Apple's Foldable Screen: Samsung's Exclusive Supply

![]() 06/25 2025

06/25 2025

![]() 868

868

Source: Byte Source

Apple has recently made a significant announcement. According to Apple analyst Ming-Chi Kuo, Apple supplier Hon Hai Precision Industry (Foxconn) is anticipated to commence production of Apple's foldable screen phone by the end of the third quarter (September) or the beginning of the fourth quarter (October) of this year. The device is expected to be officially unveiled alongside the iPhone 18 series in the fall of 2026.

Notably, Samsung has secured an exclusive deal to provide the OLED panel for Apple's first foldable screen phone. Consequently, the procurement price per unit is expected to reach approximately RMB 1,000, significantly benefiting Samsung.

However, what's even more remarkable is that while Samsung serves as a key supplier to Apple and wins significant orders, it also maintains a firm lead in the foldable screen market with a global market share of 35% last year. This dual role of "supplying Apple while competing for its market" allows Samsung to unleash its full potential in this competitive landscape.

Apple's foldable screen strategy has been inherently challenging from the outset: heavy reliance on competitors' core technologies, a potential price tag exceeding USD 2,000, and high supply chain risks, making it akin to a high-stakes gamble. Meanwhile, Samsung comfortably earns substantial profits through the supply chain while continuously leveraging its market advantages to suppress competitors.

Behind this dynamic lies the most intricate and tense "competitive cooperation relationship" in the consumer electronics industry. Apple cannot do without Samsung's technical support, while Samsung also requires Apple's substantial orders to solidify its leading position in the display business. However, the fierce competition between the two in the terminal market persists. The landscape of the foldable screen market may undergo significant changes due to Apple's entry, but the ultimate victor remains uncertain.

01

Samsung's Dual Strategy

The relationship between Samsung and Apple is undoubtedly the most complex and fascinating "competitive cooperation example" in the tech world. Samsung not only plays a crucial role in Apple's supply chain but also poses a direct threat in the terminal market.

This dual nature is clearly illustrated by this major development: Samsung Display has secured an exclusive deal to supply the OLED panel for Apple's first foldable screen phone, significantly boosting Samsung's display business.

However, Samsung Display's technological monopoly poses a strategic constraint on Apple. According to supply chain sources, the OLED panels Samsung provides to Apple utilize the latest technology, which has not even been mass-produced for Samsung's own Z Fold6.

While this "technological generation gap" ensures that Apple's foldable screen products have a certain advantage in display effects, it also means that Apple will find it difficult to reduce its high dependence on Samsung in the short term.

Nonetheless, while Apple's product is still in the planning stage, Samsung's Galaxy Z Fold6 has achieved a significant lead with its self-developed hinge technology. This "two-front strategy" of extending technological advantages from the upstream supply chain to the terminal market serves as an industry model.

Image: Samsung Galaxy Z Fold6 | Source: Samsung Official Mall

As a long-standing player in the "full industrial chain," Samsung has demonstrated remarkable operational wisdom in balancing supply chain profits and market competition. According to supply chain calculations, Apple's orders can reduce the R&D cost of Samsung's UTG technology for a single screen by 35% and generate an annual revenue increase of approximately USD 1.5 billion. Furthermore, Apple's reliance on Samsung's display technology for its first foldable screen not only ensures cash flow but also enhances Samsung's influence in setting OLED technology standards, forming a closed loop of "technology output - profit feedback to R&D - consolidation of technological barriers."

For Apple, its long-standing strategy of supply chain diversification faces severe challenges in the foldable screen sector. BOE and LG Display have been considered potential alternative suppliers, but both lag behind Samsung in terms of technology. Samsung has reportedly created the thinnest foldable OLED panel in its history.

More crucially, Samsung holds numerous patents related to foldable screens worldwide, objectively limiting Apple's options for alternative routes. Since 2001, Samsung has been filing patent applications related to foldable screens and has accelerated its pace since 2013. As of August 2019, Samsung had disclosed 142 patent applications in the Derwent database, including 56 in China.

Some analysts suggest that Apple might exchange larger-scale purchases (15 to 20 million units) for deeper technical support from Samsung, but this strategy would undoubtedly further strengthen Samsung's influence on both ends of the supply chain and the market.

Behind this dynamic lies a subtle reshaping of the power structure in the consumer electronics industry. Samsung leverages supply chain profits to support competition in the terminal market, while Apple finds itself in the paradox of "having to rely on its rival while also trying to defeat it."

02

High Prices, Dependence, and a Tight Timeframe

Apple's foldable screen strategy is facing multiple structural dilemmas: market acceptance of high pricing, practical bottlenecks in supply chain diversification, and the urgency of the time window. These core issues will directly determine Apple's ability to gain a firm foothold in the foldable screen market.

Firstly, Apple's high pricing strategy, a cornerstone of its brand positioning, may face new tests in the foldable screen sector. Rumors suggest that the pricing of Apple's foldable screen may exceed USD 2,000, significantly higher than Samsung's Galaxy Z Fold6 at USD 1,800.

Although this price range targets the ultra-high-end market, the penetration rate of foldable screens has yet to reach a critical point for explosion. Analyst Ming-Chi Kuo predicts that Apple's first-year production volume will be lower than that of regular iPhone models. Thus, whether the market can effectively digest this high pricing strategy is the primary challenge faced by Apple.

Secondly, supply chain diversification is a long-term strategic cornerstone for Apple, but it seems inadequate in the foldable screen sector. As of 2025, Samsung still holds approximately 50% of the market share in the OLED screen sector, particularly in the high-end market.

While Hon Hai Precision has initiated mass production plans, key components such as hinge solutions have not been finalized. More concerningly, the yield rate at Lens Technology's Vietnam base (5-8 percentage points lower than in China) and cost control capabilities have yet to be tested by large-scale mass production, falling short of Samsung's process level. This heavy dependence on a single supplier not only increases costs and risks but may also potentially affect the product's release schedule and final quality.

Finally, the urgency of the time window further exacerbates Apple's dilemma. Apple originally planned to launch the foldable iPhone in the fall of 2026, but the mass production of its own MicroLED technology is still far off.

Missing this opportunity could mean that the foldable screen market may already be largely divided up by "veterans" such as Samsung and Huawei. By then, it will be significantly more difficult for Apple to enter the market.

Therefore, Apple's foldable screen strategy is akin to a high-stakes gamble fought to the last. The high pricing strategy tests market patience, supply chain dependence exposes technical shortcomings, and the time window compresses the space for trial and error to the extreme. In this game, whether Apple can break through the siege will directly determine its success or failure in the foldable screen market and even impact its future position in the tech circle.

03

Asymmetric Competition and Ecological Barriers

Competition in the foldable screen market has long surpassed simple price wars or technological arms races, evolving into a complex game of multidimensional and asymmetric competition.

The pricing strategies of the Android camp, the rise of Huawei, and the increasingly strengthened ecological collaboration barriers are pushing this game to a deeper level.

The average price of Android foldable screen phones has dropped by 18% annually, and the speed of this market reshuffle is far faster than anticipated. This price war has squeezed profit margins to the brink. An IDC report indicates that the average price of foldable screen phones in China was RMB 8,500 in 2024, but R&D and supply chain costs accounted for over 60%, leading to increased losses for small and medium-sized brands.

More importantly, the price war has also pressured upstream supply chain manufacturers to the point of crisis. The capacity utilization rate of panel factories has continued to decline. According to Korean media Businesskorea, Chinese LCD panel manufacturers are collectively reducing factory capacity utilization, a move expected to have a significant impact on the global LCD panel and supply chain.

Apple's high pricing strategy stands out in this context but also reflects its structural constraints - it cannot quickly spread costs through economies of scale to participate in price competition like Android vendors.

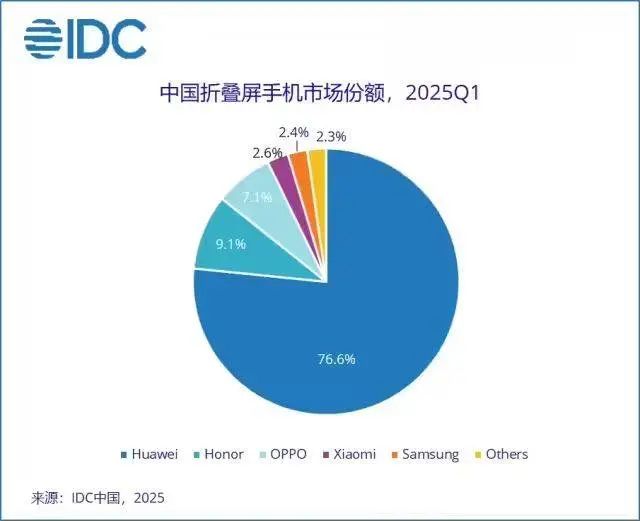

According to IDC data, Huawei's market share in the domestic foldable screen market has exceeded 70% in the first quarter of this year, making it Apple's biggest competitor upon entering the market. Huawei not only rivals Samsung in product capabilities but also firmly occupies the domestic mid-to-high-end market through localized ecology and channel advantages. For Apple's foldable screen to successfully break through, it must challenge Huawei's dominant position.

Image Source: IDC

Ecological synergy is becoming an invisible watershed in the foldable screen market. The number of exclusive foldable screen applications in the Android camp is several times that of Apple's iOS, indicating that developers are more inclined to invest resources in Android's open ecosystem. This software barrier is being simultaneously raised, while Apple's closed ecosystem has yet to demonstrate sufficient attractiveness in this new form factor of foldable screens.

Even more remarkably, Samsung is relying on Apple's large orders for foldable screens to revive its own declining business. This complex competitive cooperation relationship of "transfusing blood with one hand and fighting with the other" makes the entire industry game even more perplexing. According to Samsung's fourth-quarter 2024 financial report, the company's operating profit for the quarter was KRW 6.5 trillion (approximately RMB 33.4 billion), lower than analyst expectations, and revenue was KRW 75 trillion (approximately RMB 386.2 billion), also lower than market expectations.

In this intense multidimensional and asymmetric competition, every step Apple takes is akin to walking on a tightrope. High prices, supply chain dependence, and ecological shortcomings - each link could become a fatal weakness. The constant pressure from the Android camp and Huawei poses unprecedented challenges to Apple's foldable screen strategy.