Who Will Be the Pioneer in Launching Solid-State Batteries?

![]() 11/07 2025

11/07 2025

![]() 510

510

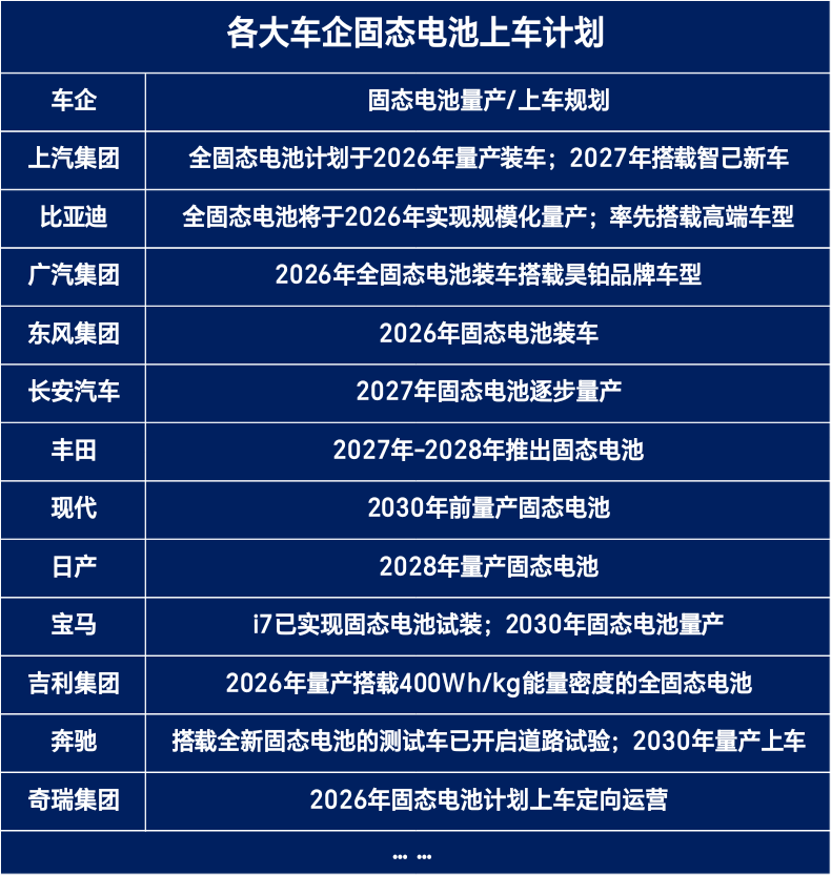

Recently, a number of automotive companies have successively unveiled the latest advancements and mass-production plans concerning solid-state batteries.

On October 27th, Japanese media reported that Nissan has achieved significant breakthroughs in the research and development of all-solid-state batteries. The trial-produced all-solid-state battery cells boast a range performance double that of the current mainstream lithium-ion batteries, paving the way for Nissan to realize mass production of all-solid-state batteries within the fiscal year 2028.

Coincidentally, just a week prior, Dongfeng Motor announced on its official WeChat account that it has successfully achieved mass production of solid-state batteries and established a corresponding supply chain, with intentions to install them in vehicles by 2026.

In fact, prior to Nissan and Dongfeng Motor, several automotive companies had already officially disclosed their plans for solid-state batteries.

Among them, Changan Automobile is set to launch a prototype vehicle equipped with all-solid-state batteries this year, conduct large-scale installation verification in 2026, and gradually transition into mass production in 2027. Geely aims to mass-produce all-solid-state batteries with an energy density of 400Wh/kg in 2026. GAC Group plans to incorporate solid-state batteries into its Hyper models in 2026. Toyota envisions launching its first model equipped with mass-produced all-solid-state battery technology as early as 2027. Mercedes-Benz has commenced road testing for its test vehicle fitted with new solid-state batteries.

From a timing perspective, the installation plans for solid-state batteries by mainstream automotive companies are predominantly clustered between 2026 and 2030. Various indicators suggest that a new round of competition for solid-state batteries is on the horizon among major automotive companies, which will also spur the application and development of solid-state batteries.

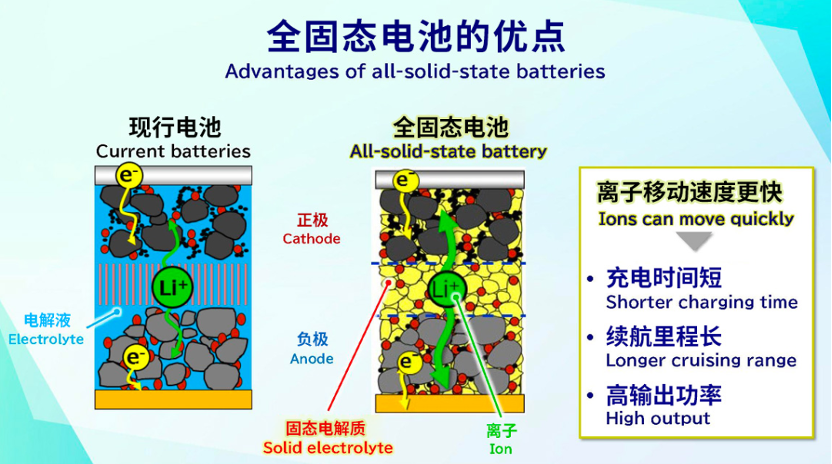

It is widely acknowledged that the core advantage of solid-state batteries lies in their solid-state electrolytes, which directly facilitate multi-dimensional upgrades. Firstly, in terms of safety, solid-state batteries exhibit high stability and are non-flammable, fundamentally addressing the spontaneous combustion issue plaguing traditional batteries. Secondly, in terms of energy density, due to their exceptional stability, they can utilize metallic lithium as the negative electrode, achieving a tenfold increase in energy density compared to current graphite negative electrodes. Meanwhile, their stable characteristics also lead to fewer side effects and a longer service life. Additionally, they demonstrate stronger adaptability to temperature, functioning normally across a wide range from -50°C to 200°C. Furthermore, as there is no need to consider leak prevention, the shape of solid-state batteries can be more flexible, perfectly fitting the structure of electric vehicle platforms, filling previously idle spaces in vehicles, and significantly boosting the volumetric energy density of power batteries.

Overall, transitioning battery electrolytes from liquid to solid represents a fundamental technological transformation in batteries.

Admittedly, solid-state batteries offer numerous performance advantages, but they are not inherently devoid of safety risks.

A review article published by a team from Yonsei University in South Korea in Advanced Energy Materials points out that all-solid-state batteries (especially sulfide-based systems) still present unique and severe thermal runaway risks. Among them, sulfides may release flammable sulfur gas (S) and toxic hydrogen sulfide (H₂S) under high voltage and high temperatures. These gases can further react violently with lithium metal anodes, triggering thermal chain reactions and leading to thermal runaway. Additionally, the thermal reactions in sulfide-based systems are unrelated to lithium dendrites but rather stem from the inherent instability of the materials, which can spontaneously combust under extreme conditions. When the electrolyte itself becomes the active heat source, even all-solid-state batteries can lose control.

High costs and safety uncertainties continue to pose numerous practical obstacles to the implementation of solid-state batteries. Moreover, the exorbitant cost of solid-state batteries also hinders their implementation. Media reports indicate that the cost of liquid lithium batteries is approximately $100-150 per kWh, while the cost of solid-state batteries ranges from $400-800 per kWh, three to four times higher. Furthermore, the construction costs of ultra-clean and dry workshops required for solid-state batteries are also significantly higher than those of traditional production lines.

Nevertheless, automotive companies continue to invest heavily and have even embarked on a 'preliminary battle.'

In market communications, the prefix 'semi-solid' is often deliberately downplayed or obscured, with many automotive companies intentionally or unintentionally confusing it with all-solid-state batteries. Previously, some companies marketed products with approximately 10% liquid electrolyte content as 'solid-state batteries,' engaging in speculative promotion. Against this backdrop, solid-state batteries have not only become a marketing strategy for automotive companies to capture market share but also a breeding ground for 'word games.'

However, this chaos has drawn the attention of regulatory authorities. Recently, media reports revealed that according to informed sources, relevant authorities are considering the introduction of a new document to rename 'semi-solid batteries' as 'solid-liquid batteries' to clearly delineate their technological boundaries with solid-state batteries.

It is worth mentioning that several automotive companies have also announced clear timelines for the technological implementation of solid-state batteries, indicating that the commercialization of next-generation power battery technology is entering the final countdown.

Automotive companies have accelerated their strategic布局 (In Chinese, it means "arrangement" or "planning". Here, using this Chinese term directly translated into English to convey the original flavor. A more natural English expression could be "strategic deployments") to seize the initiative in solid-state battery technology, intensifying industry competition. However, this surge also conceals concerns. Several industry insiders have pointed out that among the current market pursuits of solid-state batteries, there are instances of 'PPT battery production' (referring to overly ambitious or unrealistic battery production plans presented in PowerPoint presentations). Meanwhile, some industry experts claim that there is still a long way to go before solid-state batteries can truly achieve mass production and installation in vehicles. Even if solid-state battery technology matures in the future, it is unlikely to replace current battery technologies.

From the current industry progress, it is uncertain which automotive company can truly mass-produce and install solid-state batteries on schedule. However, it is certain that while market propaganda may attract short-term attention, ultimately, the competitiveness of automotive companies still hinges on their robust technological research and development capabilities and execution in mass production and implementation.

By 2027, whether solid-state batteries are a mere gimmick or genuine technology may start to become clear.

(Image source: Internet. Delete if infringement occurs)