Leapmotor Achieves Mid-Term Profitability: Industry Changes and Challenges Behind the Second NEV Startup's Profit Milestone

![]() 08/28 2025

08/28 2025

![]() 579

579

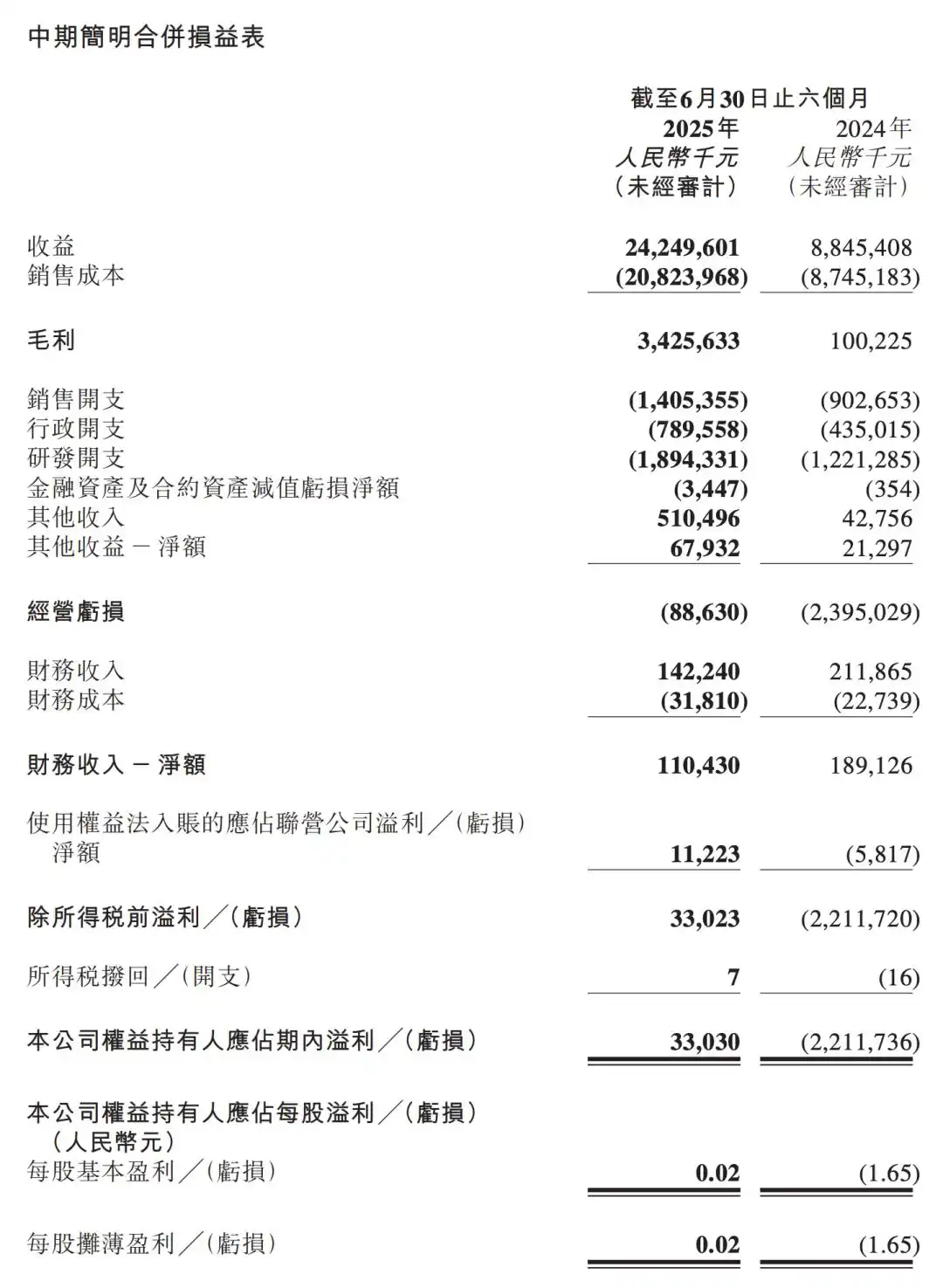

Recently, Leapmotor officially released its mid-year 2025 financial results, becoming the first new-energy vehicle (NEV) startup to do so and attracting significant attention in the industry. According to the financial report, Leapmotor generated revenue of RMB 24.25 billion in the first half of the year, marking a year-on-year increase of 174.1% from RMB 8.845 billion in the same period last year. Notably, the company's net profit attributable to equity holders reached RMB 30 million in the first half of the year, a significant turnaround from the net loss of RMB 2.21 billion in the same period last year. This achievement positions Leapmotor as the second Chinese NEV startup, after Lixiang One, to attain semi-annual profitability.

Moreover, Leapmotor's gross margin witnessed a substantial increase from 1.1% in the same period last year to 14.1%, indicating significant progress in cost control and operational efficiency.

The revenue growth was primarily fueled by an upsurge in vehicle and spare parts deliveries, augmented income from strategic partnerships and carbon credit trading, and improved related service income driven by increased vehicle sales. These data not only signify a major breakthrough in Leapmotor's own development but also reflect the crucial transformation the Chinese NEV industry is undergoing, transitioning from high-speed growth to high-quality development.

▍From Survival Verification to Leading in Profitability

Leapmotor's mid-term profitability marks a shift for NEV startups from the "money-burning" stage of purely pursuing scale expansion to a sustainable profitability stage. Financial report data reveals that Leapmotor's revenue grew by 174% in the first half of the year, outpacing the 155.7% growth in sales volume. This divergence between revenue and sales volume growth indicates an improvement in revenue quality during the scale expansion process. Critically, the company's cost of sales only increased by 137.9%, significantly lower than revenue growth, reflecting the decline in unit costs brought about by economies of scale. This virtuous cycle of "revenue growth > sales volume growth > cost growth" underscores Leapmotor's ability to enhance its gross margin.

Leapmotor's profitability is intrinsically linked to its sales growth. Financial reports indicate that the company delivered a total of 221,664 vehicles in the first half of the year, with July deliveries setting a new high of 50,129 vehicles. Specifically, the C10 model surpassed global deliveries of 100,000 units within 13 months of its launch, with a monthly delivery peak exceeding 14,000 units; cumulative sales of the C11 reached 250,000 units; and the B10 model surpassed 10,000 units in its second month after launch, making it Leapmotor's fastest product to exceed 10,000 deliveries. This rapid sales expansion has yielded significant economies of scale, a key factor in the company's improved gross margin. Economies of scale not only reduce unit fixed costs but also enhance the company's bargaining power in the supply chain, facilitating further cost structure optimization.

Leapmotor's founder and chairman, Zhu Jiangming, predicts that the company will achieve stable break-even when annual sales reach 500,000 to 600,000 units. Li Tengfei, vice president of Leapmotor, stated that August sales will show a significant increase from July's 50,100 units, with third-quarter sales expected to be around 170,000 to 180,000 units. Full-year sales in 2025 are projected to reach 580,000 to 650,000 units, and the company aims to challenge the sales target of 1 million units in 2026. Clearly, Leapmotor is currently at a pivotal stage of crossing the profitability threshold.

The effectiveness of Leapmotor's full-scope self-research strategy is evident in the financial data. The company's self-research ratio for core components exceeds 65%, and this vertical integration model directly promotes cost control. In 2024, Leapmotor's gross profit per vehicle surged from approximately RMB 555 to RMB 9,163, an increase of 16 times. The further improvement in gross margin in the first half of 2025 indicates that this cost advantage is still expanding. Simultaneously, the implementation of the platform strategy has yielded significant benefits. The reuse of the same platform's chassis and electronic architecture not only shortens the new vehicle development cycle but also significantly reduces supplier quotes through increased procurement volumes of single components. Data shows that sales of Leapmotor's C-series models account for over 77% of total sales, and the optimization of the product mix has further enhanced overall profitability.

Leapmotor's profitability has also prompted the industry to reconsider the profitability model of NEV startups. From a financial structure perspective, among Leapmotor's revenue of RMB 24.25 billion in the first half of the year, net profit accounted for only 0.12%, indicating an extremely limited profit scale. Notably, the company's non-automotive business income totaled nearly RMB 1.1 billion. This means that excluding these non-operating incomes, Leapmotor's main business has not yet achieved true profitability. This profit structure highlights the dependence of NEV startups on non-operating incomes in the early stages of profitability and reveals the high profitability threshold in the NEV industry.

From an industry competition perspective, as leading companies successively achieve profitability, the industry will shift from incremental competition characterized by "wild growth" to stock competition marked by "intensive cultivation". While achieving profitability, Leapmotor is also continuously investing in research and development. Research and development expenditures reached RMB 1.89 billion in the first half of the year, an increase of 54.9% from RMB 1.22 billion in the first half of 2024, primarily used to increase investment in intelligent driving, with plans to achieve urban NOA combined assisted driving capability by the end of 2025.

The capital market has responded cautiously optimistically to Leapmotor's profitability. As of August 22, Leapmotor's share price on the Hong Kong stock exchange was HK$71.0, with a total market value of HK$94.925 billion, an increase from previous levels. Market analysis suggests that although the profit scale is small, this breakthrough creates a favorable window for Leapmotor to initiate refinancing in the Hong Kong stock market, which will help enhance its valuation and market recognition during refinancing. Compared to peers such as NIO and XPeng, which have not yet achieved stable profitability, Leapmotor's profit breakthrough undoubtedly grants it more discourse power in the capital market.

▍Sustainability of Profitability Faces Multiple Challenges

Despite achieving historic profitability, Leapmotor still faces numerous challenges in its future development, and the sustainability of profitability is tested by multiple factors. From a gross margin perspective, although Leapmotor's gross margin reached 14.1% in the first half of the year, a significant improvement from the same period last year, there is still a gap compared to industry leaders. Data shows that Tesla's gross margin was 17.2% in the second quarter of 2025, while BYD's gross margin reached 20.1% in the first quarter of 2025. This gap indicates that Leapmotor still has room for improvement in cost control and product premiumization.

More importantly, the improvement in gross margin is partially attributed to favorable changes in the external environment, such as the decline in power battery prices. According to data from Soochow Securities, the average price of CATL's power batteries was RMB 0.69/wh in the first half of 2025, down 13% year-on-year, and the average price of energy storage batteries was RMB 0.59/wh, down 20% year-on-year. The sustainability of this dividend brought about by the decline in raw material prices is uncertain. Once battery prices rebound, they will directly pressure Leapmotor's gross margin.

Intensifying market competition is another major challenge faced by Leapmotor. The current NEV market has shifted from a blue ocean to a red ocean, with price wars intensifying, and major automakers competing for market share through price reductions and promotions. Moreover, the company needs to continuously enhance product added value while maintaining price competitiveness; otherwise, profit margins may continue to be compressed. From a sales structure perspective, Leapmotor's main models are still mid-to-low-end. Increasing the proportion of high-end models, raising average product prices, and gross margins is a critical issue for the company.

Technical research and development pressures continue to mount. As the NEV industry shifts from "electrification" to "intelligentization", intelligent driving, smart cockpits, etc., have become new competitive focuses. Although Leapmotor has increased its investment in research and development, with R&D expenditures in the first half of the year increasing by 54.9% year-on-year, and the scale of its intelligent driving team and computing power resources increasing by nearly 100%, there is still a gap in technological accumulation and R&D strength compared to giants such as Tesla and Huawei.

The company aims to achieve urban NOA combined assisted driving capability by the end of 2025, but this goal faces technical bottlenecks and time pressure. Competition in the field of intelligentization requires not only continuous high investment but also a strong talent pool and ecosystem support, posing severe challenges for NEV startups like Leapmotor. Achieving technological breakthroughs with limited resources and establishing differentiated competitive advantages is a problem that Leapmotor must solve.

In addition to the domestic market, globalization is gradually becoming Leapmotor's second growth curve. According to official data, Leapmotor exported 25,000 new vehicles in the first seven months of 2025, firmly ranking first in NEV startups' "overseas" sales. As of the end of June, Leapmotor International had established over 600 sales and after-sales service outlets in about 30 international markets, including Europe, the Middle East, Africa, and the Asia-Pacific region, with over 550 outlets in Europe and nearly 50 in the Asia-Pacific region.

Leapmotor's case demonstrates that the profitability threshold in the NEV industry lies not only in breaking through sales volume scales but also in improving profit quality. For Leapmotor, achieving truly sustainable profitability requires not only meeting the sales target of 500,000 to 600,000 units but also optimizing its profit structure, enhancing the profitability of its main business, increasing investment in technological research and development, and building a stable ecological collaboration system. For the entire industry, Leapmotor's profitability brings both hope and a wake-up call – in the crucial stage of the NEV market's transformation from high-speed growth to high-quality development, only by balancing scale and profit, short-term and long-term, cost and technology can companies remain competitive for the long haul.

Typesetting | Yang Shuo

Image source: Leapmotor