Xiaopeng, Dreaming of "Soaring", Must First Go Public

![]() 01/13 2026

01/13 2026

![]() 542

542

Xiaopeng's "SpaceX Moment" Arrives

Xiaopeng Motors is poised to "take flight" from its current position.

On January 12th, Bloomberg reported that HT Aero has enlisted JPMorgan Chase and Morgan Stanley to aid in its preparations for a Hong Kong IPO, with the fastest possible listing anticipated within this year. If confirmed, this news signifies that Asia's largest flying car company has officially entered a pivotal phase of capital operations.

Just recently, in November 2025, HT Aero's factory in Huangpu, Guangzhou, celebrated the roll-out of its first mass-produced vehicle.

From achieving mass production on the manufacturing front to pursuing independent listing on the capital front, this flurry of activity indicates that flying cars are swiftly progressing beyond the "proof-of-concept" stage and moving towards tangible commercialization.

For the tech industry, this marks not just a financing endeavor by a single company but also a significant milestone in the transition of the "low-altitude economy" from blueprints to industrialization.

This is not merely a gamble by He Xiaopeng to secure a "second growth curve" for Xiaopeng Motors; it is also a bold collective leap into three-dimensional space by the entire mobility sector after intense competition in ground transportation reached its zenith.

The ground battle has grown fiercely competitive, and Xiaopeng has chosen to ascend. But will this sky truly offer a smooth journey?

01

When Car Manufacturing Becomes a "Battle of Endurance"

HT Aero's urgency to go public primarily stems from the persistent challenges on the "ground."

In the recently concluded year of 2025, the penetration rate of China's new energy vehicle market has long exceeded 50%. However, market prosperity has not brought ease but has instead intensified unprecedented "involution."

Price wars have persisted throughout the year, becoming an industry norm. To maintain market share, automakers continuously push the limits of profit margins.

Consequently, we have witnessed an endless array of features: 800V high-voltage platforms, high-computing-power chips, air suspensions, and even large sofas with TVs and refrigerators—once exclusive to luxury cars—are now available in models priced at 150,000 yuan or even lower.

Behind this "feature surplus" lies an extremely tense industrial chain. For new car-making forces like Xiaopeng, the situation on the ground battlefield is particularly intense.

On one hand, vertically integrated giants like BYD leverage economies of scale to set price floors; on the other hand, tech giants like HiMind and Xiaomi redefine luxury cars through intelligent empowerment.

In such a winner-takes-all market with limited growth, relying solely on gross profits from car sales to support high R&D investments is becoming increasingly difficult.

This ground-level "battle of endurance" is essentially about competing for limited market share in a red ocean. For a tech company with technological ambitions, continuing to be entangled in this quagmire not only fails to secure a high valuation but may even lead to falling behind due to prolonged bloodletting.

Although Xiaopeng Motors has achieved remarkable results on the ground battlefield, in November 2025, its one millionth vehicle, a luxurious seven-seat MPV, the Xiaopeng X9, officially rolled off the line at the Guangzhou Knowledge City Intelligent Factory. However, behind this milestone of one million vehicles lies continuous heavy investment and increasingly thin profit margins.

Therefore, finding a new, untapped incremental market has become a necessity for survival.

Flying cars, or more precisely, electric vertical takeoff and landing aircraft (eVTOL), are precisely the "second battlefield" chosen by He Xiaopeng. This field possesses all the qualities to become the next trillion-dollar sector: disruptive technology, vast market potential, and a relatively early competitive landscape.

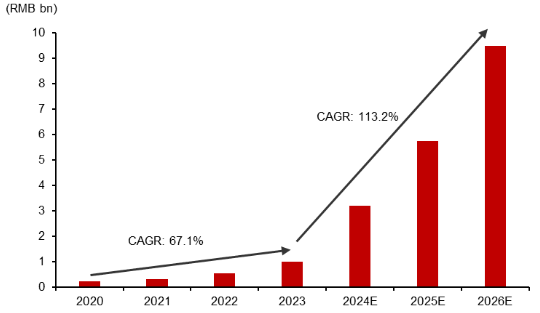

Morgan Stanley has boldly predicted that the flying car industry will experience explosive growth in the next two decades. China Merchants International's research report also offers an optimistic outlook, forecasting that the global eVTOL market size will reach 9.5 billion yuan in 2026 and is expected to surpass one trillion yuan or even reach trillion-dollar levels by 2030.

The core reason for choosing to spin off and list HT Aero at this time lies in the invisible hierarchy within the capital market's valuation system.

As an automaker, regardless of how advanced your autonomous driving technology is, the market will still habitually view you through the lens of manufacturing logic: examining your monthly sales, per-unit gross profit, and inventory turnover rate. The ceiling for automotive industry price-to-earnings ratios is evident. As long as you are still selling cars, it is difficult to enjoy the high premiums of tech stocks.

However, the "low-altitude economy" operates under entirely different logic.

In this sector, the benchmarks are not Toyota or Volkswagen, nor BYD, but SpaceX, or American companies like Joby Aviation and Archer. Investors here value not current profitability but the potential to monopolize future transportation revolutions over the next decade.

According to public information, HT Aero has completed multiple rounds of financing before the IPO, including a $150 million Series B1 financing in August 2024 and a $100 million Series B financing in July 2025, with cumulative financing exceeding $750 million.

Spinning off HT Aero for independent listing is essentially engaging in "valuation arbitrage."

The parent company, Xiaopeng Motors, can maintain its robust image as an automaker, while the independently listed HT Aero can lighten its load and attract global capital seeking high-risk, high-reward opportunities as a "hard tech unicorn."

This approach avoids the enormous R&D investments in flying cars from dragging down the parent company's financials while utilizing IPO proceeds to fund this "cash-burning" venture. For Xiaopeng, which urgently needs cash flow to support its dual-front operations, this is one of the few viable solutions.

Therefore, this IPO is a carefully calculated "strategic move." It represents a strategic breakthrough into the skies when the ground battlefield has reached a stalemate; it is about using capital to secure entry tickets and a voice in this brand-new sector.

02

IPO "Sprints" Ahead, But the Skies Are Crowded with Competitors

Despite the promising prospects, HT Aero's IPO journey is not without obstacles. The most immediate and severe challenge it faces is the "birth certificate" that determines its survival—airworthiness certification.

Unlike ground vehicles, any aircraft seeking to take to the skies must pass stringent airworthiness evaluations by civil aviation regulatory authorities and obtain three crucial certificates: the Type Certificate (TC), Production Certificate (PC), and Airworthiness Certificate (AC). These are absolute prerequisites for the legal production, sale, and commercial operation of aircraft.

Currently, HT Aero's application for the Type Certificate for the flight body of its "Land Aircraft Carrier" was officially accepted by the Central and Southern Regional Administration of the Civil Aviation Administration of China in March 2024, marking its formal entry into the lengthy airworthiness evaluation process. Its application for the Production Certificate was also accepted in May 2025.

"Acceptance" merely grants entry; the path to final "clearance" is long. The airworthiness evaluation process is complex and stringent, involving comprehensive reviews and verifications of all critical systems, including aircraft design, materials, propulsion, and flight control, with evaluation cycles often spanning years. As of January 12, 2026, the Civil Aviation Administration of China has not issued an official announcement regarding the completion of TC certification for the "Land Aircraft Carrier."

This raises a core question: Is HT Aero confident or anxious in launching its IPO before obtaining the final "birth certificate"?

This resembles a race against time. On one hand, ongoing airworthiness evaluations, factory operations, and supply chain construction require continuous funding, making the IPO the most direct and effective means to address funding anxieties. On the other hand, the capital market demands a clear commercialization path, and the success of airworthiness certification represents the largest uncertainty on this path.

HT Aero's decision to proceed with the IPO at this time is undoubtedly a "sprint" and a gamble. It bets on securing the crucial TC certificate and achieving scaled delivery before exhausting the funds raised through the IPO.

This "pushing through despite challenges" model is not unprecedented in the capital market. Many biotech companies have gone public before their core drugs received regulatory approval. Investors are purchasing expectations for the future. HT Aero is also selling the capital market a ticket to future three-dimensional mobility.

However, even if it successfully secures funding and the "birth certificate," the sky HT Aero aspires to is not empty. In fact, it is already crowded with giants, and the intensity of competition is no less fierce than on the ground.

Domestically, the biggest competitor is undoubtedly EHang, which holds a significant lead in airworthiness certification progress.

Its EH216-S unmanned passenger aircraft has become the world's first manned-level unmanned eVTOL to obtain the "3C certificate." The EH216-S has commenced commercial trial operations in multiple locations across China, with an official list price of 2.39 million yuan.

Compared to EHang, HT Aero has differentiated its product positioning.

EHang's EH216-S targets urban air mobility, focusing on "air taxis" and tourism sightseeing scenarios. It is an unmanned two-seater aircraft with a range of approximately 30 kilometers, resembling a public transportation vehicle.

In contrast, HT Aero's "Land Aircraft Carrier" targets individual users, emphasizing "land-air integrated" exploration and mobility experiences. It must be piloted by a human, with the ground vehicle providing extended range and off-road capabilities, while the flight body satisfies short-distance three-dimensional crossing needs. It resembles a combination of a personal "super toy" and a transportation vehicle.

The competition between the two represents a clash of two different technological routes and business models. EHang's first-mover advantage lies in compliance and operations, while HT Aero's strength lies in its product definition closer to C-end user habits and the synergistic capabilities of Xiaopeng Motors' channels and brand.

Globally, competitors are equally formidable.

Joby Aviation from the United States is a star player in this field. Its developed S4 eVTOL boasts stronger performance, capable of carrying one pilot and four passengers, reaching a top speed of 322 km/h, and having a range exceeding 240 kilometers.

In terms of compliance, Joby has obtained key certifications from the U.S. Federal Aviation Administration and has formed deep partnerships with giants like Toyota, possessing strong technical and financial capabilities.

Additionally, Chinese automakers including Geely, GAC Group, and Changan, as well as traditional aviation giants like Boeing and Airbus, have also deployed significant resources in the flying car sector.

Enormous funding requirements, stringent airworthiness regulations, imperfect infrastructure, public acceptance, and powerful competitors are all formidable obstacles facing HT Aero.

This sky is far more crowded than imagined. Whether HT Aero's "Land Aircraft Carrier" can find its own course in this crowded sky depends not only on its technological and product capabilities but also on the speed and efficiency of its commercialization. The IPO is precisely to fuel this sky race.

Success could pioneer a brand-new trillion-dollar market, enabling Xiaopeng Motors to achieve a magnificent "second takeoff." However, if commercialization progress falls short of expectations or it loses in the competition with global giants, today's enthusiasm from the capital market could tomorrow turn into a cold wind bursting the bubble.

The listing bell is about to ring, but this is merely the command to take off. The real challenge lies in the vast and unpredictable sky ahead.

- END-