Chengdu Auto Show Lacks Buzz as Electrification Wave 'Silences' Super Luxury Brands

![]() 08/28 2025

08/28 2025

![]() 488

488

This absence was not a sudden occurrence.

As the 2025 Chengdu Auto Show was about to illuminate its lights, this grand automotive event in western China quietly witnessed a dramatic shift in 'power dynamics'.

Once upon a time, the sleek bodies of Porsches, the handcrafted chrome grilles of Bentleys, and the iconic scissor doors of Lamborghinis gleamed brightly on exhibition stands, but now they have collectively vanished like the receding tide. A total of eight luxury brands were absent this year, with the super luxury segment suffering a 'group extinction', including foreign super luxury brands such as Porsche, Bentley, Lamborghini, Rolls-Royce, and Lotus. These star exhibits that previously ignited social media have now disappeared from the exhibition halls.

In their place were intelligent cockpit demonstrations of Xiaomi SU7, Red Flag L5's national trend design, Honda's electrification matrix, Xiaohongshu's cross-border creation of a 'mobile aesthetic space', and the giant battery modules displayed by CATL.

However, this absence was not a sudden phenomenon.

In fact, last year, Maserati's trident emblem and Infiniti's 'Breakthrough Aesthetics' had already departed early, and this year's events are merely a continuation of the domino effect. The luxury segment has shown even more cracks, with Lexus no longer bringing Japanese craftsmanship, Genesis canceling the Oriental interpretation of Korean luxury, and the British aristocratic aura of Jaguar Land Rover fading from the exhibition stand.

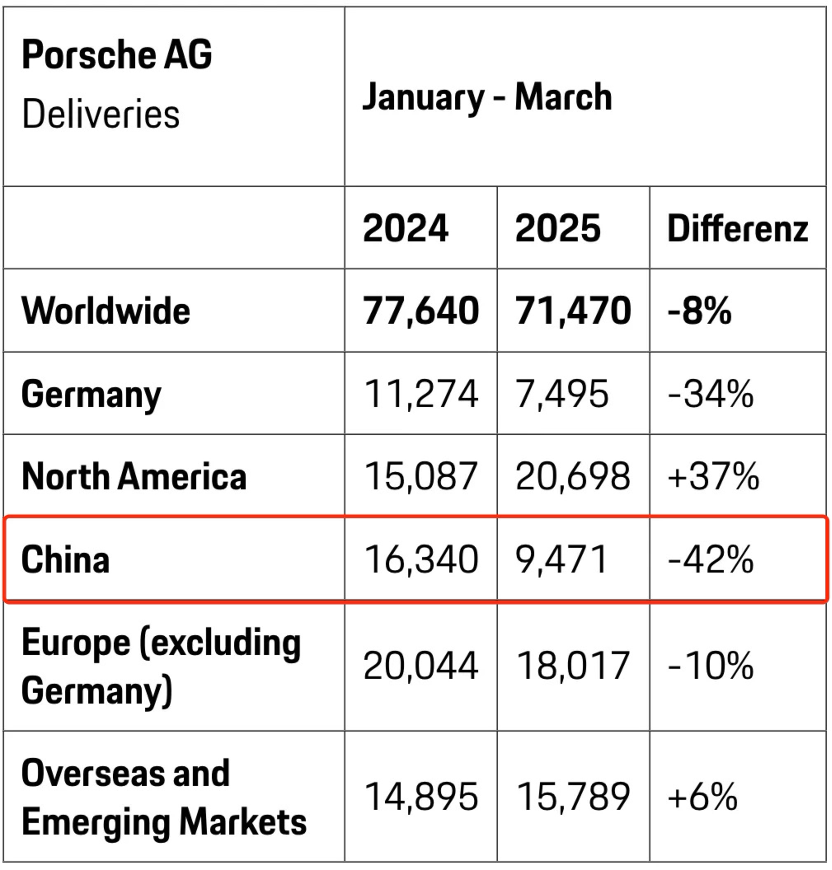

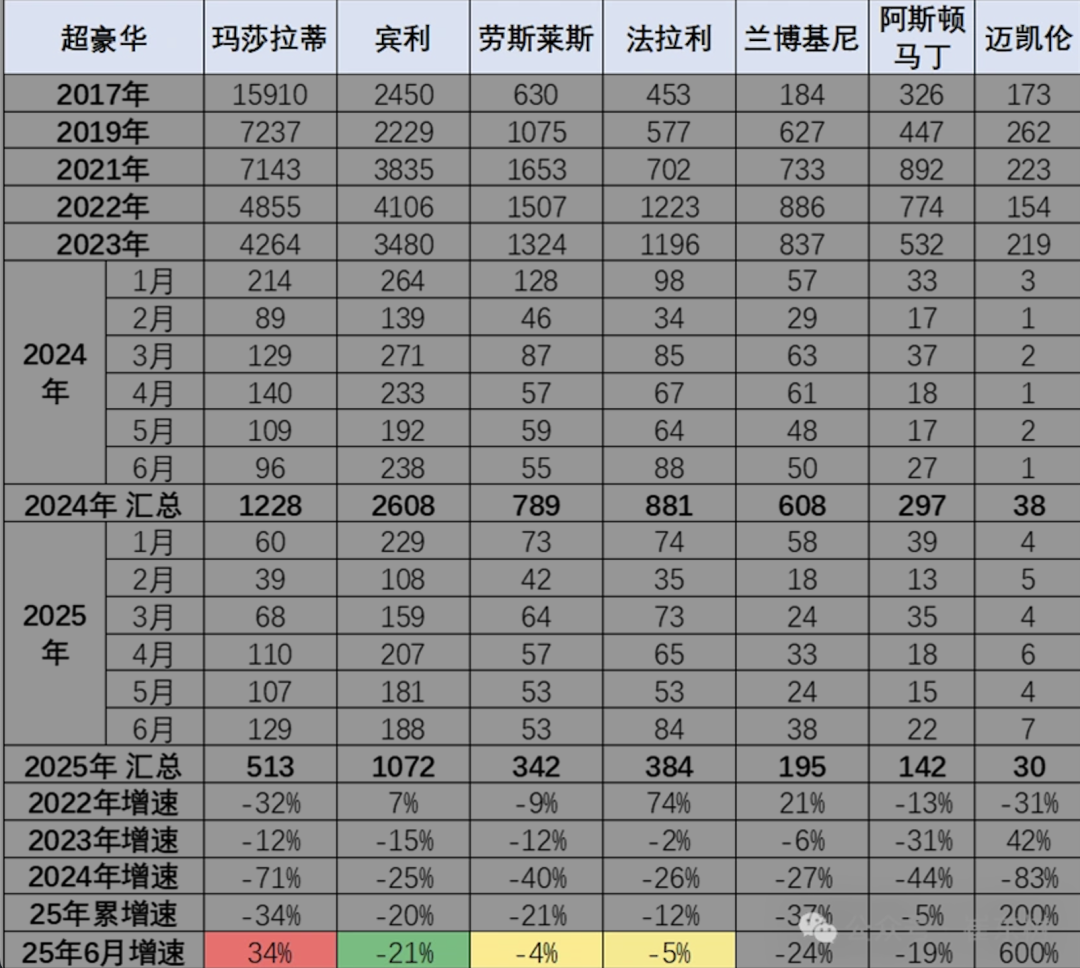

Cold data from the China Passenger Car Association (CPCA) provides a footnote to this transformation. Super luxury cars have experienced a significant decline since 2023, accelerating in 2024, with the decline continuing substantially from January to June 2025.

Simultaneously, traditional luxury cars are facing a strong offensive from independent brands, and their market share continues to erode. Data shows that in July this year, luxury car retail sales were 170,000 units, down 20% year-on-year and 29% month-on-month. The retail share of luxury brands in July was 9.3%, down 3 percentage points year-on-year.

Obviously, this is not merely a reflection of temporarily slowing consumer spending but also a typical symptom of the industry's disruption period. As waves of electrification and intelligence sweep in, the V12 engine roar and centuries-old craftsmanship that traditional luxury cars pride themselves on are being redefined by lidar configurations, AI voice assistants, and 800V ultra-fast charging technologies of emerging brands.

As a senior executive of a new force brand put it: 'Nowadays, wealthy individuals are more willing to pay for the 'evolvable' intelligent experience rather than static mechanical perfection.'

Market Trend Shift

Currently, China's super luxury car market sales continue to be under pressure.

Take Porsche as an example. For a long time, China has contributed one-third of Porsche's sales, reaching a peak of 95,000 units in 2021. Both the Cayenne and Macan sold around 30,000 units that year.

However, due to Porsche's decline in China, it not only relinquished the title of the largest single market for eight consecutive years. According to Porsche's 2024 financial report, the company's sales revenue in 2024 was approximately 40 billion euros, down 1.1% year-on-year; the company's net profit in 2024 was 3.6 billion euros, down 30.3% from the previous year. Porsche sold a total of 310,000 vehicles globally in 2024, a decrease of 3% year-on-year, with sales in the Chinese market declining by 28%.

This year, according to dealer information from Shanghai, Wuhan, and other places, the limited-time starting price of Maserati's SUV model Grecale was as low as 388,800 yuan. This is a direct reduction of more than 260,000 yuan compared to its official guidance price of 650,800-1,038,800 yuan, enough to buy a Xiaomi SU7.

Behind such a steep price reduction lies the brutal reality of a cliff-like drop in sales. The Stellantis Group's annual report shows that Maserati's sales in China in 2024 plummeted by over 90% compared to the peak in 2017. Additionally, according to CPCA data, Maserati's cumulative sales in China from January to May 2025 were only 384 units, a sharp decrease of 44% year-on-year.

Furthermore, Maserati China has changed its president three times in the past two years. The frequent personnel changes, to some extent, expose the strategic confusion of the Stellantis Group's senior management and their insufficient understanding of the Chinese automotive market.

Super luxury brand Aston Martin is also facing certain pressure on its sales in China. Relevant data shows that Aston Martin's wholesale sales in China declined by 49% in 2024 compared to 2023. Simultaneously, total debt reached £1.16 billion, an increase of 43% year-on-year.

Aston Martin CEO Andy Palmer previously stated: 'For us, in 2025, we will reshape our business in China while preparing for the business model and development in 2026 and beyond.'

However, Aston Martin also candidly stated: 'Although the Chinese market currently accounts for a negligible proportion of our total wholesale volume, it remains a long-term growth opportunity. We will continue to monitor the situation to assess potential medium-term growth opportunities.'

In addition to Porsche, Maserati, and Aston Martin, several super luxury brands, including Bentley, Rolls-Royce, and Ferrari, have all experienced declines in sales in China, with many brands seeing declines of over 40%.

Data from the Yiche Ranking shows that in China's passenger vehicle market in 2024, Bentley sold 2,706 units, down 20.44% year-on-year; Ferrari sold 889 units, down 25.11% year-on-year; and Rolls-Royce sold 812 units, down 38.48% year-on-year.

The increasingly stringent management of large-displacement models in China is also undermining the core competitiveness of super luxury brands.

On July 17 this year, the Ministry of Finance and the State Taxation Administration issued the 'Announcement on Adjusting the Consumption Tax Policy for Super Luxury Cars' (hereinafter referred to as the 'Announcement'). After the adjustment, the scope of taxation for super luxury cars includes 'passenger cars and medium and light commercial passenger vehicles with a retail price of 900,000 yuan (excluding VAT) and above for various power types (including pure electric, fuel cell, etc.).

According to data, in the first half of 2025, a total of 37,000 super luxury cars with a retail price of 1,017,000 yuan (new car price of 900,000 yuan, tax-inclusive invoicing price of 1,017,000 yuan, including VAT of 117,000 yuan at 13%) were sold, down 49% year-on-year.

In terms of power types, traditional fuel vehicles are still the absolute mainstay, with sales of 33,000 units, accounting for nearly 90%. In other words, the super luxury car market is still highly dependent on traditional fuel vehicle models, which are the main targets of policy adjustments. Industry insiders said, 'Most super luxury models happen to use large displacement as their core selling point, which puts super luxury brands under unprecedented policy pressure.'

On the other hand, due to the global economic downturn leading to a decline in consumer purchasing power, especially among high-net-worth individuals targeted by super luxury brands, 'consumer behavior has become more cautious, and the willingness to purchase non-essential items such as luxury cars has decreased.'

A 'New Racetrack' for Independent Brands

At a time when super luxury brands are 'losing color' in sales in China, independent brands are continuously launching a 'battle for the high-end' and accelerating their entry into the super luxury market.

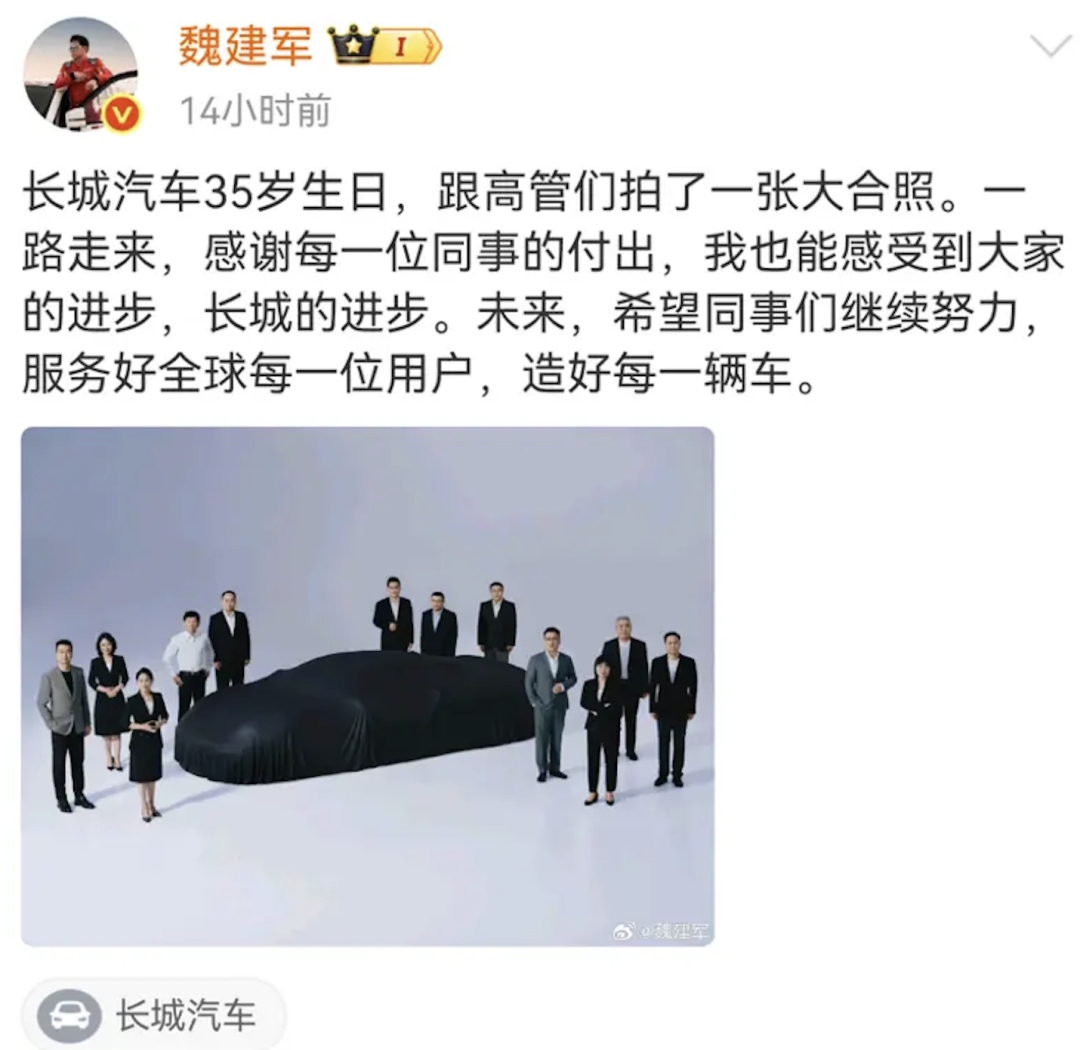

Recently, Wei Jianjun, chairman of Great Wall Motors, released a group photo of senior executives to celebrate the 35th anniversary of the establishment of Great Wall. In this photo, occupying the center position is a mysterious model covered with a black cloth. Subsequently, insiders from Great Wall Motors also confirmed to the outside world that the model 'appearing' in the photo is the supercar project being promoted.

This is not the first time news of Great Wall Motors making supercars has emerged. In January 2025, Great Wall Motors established the 'Great Wall Brand Super Luxury Car Business Group (BG)', with company chairman Wei Jianjun personally taking charge as the chairman of the new brand.

It is reported that the new brand will focus on new energy products such as hybrids, covering supercars, sedans, and other models. In February, Wei Jianjun drove a Ferrari SF90 and said in a live broadcast that 'senior executives taking turns to test drive benchmark cars is a long-term system.' In April, Wu Huixiao, chief technology officer of Great Wall Motors, revealed in an interview that the company had initiated the supercar project five years ago, with the goal of creating a supercar that can inspire the passion of drivers.

In addition, automotive industry media reported that Great Wall Motors has applied to register the 'Zixin Automobile' trademark, suspectedly in preparation for the launch of a new super luxury brand. However, this news has not been officially confirmed.

In recent years, independent brands have made significant efforts in the super luxury car segment, which has become a notable industry trend. Previously, several automakers have announced their entry into the million-yuan luxury car segment, such as BYD launching the Yangwang brand, with its U8 and U9 models priced above one million yuan, with the U9 priced as high as 1.68 million yuan.

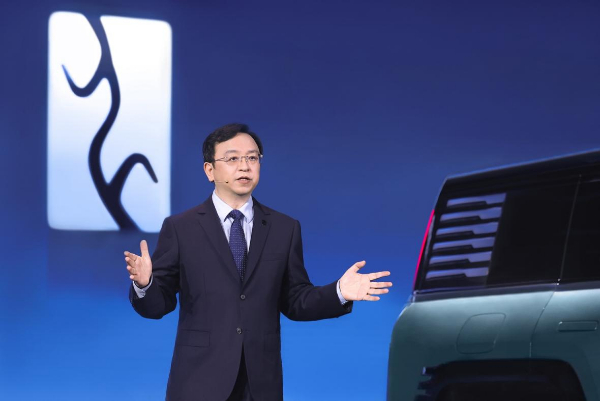

Taking the Zunjie S800, jointly created by Huawei and JAC Motors using HarmonyOS Intelligence, as an example, it is priced in the range of 1 million to 1.5 million yuan, also targeting the super luxury car market.

'Starting with the Zunjie S800, HarmonyOS Intelligence will achieve a new leap from 'passive intelligence' to 'autonomous intelligence,' said Yu Chengdong, Executive Director of Huawei and Chairman of the Terminal BG.

Another player impacting the high-end market is the Geely brand, which adheres to a luxury positioning, including the previously launched Zeekr 009 Guanghui with a starting price of 789,000 yuan and the Zeekr 009 Guanghui Collector's Edition with a starting price of 899,000 yuan. According to official disclosures, business leaders, corporate executives, public figures, and other high-net-worth user groups account for more than 75% of Zeekr 009 series users.

The upcoming Zeekr 9X, targeting the large luxury SUV market above 600,000 yuan, is expected to break the long-standing luxury market situation dominated and defined by foreign brands in this price range.

In the industry's view, the independent brands' rush into the luxury and even super luxury markets is closely related to breakthroughs in electrification and intelligence technology by Chinese automakers, the unexpected slow electrification transformation of traditional super luxury brands, and the obvious trend of consumption upgrades in the passenger vehicle market.

On the other hand, with the support of electrification and intelligence technology, Chinese consumers' perception of luxury and super luxury models has undergone tremendous changes. McKinsey's latest judgment is that Chinese consumers' perception of luxury has shifted from 'status symbol' to 'technology worship', and the speed of this transformation far exceeds the adaptability of multinational automakers.

However, there are still significant challenges for independent brands to impact the luxury and even super luxury markets. A relevant executive from an independent automaker told reporters that although ideal L9, Tangshi D9, etc., have gained a foothold in the 300,000-500,000 yuan market, challenges such as brand recognition barriers remain severe. For example, although the Yangwang U8 boasts impressive technology, its sales in July 2025 were only 80 units, proving that the million-yuan market still needs time to cultivate.

As Zeekr CEO An Conghui said: 'The era of new energy vehicles has given Chinese automakers a once-in-a-century window of opportunity, but the window will not stay open forever.'

This game of absence and substitution of super luxury brands is like a 'Song of Ice and Fire' in the automotive industry. On one side is the graceful retreat of super luxury brands as they contract their front lines, and on the other side is the sharp edge of local forces as they seize the center stage, unfolding vividly on the micro stage of the Chengdu Auto Show.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-