New Energy Vehicle Market Mid-Year Review: BYD's Dominance, New Entrants Reshuffle, and Elevated Sales Targets

![]() 07/04 2025

07/04 2025

![]() 689

689

As July dawns, the automotive market has reached unprecedented heights. Over the past two days, automakers have unveiled their June sales figures, simultaneously revealing the results of the 2025 first-half "mid-term exam."

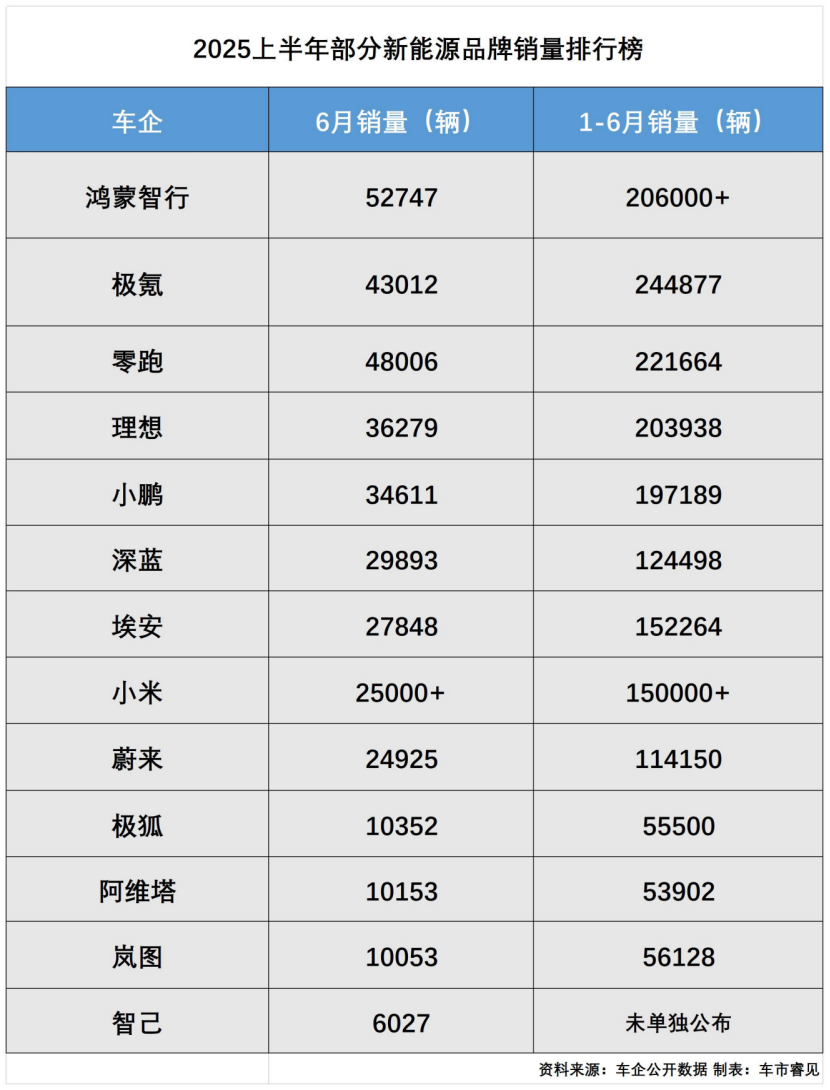

June, a pivotal mid-year milestone, serves both as the "finale" for first-half sales and the "barometer" for the second-half market trend. June's data reveals a stark divergence in sales performance among mainstream automakers: BYD sold over 380,000 vehicles, solidifying its position as the global leader in new energy vehicle sales; traditional automakers like Geely and GAC Aion are accelerating their transformation, while the new entrant camp experiences a divergence with NIO leading and Lixiang under pressure; and the entry of cross-border players like Xiaomi has injected further variables into the market.

Behind these numbers lies not only the growing acceptance of new energy vehicles by consumers. According to the China Association of Automobile Manufacturers, individual purchases of new energy vehicles accounted for over 80% of sales in the first half of 2025, a 15-percentage-point increase from 2023. However, these figures also expose underlying industry contradictions. With subsidy cuts, raw material price fluctuations, and intensifying international competition, how can automakers transition from "scale expansion" to "quality victory"?

▍Head Effect Intensifies, New Entrant Camp Divides

BYD's "dominance" has once again redefined industry perceptions, with 382,600 vehicles sold in June alone, a 11.98% year-on-year increase; cumulative sales in the first half reached 2.146 million vehicles, a 33.04% year-on-year increase, accounting for nearly 30% of the global new energy vehicle market share. Its success stems from three key factors: Firstly, its technological moat, with continuous iterations of Blade Battery and DM-i hybrid technology, covering models across the full price range of 100,000 to 1 million yuan, and the accelerated implementation of intelligent features that empower the brand. Secondly, accelerated globalization, with overseas sales of 470,000 vehicles in the first half, a 229.8% year-on-year increase, and the commissioning of the Brazil plant boosting local penetration. Thirdly, supply chain autonomy, with self-developed battery installation capacity reaching 134.5GWh, overwhelming competitors in cost control.

The new entrant camp is experiencing a "rift," with NIO emerging as the top dark horse, having been the sales champion for four consecutive months: delivering 48,006 vehicles in June, a 138.65% year-on-year surge, and accumulating 221,700 vehicles in the first half, 44% of its annual target. Its success hinges on the "high cost-performance + precise iteration" strategy: the B01 sedan, priced at 105,800-135,800 yuan for pre-sale, taps into the largest market segment; and the C16 facelift was delivered within 11 days of its launch, setting a new record for the iteration speed of new entrant products.

XPeng has made a comeback with the MONA series and P7+, delivering 34,611 vehicles in June, a 224% year-on-year increase, and accumulating 197,000 vehicles in the first half, surpassing last year's total. The volume model MONA M03 sold over 10,000 units in a single month, accounting for nearly 50% of the brand's total sales, validating the market potential of 150,000-yuan intelligent sedans.

In contrast, Lixiang and Zeekr are caught in a growth bottleneck. Lixiang delivered 36,279 vehicles in June, a 24.06% year-on-year decrease, and completed only 29% of its annual target of 700,000 vehicles in the first half. Its extended-range technology advantage is being squeezed by pure electric competitors, and it urgently needs the pure electric SUV i8, which will be launched in July, to reverse the downturn.

Notably, Lixiang Auto recently announced on the Hong Kong Stock Exchange that it expects to deliver approximately 108,000 vehicles in the second quarter of this year, down from the previously announced delivery outlook of 123,000-128,000 vehicles. Judging from the overall performance in the second quarter, 33,900 vehicles were delivered in April, 40,900 in May, and over 25,100 in the first three weeks of June, a decline from May. This may also be a significant reason for Lixiang Auto to adjust its delivery outlook. For the second half of the year, the upcoming Lixiang i8 in July and Lixiang i9 in September undoubtedly bear the heavy responsibility of driving sales.

Zeekr delivered 16,702 vehicles, a 16.93% year-on-year decrease, showing initial signs of fatigue in the high-end pure electric market. Xiaomi delivered over 25,000 vehicles in June, with its first model, the YU7, becoming an instant hit upon launch, with orders exceeding 280,000 within 48 hours, and capacity pressure becoming a key challenge.

Traditional automakers are also accelerating their transformation. Geely's new energy matrix (Yinhe + Zeekr + Lynk & Co) sold 725,200 vehicles in the first half, a 126% year-on-year surge, accounting for 52% of the group's total sales in June. Consequently, Geely Group has also raised its official sales target. In 2024, Geely's total sales were 2.17 million vehicles, and the original target for 2025 was 2.71 million vehicles, equivalent to a year-on-year increase of 25%. Now Geely has raised its full-year sales target to 3 million vehicles, an increase of about 11% from the original sales target, equivalent to a growth of about 38% compared to 2024 sales.

Chery New Energy ranks third with monthly sales of 71,600 vehicles, with exports accounting for over 40%. SAIC-GM-Wuling sold 70,357 new energy vehicles in a single month, a 73.8% year-on-year increase, with the Hongguang MINIEV family contributing the main force, validating the explosive potential of the sinking market.

▍Policy Subsidies Decline, Technological Competition Intensifies, Globalization Breakthrough

Policy incentives have entered the "targeted regulation" stage. In the first half of 2025, the trade-in policy became the core driving force: by the end of May, the number of subsidy applications nationwide reached 4.12 million, and some cities suspended applications, triggering a "last train effect." However, policies in the second half will shift to refined deployment: adjusting the subsidy rhythm, with the National Development and Reform Commission planning to allocate the third batch of trade-in funds in July and formulate monthly usage plans to avoid concentrated demand overdrafts; expanding the B-end market, with GAC Aion announcing the independent operation of its taxi business and the Haobo brand focusing on the high-end market to address the saturation of online car-hailing demand; and local subsidy withdrawal, with Shenzhen, Shanghai, and other places reducing vehicle purchase subsidies, causing sales pressure on models priced above 200,000 yuan, with Lixiang and NIO bearing the brunt.

Technological competition is intensifying, with automakers betting on next-generation technologies to build barriers: high-voltage fast charging and ultra-fast charging networks, with the Ideal i8 and XPeng G7 both equipped with 800V high-voltage platforms, and NIO adding 13,659 charging piles, ranking first in self-built charging volume in the industry; the intelligent driving arms race, with Avatar and Huawei's cooperative model ADS 3.0 system delivering over 150,000 vehicles, with an average selling price of 270,000 yuan, validating the premium ability of high-level intelligent driving; and the debate between extended-range and pure electric routes has become the differentiated strategies of automakers.

Globalization breakthrough has become the second growth curve, with Chinese automakers shifting from "probing" to "offensive" in overseas markets: localized production (BYD's Brazil plant with an annual capacity of 150,000 vehicles, and the Thailand base serving ASEAN; Great Wall sold 160,000 vehicles overseas in the first half, with a market share of 37% in Russia), high-end breakthroughs (NIO's Ledo brand entering Germany with over 6,400 orders in the first month; Zeekr's 9X technology will be equipped with CATL's Shenxing battery, directly targeting the European pure electric market), and industrial chain spillover (Guoxuan High-Tech and EVE Energy building factories in Europe to support automakers' local supply and avoid the risk of EU carbon tariffs).

The 2025 new energy vehicle market's "mid-year exam" is not only a highlight moment for BYD and others but also a warning signal for temporary losers. As the marginal effect of price wars diminishes, the true competition will return to its essence: whether it is possible to reduce user costs through technological innovation, solve real needs through scenario-based products, and explore incremental space with a global vision. BOCOM International stated that multiple hybrid models will be launched in the domestic auto market in the second half of the year, and the full-year new energy penetration rate is expected to reach 55%. The price of models equipped with high-speed NOA may fall below 200,000 yuan, and competition in the auto market may intensify. With the intensive launch of more than 30 new models such as Xiaomi YU7 and Lixiang i8, as well as the precise deployment of the country's third batch of trade-in funds, the market may also usher in a new round of reshuffling.

Typesetting by Yang Shuo | Image Source: Shutterstock