming a significant driver stimulating Tencent's performance and propelling continuous improvement in advertising, games, and other businesses.

Under this positive cycle, Tencent AI holds greater imaginative potential.