DJI vs. Insta360: Who Reigns Supreme in the Panoramic Camera Realm?

![]() 11/11 2025

11/11 2025

![]() 431

431

By / Lingdu

Source / Jiedian Finance

When Insta360's panoramic drones start to encroach upon DJI's well - established territory, and DJI's budget - friendly panoramic cameras begin to target Insta360's core market, this cross - over clash between the drone and panoramic camera realms goes far beyond a mere battle for market share. It has evolved into China's most captivating innovation rivalry in the consumer electronics sector.

Who will ascend to the throne of the panoramic camera world? This silent war has the potential to reshape the competitive landscape in both industries.

01 From a Surprising Cross - Over to a Full - Blown Confrontation

In the latter half of 2025, the consumer electronics industry was fixated on the “bidirectional cross - over” of two Chinese giants.

On July 28, Insta360, a decade - long leader in the panoramic camera market, officially unveiled the world's first panoramic drone, “Yingling Antigravity.” It entered DJI's long - dominated drone sector with the ambition to “fill a market gap.”

Liu Jingkang, the chairman of Insta360, posted on WeChat Moments: “Respect for DJI—top runners in a marathon push everyone to go faster.” His words not only acknowledged the industry veterans but also signaled a determined challenge.

The swift and fierce counterattack took everyone by surprise.

Source: Insta360 Official Website

Three days later, on July 31, DJI suddenly launched its first panoramic camera, the Osmo360, priced at 2,999 yuan—800 yuan cheaper than Insta360's flagship X5. This was a direct attack on Insta360's pricing vulnerability.

If Insta360's move was a “flanking maneuver,” DJI's response was a “frontal assault,” using Insta360's own strength in panoramic cameras to launch a targeted counterattack.

The battle intensified into a “knife - fight” during the Double 11 shopping festival.

DJI slashed the prices of its Pocket3 and Action4 models by 900 yuan and 1,129 yuan respectively, far exceeding industry norms.

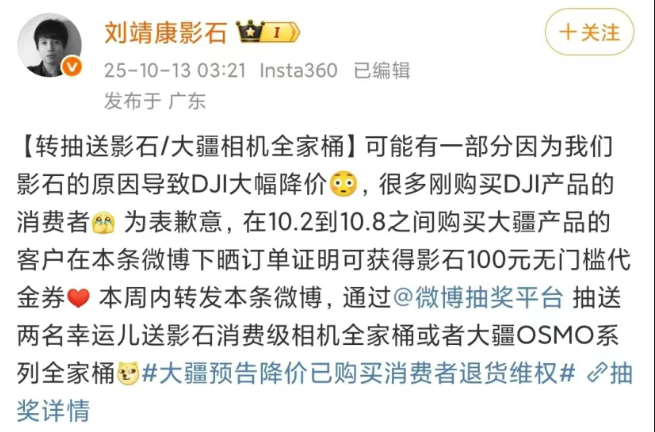

In response, Liu Jingkang made a cryptic remark on WeChat Moments: “The only monopoly king in consumer electronics—unprecedented,” revealing mixed feelings about DJI's pricing tactics.

From product launches to pricing wars and public opinion battles, the rivalry has escalated across industries, capital markets, and social media.

02 Data Controversy

As the competition heated up, conflicting industry reports plunged the debate over “who leads in the panoramic camera market share” into a situation similar to the Rashomon effect, where different perspectives lead to different interpretations.

Jiuqian Zhongtai's data showed that in Q3 2025 (the first quarter of Osmo360's release), DJI captured 43% of the global panoramic camera market in terms of revenue. Meanwhile, Insta360's share plummeted from 85 - 92% to 49%, nearly splitting the market evenly. This fueled doubts about Insta360's core competitiveness, with whispers of “losing its industry crown.”

Source: DJI Official Website

However, Frost & Sullivan's *Global Smart Handheld Imaging Equipment Market White Paper* presented a starkly different picture. In Q3 2025, Insta360 retained a 75% global market share, while DJI secured just 17.1% globally (though 37.1% in China), failing to displace Insta360's global dominance.

The discrepancy stemmed from different statistical methods. Jiuqian Zhongtai likely included broader channel revenues, while Frost & Sullivan focused on core product lines or official channels.

In response, Insta360 clarified during earnings calls that the accuracy, completeness, and authority of third - party data were unverifiable, urging investors to exercise caution. It refuted claims of a “92% to 49% market share drop,” emphasizing that its core technologies and product portfolios remained strong.

Jiedian Finance views the data dispute as a reflection of different competitive strategies. DJI leverages its supply chain advantages for price wars to rapidly gain market share, while Insta360 maintains technical barriers and a brand premium through high - end products and scenario innovations. This clash represents a collision of two competitive philosophies.

03 Clash of Technical Moats and Ecosystem Strengths

Beyond the data debates, the rivalry pits Insta360's technical prowess against DJI's ecosystem dominance.

Founded in 2015, Insta360 has made panoramic cameras its flagship product. Its technology, which has been verified by aerospace standards, powered the first panoramic camera to operate exposed in near - Earth orbit. In the consumer market, Insta360 offers a full range of products from entry - level to professional models, covering sports, VR content, and commercial promotion. It has a robust patent portfolio and a loyal user base.

Financially, its Q3 2025 earnings showed that revenue surged 92.64% year - on - year to 2.94 billion yuan, although net profit dipped 15.90% to 272 million yuan.

Its highly anticipated panoramic drone, “Yingling Antigravity,” is nearing the completion of public testing, with a tentative Q4 regional launch. However, supply chain and logistics hurdles may delay full - scale availability, leaving its crossover success pending market validation.

Meanwhile, DJI reigns supreme in the drone market, holding over 70% of the global consumer drone market. Its deep moat spans R&D, supply chains, and channel networks, enabling it to engage in aggressive pricing in the panoramic camera market through brand strength and cost control.

Notably, this rivalry was premeditated. Liu Jingkang revealed that Insta360's drone strategy was set five years ago, anticipating DJI's potential counterattack in the panoramic camera market.

Viewed through this lens, today's cross - over clash is both a strategic inevitability and a microcosm of China's manufacturing evolution from “single - breakthrough” to “multi - sector synergy.”

04 Win - Win Evolution: The Industry's Upgrade Catalyst

Jiedian Finance argues that rather than fixating on market share disputes, the focus should be on the positive impact of the rivalry on the industry. As China's consumer electronics titans, Insta360 and DJI are driving technological leaps and market expansion in both sectors.

For panoramic cameras, DJI's entry shattered Insta360's monopoly, accelerating market education through price wars. Meanwhile, Insta360's technical focus pushed DJI to rapidly improve image quality and stabilization, avoiding a “low - price, low - quality” trap.

In the drone market, Insta360's innovation created a “panoramic + drone” niche, transforming drones from “aerial tools” to “immersive content platforms.” DJI's ecosystem, in turn, ensures industry stability and technical standards.

Consumers are the ultimate beneficiaries, enjoying lower prices and better products.

China Galaxy Securities noted that since 2025, mutual market penetration by Insta360 and DJI has triggered aggressive price cuts. In early August, Insta360 slashed its flagship price by 500 yuan to counter DJI's debut; on October 28, its new X4Air panoramic camera aligned with DJI's pricing post - subsidies.

Industry data points to vast growth potential. Boyan Consulting estimates that China's consumer drone market was worth 18.5 billion yuan in 2024, with a 16% year - on - year increase. Valuates Reports projects an 8% compound annual growth rate (CAGR) for the global aerial drone markets from 2023 to 2030, while panoramic cameras are growing even faster amid the adoption of VR/AR technologies. The rivalry will accelerate global expansion and elevate “Made in China” from product exports to technical standard - setting.

Returning to the original question: DJI or Insta360—who rules the panoramic camera market? There may be no definitive answer. DJI excels in market share growth through pricing strategies, while Insta360 leads in technical accumulation and brand equity. The true victory lies not in “defeating rivals” but in “mutual evolution.”

For consumers, this means superior products, fairer prices, and more choices. For the industry, it breaks technical barriers, fosters resource integration, and amplifies China's global manufacturing voice.

For Insta360 and DJI, the cross - over clash is both a challenge and an opportunity. Only by stepping out of their comfort zones can they sustain competitiveness in a rapidly evolving market.

As Insta360's panoramic drone launches and DJI deepens its panoramic camera footprint, new chapters in this rivalry await. Regardless of market outcomes, Chinese consumers and the manufacturing sector stand to gain the most.

*Cover image generated by AI