WiFi chip market set for significant growth

![]() 11/12 2024

11/12 2024

![]() 561

561

This article is a comprehensive summary by ICVIEWS

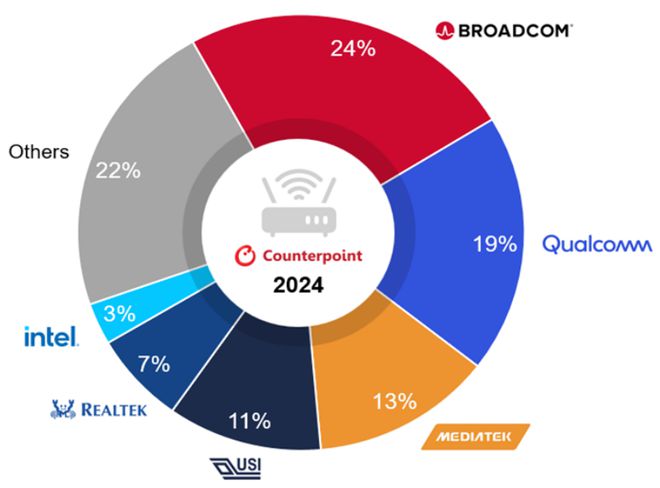

Broadcom leads the Wi-Fi 6/6E and Wi-Fi 7 markets, with an expected 24% share in 2024.

The Wi-Fi chipset market is poised for substantial growth.

According to Counterpoint's latest forecast, revenues are expected to increase by 12% year-on-year in 2025. The surge in e-commerce, web browsing, and mobile learning has driven the shift towards high-speed internet, increasing the demand for advanced connectivity. With the integration of nanochip technology, Wi-Fi manufacturers are preparing faster and more efficient solutions to meet these new demands.

Wi-Fi Standard Race: Wi-Fi 5 vs Wi-Fi 6/6E/7

Wi-Fi 5 is expected to dominate in 2024 with a market share of 56%, but the rapid rise of Wi-Fi 6, 6E, and 7 standards heralds a transformation.

In 2024, Wi-Fi 6, 6E, and 7 will collectively account for 29% of the market share, expected to rise to 43% by 2025. This shift reflects a significant transition from Wi-Fi 4 to 5 and the demand for faster, more powerful internet across multiple devices.

Key Wi-Fi Standards Specifications

Wi-Fi 7's low-latency features will drive the emergence of new devices and smoothen interactions with AI-enabled devices. Technological advancements include:

320 MHz Ultra-Wide Channels: Available only in the 6 GHz band, doubling the data rate of Wi-Fi 7 devices compared to Wi-Fi 6, supporting multi-gigabit speeds;

Multi-Link Operation (MLO): Enables efficient load balancing across links, improving throughput and reliability;

4K QAM: Offers a 20% increase in data rate over Wi-Fi 6's 1024 QAM, enhancing efficiency; 512 Compressed Block Acknowledgment (Ack): Improves efficiency and reduces overhead;

Multi-RU to Single STA: Enhances the flexibility of spectrum resource scheduling, boosting spectral efficiency.

Market Leaders: Broadcom, Qualcomm, and MediaTek

Broadcom leads the Wi-Fi 6/6E and Wi-Fi 7 markets with an expected 24% share in 2024, followed by Qualcomm (19%) and MediaTek (13%). Broadcom anticipates that Wi-Fi 6/6E will account for half of its Wi-Fi revenues this year, rising to 80% by 2025 due to platform migrations and upgrades, such as the anticipated iPhone 16.

Additionally, Qualcomm's FastConnect 7800 chipset lays the foundation for significant growth, with Wi-Fi 6E and 7 expected to account for 70% of its Wi-Fi sales by 2025.

MediaTek's Wi-Fi 7 Filogic 380/880 chipsets are also popular, with sales of Wi-Fi 6 and 7 chipsets anticipated to reach 58% of total Wi-Fi revenues in 2024 and 88% by 2025. Collaborations with brands like ZTE, TP-Link, and ASUS highlight MediaTek's market strength.

The Path Ahead for Wi-Fi 7

While Wi-Fi 7 is still in its early stages, broader adoption is expected by the end of 2025 as infrastructure and technical support catch up. Additionally, as AI increasingly becomes a core component in PCs and flagship smartphones, the demand for Wi-Fi 7 enhancements will rise, driving the need for ultra-high-speed connectivity.

Wi-Fi 7 adoption may surpass previous generations, highlighting its crucial role in next-generation connectivity for a wide range of applications from edge AI to AR/VR and IoT.

Sivaram Trikutam, VP of Infineon's Wi-Fi Product Line, said, "In the industry, when the next-generation Wi-Fi technology is introduced, routers and various forms of PCs, such as laptops, tablets, and smartphones, are typically the first to adopt it. These three areas are usually among the first to embrace new Wi-Fi standards."

Broadcom believes that with the arrival of Wi-Fi 7, we are currently in a phase where only top-tier devices—like the latest iPhones, Samsung Galaxy phones, or $3,000 laptops—are beginning to adopt Wi-Fi 7. Much of the industry is still at the Wi-Fi 6 stage.

For most home IoT devices, which are typically the last to adopt new generations of Wi-Fi, such as robotic vacuum cleaners, automatic doors, and rooftop solar panels, the transition to Wi-Fi 6 is underway. Over the next five years, we will see an increase in Wi-Fi 6 devices. By the end of the decade, Wi-Fi 6 may peak, and the number of Wi-Fi 7 devices will start to rise. Thus, this will be a decade of widespread Wi-Fi 6 adoption.

Cost Reduction: iPhone 17 to Use Apple's In-House Wi-Fi Chip

According to analyst Ming-Chi Kuo, Apple's upcoming iPhone 17, set to be released in fall 2025, will feature Apple's in-house Wi-Fi 7 chip, replacing Broadcom's current chip.

Apple's Wi-Fi 7 chip will be manufactured using TSMC's 7nm process. Apple aims to transition almost all its products to using its own Wi-Fi chips within three years, potentially lowering device costs and increasing Apple's profits.

Kuo stated that Broadcom currently supplies over 300 million Wi-Fi+BT chips (hereinafter referred to as Wi-Fi chips) to Apple annually. However, Apple plans to rapidly reduce its dependence on Broadcom. With the launch of new products in 2H25, such as the iPhone 17, Apple intends to use its own Wi-Fi chip, manufactured using TSMC's N7 process and supporting the latest Wi-Fi 7 specifications. Apple anticipates transitioning almost all its products to in-house Wi-Fi chips within approximately three years. This move will lower costs and enhance Apple's ecosystem integration advantages.

Apple's Wi-Fi chip is separate from its 5G baseband chip and not integrated, hence using different manufacturing processes, timelines, and scopes. Apple will first introduce its new 5G chip in the iPhone SE4, although this model will still use Broadcom's Wi-Fi chip.

*Disclaimer: This article is authored by the original writer. The content reflects their personal views. Our republication is solely for sharing and discussion purposes and does not imply endorsement or agreement. For any objections, please contact us.