Key Highlights from the Chengdu Auto Show: Decoding Their Significance

![]() 09/04 2025

09/04 2025

![]() 669

669

Written by: Xue Fei

Produced by: Five Star Car Reviews

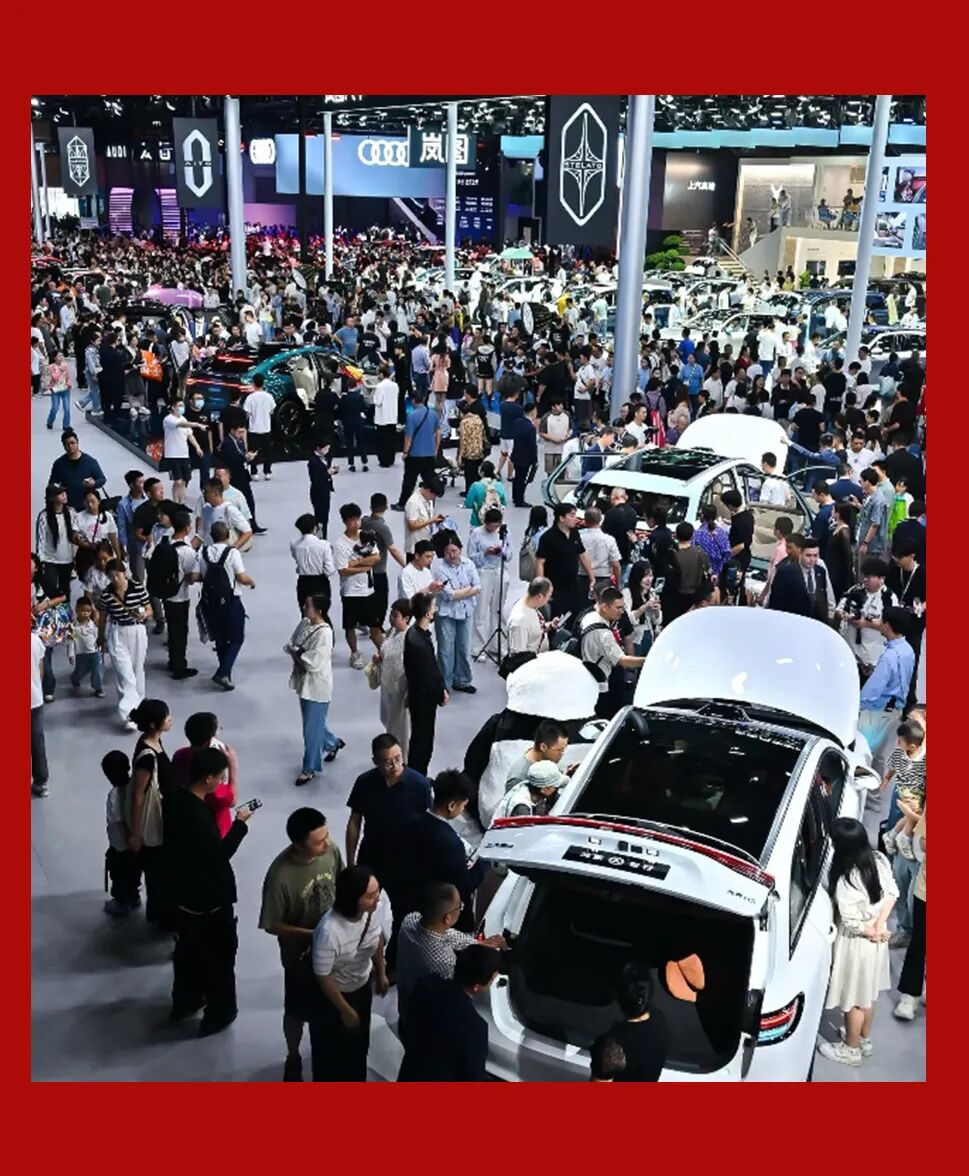

For enthusiasts who thrive on auto show gossip, this year's event might have seemed underwhelming. However, for those keen on market trends or planning to buy or upgrade their cars, even the dozen or so key models unveiled had substantial implications for the overall market.

Traditionally, a significant facelift is akin to a generational change. At this auto show, the introduction of several key new cars had the potential to reshape entire market segments.

01 New Benchmark for Independent Flagship Models

The term "million-yuan luxury car" has long been synonymous with premium flagship models, ranging from the classic "78S" to the Jaguar XJ, Lexus LS, and more recently, independent brand flagship SUVs. Although prices have softened, they typically hover around 700,000 to 800,000 yuan.

Initially, Zeekr 9X generated buzz with rumors of a 600,000 yuan price tag. However, at the Chengdu Auto Show, its pre-sale price started at a surprising 479,900 yuan.

The MAX version boasts a 2.0T engine paired with an 898-horsepower motor and a 55-kWh battery offering an official pure electric range of 300 kilometers, firmly establishing it as a flagship. The 1,400-horsepower version serves more as a positioning enhancer, while the 70-kWh battery matches the energy consumption of the three motors, offering minimal range increase.

Thus, the sub-500,000 yuan versions are the mainstay of Zeekr 9X. This suggests a shift in the standard for independent flagship models. With data comparable to any flagship but priced around 200,000 yuan lower, Zeekr 9X, dubbed the "Cullinan of Hangzhou Bay," may pull independent flagship prices down to the 500,000 yuan range.

Meanwhile, SUVs priced around 400,000 yuan face delicate market positioning. If they don't lower prices, their high-end configurations will compete directly with newer flagship models like Zeekr 9X. If they do, their own 300,000-plus yuan offerings will need adjustments. Thus, a highly competitive product influences not just its segment but also upstream and downstream products.

02 Joint Venture Brands Embrace Powertrain Transformation

From American and Korean brands adopting high-power engines across their lineups to Japanese brands popularizing hybrid powertrains, and now German brands introducing the 380TSI to volume-selling A-segment models, joint venture brands are continually evolving their powertrains.

Is it because their decades-old powertrains are obsolete? Far from it! Traditional fuel powertrains still dominate most global markets and won't change significantly in the next five to ten years.

However, with the influx of electric, extended-range, and plug-in hybrid vehicles in China, traditional fuel powertrains now seem inadequate. As horsepower depreciates, consumer expectations for power have soared. Hence, to cater to different target groups, joint venture brands are downsizing high-power engines for smaller models while developing new energy powertrains to adapt to market changes.

When the new Lamando debuted, its front design sparked controversy. Nonetheless, its frameless doors, hatchback design, and nearly largest size among A-segment sedans sustained sales, even with a 1.4T engine.

The GTS model launched at this year's Chengdu Auto Show, priced at 139,900 yuan, skipped the 186-horsepower 330TSI version and came equipped with a 220-horsepower EA888 high-power engine. Coupled with standard features like full-speed adaptive cruise control, this "disregard for competitors and own products" strategy impressed independent brands and new forces, setting a new benchmark. The GTS version of the all-new Lamando L raises the "qualification line" for joint venture family sedan power to hybrid mainstream levels (around 7 seconds to 100 km/h).

For small and medium models, traditional fuel engines suffice. However, for large SUVs often weighing 2.5 tons, new powertrain forms are essential before launching new models. Hence, we hear more about Volkswagen, Toyota, BMW, and others soon introducing extended-range powertrains.

03 New Battleground: Entry-Level Electric Commuter Cars

With the MG4 and ARCFOX T1 entering the market, the "involution" trend has reached the 60,000 yuan segment.

This is understandable. Seeing Geely Xingyuan and BYD Haiou's soaring sales, even non-top-five players sell over 10,000 units monthly. It's hard for others not to join the fray.

The MG4 focuses on "semi-solid" batteries and an entry-level range over 400 kilometers, entering the market as a global model at a low price. The ARCFOX T1 emphasizes "real range" and electric vehicle safety, claiming a higher achievement rate despite a shorter official range for the entry-level version. Both have lengths over 4.3 meters and wheelbases over 2.7 meters, offering a significant space advantage over current A0-segment electric vehicles.

Since 2025, joint venture A0-segment cars in the 60,000-80,000 yuan market have been largely "replaced," with fuel vehicles' few thousand sales insufficient to compete with independent electric models. Electric vehicles are more likely to meet consumers' commuter car requirements in terms of economy, space, and configuration levels. Technically, creating a successful A0-segment electric car requires less, mainly comparing who is "more willing to give."

04 The 200,000 Yuan Segment: Abundance and Satisfaction

When Letao L90's (battery rental) pre-sale price dropped to 193,800 yuan, the market barely recovered before another mid-to-large SUV with the same pre-sale price arrived.

Although Geely Yinhe M9's powertrain and brand positioning differ vastly from Letao L90, their size and price align perfectly, targeting the popular mid-to-large SUV market. Their joint entry intensifies competition in the above-250,000 yuan SUV segment, forcing both veterans and newcomers to reassess their product strength against the new generation of "9-series" models.

Another way to stand out in the 200,000 yuan segment is by downgrading intelligent driving assistance hardware. Previously, high-level assisted driving features like the "Huawei Full Suite" were exclusive to 300,000 yuan-plus vehicles but are now appearing on 200,000 yuan models.

For the future home SUV market, major brands must offer "abundant and satisfying" true 7-seaters or elevate assisted driving to a higher level at around 200,000 yuan. Otherwise, they risk being swept away by the tide and losing their mainstream position.