China's Auto Industry's European Dilemma | An Industry Report for Everyone

![]() 08/28 2025

08/28 2025

![]() 517

517

I. Background and Current Situation: Overview of China-EU Auto Trade Relations

China's Position in the Auto Industry and China-EU Trade Frictions

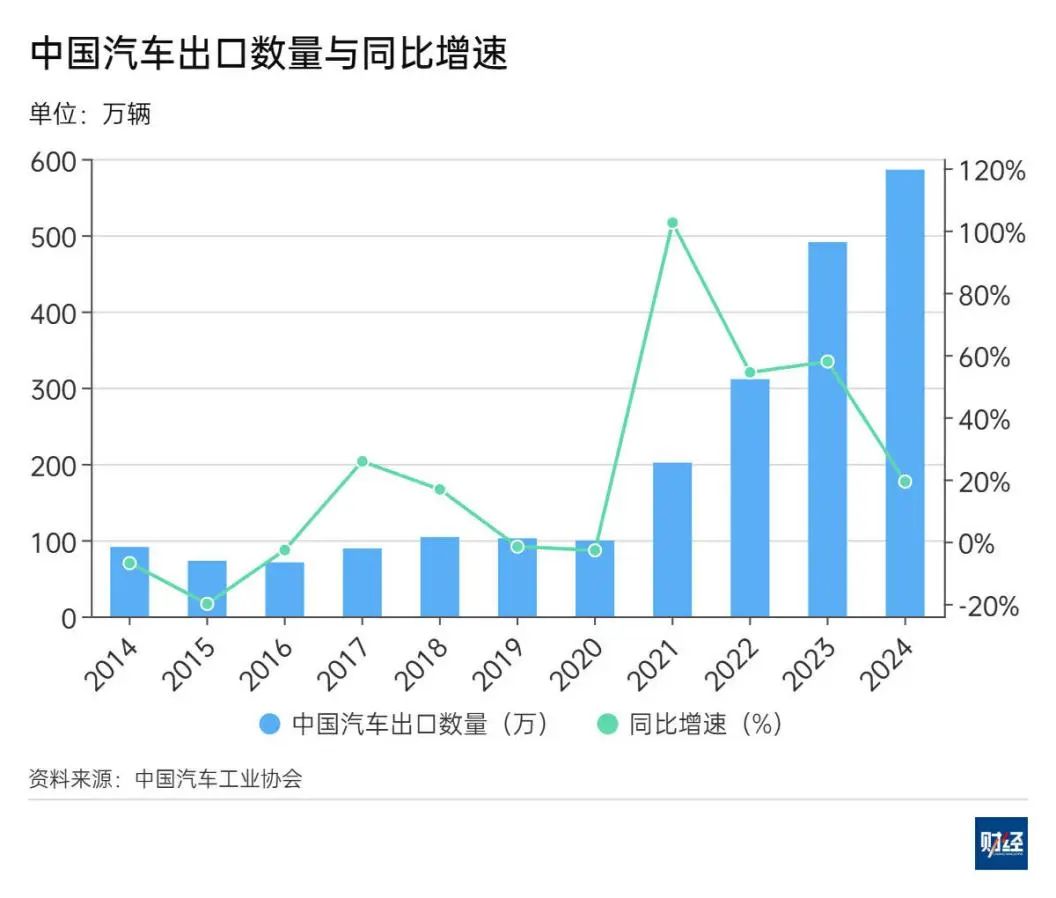

China has emerged as the world's largest automobile producer and exporter. In 2024, for instance, China exported 6.41 million vehicles, marking a 23% year-on-year increase. Behind this impressive feat, Europe, as the world's second-largest auto market, is a pivotal battleground for Chinese automakers seeking global expansion.

The European market not only boasts a substantial size and robust consumer power but is also a crucial source of global automotive technology and standards. For Chinese automakers, this presents a strategic opportunity to enhance their brand image and technological prowess.

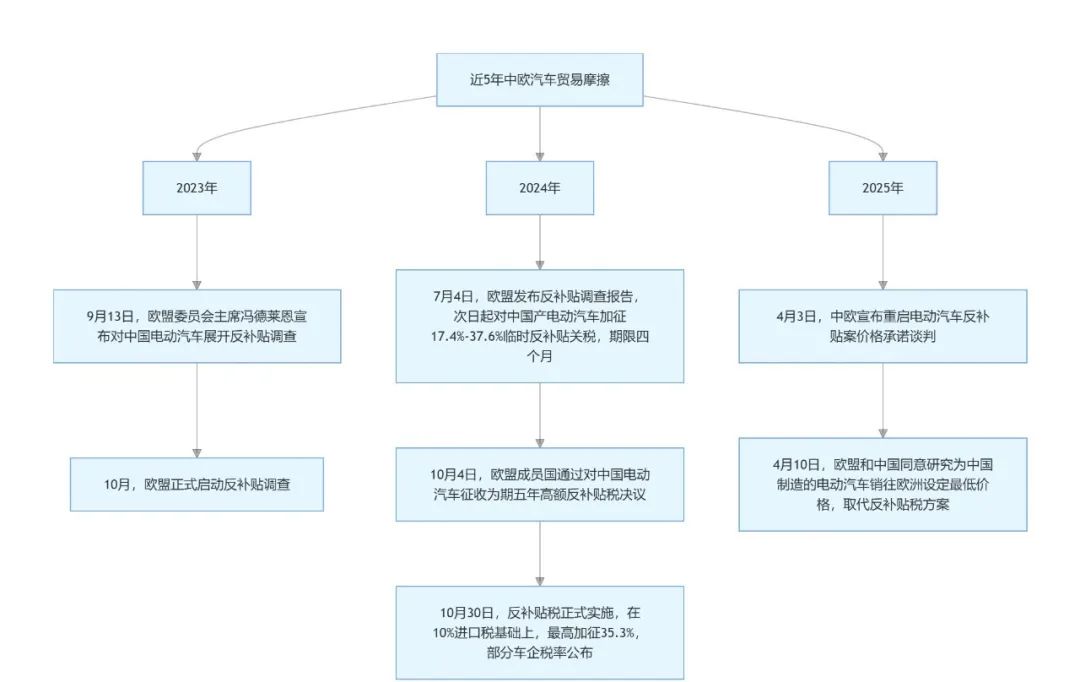

However, the China-EU auto trade relationship is undergoing significant transformations.

Since July 2024, when the EU imposed provisional anti-subsidy duties on Chinese electric vehicles, the growth momentum of these vehicles in the European market has notably declined. According to the China Association of Automobile Manufacturers, China exported 987,000 pure electric vehicles to Europe in 2024, a 10.4% year-on-year decrease compared to the 80.9% growth rate in the same period in 2023. This shift signifies a new phase in the development of China's auto industry in the European market, presenting both opportunities and challenges.

In October 2024, the EU officially imposed anti-subsidy duties on Chinese electric vehicles, with tax rates ranging from 7.8% to 35.3%, leading to a maximum combined tax rate of 48.1%. This measure directly weakened the competitiveness of Chinese electric vehicles in the European market, resulting in a significant sales decline for some Chinese automakers.

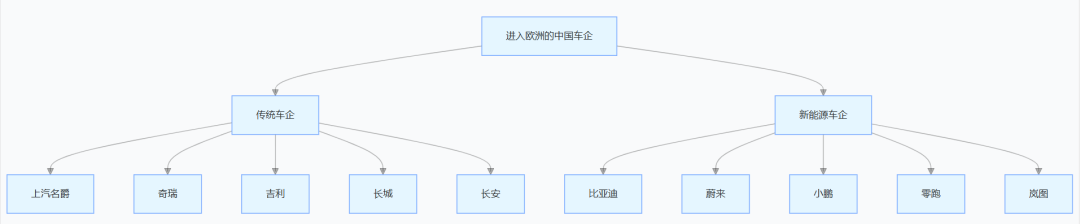

Major Auto Companies Entering Europe

However, since April 2025, China and the EU have begun exploring new negotiation channels to ease trade frictions. On April 3, China confirmed that it had agreed with the EU to restart price commitment negotiations on the electric vehicle anti-subsidy case as soon as possible. On April 15, China and the EU officially signed the "Electric Vehicle Trade Framework Agreement," replacing the original anti-subsidy tariffs with a "minimum import price" mechanism. Chinese electric vehicles exported to the EU must be priced at no less than 28,000 euros per vehicle (approximately 215,000 RMB), in exchange for the EU waiving punitive tariffs of up to 35%.

This agreement opens new avenues for Chinese automakers in the European market but also necessitates a shift in strategy from "low-price competition" to "value competition." In 2025, China's auto exports will face "relatively high pressure and market changes," and export volume predictions are cautious.

Selected Events of China-EU Auto Trade Friction in the Past 5 Years (for reference only) Click to view full-size image

II. Trade Barriers: Navigating Market Access Challenges Under Multiple Restrictions

2.1 Tariff Barriers: The Impact of Differentiated Tax Rates

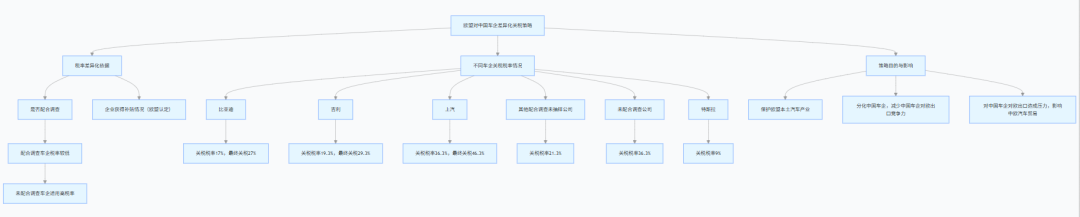

The EU's tariff policy towards Chinese electric vehicle companies is differentiated, with varying tax rates applied to different automakers. According to measures announced by the EU in March 2025, BYD and Geely face tariffs in the low teens, whereas SAIC Motor faces additional taxes exceeding 30% due to its refusal to disclose battery recipes, resulting in a total tax rate exceeding 40%.

Some industry insiders believe that this tiered strategy aims to divide the Chinese automaker camp, forcing those willing to share core technologies to continue developing in the market while penalizing those adhering to independent research and development. This directly influences the strategies of Chinese automakers in the European market. For example, SAIC Motor is severely impacted by high tariffs, while BYD partially avoids tariff impacts due to its product mix of half pure electric and half plug-in hybrids, as "Europe does not include plug-in hybrids in the electric vehicle tariff regulatory system."

Note: The EU's differentiated tariff strategy towards Chinese automakers involves complex differences in relevant data from different sources, influenced by factors such as varying time nodes, types of tax rates focused on in different articles, and discrepancies in information sources and interpretations.

2.2 Non-Tariff Barriers: Navigating Technical Standards and Environmental Requirements

Beyond tariffs, the EU's non-tariff barriers also invisibly restrict the entry of Chinese automobiles into the European market. These include the New Battery Regulation, Data Act, and Artificial Intelligence Act. Chinese automakers face challenges in re-compliance for their innovations in areas like autonomous driving and battery swapping models. The EU's Carbon Border Adjustment Mechanism (CBAM) further increases the overall cost of automotive components exported from China to Europe.

Entering 2025, the combination of escalating tariff conflicts, fragmented trade zones, and increasingly unpredictable customs clearance times has made seamless cross-border transportation and predictable transit times, traditionally reliant on the Just-In-Time (JIT) production model, "unpredictable."

2.3 Requirements for Local Production: Balancing Cost and Technology Transfer Pressures

The EU's policy clearly favors promoting local production by Chinese automakers in Europe.

Maros Sefcovic, the EU Commissioner responsible for trade and economic security, has stated that Chinese electric vehicle and battery manufacturers should consider technology transfer if they plan to invest in the EU.

In November 2024, the EU launched a 1 billion euro battery subsidy program, with the condition that Chinese companies must share core technologies, particularly battery manufacturing processes, if they build factories in Europe. This requirement poses a dilemma for Chinese automakers. On one hand, establishing factories in Europe can circumvent high tariffs; on the other hand, technology transfer may lead to the loss of core competitiveness.

III. Brand Recognition: The Journey from Margins to Mainstream

3.1 Current Status of Brand Recognition and Acceptance

Chinese auto brands have relatively low recognition and acceptance in Europe.

According to Aisa Financial, most potential European electric vehicle buyers do not recognize Chinese brands, and even those who do are cautious about purchasing Chinese cars – reminiscent of the decades it took for Japanese and Korean automakers to gain the trust of European consumers and adapt to European tastes.

However, the situation is improving. According to McKinsey's latest "2025 Mobile Consumer Pulse Report," Italian consumers' acceptance of Chinese auto brands has significantly increased, with 33% of Italians expressing willingness to purchase electric vehicles made in China, higher than the European average of 27%. This data reflects the competitiveness of Chinese auto brands against traditional European brands, with affordable prices and high-quality performance, marking a profound shift in consumer perceptions, particularly among younger generations who favor technological innovation.

3.2 Sales Performance and Market Share Changes

Since 2025, the performance of Chinese auto brands in the European market has shown significant differentiation. On one hand, the EU's anti-subsidy investigations and tariff measures against Chinese electric vehicles have led to a decline in sales of some Chinese pure electric vehicle models; on the other hand, some Chinese brands have made significant progress in the European market through product strategy adjustments and local layout.

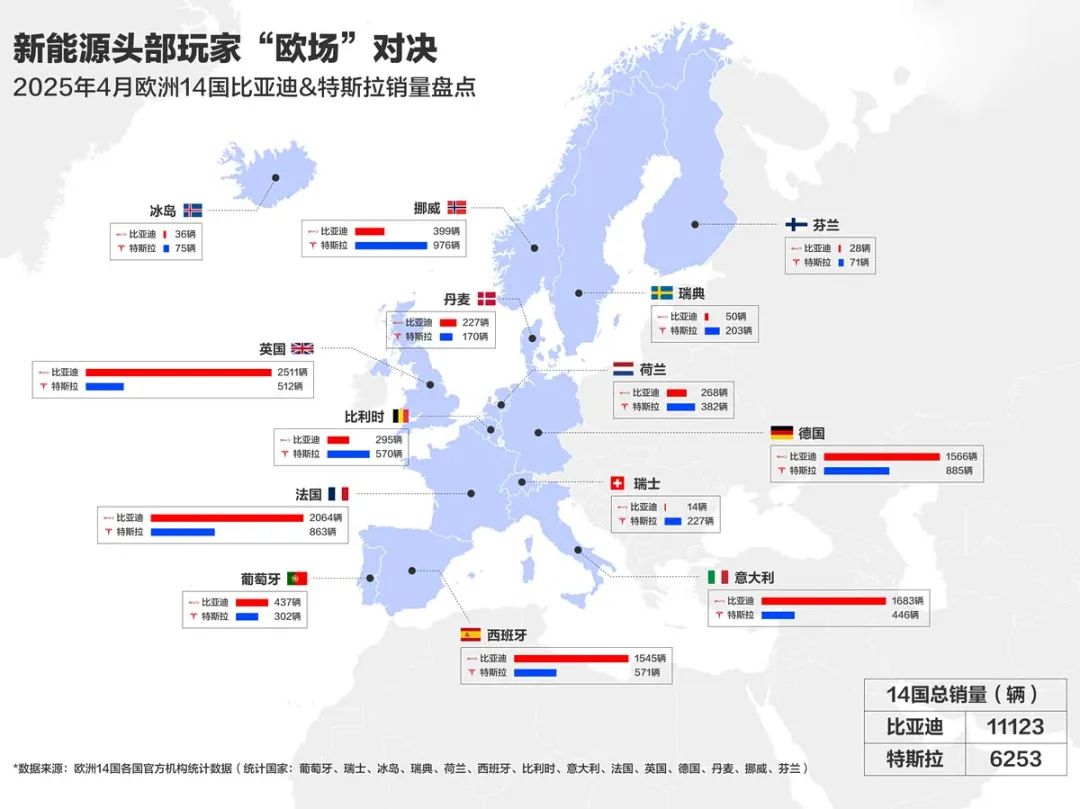

In April 2025, the European new energy vehicle market witnessed a historic turning point: BYD surpassed Tesla with monthly sales of 11,123 vehicles across 14 European countries, compared to Tesla's 6,253 vehicles, leading in core markets such as Germany, the UK, France, Italy, and Spain. Specifically, BYD sold 1,566 vehicles in Germany, a 120% year-on-year increase; 2,511 vehicles in the UK, a 654% surge; 2,064 vehicles in France, maintaining its lead; and 1,683 vehicles in Italy, topping the charts with a market share exceeding 10%.

Meanwhile, the MG brand has maintained stable growth in the European market with its diversified product line. In May 2025, MG sold 29,400 vehicles, maintaining its position as the best-selling Chinese brand in Europe, with a year-on-year increase of 30%, approximately twice the sales of Tesla in Europe during the same period. In the first four months of this year, MG's hybrid family sold over 39,000 vehicles in Europe, effectively circumventing tariff impacts.

Image Source: Autohome

3.3 Brand Positioning and Consumer Trust Building

Chinese auto brands are gradually shedding the stereotype of "low price, low quality" in the European market and transforming towards technological innovation and reliable quality. According to the South China Morning Post, Chinese brands offer consumers an attractive value proposition, with a wider range of affordable electric vehicle options equipped with technological features not found in comparable gasoline or diesel vehicles.

In terms of brand positioning, Chinese automakers have adopted a diversified strategy.

BYD has won recognition from European consumers through technological innovation and a high-end strategy. In April, its high-end brand Denza held a brand launch event in Milan, Italy, showcasing innovative features of its flagship model Denza Z9GT, including easy three-party parking, 180 km/h high-speed tire burst stability control, and intelligent crab walking, which attracted significant attention from European media and consumers.

SAIC Motor has made it clear that "we will never sell low-priced cars in Europe" but instead relies on the MG brand's accumulated sales base of one million vehicles to establish a mature channel and service system, and plans to export electric vehicle models equipped with L3 autonomous driving to Europe, focusing on "technology premium" rather than "cost advantage."

IV. Supply Chain Challenges: Balancing Global Layout and Local Production

4.1 Global Supply Chain Restructuring and Regionalization Trends

With the intensification of protectionist policies and escalating trade barriers between major economic regions, the global automotive supply chain is undergoing profound restructuring. The supply chain radius of automakers continues to shrink, with procurement strategies shifting from cross-continental globalization to nearshore outsourcing models centered on regions such as the North American Free Trade Agreement (USMCA) and the EU (CBAM framework).

This trend poses new challenges and opportunities for China's auto supply chain enterprises. On one hand, the traditional global procurement system is gradually losing feasibility; on the other hand, industry leaders are upgrading their procurement decision-making basis from "best landed cost" to a "trade-isolated cost" system to reduce the impact of fluctuating tariff environments and trade uncertainties.

4.2 European Layout of Chinese Auto Parts Enterprises

Facing the EU's localization requirements, Chinese auto parts enterprises have accelerated their layout in Europe. Contemporary Amperex Technology Co. Limited (CATL) is building a battery production base in Hungary, despite a 30% increase in construction costs. Hive Energy's German base has commenced production of 4680 large cylindrical batteries, attempting to circumvent the "minimum price" restriction. Tianqi Lithium has taken an equity stake in a Portuguese lithium mine, while Ganfeng Lithium is cooperating with France's Vulcan to develop geothermal lithium extraction, locking in policy dividends from the EU's mandatory 65% recycling rate by 2035.

China's complete vehicles and parts are forming a synergistic effect of "going abroad in groups." Multiple Chinese auto parts companies, such as Songyuan, Kabeier, Pisheng Technology, Rongtai, and Zhongyuan Internal Combustion Engine Parts, announced overseas investment and factory construction in 2024; while auto parts companies such as Xinquan, Minth, Wanfeng Auto Holdings, Joyson Electronic, and Wencan have achieved mass production in Mexico.

Some well-known Chinese auto supply chain enterprises

4.3 Logistics and Cost Control Challenges

Against the backdrop of global supply chain restructuring, Chinese automakers face challenges of rising logistics costs and extended delivery cycles. Entering 2025, the combination of escalating tariff conflicts, fragmented trade zones, and increasingly unpredictable customs clearance times has made seamless cross-border transportation and predictable transit times, traditionally reliant on the JIT model, "unpredictable."

To address this challenge, Chinese automakers are exploring new logistics models. SAIC Motor has initiated a full industrial chain layout. In the first half of this year, the world's leading auto transport ship embarked on its international maiden voyage, and the self-operated fleet route of its subsidiary Anji Logistics for complete vehicle logistics transportation has covered major export destinations such as Western Europe, the Mediterranean, Mexico, and West South America.

V. Local Production: Strategic Choices and Implementation Paths

5.1 Layout of European Production Bases for Complete Vehicle Enterprises

In response to the EU's trade barriers and localization demands, Chinese automakers have adopted diverse strategies for their European production base setups.

Chery Automobile has partnered with Spanish auto firm EV MOTORS to take over a former Nissan factory in Spain. In April 2024, Chery and EV MOTORS inked a cooperation deal to jointly establish an electric vehicle production hub in Barcelona, leveraging "Chery technology + EBRO brand" as its core. Last November, the joint venture's maiden product, the EBRO S700, rolled off the assembly line, marking Chery as the first Chinese automaker to manufacture vehicles in Europe and setting a precedent for Chinese firms to participate in the revitalization of European local brands as technology exporters.

BYD opted to build a factory in Hungary with sole investment, aiming to commence mass production within the next two years while mitigating logistics costs through local production. Great Wall Motors has established a production line in Spain, focusing on the Mediterranean market. Additionally, rumors suggest that SAIC Motor also plans to establish a factory in Europe.

5.2 Navigating Technology Transfer and Intellectual Property Protection

The European Union has imposed requirements for technology transfer on Chinese automakers establishing factories in Europe, posing a dilemma for Chinese companies between safeguarding technology and gaining market access. In November 2024, the EU launched a 1 billion euro battery subsidy program, with the stipulation that Chinese companies must share core technologies, particularly battery manufacturing processes, when setting up factories in Europe. EU automakers such as Volkswagen and Stellantis aim to acquire Chinese battery technology through joint ventures, circumventing the high costs of developing it independently.

In the face of this requirement, the Chinese government and enterprises have maintained a firm stance. On January 2, 2025, China announced plans to revise the list of technologies prohibited from export, adding key electric vehicle battery technologies such as cathode material preparation and cell assembly.

5.3 Cost-Benefit Analysis of Localized Production

While establishing production bases in Europe avoids tariffs, it also presents significant cost challenges. CATL's factory in Hungary has witnessed a 30% increase in costs. However, localized production also opens doors for market access and brand-building. The collaboration between Chery and Spanish enterprises not only made Chery the pioneer Chinese automaker to produce cars in Europe but also generated numerous jobs, invigorating the local economy and serving as a model of China-Spain cooperation.

In the long term, localized production aids Chinese automakers in establishing a stronger market presence in Europe. By employing the strategy of "trading space for tariffs," Chinese automakers are gradually transforming the manufacturing landscape of the global automotive industry. BYD's factory in Hungary has expanded its capacity to 500,000 vehicles annually, and SVOLT Energy has commenced production of 4680 large cylindrical batteries at its German facility. (This report is for informational purposes only and does not constitute investment advice. Please refrain from using it for commercial endeavors.)