Microchip FY2025: Navigating Inventory Adjustments and Structural Optimizations

![]() 05/14 2025

05/14 2025

![]() 580

580

Produced by ZhiNeng ZhiXin

Fiscal Year 2025 (FY2025) proved challenging for Microchip, as the global semiconductor cycle adjustment and sluggish downstream demand significantly impacted its revenue, resulting in a substantial year-on-year decline.

Amidst this adjustment, Microchip remained proactive, pursuing various strategies. It refined its inventory management, organizational structure, customer mix, and regional layout, aiming to consolidate its core advantages in a volatile environment and build momentum for a potential recovery in FY2026.

ZhiNeng Commentary: In the MCU business, the pressure for transformation is immense. The shift from low-end to mid-range MCUs in the Chinese market is a pronounced trend, and the market will not revert to its previous state.

Part 1: Deepening and Reshaping Microchip's Business Focus

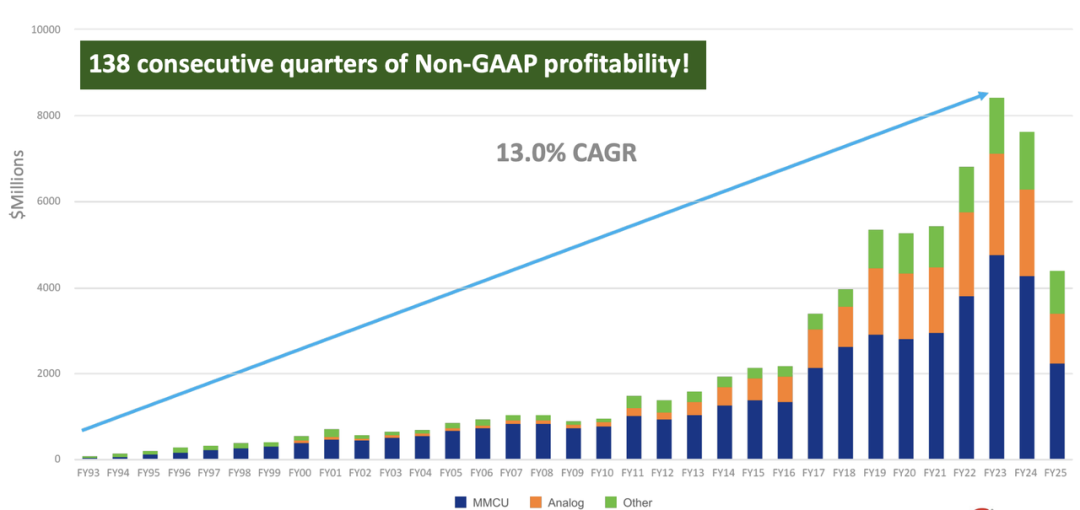

Microchip's FY2025 financial highlights include:

◎ Full-year revenue was $4.402 billion, with Q4 revenue at $970.5 million, both showing declines.

◎ Full-year non-GAAP net profit was $709 million, and free cash flow reached $743 million, accounting for 16.9% of revenue.

◎ Full-year gross margin (GAAP/non-GAAP) was 56.1%/57.0%, with Q4 at 51.6%/52.0%.

◎ Full-year debt repayment was $356 million.

Reviewing FY2025's operating data, revenue fell by over 40% year-on-year, essentially reverting to FY2018 levels. Under non-GAAP metrics, the company maintained an annual operating margin of over 24%, with quarterly gross margins around 52%, indicating initial success in cost control and product mix optimization.

Financially, the company repaid $356 million in debt and returned a total of $1.066 billion through dividends and buybacks. Despite a net loss under GAAP due to one-time costs such as restructuring and amortization, the company's true operating condition remained balanced.

The crux lies in the outlook for MCUs, Microchip's primary core business. Amid the substitution trend in China's MCU market, Microchip is directly affected, and other data points will shift accordingly. Semiconductors are now sold as holistic solutions.

Microchip made notable progress in inventory management, choosing to fine-tune its supply chain rhythm rather than resorting to excessive price cuts. This reduced inventory levels, creating flexibility for subsequent recovery. Minor adjustments to distribution channel strategies ensured sales coverage was unaffected, enhancing response speed in key regions.

Strategic adjustments in organizational structure are yielding results. By assessing the long-term value of each business unit, resources are gradually shifting towards emerging growth areas like AI and IoT. Coupled with workforce optimization and process streamlining, overall operational efficiency is improving.

At the customer level, Microchip maintains a global network of over 100,000 customers, with tailored support for key accounts. This sticky, multi-touch customer strategy mitigates macro-cycle impacts. With 55% of sales coming from direct channels, the company has greater proactivity and bargaining power in responding to rapid end-market changes.

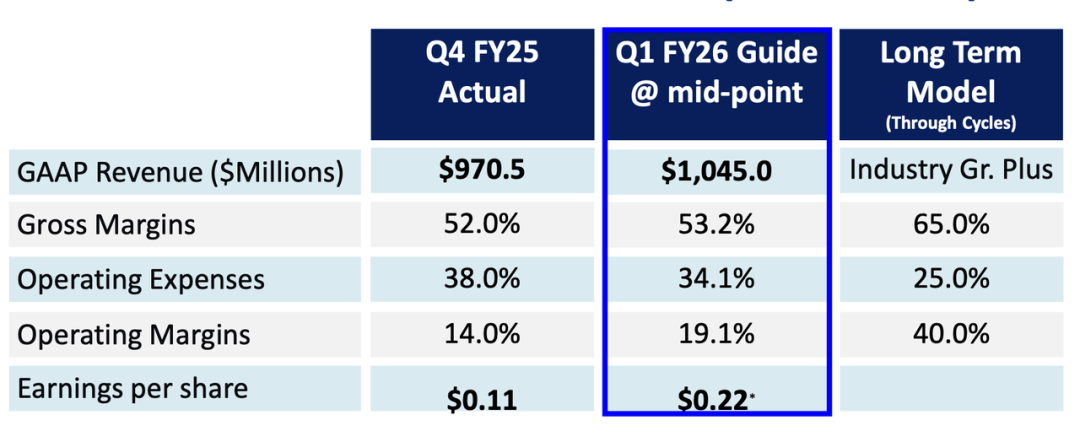

FY2026 Q1 Guidance:

◎ Net sales are expected to be $1.02 - $1.07 billion.

◎ GAAP gross margin is 51.2% - 53.2%, and non-GAAP gross margin is 52.2% - 54.2%.

◎ GAAP operating margin is 0.2% - 3.9%, and non-GAAP operating margin is 17.4% - 20.8%.

◎ GAAP operating expenses account for 49.3% - 51.1% of revenue, and non-GAAP operating expenses account for 33.4% - 34.8%.

Part 2: Business Focus Under Strategic Restructuring

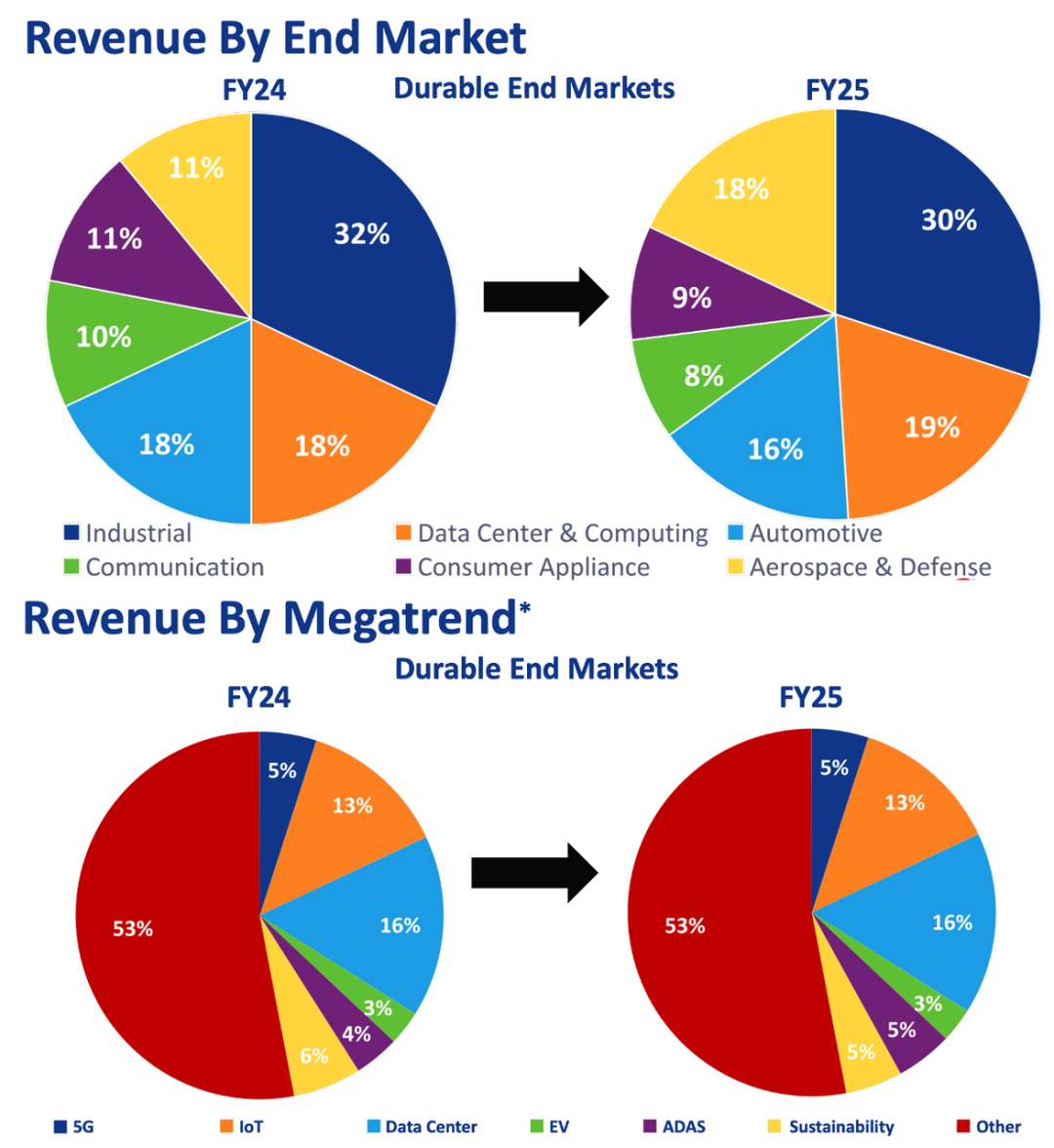

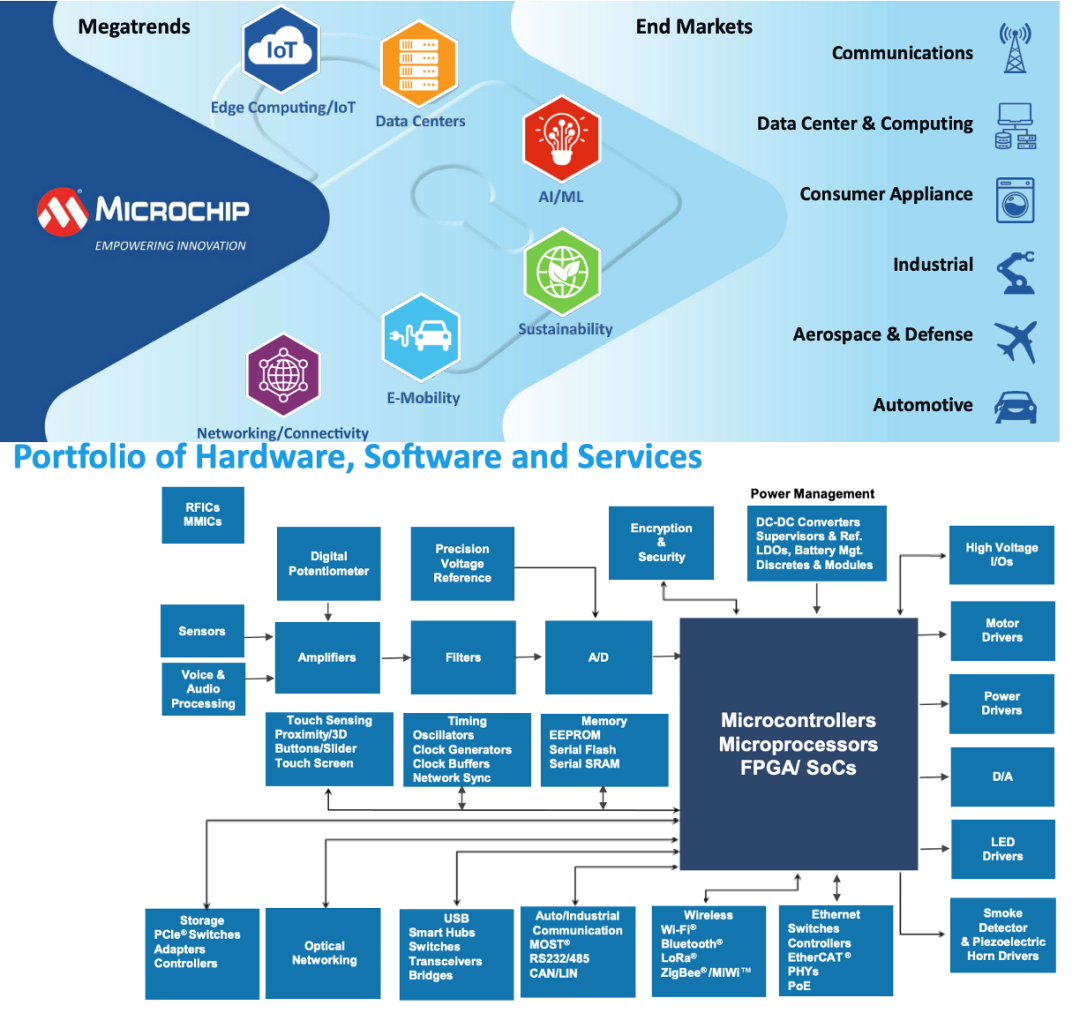

Microchip's product line spans microcontrollers, analog devices, timing chips, security modules, wireless and wired connectivity, FPGAs, and non-volatile memory, serving industries like industrial, automotive, consumer electronics, communications, and aerospace. This broad product ecosystem, while under short-term pressure, forms the foundation for long-term growth.

In Q4, mixed-signal microcontrollers contributed nearly half of product revenue, followed by analog chips, reflecting Microchip's deep expertise in low-power, highly integrated embedded control.

The industrial and automotive sectors remain pivotal, particularly as electrification and intelligence dominate the market. Microchip's battery management system chips, automotive-grade microcontrollers, and CAN/LIN communication devices are highly competitive.

In industrial scenarios, factory automation, power dispatch, and energy management require high real-time and security standards for embedded control. Microchip's product portfolio and extensive design support services cater to OEMs and system integrators, enhancing equipment intelligence.

In automotive applications, whether it's ADAS systems relying on rapid data processing and high-reliability components or BMS demanding low-power, high-precision analog signal chains, Microchip sees ample expansion opportunities.

Consumer electronics showcase another facet of Microchip's product capabilities: highly integrated SoCs, connectivity modules, and security chips meet the constraints of smart homes and wearable devices in size, power consumption, and user interaction. While shipment volumes are less stable than in industrial and automotive sectors, the company maintains strong customer loyalty.

Summary

As FY2025 concludes, Microchip's performance underscores the adaptability of traditional embedded enterprises in major cycle adjustments. The decline in revenue reveals the pressure from weakening end-demand. Through inventory compression, organizational restructuring, solidifying customer mix, and optimizing capital strategies, Microchip has fortified its fundamentals.

This inward-looking adjustment path does not rely on a single blockbuster product but builds a foundation for long-term robust operations. In the future, Microchip's ability to capitalize on growth points amid structural opportunities, such as the convergence of AI and IoT and the continuous penetration of automotive semiconductors, will determine its success in the next upcycle.