Multi-Point Makes Fourth Attempt at Hong Kong Stock Exchange IPO: IPO as a "Lifeline"

![]() 11/08 2024

11/08 2024

![]() 455

455

On October 31, Zhang Wenzhong's Multi-Point Intelligence, known as the "godfather of Chinese supermarkets," submitted another prospectus to the Hong Kong Stock Exchange. This is Multi-Point's fourth attempt at an IPO in Hong Kong, with the previous three failing due to the inability to complete hearings within six months.

Amidst a high reliance on related-party transactions, high debt ratios, and a cash flow crisis, Multi-Point Intelligence is once again attempting to pass the listing process despite its issues.

[IPO as a "Lifeline"]

Multi-Point Intelligence boasts itself as China's largest retail digitalization solution provider, with its main business encompassing retail core service clouds and e-commerce service clouds.

In terms of e-commerce service clouds, the company's revenue was still 300 million yuan in 2023 but dropped to almost zero in the first half of 2024. This is mainly due to customers transitioning their O2O operations to internal operations, managing their online stores independently, leading to the near-elimination of this business from the market.

So, what is a retail core service cloud?

Multi-Point has developed the Dmall OS system, which comprises multiple service modules aimed at aiding retailers in digital transformation, covering procurement, supply chain, operations management, in-store displays, store operations, and more.

In layman's terms, Multi-Point aims to analyze consumer preferences through vast amounts of data to guide merchants in procurement and merchandising, reducing out-of-stock losses, avoiding inventory backlogs, and enhancing overall operational efficiency.

From 2019 to 2023 and the first half of 2024, Multi-Point's revenue maintained double-digit growth. However, despite the continuous expansion of its business scale, it has yet to achieve profitability, with cumulative losses exceeding 5.2 billion yuan during this period.

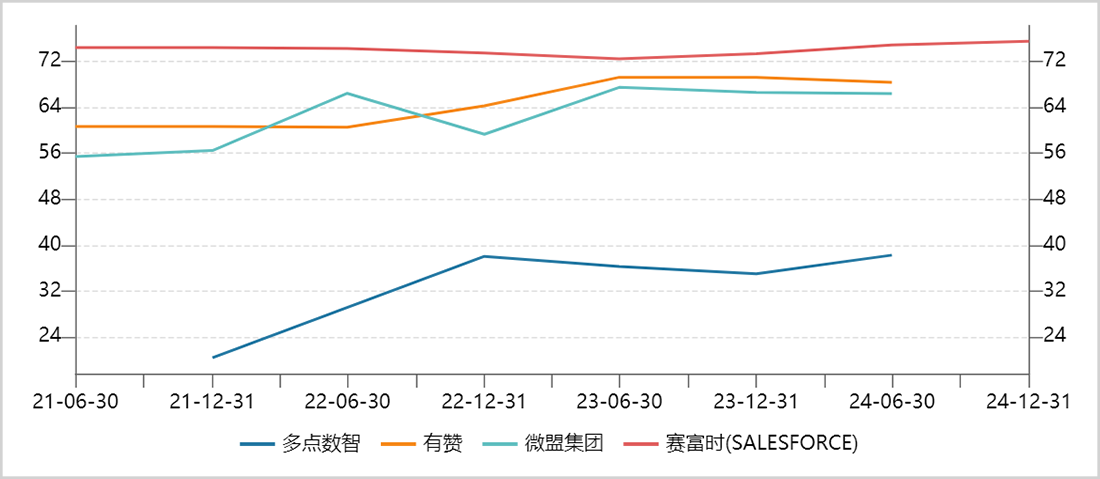

Furthermore, Multi-Point's profitability outlook is not promising. As of the end of the second quarter of 2024, the company's gross profit margin was only 38.25%, significantly lower than that of domestic and international SaaS leaders. For instance, Youzan and Weimob Group had gross profit margins of over 65% during the same period, while international SaaS leaders like Salesforce typically have margins above 70%.

▲Comparison of Gross Profit Margins of Domestic and International SaaS Leaders, Source: Wind

Additionally, despite significantly reducing sales and marketing expenses, R&D expenses, and optimizing staff numbers to lower operating costs, Multi-Point's latest net profit margin still stands at -26.5%. Clearly, this is detrimental to product competitiveness and end-sales.

More pressingly, Multi-Point faces mounting debt pressure. As of the end of the second quarter, the company had only 470 million yuan in cash on hand, while short-term liquidity liabilities, mainly short-term loans, amounted to 8.27 billion yuan, indicating high short-term debt repayment pressure. Meanwhile, the company's asset-liability ratio has continued to rise from 316% in 2019 to 620% in Q2 2024, consistently operating in an insolvent state.

Faced with high debt and continuous negative operating cash flows, the company's capital chain is at risk of rupture. This could be the core reason why Multi-Point persists in submitting listing applications despite three failed IPO attempts.

[Related-Party Transactions as an Obstacle]

Apart from underperforming overall business and strained debt repayment ability, Multi-Point faces another significant market concern—severe related-party transactions and a high dependence on Wumart's supermarkets and department stores.

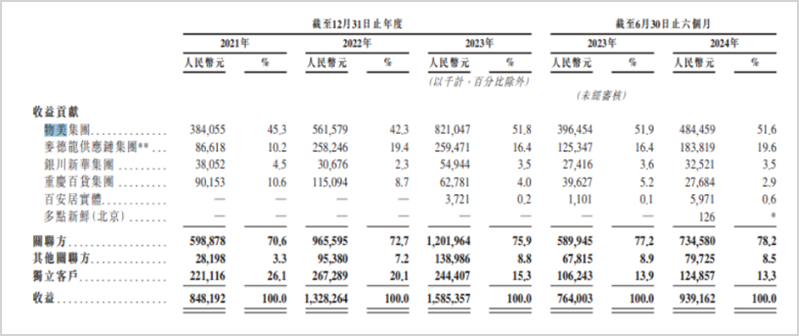

The company's top five customers are Wumart Group, Metro Supply Chain Group, Yinchuan Xinhua Group, Chongqing Department Store Group, and B&Q Entities, accounting for 51.6%, 19.6%, 3.5%, 2.9%, and 0.6% of revenue, respectively.

▲Multi-Point's revenue mainly comes from related parties, Source: Prospectus

All these major customers are related parties. Both Multi-Point and Wumart Group are controlled by Zhang Wenzhong. Additionally, Wumart Group holds 80%, 20.3%, 27.7%, and 70% stakes in Metro China, Chongqing Department Store, Xinhua Department Store, and B&Q China, respectively.

In recent years, the proportion of Multi-Point's related-party transaction revenue has been rising, exceeding 80% as of the end of the second quarter of 2024, while the proportion of independent customers has decreased to 13.3%. In contrast, the proportion of independent customers was still 26.1% at the end of 2021.

Some industry professionals believe that excessive related-party transactions were one of the key reasons Multi-Point failed previous listing hearings because the large scale of related-party transactions made it difficult to assess the authenticity and fairness of transaction prices.

In fact, as early as May 2023, the China Securities Regulatory Commission (CSRC) mainly mentioned issues related to the independence of related entities in business, assets, personnel, institutions, and finances, as well as the authenticity, fairness, and substitutability of related-party transactions, in its feedback on Multi-Point's listing.

Instead of decreasing, the proportion of Multi-Point's related-party transactions has continued to increase after the regulatory feedback. This could be another obstacle to the success of this IPO.

Worse still, the performance of companies related to Multi-Point has generally been poor, putting significant downward pressure on Multi-Point's future performance fundamentals.

From 2020 to 2022, Wumart Group's retail entity Wumart Stores' revenue declined from 3 billion yuan to 2.4 billion yuan, with losses in all three years totaling 340 million yuan.

From 2021 to 2023, Metro Supply Chain's revenue dropped from 27.82 billion yuan to 24.86 billion yuan, with profit performance fluctuating and a loss of 470 million yuan in 2022. The net profit margin for these three years was below 1.2%. Simultaneously, the asset-liability ratio exceeded 100%, cash on hand continued to decline, liquidity liabilities continued to rise, and cash flow and debt issues were also prominent.

Furthermore, Chongqing Department Store's revenue plummeted from 34.5 billion yuan in 2019 to 18.99 billion yuan in 2023, a cumulative decline of 45%. The operating conditions of Xinhua Department Store and B&Q were also unpromising.

Overall, even if Multi-Point is fortunate enough to obtain a listing hearing in the future, its fundamentals will be difficult to support a high valuation, and there is also a risk of insufficient fundraising.

[Drawbacks of the Business Model Are Apparent]

In fact, the decreasing proportion of Multi-Point's revenue from non-related customers is directly related to drawbacks in its business model.

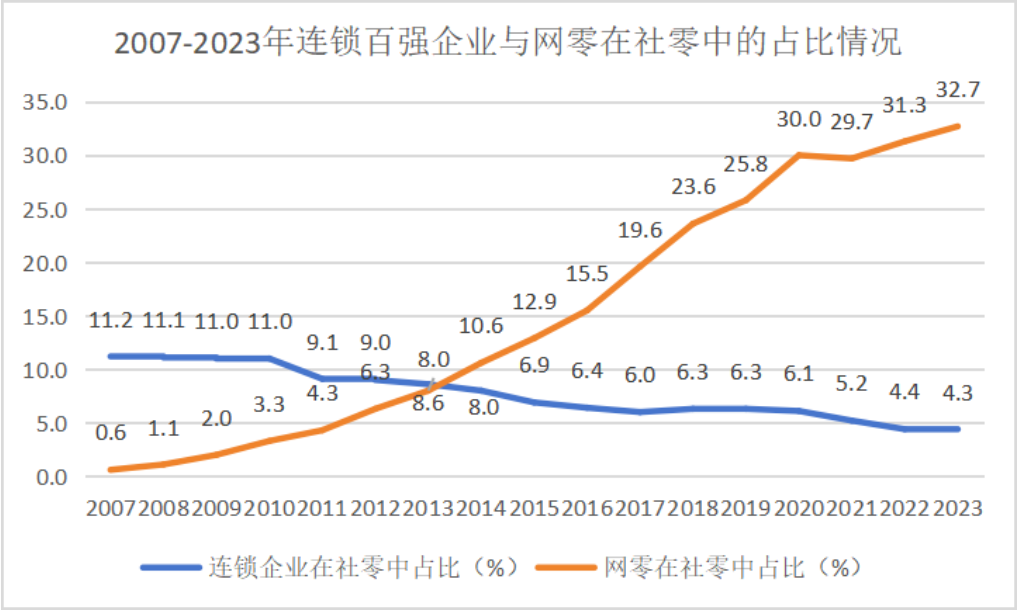

Multi-Point primarily serves downstream retail customers who are facing continuous operational pressure and even existential threats, mainly due to the increasing competition from emerging online channels such as traditional e-commerce platforms, live streaming e-commerce, and community group buying, which are continuously capturing offline retail traffic and market share.

▲Source: Institution

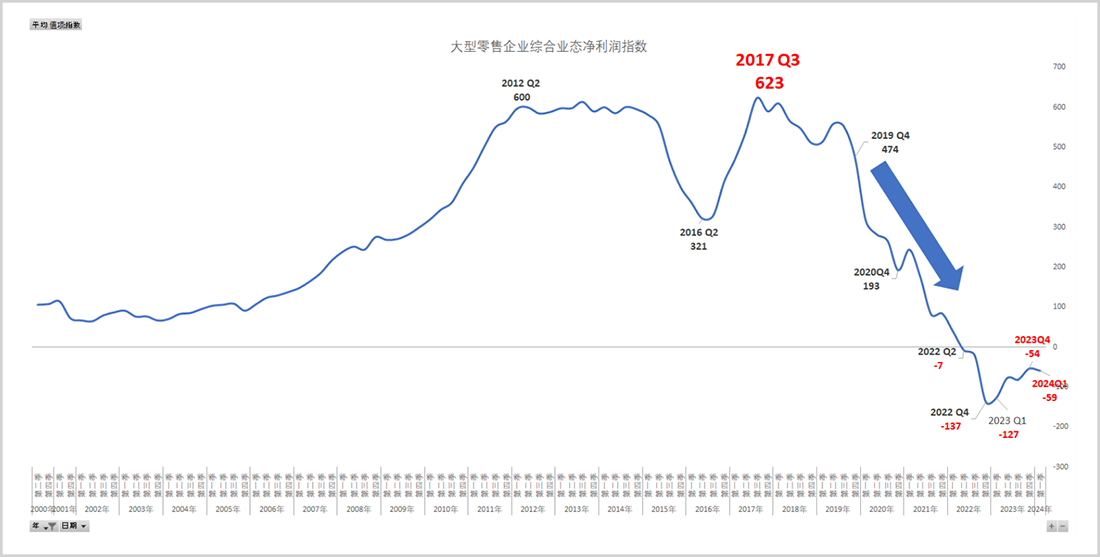

In 2023, online retail accounted for 32.7% of total social retail sales, a significant increase of 9.1 percentage points from 2018. The inflection point for sales of large offline-focused retail enterprises occurred in 2018, with a sustained downtrend since then. Profit performance faces even greater challenges, and these enterprises have been unable to return to profitability since incurring overall losses in the second quarter of 2022.

▲Net Profit Index of Comprehensive Formats of Large Retail Enterprises, Source: China General Chamber of Commerce

From a trend perspective, offline retail has declined from its peak and is rapidly on the decline. As Multi-Point's business serves traditional retail, which is part of the same industrial chain, its demand will undoubtedly face increasing pressure and challenges.

The essence of Multi-Point's business model is selling service solutions, which rarely directly bring offline traffic and business to clients. It is difficult to prove that clients can earn more money while spending before cooperation, even for existing major clients who do not perform well.

In fact, domestic SaaS vendors, including Multi-Point, face difficulties in commercial monetization.

In China, relevant traditional software vendors have not effectively educated the market, and the vast majority of enterprises are not aware of the importance of SaaS tools for business operations, leading to generally low willingness to pay.

Compared to the United States, where Salesforce was preceded by Siebel (Customer Relationship Management software) in educating the market about basic sales management processes, Workday gradually grew after PeopleSoft popularized human resource management systems.

Furthermore, unlike overseas SaaS leaders that primarily serve small and medium-sized clients with highly standardized products, domestic SaaS enterprises rely heavily on major clients for revenue. These latter clients have significant customization needs, requiring substantial human and material resources for development, testing, and post-deployment operations and maintenance, which significantly increases costs and lowers gross profit margins. Coupled with other operating costs, it is often difficult to achieve profitability.

Apart from insufficient market education and client demand, domestic SaaS products are relatively homogeneous with low technical barriers, making it difficult to effectively solve the problem of improving client operational efficiency.

Therefore, even SaaS leaders like Weimob Group, once highly anticipated by the capital market, have suffered from perennial operating losses, indicating that their business models have yet to be successful.

For Multi-Point, there is an additional constraint. Its target major clients are large retailers in the retail industry, but as part of the "Wumart system," it faces issues of horizontal competition. Because Multi-Point's retail cloud services involve extensive data collation and analysis of numerous retailers, sharing these core data would mean disclosing business secrets to competitors. It's crucial to note that supply chain management is one of the core competitiveness of retail enterprises, and these key operational data are essential.

Consequently, independent major retail clients are more conservative and cautious about Multi-Point's services. This also means that Multi-Point faces more difficulties in marketing and promoting its services and closing client deals.

In fact, almost a decade after its establishment, apart from a few related major clients, Multi-Point has relied on mergers and acquisitions as a means of acquiring new clients. However, it has not successfully unearthed independent retail leaders with significant market influence and revenue contributions solely through product competitiveness.

Overall, given its less-than-stellar business model, Multi-Point faces numerous challenges in future revenue growth and struggles to overcome its current reality of continuous negative cash flows and high debt. For Multi-Point, completing an IPO and securing funding as soon as possible may be the company's primary and urgent task.

Disclaimer

This article involves content related to listed companies and is based on the author's personal analysis and judgment based on information publicly disclosed by the listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Observation assumes no responsibility for any actions taken based on this article.

——END——