"Sailing Abroad" Series: Chinese Automakers Utilize Electric Vehicles to Penetrate the Japanese Auto Market

![]() 02/12 2025

02/12 2025

![]() 586

586

Lead

The Japanese auto market, traditionally conservative, is gradually seeing a breakthrough by BYD. As close neighbors, China's automakers eyeing a global footprint find Japan an attractive target market.

Produced by|Heyan Yueche Studio

Written by|Zhang Dachuan

Edited by|He Zi

Total words: 2670

Reading time: 4 minutes

Despite the sluggish demand in the Japanese auto market, Chinese automakers may leverage the advantages of electric vehicles to carve out a new niche.

According to data released by the Japan Automobile Dealers Association and the Japan Light Vehicle Dealers Association, new car sales in Japan totaled 4.4215 million units in 2024, a 7.5% decrease year-on-year. Some media attribute this decline to the steady economic growth backdrop but primarily to data falsification scandals involving automakers like Daihatsu and Mazda, which led to the suspension of new car shipments, constraining market supply.

△Data falsification scandals by some Japanese automakers led to shipment suspensions

Market Dominance

Among new car sales in Japan, K-Cars, with engine displacements of 660ml or less, accounted for 1.5579 million units, a drop of approximately 10.7% from the previous year. Sales of other vehicles with displacements exceeding 660ml totaled 2.8636 million units, a decrease of about 5.6%. Further analysis reveals that 2.5428 million units of the latter category were domestically produced, accounting for roughly 88.8%, while 320,800 units were imported, making up about 11.2%. Overall, Japanese consumers favor locally produced models.

△The Corolla family surpassed the Yaris to become Japan's best-selling model in 2024

Toyota dominated the top ten sales rankings with six models, occupying the top three spots. The renowned Corolla (including sedans, hatchbacks, station wagons, and crossovers), Yaris (including Yaris Cross), and Sienna were Japan's three best-selling models in 2024.

△Top 10 selling models in Japan in 2024

Among the top ten sellers, except for the Honda HR-V, the rest are MPVs and hatchbacks (Corolla and Yaris are counted as families, including SUV models), reflecting Japanese consumers' preference for compact cars. These vehicles offer agile handling and convenient parking in crowded cities, along with high fuel economy. Popular overseas models like the Toyota RAV4, Highlander, and Honda CR-V failed to make the top ten list.

△The Toyota RAV4, a hit in overseas markets, missed the top ten list

Declining Electric Vehicle Market

Data from local institutions in Japan revealed that 59,736 pure electric vehicles were sold in 2024, a 33% year-on-year decrease. This marked the first decline in Japan's pure electric passenger vehicle market in four years, and its market share fell below 2%.

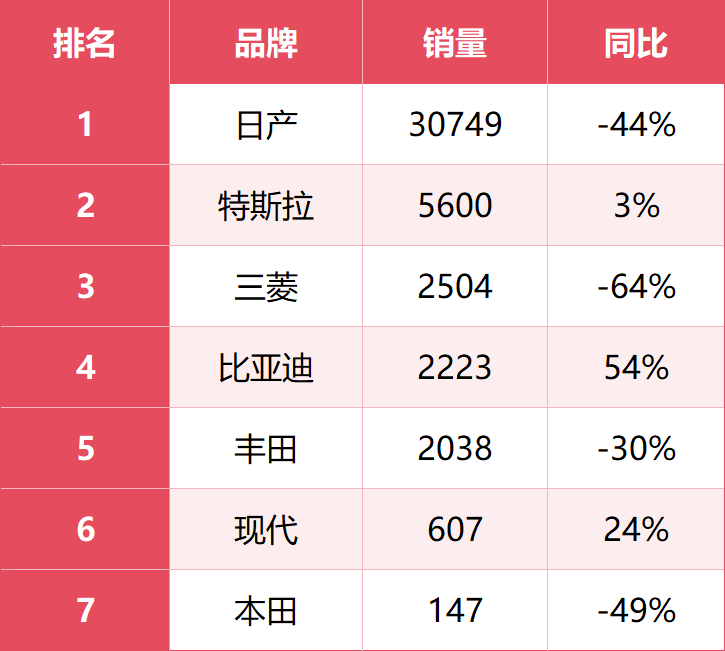

△Top brands in Japan's electric vehicle market

Nissan, the leading electric vehicle seller in Japan, saw a 44% decline with annual sales of only 30,749 units. Its main models, SAKURA and LEAF, experienced year-on-year declines of 38% and 48%, respectively. Mitsubishi and Toyota also witnessed significant year-on-year drops, with Toyota's mid-sized pure electric SUV bZ4X, the backbone of its electric vehicle sales, selling only 2,038 units for the year.

△SAKURA, Nissan's electric vehicle sales mainstay, saw a significant sales decline last year

Japanese consumers show limited interest in electric vehicles. The government subsidy of up to 50,000 yen is insignificant for expensive electric vehicles. Additionally, Japanese cars are renowned for their fuel efficiency, and both the government and automakers have long viewed electric vehicles as a transitional solution for new energy vehicles, with fuel cells seen as the true zero-emission answer. Consequently, giants like Toyota and Honda have been hesitant to invest heavily in electric vehicles. Although fuel cell products are available, they are still far from replacing gasoline vehicles in terms of cost and hydrogen refueling infrastructure.

△Fuel cell vehicles are unlikely to become mainstream in the short term

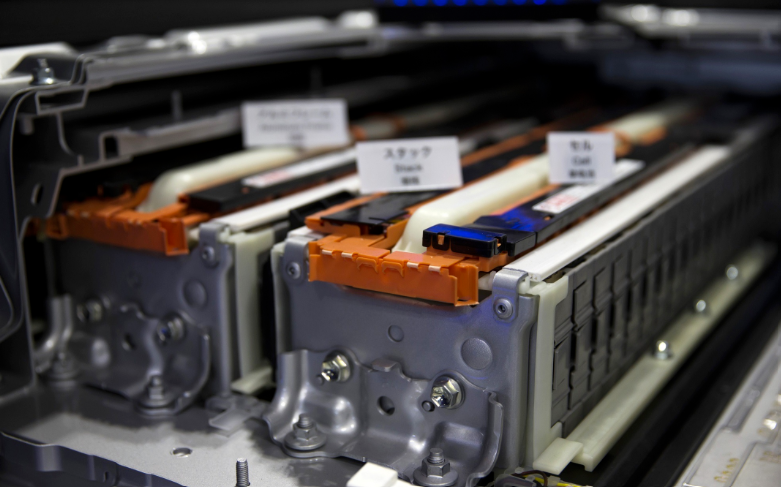

Japanese brands aren't entirely uninterested in electric vehicles; their biggest bet lies in solid-state batteries. Compared to current liquid lithium-ion batteries, solid-state batteries offer revolutionary improvements in energy density and safety. Toyota holds the most patents globally for solid-state batteries. However, domestic automakers are more aggressive in applying and deploying solid-state batteries. For instance, SAIC has provided a timeline for launching solid-state battery products, and domestic automakers like SAIC and NIO have already mass-produced semi-solid-state battery products.

△Solid-state batteries are seen as the key to turning the tide for Japanese automakers in the electric vehicle sector

BYD Navigates Japan's Auto Market

Among the aforementioned electric vehicle sales rankings, the "foreign monks" of Tesla, BYD, and Hyundai performed well in Japan's electric vehicle market. Tesla's sales remained largely unchanged, with a 3% year-on-year increase. In contrast, BYD and Hyundai saw year-on-year increases of 54% and 24%, respectively, standing out amidst the sluggish performance of Japanese cars.

For Chinese automakers, BYD's outperformance of Toyota with 2,223 units sold in Japan's pure electric vehicle sales rankings in 2024 is undoubtedly encouraging news. Since entering the Japanese market in July 2022, BYD has launched the ATTO 3 priced at 4.4 million yen, followed by models like the Dolphin and Seal. The latter two have driven BYD's sales growth in Japan, particularly the Seal priced at 5.28 million yen, which won the "Top 10 Best Cars" award at the 2024-2025 Japan Car of the Year Awards, marking a milestone for Chinese automakers. Besides BYD, Great Wall and Geely also have sales in Japan, but their influence is not as significant as BYD's.

△BYD Seal wins the "Top 10 Best Cars" award at the 2024-2025 Japan Car of the Year Awards

For Chinese automakers, gaining a foothold in the Japanese auto market through gasoline or hybrid vehicles is challenging. Japanese automakers have gained a significant advantage through years of deep cultivation in their home market. For Chinese automakers to break into the Japanese market, electric vehicles offer the only viable path. The decline in Japan's pure electric vehicle sales in 2024 presents both challenges and opportunities for Chinese automakers.

On one hand, local Japanese consumers do not prioritize pure electric technology, making the entire electric vehicle market less popular. Additionally, electric vehicles heavily rely on charging infrastructure like charging piles. Low consumer demand for electric vehicles dampens the Japanese government and third-party capital's confidence in investing in charging infrastructure, hindering electric vehicle promotion.

△Promotion of electric vehicles in Japan faces hurdles

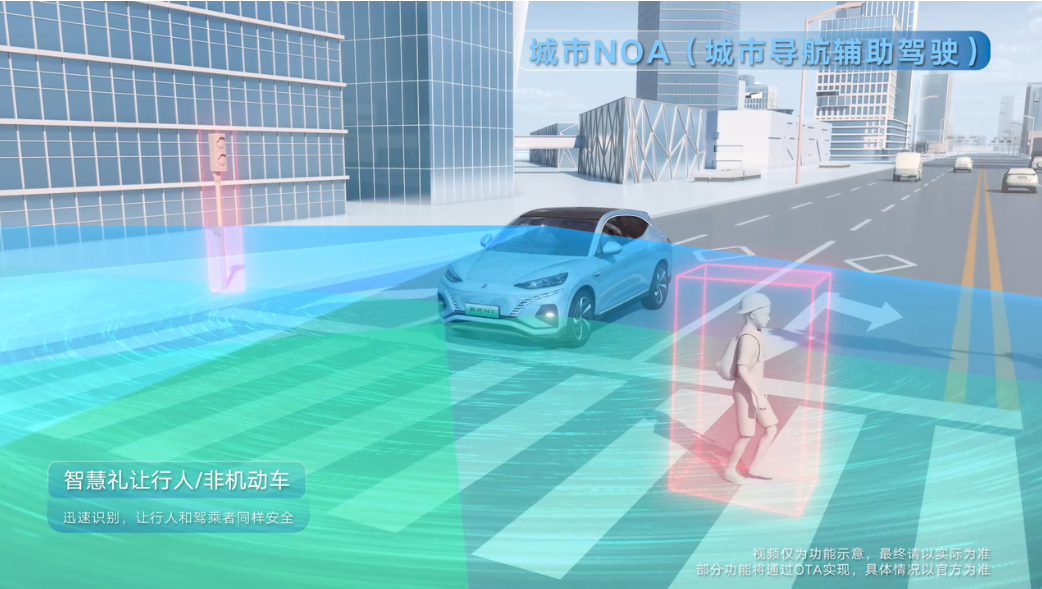

On the other hand, the unpopularity of the pure electric market discourages Japanese giants like Toyota, Honda, and Nissan from increasing their electric vehicle offerings domestically. Apart from Tesla, Chinese automakers face minimal competition. Chinese pure electric vehicles not only excel in the field of three-electric systems but also lead Japanese automakers in intelligence. Whether it's a feature-rich, smooth-running smart cockpit or intelligent driving approaching or even reaching L3 levels, these can be potent tools for BYD and other domestic automakers to expand into the Japanese market.

△Chinese automakers have significant advantages in intelligent connectivity

Commentary

The Japanese auto market boasts annual sales exceeding 4 million units. However, Japanese automakers' insufficient emphasis on electric vehicles presents an opportunity for Chinese automakers to carve out a niche. BYD has ambitious plans for the Japanese market, and cost-effective electric vehicles will help it penetrate the conservative Japanese market. Other Chinese automakers can leverage BYD's growing popularity in Japan to export more competitive smart electric vehicles. Beyond sales and revenue, the brand prestige and impact of a solid presence in the Japanese market are invaluable.

(This article is original content from "Heyan Yueche" and may not be reproduced without authorization)