European Auto Market | UK 1st Half of 2025: MG and BYD Shine

![]() 07/08 2025

07/08 2025

![]() 560

560

In June 2025, the UK auto market sustained its recovery trajectory, posting a year-on-year growth of 6.7%, marking the best performance for that period since the pandemic.

The surge in EV sales emerged as the predominant narrative, with pure electric vehicles accounting for nearly a quarter of the market, and plug-in hybrids also witnessing a notable uptick.

At the brand level, Volkswagen maintained its lead, while Hyundai soared to a record-high fourth position. Chinese brands BYD and Jetour maintained their momentum, registering substantial year-on-year sales increases.

01

Sales Overview and Powertrain Structure Transformation

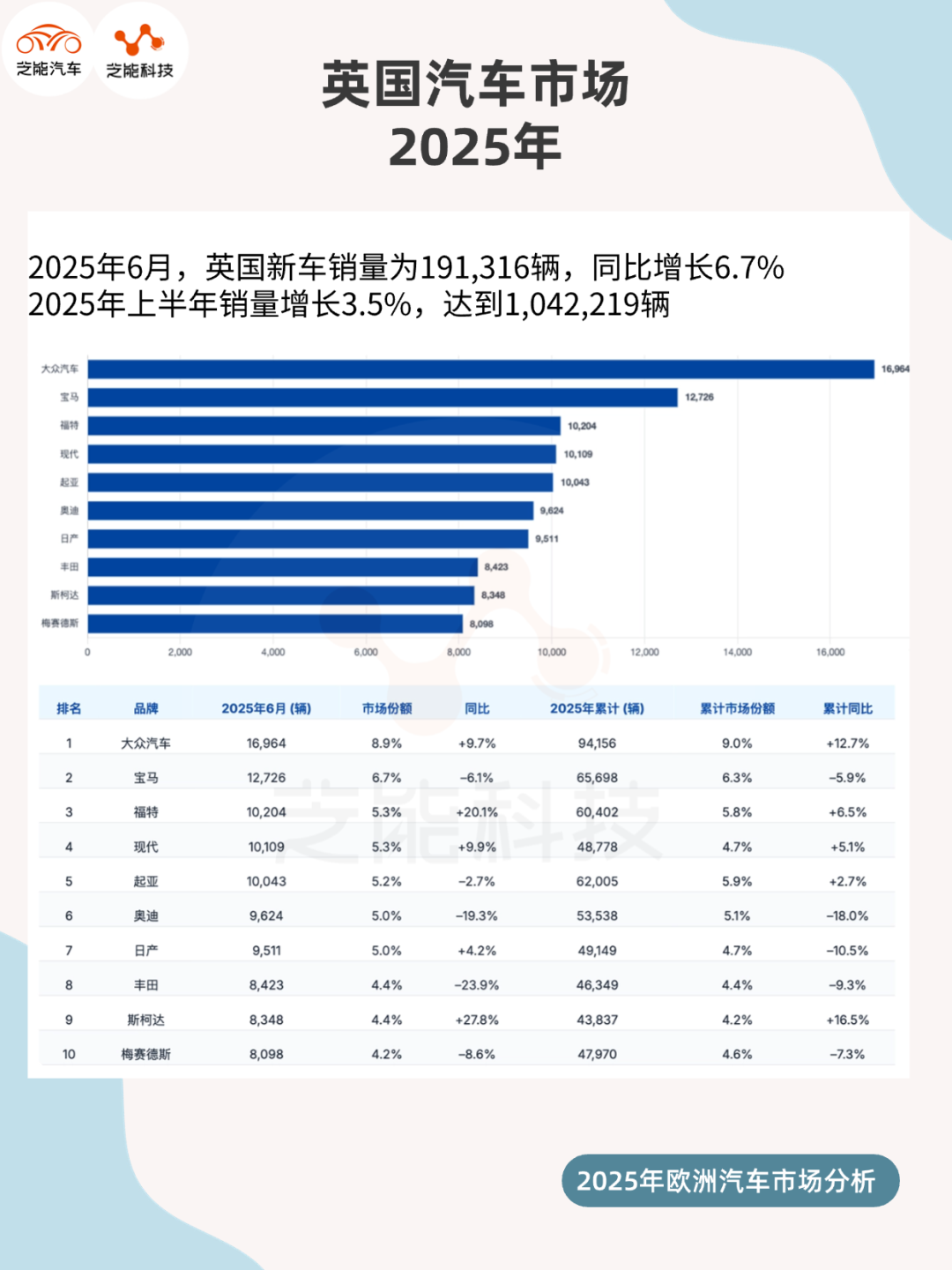

In June 2025, new car registrations in the UK totaled 191,316, a 6.7% year-on-year increase, marking the best June performance since pre-pandemic times in 2019.

Cumulative sales for the first half of 2025 reached 1,042,219 vehicles, up 3.5% from the same period in 2024, reflecting the resilience of the UK auto consumer market amidst high interest rates and economic uncertainty.

From the Perspective of Sales Channels

◎ Private car purchases accounted for 37.4%, marginally lower than 37.7% in the same period last year.

◎ Lease fleet sales increased by 8.5%, comprising 60% of the market and remaining the primary driver of market growth.

◎ Business car purchases declined by 15.8%, accounting for just 2.5% of the market.

From the perspective of powertrain structure, the trend towards electrification is increasingly evident:

◎ Sales of pure electric vehicles (BEV) reached 47,354 in June, a 39.1% year-on-year increase, with market share rising from 19% last year to 24.8%.

◎ Plug-in hybrid vehicles (PHEV) increased by 28.8% to 21,382 units, accounting for 11.2% of the market.

◎ Hybrid vehicle sales (HEV) declined by 8.5% to 23,835 units, representing 12.5% of the market.

In contrast, traditional internal combustion engine vehicles continue to decline:

◎ Gasoline car sales fell by 4.2% to 88,029 units, with market share dropping to 46%.

◎ Diesel car sales remained relatively flat, with only a 0.2% increase, accounting for 5.6% of the market.

From the Brand Rankings

◎ Volkswagen retained its top spot with an 8.9% market share, leading for 25 consecutive months.

◎ BMW slipped slightly but held onto second place.

◎ Ford grew by 20.1% to claim third place.

◎ The Korean brand Hyundai made a significant impression, entering the UK top four for the first time, overtaking Kia, which declined by 2.7%.

◎ Škoda saw substantial growth of 27.8%.

◎ Toyota, Audi, and Mercedes-Benz experienced notable declines.

At the Model Level

◎ Nissan Qashqai reclaimed the monthly sales crown with 5,008 units, topping the charts for the first time since March 2024.

◎ Ford Puma and Tesla Model Y ranked second and third, respectively.

◎ Additionally, Vauxhall Corsa, MG HS, and Tesla Model 3 all made it into the top six, underscoring the growing appeal of electric vehicles and locally manufactured products.

02

Rise of Chinese Brands and Market Layout

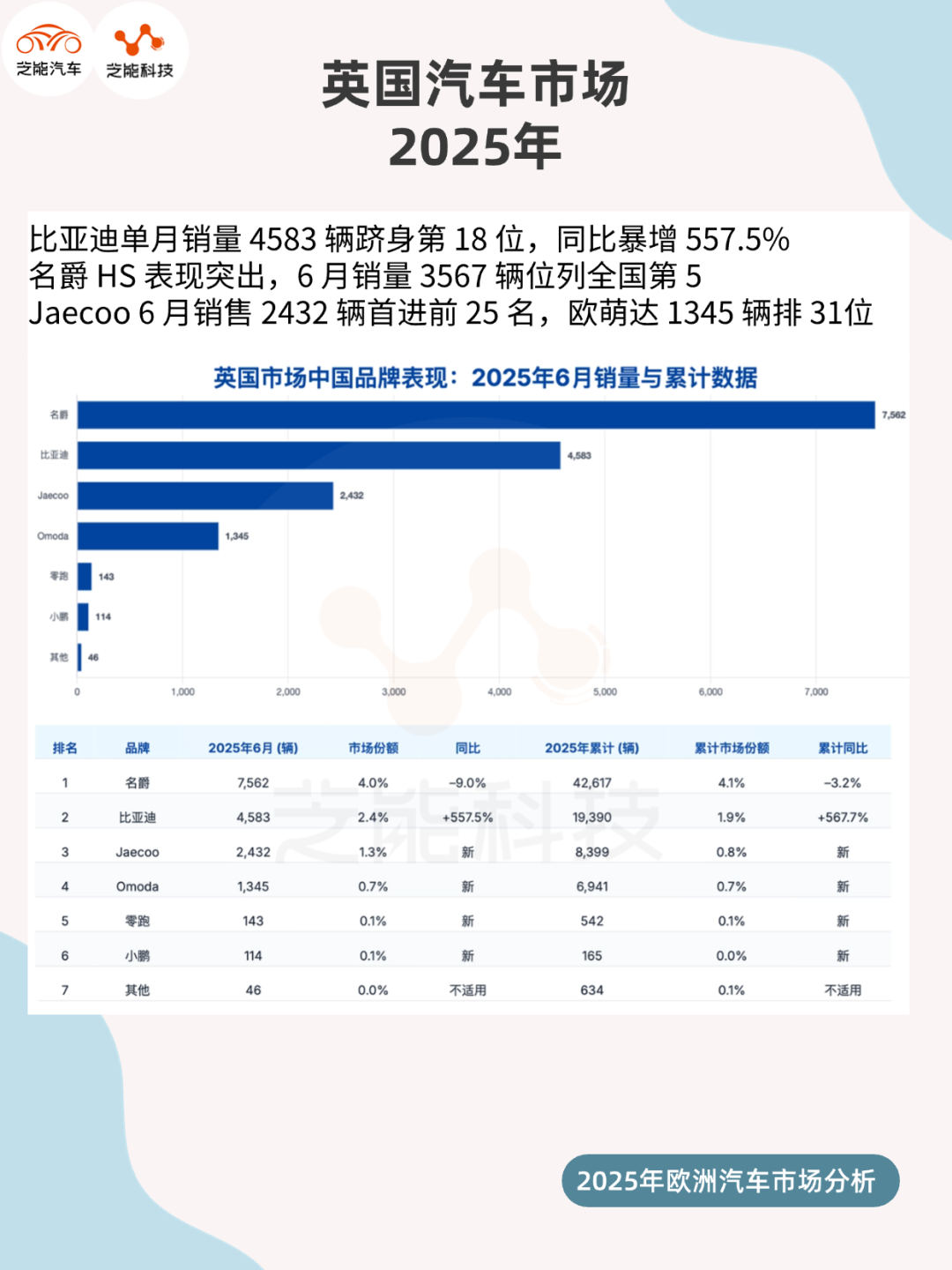

The influence of Chinese auto brands in the UK market is rapidly expanding. BYD ranked 18th with monthly sales of 4,583 units, a year-on-year surge of 557.5%, the highest growth rate among all brands. Cumulative sales for the first half of 2025 reached 19,390 units, up 567.7% year-on-year, enabling BYD to gradually establish a strong presence in the UK's new energy vehicle market.

In terms of models:

◎ MG HS was the standout Chinese model, with sales of 3,567 units in June, ranking fifth nationally. With cumulative sales of 16,115 units for the year, it ranked among the top ten. As an early entrant into the UK market, MG has built a solid reputation locally by introducing relatively mature hybrid and electric models in recent years.

◎ Jaecoo, a rapidly growing brand, sold 2,432 units in June, entering the UK market's top 25 for the first time and becoming the year's best-performing newcomer.

◎ Omoda also ranked 31st with 1,345 units, gradually establishing a market presence.

◎ Emerging brands such as Zeekr, XPeng, and Leapmotor have also begun testing the UK market. In the electric SUV segment priced between £20,000 and £30,000, Chinese brands offer significant competitiveness in terms of configuration, range, and intelligence.

The primary advantages of Chinese brands in the UK lie in their high level of product intelligence, robust cost control, and swift response times. Chinese companies continue to strengthen their capabilities in right-hand drive adaptation and local sales and service network construction, gradually overcoming past hurdles related to user trust and service.

Summary

The UK auto market in June 2025 demonstrated three major trends: rapid electric vehicle penetration, the strong emergence of Chinese brands, and localization capabilities becoming the core of competition. Chinese companies, represented by BYD and MG, have already achieved sales breakthroughs. For Chinese brands, the UK is just one stop on their expansive overseas market strategy.