Alibaba Initiates Strategic Campaign for 'Embodied AI'

![]() 11/07 2025

11/07 2025

![]() 639

639

As the dividends from internet traffic reach their peak, tech behemoths are redirecting their next major endeavor towards the physical realm.

By 2025, the AI landscape is transitioning from a focus on algorithmic prowess to real-world deployment competitions. Embodied AI is emerging as the central theme of this technological wave, empowering AI not merely to 'comprehend' but also to 'execute'.

Amidst this global shift towards intelligence, Alibaba is channeling unprecedented investment density into the embodied AI supply chain. After acquiring stakes in companies specializing in humanoid, bionic, quadrupedal, collaborative, and other robotic technologies, Alibaba recently spearheaded another funding round for Skythorch Intelligence. This firm, dedicated to tactile and force learning, is considered crucial for 'imbuing robots with a sense of touch'.

These investments are not isolated incidents but part of Alibaba's strategic maneuvering to gain the upper hand as AI ventures into the physical world.

01

Investment Blueprint: The Emergence of Alibaba's Robotics 'Arsenal'

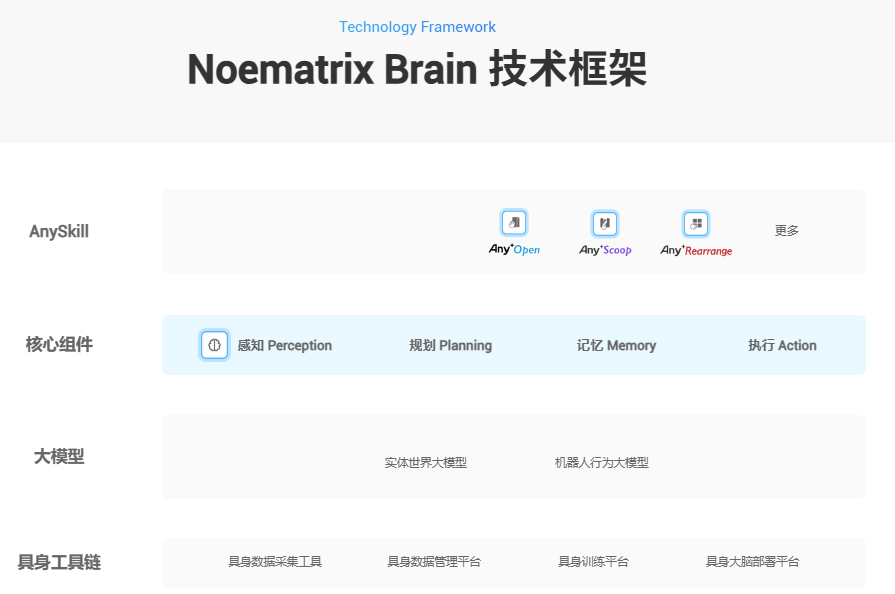

Alibaba's robotics investment strategy is systematically structured, encompassing everything from robotic 'bodies' to 'nervous systems'.

Technologically, Alibaba's investments span a wide array of robot forms and directions.

From 2024 to September 2025, Alibaba Group and its affiliates have invested in key players in embodied AI, including FAORobotics (collaborative robots), StarMotion Era (humanoid robots), LimX Dynamics (bionic direction), Unitree Robotics (quadrupedal robots with international competitiveness), and Autovariable Robotics (general-purpose robots).

The latest lead investment in Skythorch Intelligence fills a crucial void in tactile and force learning, endowing robots with more refined 'perception and control capabilities'.

Source: Skythorch Intelligence Official Website

These companies are not mere suppliers of hardware or components; they are robotics firms with comprehensive product systems and independent R&D roadmaps.

Through this strategic layout, Alibaba's strategy becomes evident.

Firstly, Alibaba adopts an 'all-encompassing, unrestricted' investment approach, refraining from betting on a single technology. Instead, it extensively connects industrial innovation forces through capital, akin to 'Today Capital's' investment strategy during the e-commerce platform boom—investing in all quality targets when the industrial landscape is uncertain. This is not about predicting winners but increasing the likelihood of backing eventual champions to secure advantageous ecosystem positions upon industry maturation.

Simultaneously, Alibaba does not directly intervene in the technological route choices or product definitions of its invested firms. Instead, it leverages its rich e-commerce, logistics, and retail scenarios to construct a platform-based support system. From Cainiao warehouses to Ele.me delivery stations and Hema stores, these real-world commercial scenarios serve as natural testing grounds for invested firms to autonomously validate technological value and scenario adaptability.

Secondly, Alibaba has developed a mature 'internal validation, external diffusion' methodology, successfully verified in its cloud computing and DingTalk businesses.

Alibaba Cloud initially supported Alibaba's e-commerce system, particularly refining its stability and distributed capabilities during 'Double 11' traffic surges. After internal validation, its cloud computing capabilities were globally disseminated through Alibaba Cloud, transitioning from 'solving internal problems' to 'exporting external capabilities'.

DingTalk followed a similar trajectory. Its early features addressed internal and invested firms' collaboration pain points, with modules like approvals, logs, and project management refined through practice. After validation within Alibaba's ecosystem, this collaboration model was integrated into a unified business middleware and launched as DingTalk, achieving a leap from an internal tool to an 'enterprise collaboration platform'.

Today, the same logic applies to robotics. Alibaba does not enforce unified industry standards or interfaces but provides scenario access and data feedback for diverse robotics firms, enabling them to autonomously explore technological fusion and commercialization paths.

Of course, this ecosystem approach faces challenges. As invested firms maintain independent technological standards, communication protocols, and data interfaces, their synergy relies more on market-driven cooperation than Alibaba's top-down integration. While this autonomous ecosystem model offers flexibility, it may lag in system efficiency and synergy depth compared to full-stack self-research paths.

02

Tech Giants' 'Embodied AI' Battle

In the burgeoning embodied AI arena, tech giants have chosen vastly different paths based on their core competencies and resource endowments, engaging in a strategic battle for the future.

Tesla, leveraging its hardware manufacturing and autonomous driving expertise, firmly pursues a 'vertical self-research' path. Musk replicates the electric vehicle industry's success in robotics, aiming to construct a full-stack self-research technology closed loop—from chips and motors to the Optimus robot.

Source: Tesla Official Website

This highly integrated model seeks absolute control over technological linkages, driven by the migration of mature engineering capabilities across domains to erect insurmountable technical barriers. More profoundly, Tesla aims to establish a new manufacturing paradigm—viewing robots as the next mass-producible intelligent hardware product after cars, sharing technological roots with autonomous driving. Although capital-intensive, this path, once broken through, will form a complete moat from core technologies to end products.

On the other hand, Amazon exemplifies an 'application-driven' pragmatic approach. With over a million warehouse robots deployed, Amazon launched the DeepFleet AI model to coordinate robotic cluster operations.

Source: Bilibili

This strategy, rooted in urgent business needs, enables rapid technological iteration and immediate value creation in real scenarios, forming a virtuous cycle of demand-driven technology. Amazon does not pursue perfect robots in labs but lets them 'learn and grow' in actual operations, turning logistics warehouses into valuable training grounds. This path excels in technological implementation capability and clear ROI, with each step directly translating into operational efficiency gains.

Huawei and Tencent, among other tech giants, have chosen a 'smart enablement' third path. Huawei Cloud introduced the R2C protocol and CloudRobo, a one-stop model development platform, aiming to establish unified standards for robot-cloud connectivity. Tencent Robotics X Lab, after seven years of technical accumulation, launched the Tairos embodied AI open platform, providing large models, development tools, and data services modularly to the industry. Both aim to become industrial infrastructure by lowering development barriers and gaining influence through standard-setting.

In contrast, Alibaba, as a platform company, maximizes its ecological DNA with a 'collaborative integration' model. Its core is not manufacturing all components but integrating top-tier robotic 'body' makers with leading 'brain' and 'cerebellum' developers through investment, rapidly building a robotic ecosystem alliance covering diverse technological routes. This model leverages Alibaba's strengths, integrating optimal industry resources lightly for rapid deployment and risk diversification.

Despite divergent paths, all giants agree on one core consensus: embodied AI will become the key interface and core productivity tool for next-gen human-machine interaction. This competition is essentially about dominating the future human-machine symbiosis era.

03

The Tipping Point of Value Realization

From an industrial perspective, the commercialization dawn of embodied AI is emerging.

Since 2025, companies like UBTECH, Zhiyuan Robotics, and Unitree have secured billion-yuan orders, marking the industry's shift from R&D to commercial application. These orders feature distinct vertical scenarioization, e.g., UBTECH's Walker S2 humanoid robot achieving 7×24 autonomous battery swapping in dark factories, reaching 30% of human efficiency; Zhiyuan Robotics' multi-million-yuan collaboration with Fulian Precision, deploying nearly a hundred wheeled robots in automotive parts manufacturing, becoming the first case of industrial embodied robot mass commercialization.

Source: UBTECH Official Website

These cases reveal a trend: in relatively structured industrial scenarios, robotic technology best demonstrates its economic value in replacing labor, precisely Alibaba's main battlefield for rapid entry and advantage-building through ecological integration.

From a market perspective, the imagination boundary of embodied AI is expanding rapidly.

Morgan Stanley predicts the global humanoid robot market will reach $5 trillion by 2050. Mapping this macro blueprint to Alibaba's strategy, its ecosystem-covered logistics, retail, and local life sectors are precisely the most valuable core scenarios in this trillion-dollar ocean.

Alibaba's robotic industry ecosystem business model is essentially an 'ecological value investment' model. It does not rely on direct robot product sales but constructs a commercial closed loop through multi-tiered value realization paths.

At the direct revenue level, Alibaba gains financial returns from invested firms' equity appreciation and service revenue from exporting cloud services, AI large models, and other technical capabilities.

Strategically, the massive data generated by robots operating within Alibaba's ecosystem fuels its training of stronger AI models, while ecosystem expansion grants it the voice to define industry standards.

This model of short-term financial returns and long-term ecological empowerment forms Alibaba's unique value proposition in robotics.

However, to operationalize this model, Alibaba must confront two core challenges.

Firstly, ecological synergy governance. Alibaba's investments essentially build a cooperative network of diverse entities. Establishing effective synergy mechanisms among invested firms and balancing technological routes and commercial interests become key to ecological health. This requires not only unified technical standards but also well-designed value distribution mechanisms to avoid internal resource friction or innovation inertia. Alibaba faces the test of maintaining alliance openness to absorb optimal technologies while ensuring strategic direction concentration.

Secondly, market acceptance value proof. Before technological maturity and cost-benefit balance are achieved, securing market buy-in becomes a practical issue. Especially in industrial sectors, clients prioritize ROI cycles and system stability. Under Alibaba's ecosystem model, while Alibaba provides capital support and scenario resources, the responsibility to prove commercial value rests with invested firms. They must demonstrate quantifiable efficiency gains to transform smart investment from a 'technical option' to a 'commercial necessity'. Only when technological efficiency improvements clearly translate into economic benefits can Alibaba's business model achieve scalable breakthroughs.

04

Conclusion

In the yet-to-be-defined embodied AI race, Alibaba has chosen a unique path of capital-driven, scenario-based industrial ecosystem construction through connection and empowerment. The success of this path not only determines its robotics business prospects but also tests whether platform companies can replicate ecological advantages in hard tech fields. Facing dual tests of ecological governance and value proof, the market awaits Alibaba's more convincing answers.

*Images sourced from the internet. For copyright infringements, please contact for removal.