2025 Outlook for China's Auto Industry: New Energy Frenzy and Intelligent Driving Intensification

![]() 05/08 2025

05/08 2025

![]() 578

578

Introduction

By 2025, China's auto market will resemble a high-stakes tech reality show, where every turn reveals a new breakthrough.

With new energy vehicles (NEVs) accounting for over 50% of sales, every second car on the road will be electric, leaving fuel vehicles in the same sorry state as Nokia once did.

Intelligent driving has evolved from a distant promise to an imminent reality, with L3 autonomous driving now on the roads. However, human drivers remain cautious, using NOA (Navigate on Autopilot) while keeping their foot hovering over the brake, ready to intervene at any moment – no matter how advanced the technology, it can't compete with human paranoia.

Price wars have hit rock bottom, with BYD pushing plug-in hybrids below 100,000 yuan. Netizens joke, 'In the past, we bought cars based on specs; now, it's like playing Pinduoduo's discount game.'

Today, Unmanned Vehicle News (WeChat public account: unmannedvehiclenews) delves into the most compelling trends shaping China's auto industry in 2025.

(For reference, please click:

"South Korean Media: China Has Already Surpassed South Korea in Autonomous Driving Technology! China's BYD, XPeng, NIO, and Li Auto Are Investing Heavily in Autonomous Driving Technology")

I. Market Trends: Steady Progress with NEV Penetration Surpassing 50%

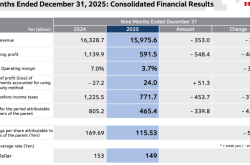

In 2025, China's auto market will witness steady growth amidst significant shifts. Full-year sales are projected to reach around 32.5 million units, with domestic sales of approximately 26 million units (a 3% increase) and exports of about 6.5 million units.

While this growth may seem modest, it is achieved on a substantial base, making it highly significant.

Most notably, NEV penetration in the domestic market will exceed 50%. This means that for every two cars on the street, one will be electric. Such penetration is more common than pearls in bubble tea!

NEVs' popularity stems from advancing technology, decreasing costs, and supportive policies. The trade-in policy alone drove domestic passenger vehicle sales up by over 2 million units – more enticing than Double 11 coupons!

II. NEVs: Plug-in Hybrids and Extended-Range Models Take Center Stage, with Intense Price Competition

The NEV market will be the highlight of 2025, with sales expected to reach 16.5 million units, a nearly 30% growth rate, and domestic NEV penetration anticipated to hit 55%.

These figures are astonishing!

Within NEVs, plug-in hybrids and extended-range electric vehicles have emerged as favorites. They address range anxiety and reduce operating costs, with plug-in hybrid sales projected to exceed 8 million units, a 60% growth rate, accounting for nearly 50% of overall NEV sales.

Even more exciting, a new generation of products, represented by solid-state batteries, will accelerate mass production. Solid-state batteries, offering high energy density, excellent safety, and fast charging, are the ultimate weapon for NEVs.

Despite slight overall volume increases, price competition is intense. The average price of plug-in hybrids has fallen below 150,000 yuan, 30,000 yuan cheaper than fuel vehicles. Consumers exclaim, 'Buying an NEV now is like buying cabbage!' Yet, this price war is tough on automakers – one major automaker earns less than 3,000 yuan in profit per plug-in hybrid sold, equivalent to selling 10 vehicles just to buy an iPhone 20.

III. Intelligent Driving: L3 Autonomous Driving Hits the Market, with City NOA Becoming Standard

If NEVs are the highlight of 2025, intelligent driving is the grand finale. L3 autonomous driving has entered commercialization, with intelligent driving technology becoming the core of automakers' differentiated competition.

In 2025, City NOA (Navigate on Autopilot) will become standard, with high-speed NOA functionality expected to further penetrate the 100,000 yuan market segment. Sales of models equipped with NOA are projected to reach 5-6 million units, with market penetration rising to 30%.

Automakers are investing heavily in intelligent driving technology. Systems like Huawei's ADS 4.0 and XPeng's XNGP enable autonomous urban driving, and models priced below 200,000 yuan are starting to come standard with advanced driving functions.

IV. Passenger Vehicle Market: Slower Growth with Concentrated Resources

The passenger vehicle market will continue to grow in 2025, albeit at a slower rate of around 2%, with sales expected to exceed 28 million units.

Market competition will intensify, with industry resources concentrating on leading automakers, showcasing a 'one big, many strong' pattern.

'One big' refers to BYD, which is expected to continue its pricing strategy, launch multiple new products, and improve intelligence capabilities, leveraging its vertical integration advantages in the NEV supply chain to drive sales growth. 'Many strong' includes automakers like Chery, Geely, and Changan, which have formed complete product matrices in the NEV market, ushering in a sales explosion. New players like Xiaomi Automobile, Hongmeng Zhixing, and NIO-XPeng-Li Auto also show strong growth potential.

Leading automakers are investing heavily to secure market share, focusing on technological innovation, product upgrades, and channel expansion. Tail-end automakers face significant pressure, and any misstep could lead to market elimination.

V. Commercial Vehicle Market: NEV Heavy-Duty Trucks Shine, with a Diverse Market Structure

The commercial vehicle market will enter a rapid growth phase in 2025, with sales expected to reach 4.5 million units. Notably, NEV commercial vehicle sales will skyrocket, potentially exceeding 900,000 units, with a penetration rate of over 30% and a year-on-year growth rate of 80%.

NEV heavy-duty trucks have become a highlight, with expected penetration exceeding 20%. Natural gas heavy-duty trucks will also see increased market penetration, rising to 31% with annual demand reaching 330,000 units.

Over the next five years, the commercial vehicle market may form a diverse structure comprising fuel, gas, and NEVs. Market opportunities will emerge from these segments, prompting automakers to adjust strategies and deploy in the NEV heavy-duty truck sector.

VI. Export Market: Global Landscape Reconstruction with Localized Production

China's auto exports will continue to grow in 2025, but trade barriers are forcing strategic transformation among automakers. Total exports are expected to reach 6.8-7.2 million units, but the growth rate will slow to 10% from 23% in 2024.

Facing challenges from EU carbon tariffs and US trade barriers, Chinese automakers are transforming from 'selling cars' to 'selling ecosystems.' Starting in 2025, they are accelerating overseas localized production, adopting both assembly and full-process production models to gradually break through trade barriers.

BYD is building a factory in Brazil with workers trained in China, while Chery is promoting a 'Russian-standard Tiggo' in Russia, even including Russian swear word emojis in the infotainment system. Chinese automakers are also jointly developing charging standards in Southeast Asia, forcing European automakers to adapt.

In the long run, China's global auto landscape is being quietly reshaped. While exports to the US, Japan, and South Korea may not grow significantly, China will gradually form large-scale exports in major global markets. Europe and Africa will become the core export markets for NEVs and fuel vehicles, respectively, while Southeast Asia and Latin America's potential is gradually being activated, expected to develop into the second and third largest export markets in the future.

VII. Joint Ventures: Differentiation with Emphasis on Localized Cooperation

Joint ventures will tend to differentiate in 2025. Some will be marginalized in the Chinese market or maintain a presence only in niche markets.

However, those that believe in and continue to invest in the Chinese market, fully embrace local vehicle and supplier partners (especially in intelligence), and actively integrate into China's local industrial ecosystem are expected to stabilize and maintain a significant market share.

To survive in the Chinese market, joint ventures are vigorously pursuing localized cooperation, introducing advanced technology, optimizing product layouts, and improving service quality.

VIII. Future Outlook: Quantum Leap from Quantity to Quality

The China auto industry in 2025 is both a fiercely competitive battlefield and the starting point for a transformative renaissance.

The deep integration of NEVs and intelligent driving technology will drive a quantum leap from quantity to quality. To succeed, automakers are investing heavily in research and development, optimizing products, and expanding markets. Technological innovation, cost control, and a global vision are critical.

In 2025, the 'magical reality' of flying cars is accelerating. EHang Intelligence obtained the world's first airworthiness certificate, and flying cars conducted test flights in Shenzhen. While citizens complain about the lack of landing pads, automakers like GAC, Chery, XPeng, and Hongqi have already deployed in the flying car sector.

So, who will be the ultimate winner in this transformative auto industry?

Will it be domestic brands like BYD, Changan Automobile, and Geely Automobile? Or international giants like Tesla, BMW, and Mercedes-Benz? Or joint venture automakers and new-force automakers?

Time will tell!

In summary, Unmanned Vehicle News believes that China's auto market in 2025 is bustling with innovation. While traditional automakers struggle with 'oil-to-electric' conversions, others are harvesting orders in rural markets with unmanned vehicles. When joint ventures indulge in 'nostalgia marketing,' Chery is sweeping the Russian market with extended-range vehicles. And while overseas giants impose technology blockades, BYD has advanced its solid-state battery mass production timeline by two years.

In 2025, China's auto industry is not just 'overtaking on curves' but 'taking off from the ground' – under the dual engines of NEVs and intelligent driving, there may be no ultimate winner, but all participants are destined to redefine the word 'automobile.'