Hovo Auto's Independent Listing and Dongfeng's 'Restructuring': A Capital Experiment in New Energy for Traditional Automakers

![]() 08/28 2025

08/28 2025

![]() 580

580

Recently, Dongfeng Motor Corporation officially announced that its new energy brand Hovo Auto will list on the Hong Kong Stock Exchange through introduction, while Dongfeng Motor Corporation will complete privatization and delisting simultaneously. This transaction adopts an innovative combination model of "equity distribution + absorption and merger", with the two key links being mutually preconditioned and advanced simultaneously.

On the day the news was announced, Dongfeng Motor Corporation's ADR (American Depositary Receipt) closed at $61, with an increase of 87.69%. The capital market expressed its positive response to this capital operation in the most direct way. Against the backdrop of the accelerated expansion of the new energy vehicle market and the continuous shrinkage of the traditional fuel vehicle business, what strategic considerations underlie Dongfeng Motor Corporation's "delisting + listing" combination? Behind the complex model of "equity distribution + absorption and merger", what transformation anxieties and breakthrough strategies do traditional automakers reflect?

▍Dual-track Strategy of Equity Restructuring and Value Release

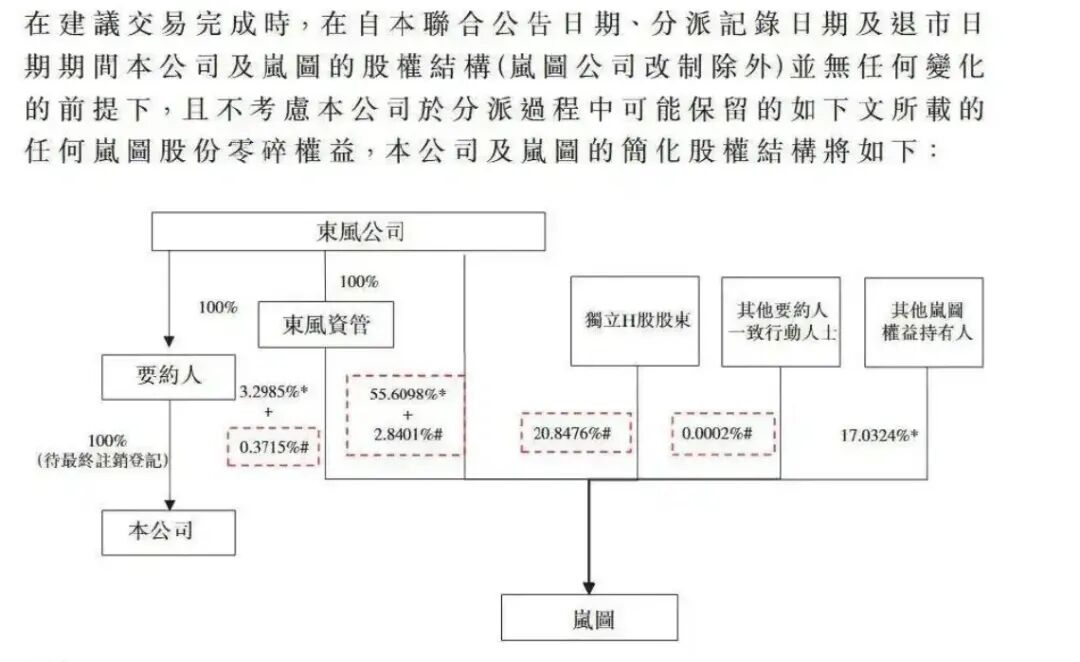

The "equity distribution + absorption and merger" combination model launched by Dongfeng Motor Corporation this time is a relatively innovative capital operation attempt in China's capital market in recent years. Its core lies in realizing the revaluation of asset value through the restructuring of equity structure. According to the announcement, this model is divided into two closely related links: Firstly, in the equity distribution link, Dongfeng Motor Corporation distributes 79.67% of the equity it holds in Hovo Auto to all shareholders in proportion to their shareholdings; subsequently, Hovo Auto will list on the Hong Kong Stock Exchange through introduction, a listing method that does not require the issuance of new shares or fund-raising, and achieves public listing by listing the issued shares on the exchange.

After completing equity distribution and Hovo Auto's listing, the transaction enters the absorption and merger link. Dongfeng Motor Group (Wuhan) Investment Co., Ltd. serves as the domestic absorption and merger subject, paying equity consideration to the controlling shareholder Dongfeng Motor, and simultaneously paying cash consideration and acquisition consideration combining Hovo Auto equity to other minority shareholders. The overall acquisition price is HK$10.85 per share, of which the cash consideration is HK$6.68 per share and the Hovo Auto equity consideration is HK$4.17 per share, ultimately achieving 100% control over Dongfeng Motor Corporation shares and privatization and delisting.

This model realizes "seamless" capital operation, with the two key links being mutually preconditioned and advanced simultaneously, which not only guarantees the continuity of shareholders' rights and interests but also completes the strategic reorganization of assets. For the original shareholders of Dongfeng Motor Corporation, this arrangement provides a smooth transition investment option: obtaining shares of Hovo Auto through equity distribution, while choosing to exit with cash or convert to parent company equity.

The choice of introduction listing also reflects strategic flexibility. Compared with traditional IPOs, introduction listings do not require a lengthy fundraising roadshow process and can quickly realize asset securitization, making it more suitable for Hovo Auto, a new energy brand in its growth stage. It is worth noting that the Hong Kong stock market's requirements for introduction listings are equally strict, requiring proof that the enterprise has sustainable operating capabilities and a sufficient shareholder base. The fact that Hovo Auto can adopt this method for listing itself reflects the market's recognition of its development prospects.

Judging from the capital market's reaction, Dongfeng Motor Corporation's ADR surged in a single day, reflecting investors' recognition of the switch in valuation logic. The acquisition price of HK$10.85 per share offered by the transaction has a significant premium compared to the share price before the trading suspension. The cash consideration provides certain returns, while the Hovo Auto equity consideration gives growth expectations. This combination of "secured returns + potential appreciation" meets the needs of investors with different risk appetites. Investors clearly favor this capital operation logic of "spinning off high-quality assets for independent listing + parent company delisting and restructuring", believing that it can solve the valuation dilemma that has long plagued Dongfeng Motor Corporation.

By separately listing high-growth new energy assets while achieving the delisting of the parent company, Dongfeng Motor Corporation is expected to break the drag on valuation caused by traditional businesses and create conditions for releasing the value of high-quality assets.

▍Valuation Reshaping Amid Industry Changes

Dongfeng Motor Corporation's choice to promote the "delisting + listing" capital operation at this time is essentially a strategic adjustment in response to changes in the automotive industry, with industry logic and corporate development demands behind it.

From a macro perspective, the potential of China's new energy vehicle market continues to be unleashed. According to predictions by the China Association of Automobile Manufacturers, new energy vehicle sales (including exports) are expected to exceed 16 million in 2025, with new vehicle sales accounting for more than 50%. Against this backdrop, the structural contradiction between the continuous shrinkage of the traditional fuel vehicle business and the rapid growth of the new energy business has become increasingly prominent, serving as the fundamental driving force for automakers such as Dongfeng Motor Corporation to make strategic adjustments.

Dongfeng Motor Corporation's performance in recent years has also reflected this transformation pressure. In the first half of 2025, the company achieved revenue of RMB 54.533 billion, a year-on-year increase of 6.6%, but net profit attributable to shareholders of the parent company was only RMB 55 million, a year-on-year decline of nearly 92%; during the same period, vehicle sales totaled 823,900 units, a year-on-year decrease of 14.7%. The decline in performance is mainly due to the shrinking market share of joint venture non-luxury brands, while independent brand research and development, channel, and marketing investments continue to increase. The dual pressure of traditional business and new energy transformation has long suppressed the company's overall valuation.

In stark contrast, Hovo Auto has become the brightest growth engine within the Dongfeng system: In 2024, it delivered 85,700 vehicles, a year-on-year increase of approximately 70%; since 2025, sales have exceeded 10,000 units for five consecutive months, with cumulative sales reaching 56,128 vehicles in the first half of the year, a year-on-year increase of 85%, including 12,135 vehicles delivered in July, a year-on-year increase of 102%. In terms of financial performance, Hovo Auto has also shown a good improvement trend, with net after-tax losses narrowing from RMB 1.472 billion in 2023 to RMB 18 million in 2024, and achieving quarterly profitability in the fourth quarter, laying a solid foundation for independent listing.

This pattern of "traditional business decline and new energy business surge" makes spin-off listing an inevitable choice for optimizing resource allocation. From an industry perspective, new energy vehicle enterprises receive significantly higher valuation premiums in the capital market than traditional automakers. Taking BYD as an example, it has achieved continuous valuation improvement by focusing on the new energy business. In 2024, BYD's global new energy vehicle sales reached 4.087 million units, maintaining its global market share lead, which has brought significant valuation dividends.

By independently listing Hovo Auto, Dongfeng Motor Corporation enables it to directly connect with the capital market, obtain a valuation pricing that matches business growth, and get rid of the valuation drag of traditional businesses. Meanwhile, after the privatization and delisting of the parent company, it can more flexibly promote strategic adjustments and reduce the interference of short-term performance pressure in the capital market on long-term transformation.

This capital operation also reflects the common dilemmas and breakthrough paths of traditional automakers in the new energy transformation. Shi Jianhua, deputy secretary-general of the China Electric Vehicle Hundred Person Council, pointed out that the new energy consumer market is undergoing structural changes, with incremental and replacement purchase demand becoming the core driving force. The market is rapidly expanding to third-tier and lower cities, and the industry is moving towards a new stage of "technology inclusiveness." In this process, traditional automakers face multiple challenges, including aging brand images, rigid organizational structures, and inefficient decision-making.

By "spinning off high-quality assets + parent company restructuring", Dongfeng Motor Corporation not only ensures that the new energy business obtains sufficient development resources and market-oriented mechanisms but also creates space for the transformation and upgrading of traditional businesses. As Dongfeng's independent high-end smart new energy brand, Hovo Auto's star model "Dreamer" has won the monthly sales championship in the new energy MPV segment multiple times, and the new model FREE+ received over 11,000 firm orders just 15 minutes after its launch. These market performances prove the advantages of independent operation.

Dongfeng Motor Corporation's combined operation of delisting and Hovo Auto's listing provides the industry with a reference sample for valuation reshaping and strategic transformation, demonstrating how traditional automakers can optimize resource allocation and realize the transition between old and new growth drivers through capital means. Through the innovative model of "equity distribution + absorption and merger", Dongfeng Motor Corporation may solve the problem of valuation discounts, open up a capital market channel for the development of the new energy business, and create opportunities for value enhancement for shareholders. What is most noteworthy is whether Dongfeng's move this time will become a "capitalization template" for state-owned enterprises in new energy. If this model is proven effective, it may ultimately be replicated among more state-owned enterprises in new energy.

Typesetting 丨 Zheng Li

Image Source 丨 Dongfeng Motor Corporation, Hovo Auto