Leading Game Company Caught in False Disclosure Scandal, Evading Detection for Four Years!

![]() 11/12 2025

11/12 2025

![]() 578

578

Author: Shi Yu Xing Kong

ID: SingingUnderStars

Chengdu has recently become a hub of disappointment for 'League of Legends' fans!

The League of Legends Global Finals, often dubbed a premier event in the esports world, has made its long-awaited return to China, with Chengdu hosting the most anticipated showdown stage!

Simultaneously, the League Carnival, touted as the grandest fan celebration in League of Legends history, has officially descended upon Chengdu. Featuring nine interactive zones, sprawling over 6,500 square meters, and collaborating with five top-tier commercial entities, it offers esports enthusiasts a unique offline gathering infused with local cultural flair.

League of Legends, originally developed by Riot Games in the United States and operated by Tencent Games in mainland China, has seen numerous Chinese game companies, including 37 Interactive Entertainment [002555.SZ], expand their reach overseas.

Founded in 1995, the company ventured into the gaming market in 2009. Its core business spans game development and operation, as well as quality education. Simultaneously, it is branching out into new realms such as productive forces, pan-entertainment, and urban consumption, strategically positioning itself in cutting-edge fields like artificial intelligence, XR, human-computer interaction, and life sciences.

In 2015, 37 Interactive Entertainment went public in its entirety. By 2024, its game 'Call Me Boss' had been selected as a key national cultural export project, and its MSCI ESG rating soared to AA, making it the sole company in China's internet industry to achieve this distinction.

However, the company recently faced administrative penalties for various information disclosure violations. In addition to being ordered to rectify its mistakes and warnings issued to directly responsible individuals, it was slapped with a hefty fine exceeding 30 million yuan.

01

Is There Foul Play in Shareholder Holdings?

Originally known as 'Shunrong Co., Ltd.,' 37 Interactive Entertainment primarily manufactured automotive plastic fuel tanks. In 2014, the company underwent a major asset restructuring, acquiring a 60% stake in 37wan from Li Weiwei and Zeng Kaitian, thus adding online gaming to its business portfolio.

The total transaction consideration amounted to 1.92 billion yuan, with 480 million yuan raised in cash through the issuance of shares to specific objects for the purpose of raising matching funds. The share-based payment consideration was 1.44 billion yuan, with Li Weiwei and Zeng Kaitian receiving 752 million yuan and 688 million yuan, respectively.

Among the 47.71 million shares issued for the asset restructuring's supporting financing, 22.72 million shares subscribed to by Wu Weidong, Wu Weihong, Wu Bin, Ye Zhihua, and others were actually held on behalf of Li Weiwei and Zeng Kaitian.

The shareholding arrangement was orchestrated by Li Weiwei and Zeng Kaitian, with the funds for the shares held on their behalf entirely sourced from the equity acquisition proceeds received by them.

Additionally, the shares held on behalf of Wu Weidong and others began to be reduced starting in 2018 and were fully divested by September 2021. The reduction instructions were also arranged by Li Weiwei and Zeng Kaitian through Yang Jun, while the distribution of dividends and reduction proceeds from the shares held on their behalf was controlled by them.

Li Weiwei became the actual controller of 37 Interactive Entertainment on April 8, 2019, but he concealed the shares jointly held by him and Zeng Kaitian in the annual reports for 2018, 2019, and 2020.

When Li Weiwei signed the annual reports from 2014 to 2020 and Zeng Kaitian signed the annual reports for 2019 and 2020, both guaranteed that the disclosed information was true, accurate, and complete. However, the shareholder holdings disclosed in 37 Interactive Entertainment's annual reports from 2014 to 2020 all contained false records.

Besides the current actual controller concealing the shares held on behalf of the former actual controller, there were also numerous significant omissions in 37 Interactive Entertainment's annual reports.

02

Significant Omissions in Annual Reports

In 2011, Li Weiwei and Zeng Kaitian established Shanghai 37, while Hu Yuhang operated a company in Chengdu for game development on behalf of Shanghai 37.

In October 2013, Shanghai 37 established Jiangsu Aurora to handle its game development business, with Hu Yuhang becoming the head of Jiangsu Aurora. Subsequently, Li Weiwei and Zeng Kaitian continued to include Hu Yuhang in 37 Interactive Entertainment's core management team and provided him with incentive benefits.

In February 2018, 37 Interactive Entertainment announced the acquisition of a 20% stake in Jiangsu Aurora held by Hu Yuhang. In reality, Hu Yuhang was a connected natural person of the listed company, making this acquisition a related-party transaction between 37 Interactive Entertainment and Hu Yuhang. However, 37 Interactive Entertainment's 2018 annual report failed to disclose this related-party transaction, resulting in a significant omission.

Yet, the same 'mistake' was repeated multiple times: In December 2020, 37 Interactive Entertainment announced its intention to acquire a 100% stake in Huai'an Shunqin Partnership Enterprise held by Xu Zhigao and Xue Min, as well as a 100% stake in Huai'an Shunjing Partnership Enterprise held by four individuals, including He Hong, to indirectly acquire a 20% stake in Guangzhou 37. The transaction was not considered a related-party transaction.

Upon verification, Xu Zhigao was a connected natural person of the listed company, making the aforementioned transactions related-party transactions. The interim announcements disclosed by 37 Interactive Entertainment contained false records, and the 2020 annual report failed to disclose the aforementioned transactions, resulting in significant omissions.

Additionally, companies established and controlled by Li Weiwei, Zeng Kaitian, and others, such as Hainan Liyuan, were actually related parties of 37 Interactive Entertainment. However, 37 Interactive Entertainment's annual reports from 2018 to 2021 failed to disclose related-party transactions worth 1.176 billion yuan with companies like Hainan Liyuan, resulting in significant omissions.

Surprisingly, both Guangdong Zhengzhongzhujiang Certified Public Accountants and Huaxing Certified Public Accountants, which audited the annual reports from 2018 to 2021, issued standard unqualified audit reports.

Due to its involvement in the Kangmei Pharmaceutical financial fraud case, Zhengzhongzhujiang had its practicing certificate revoked in July 2022. Starting from 2023, Huaxing began issuing unqualified audit reports with emphasis-of-matter paragraphs, highlighting that the actual controller and chairman, Li Weiwei, and the vice chairman, Zeng Kaitian, were under investigation by the China Securities Regulatory Commission.

The penalties imposed on 37 Interactive Entertainment this time indicate that the unqualified opinions received in the past were not highly credible. On the other hand, the company is facing a slowdown in revenue growth and a decline in gross profit margins, making it a case of 'when it rains, it pours.'

03

Q3 2025 Performance

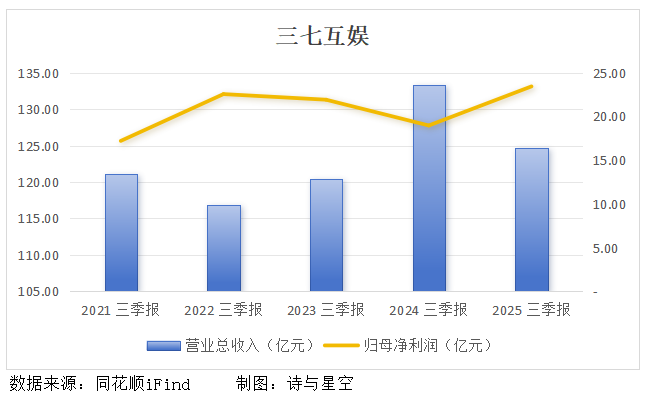

In the first three quarters of this year, 37 Interactive Entertainment achieved revenue of 12.461 billion yuan, a year-on-year decrease of 7%. Its net profit attributable to shareholders was 2.345 billion yuan, a year-on-year increase of 24%. This was not due to significant growth in performance this year but rather because the net profit attributable to shareholders in the same period of 2024 had hit rock bottom.

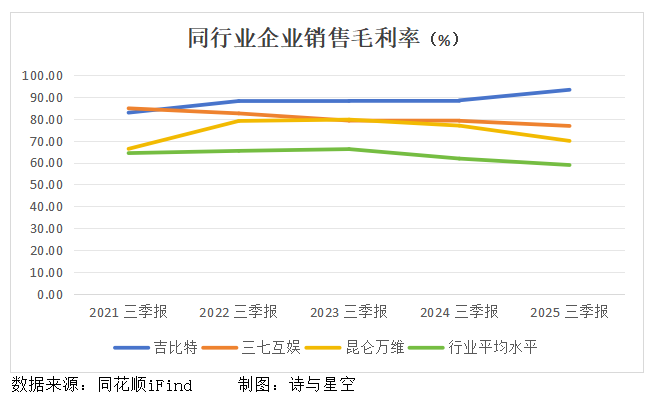

In comparison with the industry, 37 Interactive Entertainment's gross profit margin is at the upper level, earning it the nickname 'the Maotai of games.' However, in recent years, due to a slowdown in revenue growth and the growth rate of operating costs and period expenses exceeding revenue, its net profit margin has hovered around 15%, with very limited profitability.

Furthermore, asset impairment losses have also, to a certain extent, dragged down net profit, primarily due to the impact of long-term equity investment impairments.

Notably, as of the end of the third quarter this year, the net value of goodwill was close to 1.6 billion yuan. Goodwill is a major issue for game companies, and caution should be exercised regarding the potential impact of goodwill impairments on performance.

04

Restricted Assets, Borrowing to Pay Dividends?

Currently, 37 Interactive Entertainment has approximately 4.7 billion yuan in cash on hand. However, according to the 2024 annual report, approximately 60% of these funds are restricted, primarily consisting of pledged time deposit principal and interest within one year.

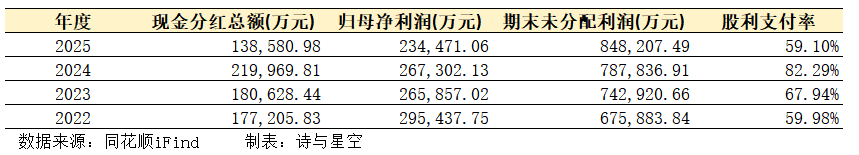

On one hand, the company has a high balance of long-term and short-term loans amounting to 2.9 billion yuan. On the other hand, the company paid dividends of approximately 462 million yuan each quarter this year, totaling 1.386 billion yuan in cumulative dividends, with a dividend payout ratio of 59.10%.

The company's actual controllers and senior executives, Li Weiwei, Zeng Kaitian, and Hu Yuhang, who are also the top three shareholders, collectively hold approximately 35% of the shares. It can be said that a significant portion of the dividends went into the pockets of the major shareholders.

However, it should not be forgotten that 37 Interactive Entertainment was fined for concealing shareholder holdings and related-party transactions. The actual benefits received by the major shareholders from their true shareholdings and the proceeds from the reduction of their shares may be difficult to estimate.

-END

-Disclaimer: This article is based on the public company attributes of listed companies and relies primarily on information disclosed by listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms) as the core basis for analysis and research. Shi Yu Xing Kong strives for fairness in the content and viewpoints presented in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Shi Yu Xing Kong does not assume any responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is original to Shi Yu Xing Kong and may not be reproduced without authorization.