MPS Q1 2025 Financial Report: Navigating the AI Wave

![]() 05/13 2025

05/13 2025

![]() 609

609

Produced by ChiNeng SmartChip

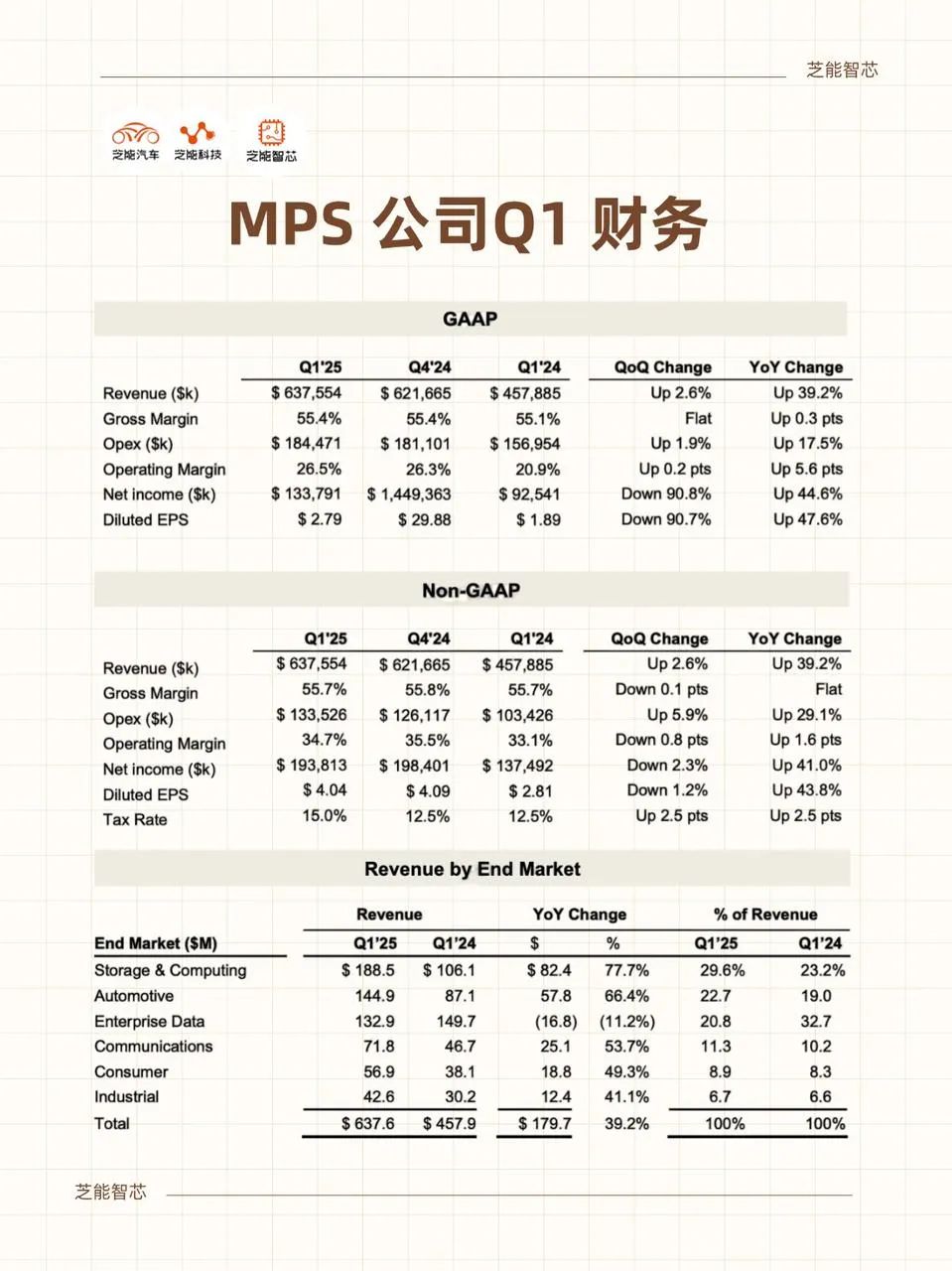

Amidst the fluctuating cycles of the global semiconductor industry, MPS has released a Q1 2025 performance report that surpasses expectations.

Revenue reached a new peak, with a year-on-year increase of nearly 40%, robust cash flow, stable profits, and a diversified business portfolio gradually demonstrating resilience against cyclical challenges.

From the rapid expansion in storage and computing to the consistent volume growth in automotive electronics, to the short-term adjustments and long-term potential of the enterprise data business, MPS's ability to convert technological advantages into tangible growth is evident.

Leveraging its deep technical expertise in power management and a global supply system, MPS is quietly transitioning from a "power chip company" to a "system-oriented solutions enterprise," steadily fortifying its competitive edge.

Note: The MPS case merits close study. We have thus extracted and compiled the AI and automotive-related sections from their March Investor Day separately.

Part 1

Structural Transformation Amid Financial Stability

● MPS's revenue for Q1 2025 amounted to $637.6 million, marking a 39.2% year-on-year increase. This growth trajectory is not fueled by a single market's explosion but by the synergistic efforts across multiple product lines.

Particularly, driven by the consistent volume surge in high-growth segments like storage & computing, automotive, and communications, MPS's diversification strategy has evolved beyond mere structural adjustment, serving as a stabilizer for profit growth.

● Gross margin remained above 55%, a testament to MPS's profound understanding of supply chain management and product positioning amidst fierce competition in raw materials, capacity utilization, and pricing.

R&D investment rose steadily to $133.5 million, leading to a 5.9% year-on-year increase in non-GAAP operating expenses. These expenses are channeled into continuously expanding the product matrix and sustaining the growth trajectory for the upcoming quarters.

● Despite ongoing increases in R&D and certain business costs, MPS achieved a non-GAAP profit of $193.8 million, indicating that profitability efficiency was not compromised during its expansion.

Furthermore, cash flow emerged as a significant highlight, with quarterly operating cash flow reaching $256.4 million and book funds exceeding $1 billion, providing a solid foundation for MPS's subsequent R&D, mergers and acquisitions, and capacity expansion endeavors.

Accounts receivable and inventory levels increased, with the sales collection cycle extending by 6 days and inventory turnover time by 8 days, preparing for future order growth. This also suggests that short-term operational rhythms may require more refined dynamic scheduling to maintain capital utilization efficiency.

Looking ahead to 2025-2027, MPS has set clear and ambitious non-GAAP financial targets:

◎ Aiming to exceed market growth rates by 10% - 15% in terms of revenue;

◎ Maintaining gross margin in the range of 55% - 60%, balancing product profitability and cost control;

◎ Controlling operating expenses at 80% - 90% of annual revenue growth for efficient resource allocation and cost management;

◎ Allocating 40% - 50% of free cash flow (FCF) to shareholder returns.

Part 2

Business Highlights and Rhythm Changes

● The storage & computing segment maintained its momentum, driving the quarterly growth. Revenue soared 77.7% year-on-year, accounting for nearly 30% of total revenue.

The increasing adoption of DDR5 fueled sustained demand for memory power chips, while AI-enabled PC upgrades and the rise of gaming laptops spurred widespread structural demand on the client side.

Leveraging its comprehensive technological advantages in high-efficiency power conversion, compact packaging, and thermal management, MPS secured multiple design wins from mainstream customers.

● The enterprise data segment experienced a double decline, both sequentially and year-on-year. Revenue dropped by more than 30%, primarily due to periodic adjustments and delayed delivery schedules for major customer projects.

Structurally, the continuous rise in orders and certifications underscores the recognition of MPS's technical approach in the data center market.

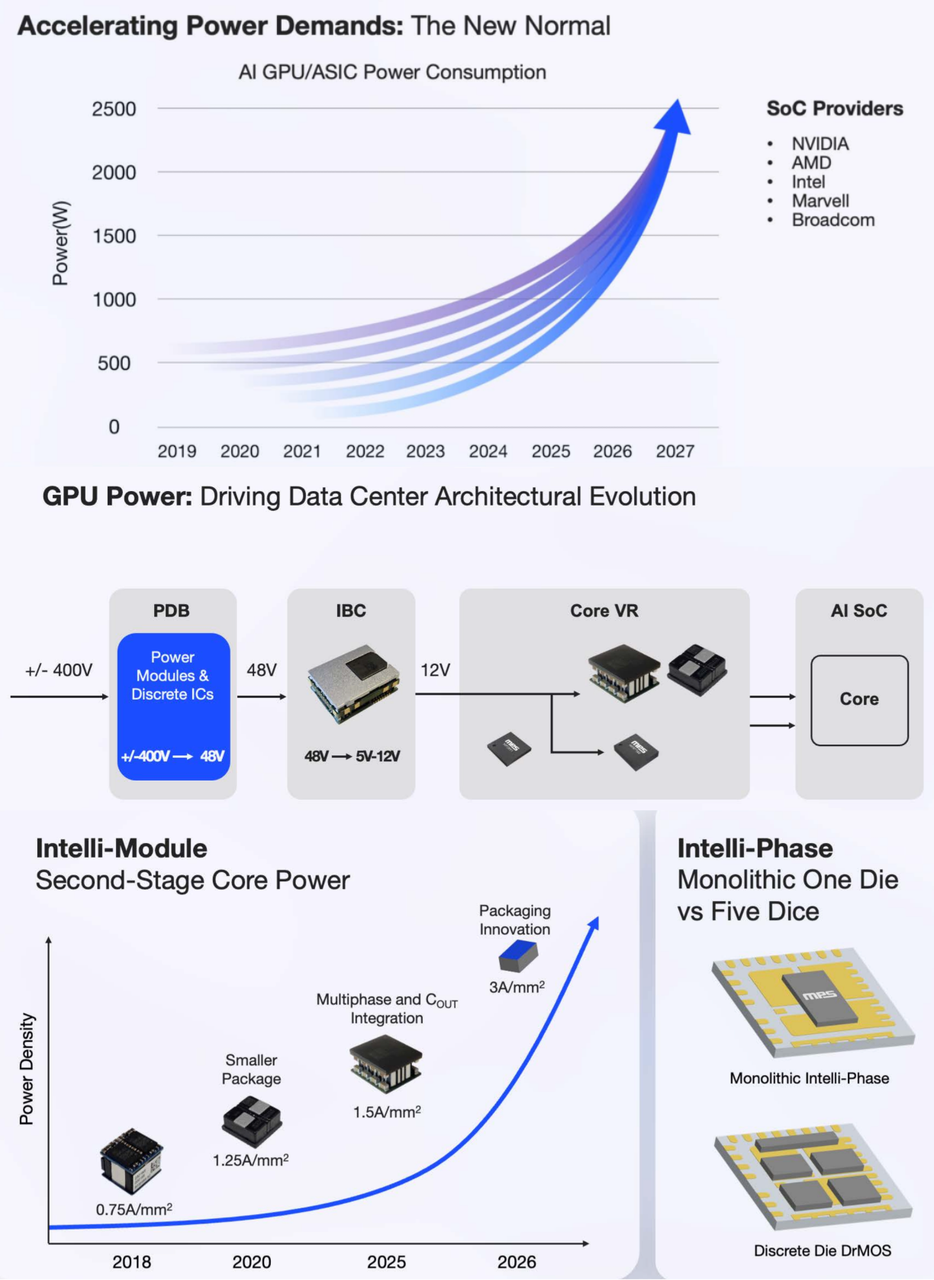

As AI servers demand higher integration and efficiency from power modules, MPS has commenced the deployment of 400V rack power architectures, anticipated to enter actual supply stages in the second half of the year. Once these projects enter mass production, the segment's profitability is expected to surge.

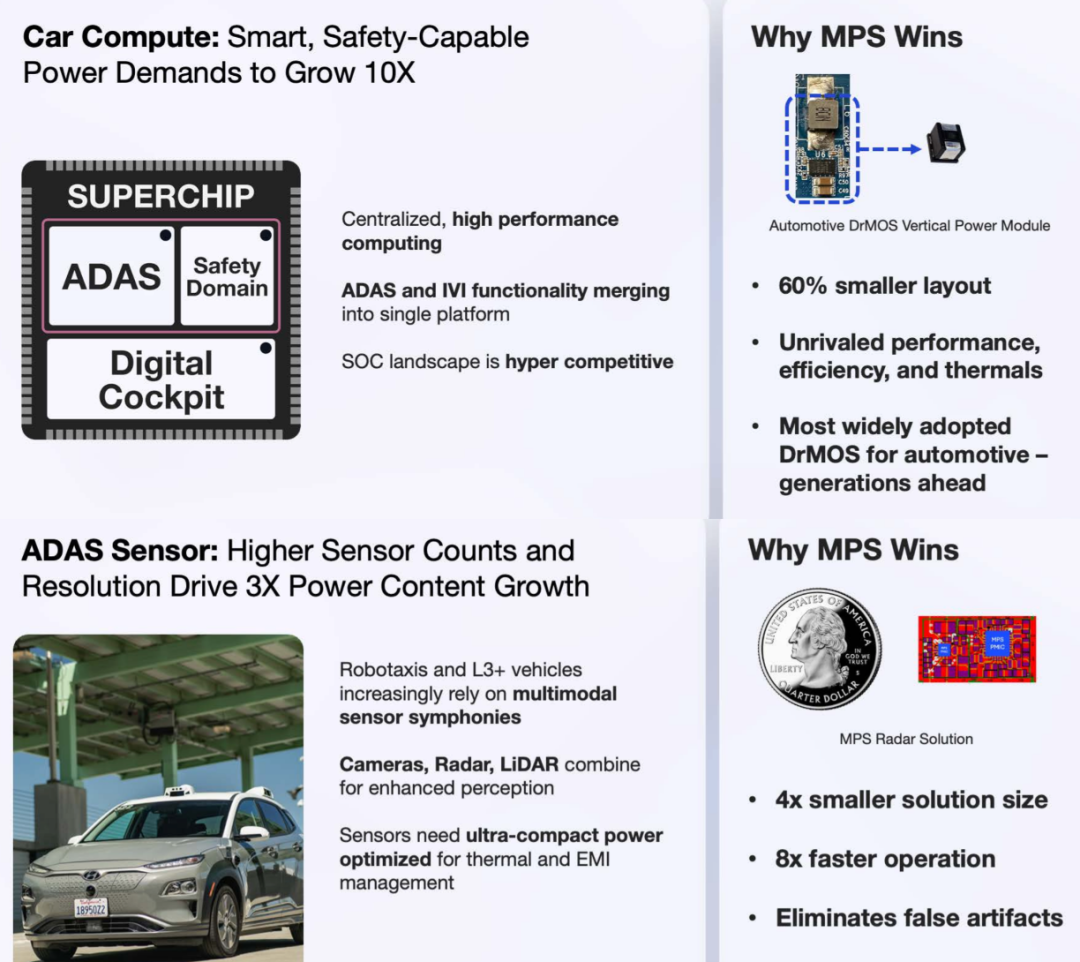

● The automotive electronics business continued its upward trajectory, with quarterly revenue growing by 66.4% year-on-year.

Whether it's ADAS, in-vehicle entertainment, or information systems, customers increasingly demand power chips with high efficiency, wide input voltage range, and low EMI.

MPS has commenced mass production of multiple power modules under the 48V/800V architecture, with some products already installed in Chinese new energy vehicle factories and European and American vehicle platforms. This segment's incremental space is expanding, and double-digit growth is anticipated in the near term.

● The communications business achieved a 53.7% year-on-year growth, fueled by the dual impetus of 5G infrastructure upgrades and heightened demand for optical modules.

Particularly in the power management field of optical modules, MPS products have penetrated multiple uplink paths, with their compact size and high power density design gaining positive feedback in the 800G and 1.6T optical module markets.

● The consumer and industrial markets exhibited a steady upward trend.

◎ The consumer electronics segment witnessed a slight sequential decline due to the correction in gaming terminals, but smart TVs, electric meters, and wearable devices provided resilience to the business.

◎ The industrial sector performed relatively steadily. In smart grid and industrial automation applications, MPS's chip solutions for long life and high reliability have entered a phase of stable volume growth.

Summary

Horizontally, MPS is evolving from a multiple-product company to a multi-platform enterprise. Vertically, it is redefining system-level value based on its core power management technology, reflected in a balanced revenue structure, enhanced profit stability, and the extension of its technological reach upstream to system design and downstream to industry applications.

Currently, the high-growth segments of AI, automotive electronics, and optical communications are undergoing structural transformations. The demand for power chips has transcended basic voltage conversion, and with its fully in-house power architecture design capabilities and scalable modular platforms, MPS has deeply integrated into the customer product ecosystem, fostering stronger customer loyalty and bargaining power.