OPPO's High-End Charge: Winning the Crucial Battles

![]() 05/18 2025

05/18 2025

![]() 957

957

On May 15, OPPO unveiled its latest product. As anticipated, the OPPO Reno 14 continues to emphasize photography, simulating the popular "tear-off film" animation effect.

OPPO is highly confident in its photographic prowess.

During last year's launch event for the Find X8 series and flagship ecosystem products, OPPO Chief Product Officer Liu Zuohu boldly declared, "Our portrait photography is the best," and "We aim to convert Apple users."

When asked if the OPPO Find X8 would become a formidable competitor against Apple and Samsung, Liu Zuohu concurred, stating that to reach the high-end market, direct competition with these giants is inevitable.

However, recent online complaints about the Find X8 series have emerged, with some netizens questioning OPPO's motives for promoting its new flagship models while seemingly undermining older ones through unfair treatment.

This after-sales controversy underscores the bumpy road OPPO has taken in its pursuit of high-end status. From its initial foray into the high-end market over a decade ago to the present, how has OPPO fared in this strategic offensive?

I. Pushing for High-End Status: Achievements and Hurdles

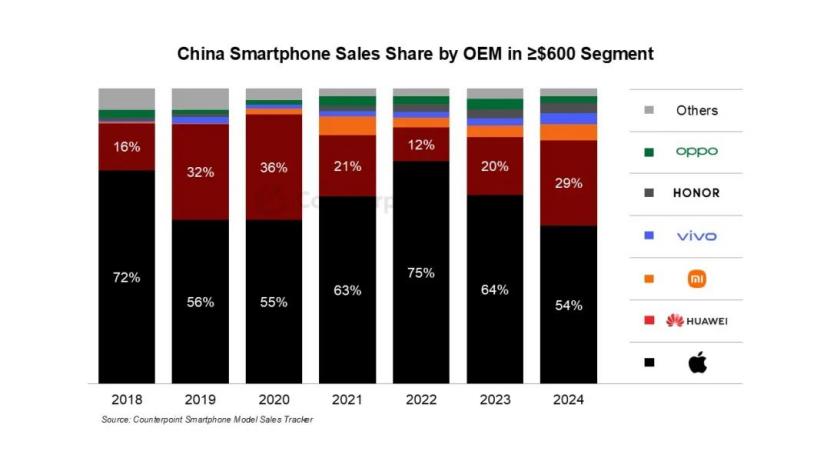

Typically, models priced at $600 or above 4000 yuan are considered high-end flagships. These devices are costly, target a specific consumer profile, and offer significant profit margins and brand value to hardware vendors. As of last year, the share of high-end phones in the Chinese market rose to 28%, making it a crucial territory for vendors.

Since launching the Find series in 2011, OPPO, a domestic phone manufacturer, has been exploring the high-end market for years, continuously innovating in technologies such as 5G, AR, photography, and foldables, and has seen initial success in recent years.

Initially, OPPO's high-end push was product-focused. Now, its strategy has evolved to encompass providing an overall product and solution.

In 2024, the X8 series sold well upon its initial release, thanks to features like long-range telephoto technology, with shipments increasing by over 60% compared to the previous generation. It became the product with the largest sales increase among new flagship offerings, directly driving a 32% year-on-year increase in OPPO's shipments of models priced above 4000 yuan in the fourth quarter. As of this year's Q1, the OPPO Find X8 series continued to perform well.

OPPO has tasted success in its high-end push, but it cannot afford to rest on its laurels.

Longer-term data from Counterpoint Research shows that in 2024, Apple, Huawei, and Xiaomi occupied the top three spots in China's high-end phone market. Even in this year's Q1, IDC data indicates that OPPO's market share in foldable phones was only 7.1%, significantly lower than Huawei's three-quarters share, highlighting insufficient momentum in its high-end offensive.

Success coexists with challenges, reflecting OPPO's dual-sided battle: high-end products sell well, but a solid market position has yet to be established.

In other words, to compete firmly with established high-end players, OPPO still faces an uphill battle.

II. The High-End Dilemma: Technology, Mindset, and Market Position

In the fiercely competitive mobile phone industry, the success of a high-end strategy hinges on three key factors: "high-end technology, high-end mindset, and high-end market position." OPPO's challenges lie precisely here.

Core original and innovative technology is the first major capability factor for a mobile phone brand to achieve high-end status.

During the early smartphone boom, Apple was an insurmountable obstacle for domestic phone manufacturers, dominating 70-80% of China's high-end phone market. Almost no vendor could match Apple's brand tone and identity, and most domestic manufacturers had to compete in the low-to-mid-range market.

The launch of Huawei Mate7 began to shift this rigid pattern. As the technology and quality of the Mate series matured, it carved out a niche in the Apple-dominated high-end market, providing a positive example for domestic brands to enter the smart high-end phone race.

Subsequent years saw the introduction of a series of cutting-edge technologies such as the HarmonyOS ecosystem, flagship chips, global satellite phones, and Kunlun glass screens, with domestic brands building an ecological technology system reliant on China's supply chain.

OPPO too is continuously investing in photography, gaming, productivity, health, and other aspects. Taking the latest flagship product, the Find X8 Ultra and its series, released in April, as an example, due to its exceptional night photography performance, the series has been hailed as a "night portrait masterpiece" by numerous reputable digital media outlets and users. It's evident that OPPO boasts numerous selling points in terms of thickness, screen, office functionality, and photography.

According to Kantar Mobile Consumer Data, five years ago, when Chinese consumers chose mobile phones, they valued 5G network support, battery life, and screen size the most. Nowadays, consumers' priorities have shifted significantly. High-end phone users now prioritize a comprehensive and exceptional user experience.

Data from iiMedia Consulting also shows that in 2024, among Chinese iOS users, 37.29% expressed great satisfaction, while the proportion for Android users was 17.74%. This underscores the importance brand buyers place on comprehensive experience dimensions such as system, interaction perception, and processor CPU performance.

In the industry, self-developed technologies like chips and operating systems are often seen as symbols of high-end status.

For instance, Huawei, with its Kirin chip and native HarmonyOS operating system, led China's high-end phone market with ultra-high annual growth rates. Xiaomi also announced its self-developed mobile SoC chip, "Xuanjie O1," to be released in late May.

"Customized self-developed chips allow vendors to embed their understanding of users and scenarios, algorithms, etc., into the chip, enabling better integration of algorithms with the entire chip architecture and higher computing efficiency," said Li Jie, president of OnePlus.

An overlooked fact is that OPPO once abandoned its chip development efforts and the Hangzhou R&D center project. As a result, while OPPO's current flagship models offer impressive features, they do not fully align with OPPO's high-end ambitions, as evidenced by market share rankings.

Breaking through the high-end mindset is OPPO's second major challenge.

On one hand, through technology upgrades and substantial resource investments, OPPO has demonstrated good momentum in catching up. Coupled with its past brand building, high-end users' overall recognition of its brand has increased. On the other hand, it's not easy for OPPO to compete for market share among the existing core user groups of more competitors and establish deep emotional connections and user loyalty. After all, phone brands have formed relatively solid fan bases.

Some phone manufacturers have also cultivated long-term and solid brand perceptions of "high-end exclusivity" and "classic value preservation" through high-end new energy vehicles and a full-scenario ecosystem encompassing wearables, tablets, and PCs.

High-end products recognized by users are not merely about high prices; they often also focus on the product's premium level in the secondary market and whether the brand leads trends and offers a diverse product mix. The stronger a brand's ecological capabilities, the more solid its "high-end" image becomes, and the more pronounced its degree of recognition and competitive advantage in the market.

Overall, OPPO still has significant room for improvement in shaping the high-end mindset of consumers. The underlying logic is that high-end phone users value a brand's industry position and overall image when choosing a phone.

A high-end market position represents both a phone manufacturer's brand image and tests its retail channel capabilities.

Currently, the offline market still accounts for nearly 60% of the smartphone industry. Manufacturers like Huawei, Xiaomi, Honor, and OPPO have invested heavily in building offline customer retail capabilities, particularly for flagship stores and brand experience stores. These positions represent the brand image of the manufacturer and provide a more comfortable purchase and experience scenario compared to traditional operator channels.

From relying on traditional sinking channels to actively building high-end brand stores, OPPO has placed greater emphasis on the construction of offline brand positions. Data shows that OPPO opened 2000 Mall stores last year.

This will strongly support OPPO's sales of high-end flagship models, but OPPO's supply of high-end positions in some third- and fourth-tier cities is still slightly insufficient. Therefore, promoting the construction of more experience stores in these markets will be crucial for OPPO to achieve greater sales volume of ultra-high-end products.

III. Can AI Spark a New High-End Revolution?

Besides maintaining established breakthroughs in commercial competition, such as branding and retail, AI is also an unavoidable topic.

2024 is known as the first year of AI phones. The vice president of IDC China once stated that by 2028, new-generation AI phones are expected to account for over 80% of the market in China. Amid this AI trend, almost every vendor is making strategic moves.

OPPO is no exception. For instance, the OPPO Find X8 series introduces the AI One-Click Flash Note function, and "Xiaobu Memory" can be seen as a "savior for forgetfulness," showcasing OPPO's technological exploration in creating AI phones.

Currently, there is no universally accepted definition for AI phones in the industry, but core consensuses are emerging: AI phones must possess features like large client-side models, computing power, system and AI integration, and scenario-based active services.

One of the main technical directions of AI phones currently is to implant large models or AI agents in phones to form synergy between the client side and the cloud, thereby providing consumers with numerous AI invocation services in areas like office work and photography. As for the forms future AI intelligent terminal products will take and whether they must be phones, there is no definitive conclusion.

However, a survey of 10,000 global consumers by the GSMA Intelligence Unit revealed that 51% of respondents believed that "current AI phones are just an additional voice assistant," and only 12% of users could accurately distinguish between the technical differences between device-side AI and cloud-side AI. As some observers have noted: "When all vendors are touting AI, the real competition will return to the most basic user experience."

Currently, some vendors have announced AI strategies. While OPPO has invested and explored AI technology for a long time, it must also consider how to take the lead and build sufficiently strong AI product capabilities to offer consumers the most valuable and unique experience. Only by possessing more unique and differentiated AI capabilities can a brand gain the favor of more users.

It's vital to be vigilant that this AI revolution seems more like a vision for the future, while changes in China's smartphone market competitive landscape are happening daily. Distant water cannot put out a near fire. While focusing on AI, phone manufacturers must also attend to the present.

Liu Bo, the former president of OPPO China, once said, "OPPO recently determined several internal directions: isolate external forces, stay focused, go deep into the front line, and create value. I believe this is a manifestation of OPPO's culture of doing one's duty. Regardless of the environment, we must bravely move forward."

In its pursuit of the high-end market, OPPO's culture of duty will go hand in hand with its upward and enterprising philosophy. OPPO, which has already made initial achievements, will receive market feedback on how far it can go in the high-end market in the future.