European Auto Market | Spain April 2025: MG, BYD, and Chery Forge a Tripartite Battleground

![]() 05/09 2025

05/09 2025

![]() 955

955

In April 2025, Spain's new car market sustained robust growth, recording a year-on-year increase of 7.1%. Notably, the share of new energy vehicles surged significantly to 16.2%.

Amidst a mixed performance among traditional European brands, Korean automakers like Hyundai and Kia emerged as formidable new players, while Chinese brands MG and BYD maintained their upward trajectory, substantially expanding their market presence.

This article delves into the competitive dynamics of the Spanish market, analyzing overall sales trends, powertrain distribution, and brand and model performance. It also highlights the sales achievements and growth potential of Chinese brands, offering crucial insights for Chinese automakers' "Westward Expansion" into Europe.

01

Overall Market Performance:

New energy vehicles shine, Korean brands defy the odds

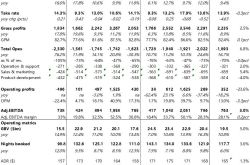

In April 2025, Spain's new car market continued its robust recovery, posting a year-on-year increase of 7.1% to 98,522 units. Remarkably, this growth was achieved on the back of an already high base in April 2024 (+23.1%).

From the start of the year to April, cumulative sales reached 377,889 units, up 12.2% year-on-year but still 13% below pre-pandemic levels in 2019.

New energy vehicles, particularly plug-in hybrids and pure electric vehicles, witnessed explosive growth. Sales soared to 15,957 units this month, a year-on-year increase of 79%, with market share jumping to 16.2%, a substantial rise from 9.7% in the same period last year. Cumulatively, their market share also reached 14.7%.

Private car purchases, corporate car acquisitions, and leasing sales all increased, with leasing sales growing the fastest (+11.5%), indicating a more vibrant auto financing and leasing market in Spain.

All regions performed well, with Valencia (+66.8%) witnessing a booming used car market, signaling a significant acceleration in vehicle demand and replacement rates in the area.

Brand Performance:

◎ Toyota experienced a month-on-month decline but retained its year-to-date lead;

◎ Hyundai and Kia surged ahead with high growth rates (+35.2% and +31.1% respectively), with Hyundai leaping to second place in monthly brand sales with a share of 8.0%.

◎ Renault also fared well, reporting a year-on-year increase of 19.9%.

◎ In contrast, traditional European brands such as Volkswagen (-8.8%) and SEAT (-18.3%) showed signs of fatigue, with Citroen plunging 24.7% year-on-year.

Top-selling Models: Korean compact cars rise, Chinese SUVs steady with upward trajectory

◎ Champion: Dacia Sandero (-15.3%, but maintaining the cumulative lead);

◎ Dark horse: Hyundai i20 (+105.4%, surging to second place);

◎ Third place: MG ZS (+41.1%, also second in cumulative sales);

◎ Other notable mentions: SEAT Ibiza, Toyota Yaris Cross, Peugeot 2008, and 208 all made it into the top ten, showcasing a diverse range of consumer preferences.

Among the top ten models, two are either from Chinese brands (MG ZS) or have Chinese investment backgrounds (such as the i20 and Kia Stonic, which leverage platforms and systems with extensive Asian technological integration). This underscores that Chinese automakers' product strategies are increasingly aligned with Spanish consumers' preferences, particularly for compact SUVs, crossover styles, and high cost-effectiveness.

02

Chinese Brands Continue Their Momentum:

MG and BYD Lead the Charge, Deepening Chinese Investment Footprint

In the Spanish market in April 2025, Chinese brands continued their strong growth trajectory, emerging as the most noteworthy "new force." Not only did sales surge, but they also steadily gained a solid footing in the brand rankings.

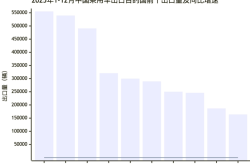

MG Holds Steady: MG ranked 12th among brands with sales of 3,629 units, a year-on-year increase of 48.8%. Year-to-date sales reached 16,555 units, marking an astonishing growth of 79.8%.

Its flagship model, the MG ZS, has consistently ranked among the top three in sales, becoming one of the most popular electric or hybrid SUVs in the Spanish market. MG has achieved a high degree of alignment with the Spanish market in terms of product definition and pricing, especially among leasing companies and younger consumer groups.

BYD Rises Rapidly: BYD soared to 20th place with monthly sales of 1,545 units, a remarkable year-on-year increase of +444.0%. Year-to-date sales reached 5,354 units, surging 645.7% year-on-year. This growth rate not only outpaces other Chinese brands but is also exceptionally rare in the overall market.

BYD's model lineup (such as the Yuan PLUS/Atto 3, Dolphin, and Song PLUS) effectively capitalizes on Spain's electric vehicle policy incentives, combined with high safety standards and impressive range performance, enabling it to swiftly gain a foothold in the market.

The common thread between MG and BYD in the Spanish market is their focus on "new energy + high cost-effectiveness." MG leverages its traditional joint venture experience, while BYD relies on vertical integration of batteries and vehicles to reduce costs.

As Spain accelerates its transition to electrification, Chinese brands naturally enjoy a competitive edge. In addition to MG and BYD, Chery (Omoda/JAECOO), Nezha Auto, XPeng, and other brands are actively expanding their presence in the Spanish market, either through channel partnerships or regional pilot programs. Although their sales have yet to break into the top 20 in the short term, with new product launches and the establishment of service networks, their potential for future growth is promising.

Summary

In April 2025, Spain's auto market exhibited a strong trend of "shifting east" in terms of overall sales trends, powertrain structural changes, and brand competitive landscape. Korean cars emerged as formidable players, and Chinese brands continued to make significant breakthroughs.

With mature products, rapid localization capabilities, and clear market positioning, MG and BYD are challenging the dominance of traditional European automakers. For Chinese auto brands, the Spanish market is not only the "gateway to Southern Europe" but also a strategic launchpad for the entire European continent.