From Second-Quarter Financial Reports: Evergrande Not Among Auto Industry Newcomers

![]() 09/03 2025

09/03 2025

![]() 525

525

As listed automakers successively release their first-half financial results, the notion of "Evergrande in the auto industry" increasingly appears to be a misconception.

Besides Li Auto, Zero Running has become the second new force automaker to achieve profitability; NIO and XPeng have narrowed their losses, and the "hidden king" Thalys has seen its first-half net profit surge by over 80%...

During the golden September and silver October in the auto market, Chinese automakers have clustered to unveil new electric vehicles. Judging from August sales figures, the robust growth of domestic electric vehicles has already threatened Tesla's position, with the newly released version of the Model 3 announcing a price reduction of RMB 10,000 within a month of its launch.

However, the pressure to reduce prices is not unique to Tesla. Judging from the recent flurry of new product launches, almost every company has reconsidered their pricing strategies. Setting a price at launch in one fell swoop stands out as the most obvious difference from engaging in a price war. For instance, Li Auto's i8 reduced its configuration and adjusted its pricing just a week after its launch, and Huawei broke the convention of pure electric versions being priced higher than extended-range versions shortly before the Chengdu Auto Show, entering the era of "same price for oil and electricity"... This demonstrates its determination to transition to pure electric vehicles, and the high-end pure electric market is about to undergo a significant transformation as a result.

In addition to NIO and Li Auto, XPeng and Zero Running have also planned to release multiple high-end products in the second half of this year. What is alarming is that sources have revealed that sales of the AITO brand's pure electric models have already surpassed those of its extended-range models. As Huawei takes the lead in transitioning to pure electric vehicles, what will new forces rely on besides adjusting prices?

From the financial reports, new forces do not have "Evergrande"

"Long-term losses, coerced by capital"... Three months ago, Wei Jianjun, the chairman of Great Wall Motors, made a startling statement and proposed the "Evergrande in the auto industry" theory.

NIO, which released its first-quarter financial report shortly thereafter, was labeled as "Evergrande in the auto industry" due to its insolvency. In 2021, Evergrande Group, with total assets of RMB 2 trillion, had liabilities of up to RMB 2.5 trillion and a full-year loss of RMB 700 billion.

In recent days, almost all listed automakers have released their second-quarter results. Judging from the financial reports, "Evergrande in the auto industry" is indeed a misconception.

Taking NIO as an example, the increase in deliveries has led to a revenue increase of RMB 19.01 billion, with a comprehensive gross margin of 10%. Although it has not yet achieved quarterly profitability, Li Bin pointed out in the financial report conference that night that the operating loss in the second quarter narrowed by over 30% quarter-on-quarter, and the effect of cost optimization was significant.

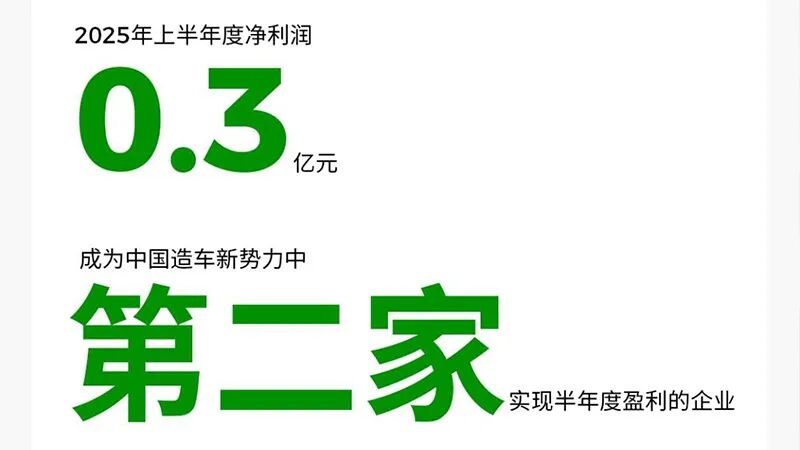

Zero Running achieved semi-annual profitability for the first time, with a net profit attributable to shareholders of RMB 30 million, turning a profit year-on-year. The surge in new vehicle sales has led to significant improvements in revenue and profitability. Zero Running's revenue in the first half of the year was RMB 24.25 billion, a year-on-year increase of 174%; its gross margin was 14.1%, a year-on-year increase of 13.0%.

Li Auto, the "top student" among the new forces, generated revenue of RMB 30.2 billion in the second quarter, with a quarterly net profit of RMB 1.1 billion, an increase of 69.6% from the first quarter, achieving profitability for 11 consecutive quarters.

In addition to Li Auto and Zero Running, which have already achieved profitability, XPeng's losses also narrowed significantly in the second quarter. In the second quarter, XPeng's net loss was RMB 1.14 billion, a year-on-year reduction of RMB 1.51 billion.

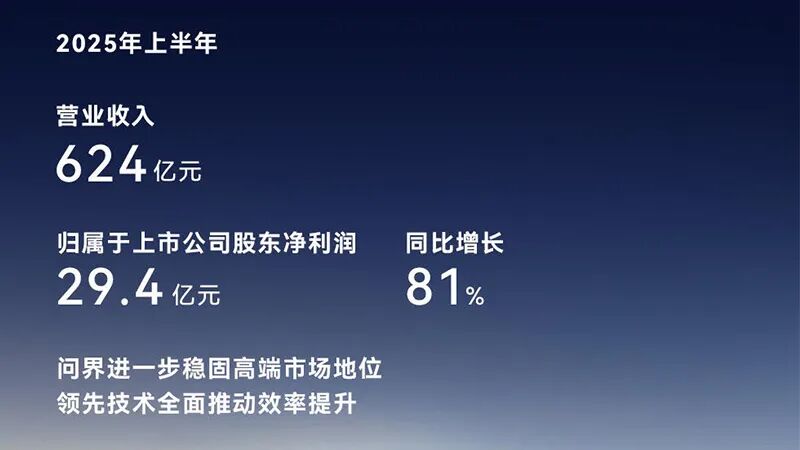

Furthermore, Thalys, which has quietly become wealthy, has seen its net profit surge in the first half of the year due to the popularity of AITO. Thalys' revenue in the first half of the year was RMB 62.4 billion, with a net profit attributable to shareholders of RMB 2.94 billion, a year-on-year increase of 81.0%.

Judging from the financial report data, the core financial indicators of new force automakers have all shown a positive trend, and there are no signals of unsustainable deficits in the financial reports. Upon closer inspection, almost every new force automaker has demonstrated commendable cost control capabilities, meaning that under the effect of scale, even if the average price per vehicle decreases, profitability still increases.

Li Auto's average price per vehicle fell from RMB 266,000 in the first quarter to RMB 260,000, while NIO's fell from RMB 236,100 in the first quarter to RMB 224,000. XPeng's average price per vehicle in the second quarter was RMB 159,000, a year-on-year decrease of 33%.

Thalys stands out as the hidden king, with the popularity of the AITO M8 and M9 driving up its revenue and profit per vehicle. In the first half of this year, Thalys' net profit surged by 81% year-on-year, despite its revenue being lower than the same period last year. Among them, the average price per vehicle in the second quarter was RMB 332,000, an increase of RMB 120,000 from the same period last year, and the net profit per vehicle reached RMB 17,000... It can be said that the AITO series has not only achieved success in terms of products and sales but has also greatly improved Thalys' profitability.

Huawei Leads the Transition to Pure Electric Vehicles, and New Forces Can Only Reduce Prices?

With Huawei's support, Thalys has demonstrated a system capability that surpasses that of new force automakers. This is particularly evident in Li Auto, which also sells extended-range vehicles.

In the second quarter, the sales shares of Li Auto's L9, L8, L7, L6, and Mega were 13.0%, 13.3%, 23.8%, 46.8%, and 3.1%, respectively. The L6, with the lowest price, accounted for the largest sales share. The reason is self-evident: the more high-end extended-range market is being dominated by the AITO M8 and M9.

Since the recent launch of Li Auto's i8, Li Auto has officially entered the high-end pure electric vehicle market. Shortly thereafter, Huawei launched the AITO M8 pure electric version, with a starting price of RMB 359,800, identical to that of the extended-range version. On the same day, the refreshed version of the Vision R7 was also released, with the pure electric version priced the same as the extended-range version, breaking the long-standing convention that pure electric versions are priced higher than extended-range versions.

Official data shows that the AITO M8 pure electric version received over 10,000 orders within 24 hours of its launch. As Huawei takes the lead in transitioning to pure electric vehicles, the high-end pure electric market is about to undergo a significant transformation.

After the launch of the AITO M8 pure electric version, NIO's pre-sale price for its all-new ES8, which was significantly discounted, led to Li Bin being dubbed "Bin God" on the spot. However, compared to the previous generation NIO ES8, the new ES8 is priced over RMB 80,000 cheaper, which has caused existing owners to feel betrayed. Li Bin could only helplessly state, "Surviving is the most important thing."

Li Bin's remarks are not alarmist but rather reflect NIO's genuine "will to survive." It is a simple truth: continuing to maintain high prices will make it difficult to compete in the market. Moreover, in the new energy market above RMB 300,000, neither NIO nor Li Auto can ignore Huawei's presence.

Soon, the heavily revised version of the AITO M7 will also be released this month. Based on the pricing strategy of the AITO M8, the extended-range and pure electric versions will have the same starting price. For a long time in the past, due to battery costs, the pricing of extended-range models has been lower than that of pure electric models. Under this cost-based pricing logic, extended-range models have had a competitive advantage over pure electric models, quickly capturing a share of the high-end new energy market. Nowadays, with pure electric and extended-range models priced the same, Huawei can replicate the success of extended-range models in the pure electric market.

Also appearing in September is Li Auto's second pure electric SUV, the i6. Although Li Auto has consistently stated that it is targeting the RMB 250,000 to RMB 300,000 price range, speculation persists that the starting price will be below RMB 250,000. Taking Li Auto's i8 as a reference, although it is not the same model as the L8, its starting price before the price adjustment was RMB 321,800, identical to that of the L8.

The strategy of "same price for oil and electricity" is likely to continue to be applied to the Li Auto i6. Even with a reasonable speculation, if the company has more aggressive sales targets for the Li Auto i6 internally, it is possible that the price of the electric version could be lower than that of the extended-range version: a starting price below the RMB 249,800 of the Li Auto L6. Given Huawei's presence, it is difficult for new forces to be overly optimistic about their predictions for the high-end pure electric market.