Microsoft's AI Renaissance: Ascending to the Second $4 Trillion Market Cap Milestone

![]() 08/01 2025

08/01 2025

![]() 610

610

Produced by Zhineng Technology

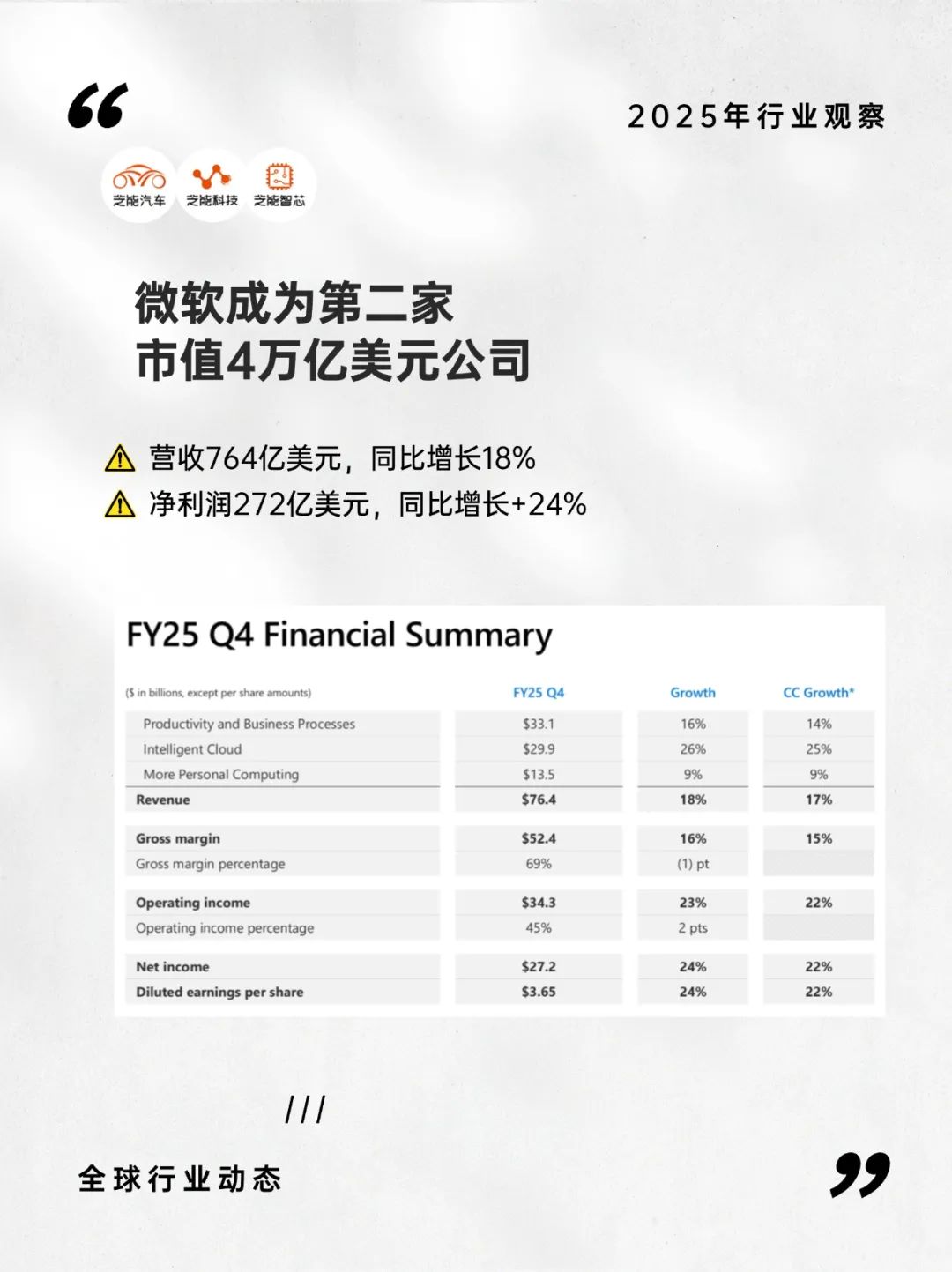

Microsoft posted an impressive performance in the fourth quarter of FY2025, with revenue soaring to $76.4 billion, marking an 18% year-over-year increase, and earnings per share rising 24% to $3.65.

Powered by robust growth in cloud computing and artificial intelligence, the company's market capitalization soared past the $4 trillion mark, becoming the second enterprise after NVIDIA to join this elite club.

Microsoft's across-the-board financial outperformance underscores its prowess in AI commercialization, infrastructure investments, and the scalable synergy of its cloud business, particularly Azure's sustained high growth and the introduction of the Copilot family, which have laid the cornerstone for Microsoft's long-term strategy of an "AI operating system".

The capital expenditure plan directly addresses foundational bottlenecks in space, power, and GPU deployment, indicating that the company is poised for a new phase of growth.

01 Journey to AI Commercialization: From Copilot's Launch to Azure's Revenue Leap

The quarter's standout achievement for Microsoft was the maturation of its AI product suite and the tangible realization of its business model.

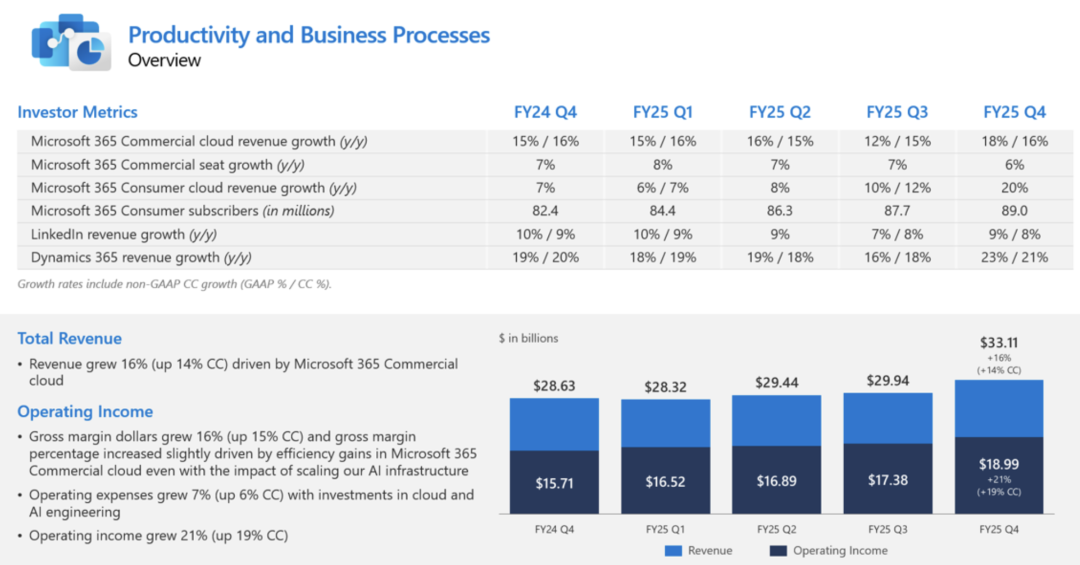

From the seamless integration of Copilot into core office scenarios like Office and Teams to its penetration into programmer communities via GitHub Copilot, Microsoft has expanded its reach in both ToB and ToC dimensions. These AI tools have coalesced into a comprehensive entry-level product matrix, achieving significant user growth.

Publicly disclosed monthly active users have surpassed 100 million, encompassing both paid and unpaid users, further attesting to the transition of its services from "auxiliary tools" to primary drivers of enterprise and individual productivity enhancements.

Copilot is not merely a functional plugin but is deeply embedded within the Microsoft 365 ecosystem, redefining AI-driven SaaS products. For instance, the email response generator in Outlook, the meeting summary tool in Teams, and the semantic rewriting suggester in Word all enhance user engagement.

This AI integration approach not only amplifies the user experience but also boosts the subscription service's unit price, leading to a higher ARPU (Average Revenue Per User).

Although management has not disclosed the revenue breakdown for AI products, this system already possesses a well-defined monetization path and nascent scale effects.

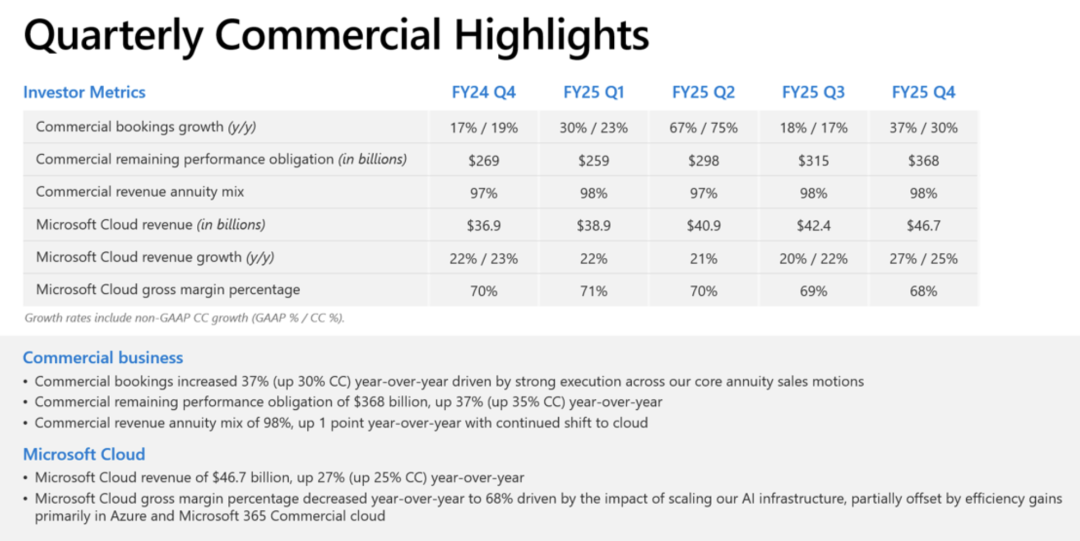

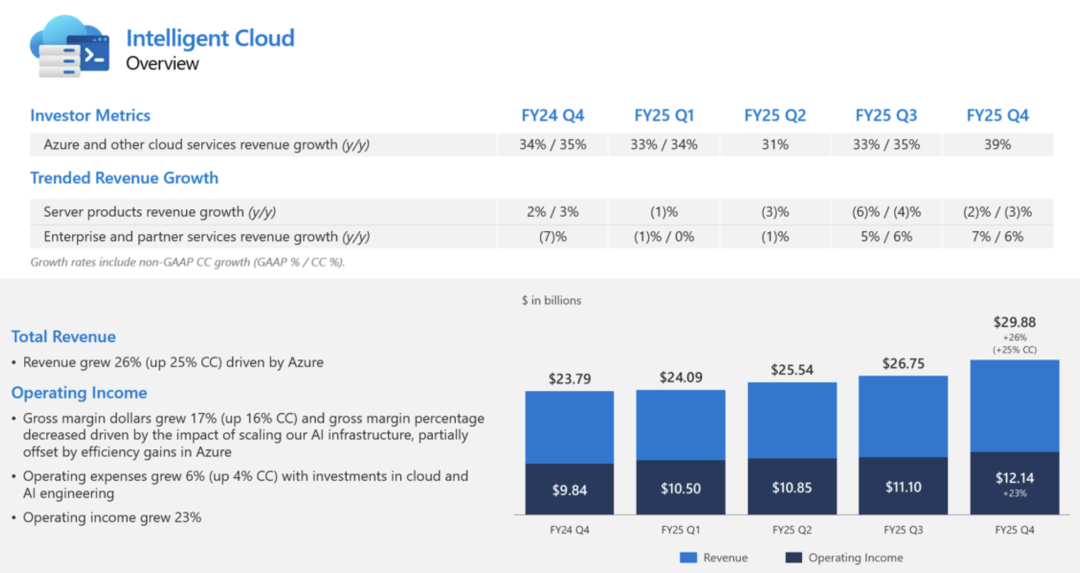

At the cloud computing level, Azure's revenue growth rate for this quarter ranged between 34% and 39%, the highest in the past two fiscal quarters. Annually, Azure has surpassed the $75 billion mark, making it the world's second-largest cloud platform.

This growth is fueled by stable and ongoing cloud migration and AI deployment demands from enterprise customers, rather than one-time contracts or the concentrated recognition of OpenAI training revenue.

Microsoft emphasizes that there were no significant incentives to drive customers to the cloud; rather, it was a natural outcome of market demand.

Microsoft is also visionary in its investments and service capabilities building within the AI infrastructure layer. For instance, in AI model services, Azure not only hosts OpenAI's GPT series but also supports open-source models, private deployments, and enterprise-level customization, significantly broadening its customer base.

Beyond model invocation, Azure offers an integrated tool chain for data cleaning, model tuning, security compliance, etc., lowering the threshold for AI adoption and enhancing platform stickiness.

By embedding AI capabilities into productivity tools and cloud service platforms, Microsoft's two core pillars, the company has completed a full loop from technology to products to revenue. With Azure as the foundation and Copilot as the interface, customers can both utilize and deploy AI, while Microsoft captures value returns at every stage.

02 Capital Expenditure and Infrastructure Expansion: Paving the Way for Future AI Computing Dominance

Another focal point of Microsoft's fourth quarter in FY2025 was the substantial increase in capital expenditure.

Expenditure for this quarter reached $24.2 billion, a 27% year-over-year increase, with full-year planned expenditure expected to exceed $120 billion, a record high for the company.

This significant investment is not merely about expanding servers and data storage but is focused on infrastructure construction for a new wave of AI computing power, encompassing GPU deployment, power architecture optimization, cooling system upgrades, and data center location selection.

Expenditure in the first half of the year was notably higher than in the second half, reflecting Microsoft's proactive approach to GPU deployment. In other words, Microsoft's current large-scale capital expenditures will primarily manifest their production capacity effects starting in FY2026.

This strategy resembles an "AI infrastructure land grab," establishing a first-mover advantage in hardware resources, rack space, and energy consumption control. Amidst a global shortage of high-performance GPU resources and limited power supply, securing production capacity in advance and constructing bespoke data centers have become pivotal competition areas for large cloud service providers.

Beyond GPU deployment, data center space density and power supply are also critical bottlenecks for current AI expansion.

Microsoft management acknowledged that current gross margin pressure does not stem from GPU costs but from insufficient space and power utilization efficiency. To address this, the company is accelerating the structural upgrade of data centers and diversifying energy sources, aiming to unlock more computing power potential from physical constraints.

Another portion of capital expenditure flows into Microsoft's investments in model development, data engineering, and security compliance. For instance, enterprise-level AI deployments have stringent data security requirements, and Microsoft is enhancing the interpretability of self-developed models, behavioral boundary control, and audit mechanism construction, aiming to provide enterprises with a "trustworthy AI tool chain." These seemingly non-direct revenue projects wield considerable influence on B-end customers' purchasing decisions.

From an investment return cycle perspective, Microsoft's current expenditure structure is more aligned with long-term strategic goals rather than quarterly profit drivers. For instance, during the earnings call, the company did not lower its profit margin expectations due to increased expenditures but emphasized that depreciation expenses would rise moderately, and future gross margins would not fluctuate dramatically. This regulatory capability underscores Microsoft's ability to absorb short-term pressure from capital expenditures through its business structure and software efficiency.

The balance between technology and financial management has emerged as a pivotal factor in Microsoft's ability to maintain profitability amidst "high investment and high growth".

Currently, the gross margins of cloud services and AI products remain above the overall business average, ensuring that even with continuous capital expenditure growth, its profitability remains resilient. This is the fundamental rationale behind Microsoft's ability to uphold investor confidence and secure a higher valuation premium amidst rapid expansion.

Summary

Microsoft's ascent to a $4 trillion market cap was not propelled by a single quarter's exceptional performance but by its systematic growth capabilities in the AI era. Whether it's the productization and launch of Copilot, Azure's relentless scale expansion, or the forward-thinking investment in long-term infrastructure layout, Microsoft has demonstrated unwavering strategic clarity and robust execution capabilities.

This AI wave is no longer solely a competition of model superiority but a comprehensive battle of underlying computing power, platform tool chains, and enterprise service capabilities. In this profound structural transformation, Microsoft has emerged as a "hub enterprise" bridging infrastructure, productivity tools, and commercial applications, leading not just in technology but also in the synergistic integration of platform-level capabilities.