Exclusive: Amid Shareholder Discontent Over Low Stock Prices, Meituan Seeks to Underplay Profitability

![]() 06/17 2025

06/17 2025

![]() 691

691

By Leon

Edited by cc Sun Congying

On June 9, Meituan convened its Annual General Meeting of Shareholders at its Beijing headquarters, with Founder and CEO Wang Xing in attendance alongside other senior executives.

Responding to shareholders' queries about competition with JD.com and Taobao Flash Sale, Wang Xing stated, "Firstly, we welcome more participants. Secondly, we reiterate that Meituan is firmly opposed to intense internal competition. Lastly, we are very confident in the long term."

However, self-media outlet "Key Points" reported that some shareholders felt dissatisfied with pre-arranged questions and scripted management responses. Post-meeting, shareholders surrounded Xu Sijia, Vice President of Marketing and Investment, continuing discussions in a small meeting room for half an hour. Nonetheless, Beijing Sankuai Technology Co., Ltd., representing Meituan, issued a retraction letter to "Wall Street Technology Eye," stating that the content was untrue and that the article had been deleted from "Key Points" via regulatory channels.

Meituan has maintained a low profile, with its public opinion management department only intervening in media interpretations of financial reports through platform complaint mechanisms. As of the article's second publication, "Wall Street Technology Eye" still hadn't managed to contact Meituan's public relations department, and an official response regarding the true situation on-site remained elusive.

"Without dividends from Meituan, we can only obtain returns by selling shares. If the company lacks shareholder awareness and only talks about long-termism, it's hard to build trust. How can I hold shares long-term?" Shareholders expressed dissatisfaction with the persistently low stock prices.

As of June 11, Meituan's Hong Kong stock closed at HK$143.8 per share, marking a slight decline of 0.42% from the previous day. Compared to its peak of HK$217 in October 2024, it has fallen by approximately 34%.

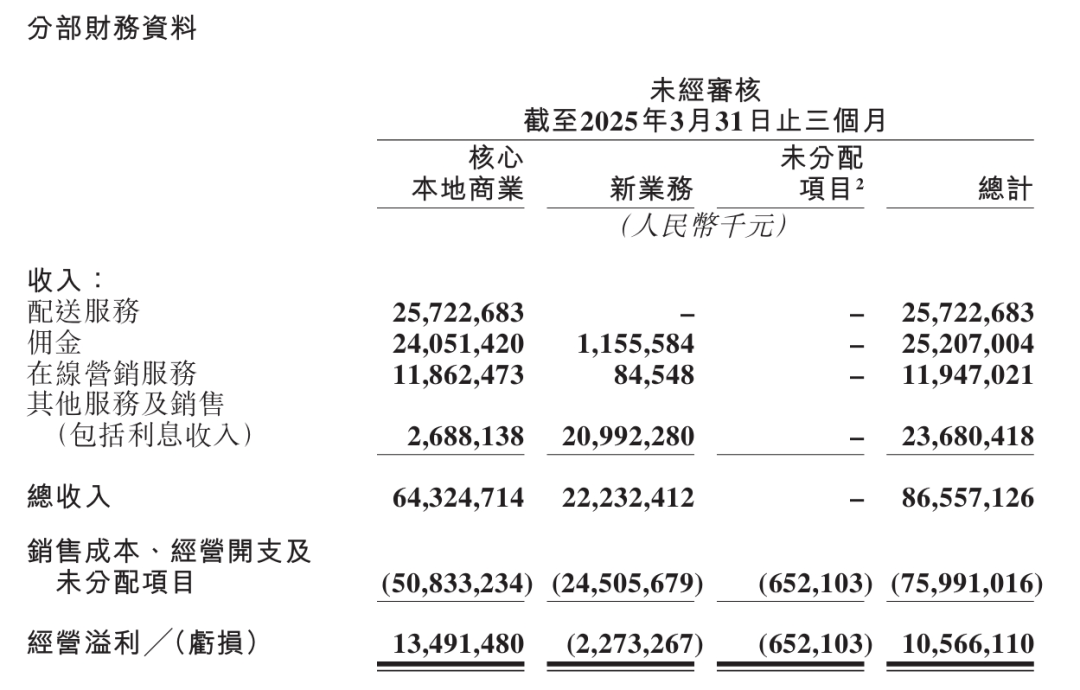

In contrast to its stock price, Meituan's performance has been impressive. In the first quarter of 2025, Meituan achieved revenue of RMB 86.55 billion, a year-on-year increase of 18.1%; adjusted net profit was RMB 10.95 billion, a year-on-year increase of 46.2%, equating to daily earnings of RMB 120 million. Interestingly, Meituan is reluctant to highlight the company's profitability. In the retraction letter issued to "Wall Street Technology Eye" post-publication, Meituan argued that "simplifying profitability to daily earnings calculations is an intentional exaggeration by 'Wall Street Technology Eye' (the author)" while simultaneously using the same calculation method to directly provide the daily profitability of large internet companies like JD.com, Alibaba, and Tencent. According to data directly provided by Meituan to the "Wall Street Technology Eye" publishing platform, Alibaba earns RMB 330 million daily, Tencent earns RMB 530 million daily, and JD.com earns RMB 120 million daily. This data suggests that Meituan's move is intended to downplay its profit performance by comparing its results with leading companies, yet the data itself implies its considerable profitability.

What's intriguing is that while shareholders hope to boost stock prices with core data such as corporate profitability, Meituan chooses to intervene in media publication guidelines through official email complaints. The underlying motivation behind this move undoubtedly leaves room for market speculation.

Image: Screenshot of the complaint letter sent by Meituan

Rising from the "Thousand Group Wars" and growing through its takeout business, Meituan is a company that has thrived in fierce competition. Coinciding with Meituan's 15th anniversary, this technology retail giant faces more complex and multidimensional challenges.

The Scramble for Instant Retail

Since achieving its first annual profit in 2019, Meituan has firmly established itself as the leading takeout platform, maintaining a stable market share of around 65%. However, beneath the surface of this seemingly settled market lies undercurrents.

On one hand, short video platforms like Douyin and Kuaishou have entered the group-buying market through location-based and interest-driven recommendation mechanisms, eroding a portion of Meituan's market share. Simultaneously, JD.com has entered the takeout market with high profile, and Alibaba has integrated Taobao and Ele.me resources to intensify competition, all penetrating deep into Meituan's core areas.

According to data from iResearch Consulting, JD.com's daily takeout order volume has exceeded 25 million, and on May 26, Taobao Flash Sale and Ele.me jointly announced that their daily order volume had surpassed 40 million. Although the scale of these two competitors still cannot match Meituan's peak daily order volume of 78 million, the competitive landscape has formed. Instant retail has become a new battleground for internet giants.

Under these circumstances, Wang Xing responded forcefully during the first-quarter earnings call: "Meituan will spare no expense to win this competition." A significant adjustment was the independence and upgrade of the "Meituan Flash Sale" section launched in 2018, with an entry on the homepage of the Meituan App, alongside "Takeout" and "Group Buying" as the company's first-tier business lines.

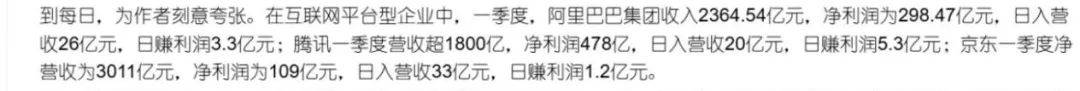

Unlike before, the flash sale business has expanded to include categories such as mobile phones and home appliances, quality department stores, beauty and personal care products, etc., and has also participated prominently in this year's 6.18 promotion, counterattacking the retail industry from the takeout market. According to Meituan's official battle report, from 0:00 to 24:00 on May 28, Meituan Flash Sale's transaction volume increased by 2 times year-on-year, the transaction volume of nearly 800 retail brands increased by 1 time year-on-year, and Meituan Lightning Warehouse's transaction volume increased by nearly 3 times year-on-year.

Meituan Flash Sale's merchant base is primarily concentrated in offline brand direct stores or authorized stores, such as Apple dealers, Xiaomi Stores, Decathlon specialty stores, etc., in addition to large supermarkets, convenience stores, and small supermarkets that previously entered the flash sale section. From a practical experience perspective, products like the iPhone 16 that participate in government subsidies start at a price of RMB 4,299, which is comparable to prices on JD.com and Taobao, with the former's advantage being 30-minute delivery to the home.

However, Meituan Flash Sale's current disadvantages are also evident, namely incomplete coverage of product models and brands, especially in categories such as major home appliances, computers, clothing, and beauty products. This means that Meituan Flash Sale's current positioning is mainly suitable for "urgent use" scenarios, and consumers will still turn to JD.com's self-operated stores for major appliances and Tmall flagship stores for branded clothing.

If Meituan aims to further penetrate its competitors' core areas, it will require additional investment in sales and marketing. This investment is already reflected in Meituan's first-quarter financial report, with sales costs and sales and marketing expenses increasing to varying degrees compared to the previous year.

Traditional businesses are being squeezed, emerging businesses are not yet mature, and various issues accumulated during the development period may lead investors to question Meituan's management's future plans for the company.

Investors' Anxiety and Wang Xing's Confidence

"80% of online reviews of Meituan are negative. What is the management's strategy to turn around public opinion?" This may have been the only "sharp" question posed by an actual shareholder at this year's Meituan conference.

Mu Rongjun, co-founder and vice president of Meituan, took the microphone from Wang Xing and responded, "Firstly, the cause of this matter is complex, involving aspects where we have performed poorly and where society as a whole is divided, but more importantly, how we should address this situation. Secondly, in the past, the company's style was more pragmatic, doing more than talking or doing more with less talking. In the future, we need to tell our story well while doing, which is our focus going forward."

Leading the opposition to intense internal competition is the narrative Meituan wishes to convey at this stage. In February this year, Meituan announced the cancellation of overtime fines for riders, as the first implementation point of opposing intense internal competition. Simultaneously, Meituan has formulated a clearer and relatively lenient social security payment plan for riders: as long as their monthly income reaches the lower limit of the payment base in the employment location and meets this standard for three months within the past six months, and if the riders are willing to pay, Meituan provides a 50% subsidy. It also supports four unlimited conditions, namely no pre-qualification, no restriction on the place of insurance, no restriction on the duration or volume of orders, and no restriction on the type of order (full-time, part-time, or crowd-sourcing are all acceptable). (For details, see: Ordering on Douyin, Delivery by Meituan)

Interestingly, throughout Meituan's development, Wang Xing has repeatedly demonstrated extreme competitive thinking, such as huge takeout subsidies, reducing merchant commissions, and using extreme algorithms to improve delivery efficiency. Now, by leading the opposition to intense internal competition, the transformation is significant. Meituan's opposition to intense internal competition, like the recent collective shortening of supplier payment terms to 60 days by automakers, is a result driven by the overall environment.

So, where does Wang Xing's confidence stem from in "sparing no expense to win the competition" on the basis of opposing intense internal competition? Essentially, Meituan's overall strategy is retail + technology, with technology playing a crucial role. The O2O (Online to Offline) "Super Brain" delivery algorithm is the key to Meituan's ability to win the first takeout competition. After several years of iteration, it can quickly analyze the starting point and destination of each order, allocate the most suitable rider based on real-time traffic conditions, and plan the most time-saving route for them. Based on this, combined with Meituan's strong ground promotion capabilities, it has built its unique infrastructure.

The practical effects of this infrastructure are also very obvious: merchants can receive the most orders, takeout riders have a stable volume of orders, and consumers can receive their takeouts as quickly as possible. This is why, despite "the world suffering from Meituan for a long time," it cannot be completely abandoned.

In summary, Meituan still boasts the largest takeout market share, the highest commission rate, and a high net profit margin on sales (11.62% in the first quarter). Based on past practical experience, Meituan is also expanding into overseas markets, aiming to recreate another Meituan.

Recreating Another Meituan Overseas

Another focus of Meituan's long-term development is its overseas expansion. In 2023, Meituan launched its Keeta takeout business in the Hong Kong market. According to market data, Keeta's market share reached 44% in the first quarter of 2024, making it the largest takeout platform in Hong Kong. This remarkable achievement in just one year has significantly boosted Meituan's confidence in advancing its globalization strategy.

In May this year, Wang Xing met with Brazilian President Lula at the "China-Brazil Business Seminar" and witnessed the signing of an investment agreement between ApexBrasil, the Brazilian Export and Investment Promotion Agency, and Keeta. It is reported that Keeta will officially enter the Brazilian market in the coming months, with plans to invest USD 1 billion in business development over five years.

Image: Brazilian President Lula (right) and Meituan Founder and CEO Wang Xing (left)

At the shareholders' meeting, Wang Xing stated that the investment in the Brazilian market was well-considered. Firstly, the Brazilian market is a huge economy with the fifth-largest takeout scale globally, offering vast development potential. He also revealed that Keeta is making good progress in the Saudi market, with its market share entering the top three in the local takeout market.

However, the Brazilian market is not entirely a blue ocean. In addition to local giant iFood, which occupies a significant portion of the market share, there is also Uber Eats, which has a strategic partnership with iFood, and 99Food, under Didi, which briefly exited the market but restarted this year. While Meituan can replicate its algorithm + localized ground promotion strategy, it will take time to achieve economies of scale.

Currently, Meituan faces a more complex market environment. The domestic market is in a state of defense (takeout) and new business expansion (flash sale) overlap, while also advancing into overseas markets, creating a long front. Multiple institutions such as UBS, Huatai Securities, and CCB International have downgraded their target prices for Meituan, citing almost the same reasons: short-term pressure on the takeout business and uncertainty in new businesses.