Can the African Mobile Phone King Make a Triumphant Return?

![]() 05/15 2025

05/15 2025

![]() 550

550

TECNO, having shunned domestic competition, is now facing stiff rivalry from Chinese brands in Africa.

On May 8, Lu Weibing highlighted Xiaomi's impressive performance in Africa: capturing a 13% market share, ranking third, and enjoying a year-on-year sales surge of 283%. Closely trailing Xiaomi are fellow Chinese giants OPPO and Honor.

TECNO, which has reigned over Africa for nearly two decades, saw its market share dip by 5% year-on-year, despite maintaining a substantial 47% share. Notably, it is the only brand among the top five to experience a decline.

Moreover, in the first-quarter global smartphone market reports from TechInsights, IDC, and Canalys, TECNO fell out of the top five, replaced by Xiaomi, OPPO, vivo, Apple, and Samsung.

TECNO had been among the top five players in the global smartphone market for two consecutive years, from 2023 to 2024.

This market performance is clearly reflected in its financial reports.

In the first quarter, TECNO's revenue declined by 25.45% year-on-year, and its net profit plummeted by 69.87%.

For TECNO, the more pressing issue appears to be the lack of viable solutions.

On one hand, its path to success in Africa is being rapidly replicated by competitors; on the other hand, it struggles to find a new growth trajectory.

What lies ahead for TECNO?

01

Rising to Prominence in Africa

TECNO's success in Africa can be described as the epitome of "leveraging strengths and avoiding weaknesses".

In 2005, the Chinese mobile phone market was in turmoil, with foreign brands like Nokia, Motorola, and Samsung dominating, and domestic brands like Bird, TCL, and Lenovo leading the charge. The collaboration between MediaTek and Huaqiang North was also poised to spawn a myriad of knock-off phones.

At this juncture, Zhu Zhaojiang, then the Executive Deputy General Manager of Bird, ventured abroad and sold 6 million mobile phones for Bird within two years.

Having traveled to over 90 countries, Zhu Zhaojiang keenly observed that despite Africa's relatively low purchasing power, its vast, youthful population and limited brand presence (dominated by Samsung and Nokia) presented a significant blue ocean opportunity.

In 2006, Zhu Zhaojiang resigned to start his own venture, registering Hong Kong-based TECNO Mobile Limited, thereby embarking on the legendary journey to become the African Mobile Phone King.

TECNO deeply resonated with African consumers' needs. Addressing challenges like numerous operators and limited signal coverage, TECNO pioneered dual-SIM phones and later introduced quad-SIM phones with four standby options.

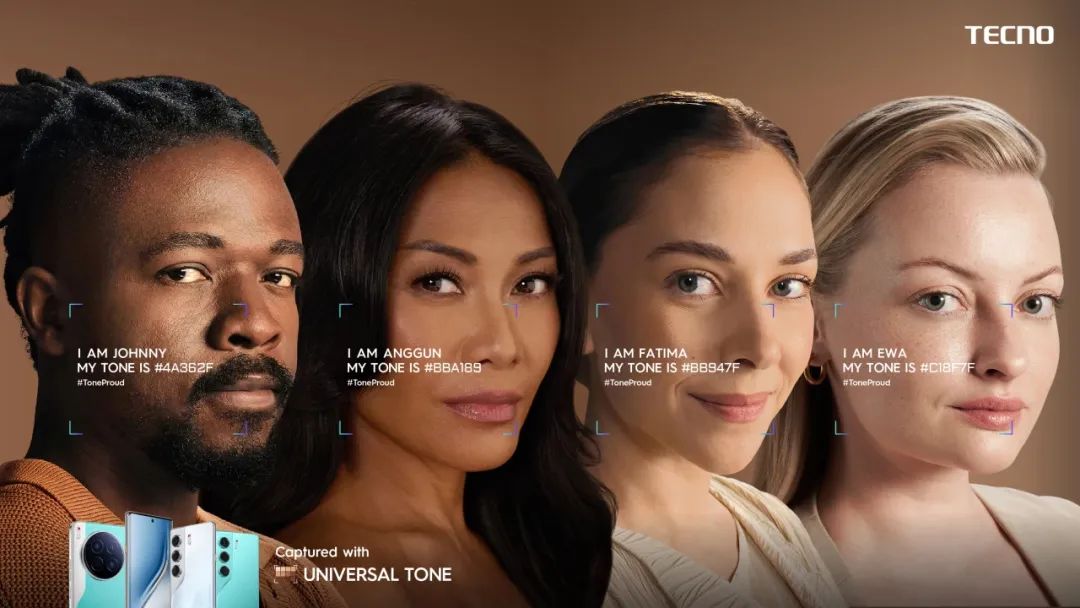

Image source: TECNO social media

Furthermore, TECNO developed a beauty camera app tailored for black skin tones and introduced phones with large 8000mAh batteries to tackle frequent power outages. Given Africans' passion for music and dance, TECNO also launched phones equipped with four and eight speakers.

Africa's vast territory and underdeveloped logistics posed significant challenges for establishing stable sales and service networks. TECNO patiently built a comprehensive three-tier distributor system, starting with partnerships with mom-and-pop stores, and even established combo shops offering "phone repair + charging stations + mobile recharge" in desert tribes.

Price remains a crucial factor. TECNO's mobile phones, priced below $99, are highly suited to the African market's consumer demands.

In 2018, TECNO surpassed Samsung to become Africa's top-selling mobile phone brand, a title it has held ever since. According to Canalys data, in 2024, TECNO's smartphones accounted for 51% of the African market share.

Subsequently, other Chinese brands also entered Africa.

02

Stagnation in Africa

After 19 years of hard work, TECNO has grown strong, fueled by the niche African market, but it now faces two challenging situations: First, the African market has limited growth potential, with low-end phones still dominating, preventing TECNO from ascending to the mid-to-high-end segment.

According to Canalys, smartphone shipments in Africa increased by 9% year-on-year in 2024, but were still hampered by persistent high inflation, currency depreciation risks, and limited economic growth momentum.

During the May 2024 earnings conference call, Zhu Zhaojiang also acknowledged, "The transition from feature phones to smartphones remains a significant driver of smartphone market growth in emerging markets like Africa."

The African land that TECNO has cultivated for over a decade is still not sufficiently fertile. TECNO is still engrossed in the entry-level market, encouraging African consumers to upgrade from feature phones to smartphones. However, these paths have already been traversed in China, Southeast Asia, and even Latin America.

This leads to the second challenge for TECNO: After dominating Southeast Asia and the Middle East, Chinese peers are now encroaching on the African market.

Previously, many Chinese mobile phone manufacturers had intermittently entered the African market but failed to find the right approach. This time, they adopted TECNO's strategy, and it proved effective once again.

In 2024, Xiaomi's Redmi brand led the charge, with its popular Redmi 10A and 12C priced at just $75 and $95, respectively, penetrating TECNO's $99 price fortress.

OPPO's realme brand followed suit, with its main sales model, the realme Note50, also priced in the tens of dollars.

Moreover, Xiaomi replicated its fan-centric approach, hosting the "Mi Deals Festival" in Egypt and the "Mi Fan Meetup" in Nigeria.

Image source: Canalys

According to Canalys data, Xiaomi shipped 8.4 million units in Africa in 2024, capturing an 11% market share and achieving a year-on-year growth of 38%, ranking third. Realme ranked fourth with shipments of 3.8 million units, experiencing a staggering year-on-year growth of 89%.

This serves as a wake-up call for TECNO: When domestically honed competitor products enter Africa and engage in price wars, TECNO, which has cultivated the market for years, lacks a significant competitive advantage.

Ultimately, it becomes evident that what African consumers care about most is price, price, and price.

03

Struggling to Find a Growth Trajectory

TECNO had anticipated the decline in market performance and the intense competition, and it has been searching for a new growth trajectory, but with limited success.

First, in terms of products, TECNO is not solely focused on low-end phones and has been striving to reach higher ends.

Image source: TECNO social media

For example, at MWC 2025, TECNO showcased the vertically foldable Infinix ZERO, the ultra-slim Tecno Spark Slim with a thickness of just 5.75mm, and a concept phone with perovskite solar cells, all keeping pace with global mobile phone trends.

Additionally, the TECNO brand displayed two new AI smart glasses, and the PHANTOM V Fold2 foldable phone is equipped with the Tongyi Qianwen large model. TECNO continues to explore AI technology, particularly in full-skin tone beauty adaptation and AI translation.

However, these high-end technologies remain niche. Whether in the mainstay African market or the recently targeted Southeast Asian and Latin American markets, the mainstream remains mid-to-low-end products. TECNO's "flexing of muscles" does not elevate its brand positioning.

Furthermore, TECNO has ventured into the ecosystem, establishing the digital accessory brand Oraimo, the home appliance brand Syinix, and the after-sales brand Carlcare, all of which have achieved certain results.

TECNO has even partnered with internet companies like NetEase to create its own app market, music, and short video apps in Africa.

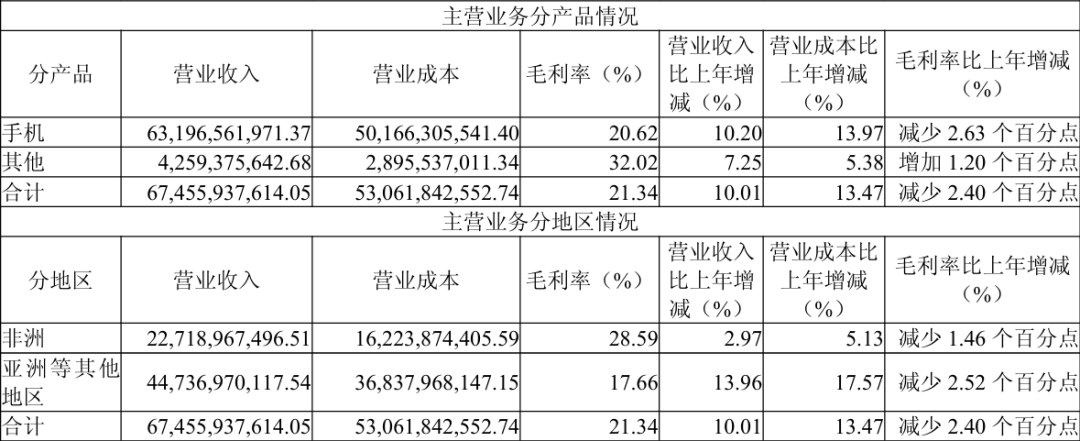

While it appears to be building a hardware + software + ecosystem, the 2024 financial report reveals that mobile phone business revenue accounts for 93.7% of total revenue, indicating that the new growth trajectory has not truly materialized.

Image source: Financial report

Moreover, TECNO has also ventured into overseas markets early. In 2024, only one-third of its revenue came from Africa, with the remaining two-thirds originating from other regions like Asia.

In 2024, TECNO's market share in Pakistani smartphones exceeded 40%, ranking first, and in Bangladesh, it held a 29.2% market share, also ranking first.

However, Africa remains TECNO's pillar, with a gross margin of 28.59%, while other regions like Asia have a gross margin of only 17.66%. Moreover, operating costs in regions like Asia increased by 17.57% year-on-year, while gross margins declined by 2.52% year-on-year.

From TECNO's perspective, markets outside Africa are newly expanded territories; however, from the perspective of other competitors, these "new" markets for TECNO are already well-established territories for them.

This also means that TECNO is trapped in Africa.

With competitors accelerating their overseas expansion, the African Mobile Phone King has limited time to act.